Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 22 Oct, 2021 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

The S factor has become an X factor for investors and companies engaged in benchmarking ESG performance — everyone agrees that it’s important, yet the definitions can be frustratingly vague.

Part of the issue is that, while data collection on gender has improved in the past five years, measuring other types of diversity such as race, ethnicity, LGBTQI+ status, age, and disability is more challenging. Measurement of diversity is governed by a patchwork of regulations and guidelines that leave interested investors dependent on voluntary disclosure through tools like the S&P Global Corporate Sustainability Assessment.

Europe’s major banks have been leaders in the effort to link executive pay to diversity targets. Eleven of 13 major European lending institutions have confirmed to S&P Global Market Intelligence that they benchmark against diversity goals and this is reflected in executive pay. However, a recent article looking at banks in the U.K. found gender pay gaps of 14.1%-33.6%. The numbers look worse for foreign-owned banks operating in Britain. JP Morgan had the largest gender pay gap, at 50.3%

"It's clear that much more needs to be done to close it and to better value women," Felicia Willow, CEO at the Fawcett Society, a charity which campaigns for gender equality, told S&P Global Market Intelligence.

While diversity data is unquestionably important, the S factor is supposed to measure and benchmark equity and justice, of which diversity is only one aspect. Lindsey Hall, Head of ESG Thought Leadership at S&P Global, agrees. “We’re constantly thinking about how to advance the discussion around the social issues that are increasingly shaping company strategy, investor activity and policy decisions. This includes everything from human rights to talent attraction and retention.”

Despite measurement challenges, the social bond market grew rapidly in 2020 with more than $164 billion in social bonds coming to market. Governments have been the biggest issuers of social bonds, as they respond to pandemic-induced fiscal challenges.

With the flood of new social bonds, concerns about “social-washing” have increased, leading to calls for harmonized standards and taxonomy.

Today is Friday, October 22, 2021, and here is today’s essential intelligence.

Emerging Markets: Latin America Looks Past COVID-19 And Sees Political Uncertainty And Old Challenges

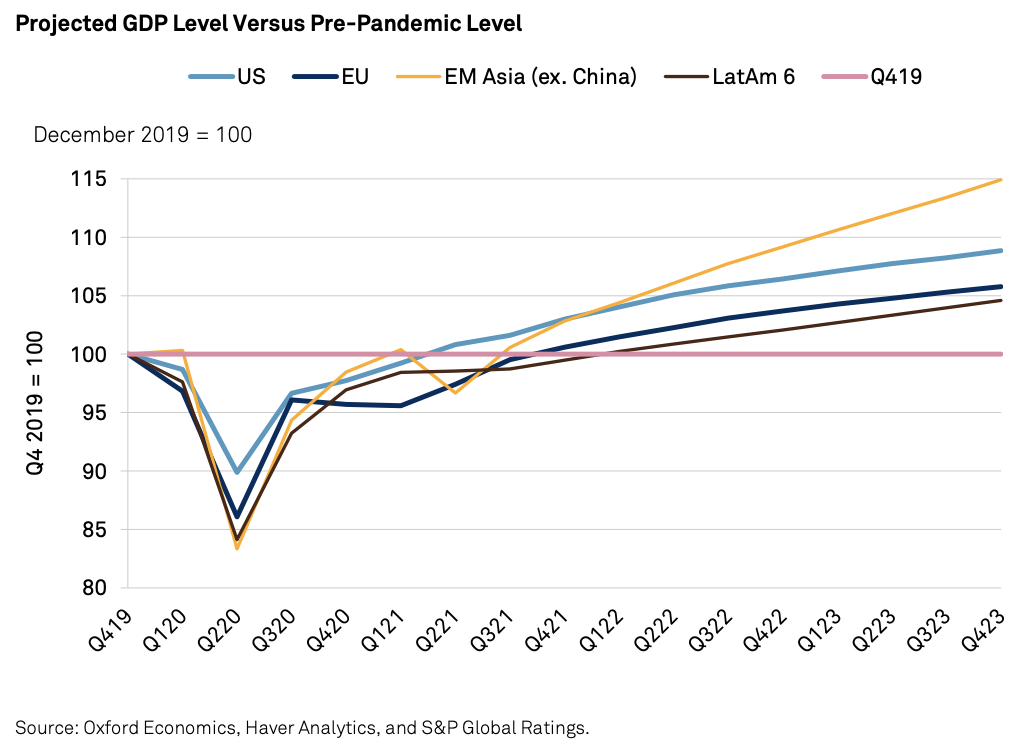

While COVID-19 isn't going away anytime soon, and lockdowns to prevent the spread of future variants are still on the cards, the pandemic's harsh impact on GDP is falling. Nevertheless, LatAm will continue to face the same structural economic challenges it did before the pandemic, including slow productivity growth resulting from low and inefficient investment.

—Read the full report from S&P Global Ratings

Container Shipping Rates Entering Extended Period Of Volatility: CEO

The global container shipping industry is entering a period of volatility that will extend long after the current peak shipping season, with a return to pre-pandemic market conditions almost certainly out of reach, according to consultancy Vespucci Maritime CEO Lars Jensen.

—Read the full article from S&P Global Platts

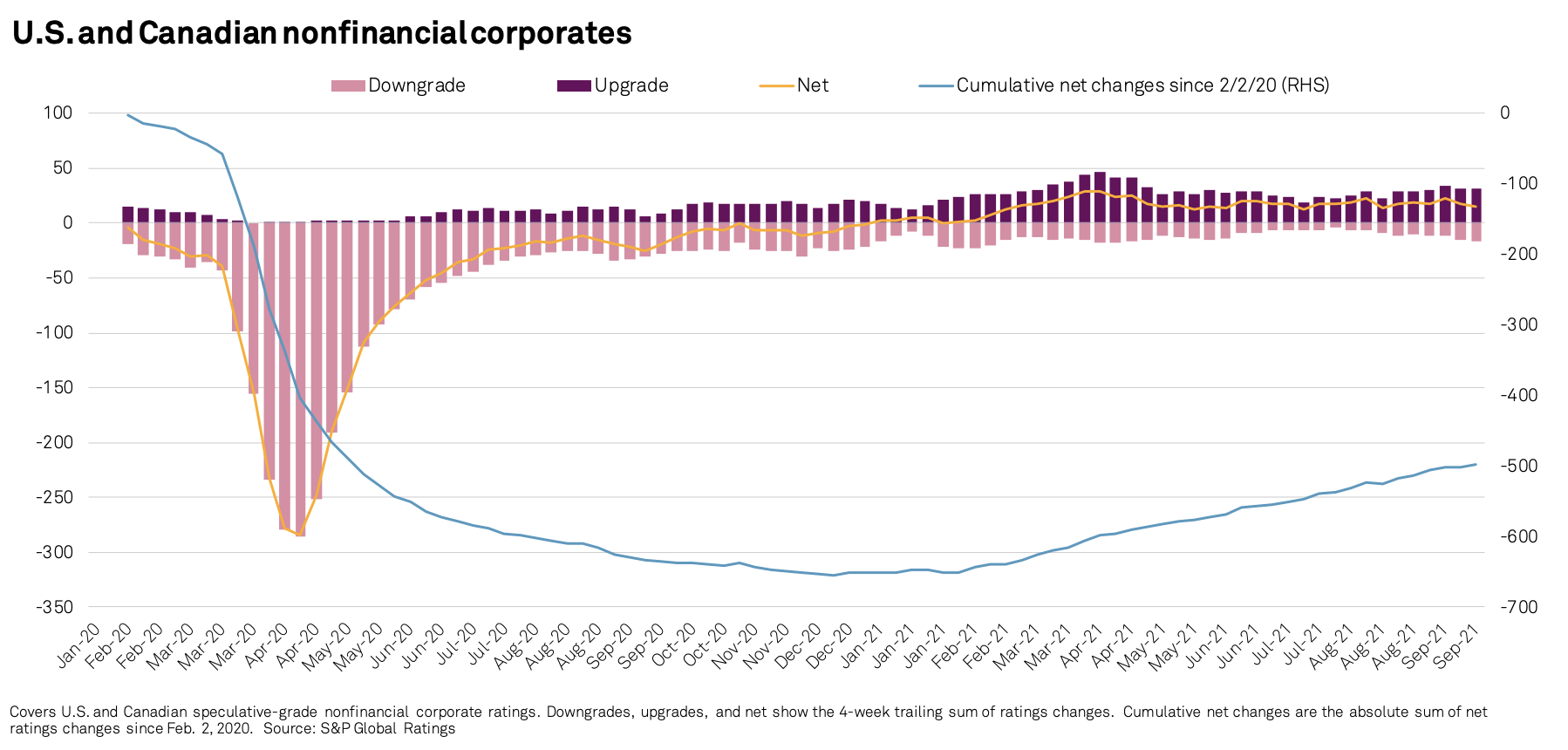

Will CLOs Be Singing The Delta Blues? Corporate Credit, COVID Variants, And CLOs

U.S. CLO ratings weathered the COVID-19 pandemic in 2020 with only modest damages. But with elevated corporate leverage ratios, a historically weak mix of corporate ratings, and declining recovery prospects, will the ratings of pre-pandemic CLOs come under pressure again?

—Read the full report from S&P Global Ratings

Japan Corporate Credit Spotlight: Fragile Stability Faces Three Threats

As the world's major economies emerge from the COVID-19 pandemic, the credit quality of Japan's corporate sector is stabilizing on the back of efforts to reduce costs. However, three main risks threaten the fragile recovery.

—Read the full report from S&P Global Ratings

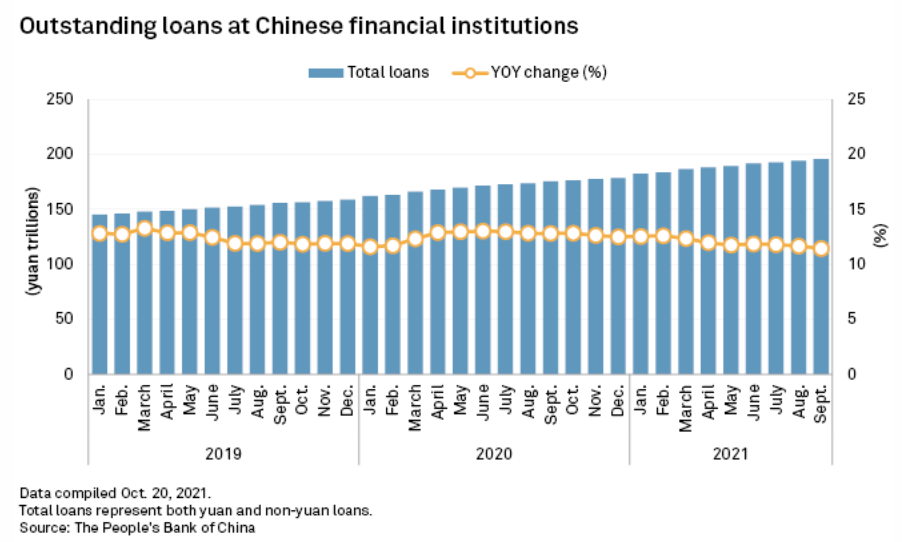

China's Bank Loan Growth Slowdown May Worsen On Property Curbs

China's slowing bank loan growth will likely cool further after the slowest gain in more than 15 years amid attempts to rein in the property market. Concerns about borrowers' ability to make repayments, particularly in the real estate sector, following debt crises at China Huarong Asset Management Co. Ltd. and China Evergrande Group, could force banks to tighten credit.

—Read the full article from S&P Global Market Intelligence

North American Financial Institutions Monitor 4Q 2021: Riding The Economy's Tailwind And Aiming For A Smooth Landing

The proportion of banks and NBFIs with negative outlooks has plummeted in the last year. However, the mix of risks has changed. While the pandemic still poses risks, financial institutions also face threats related to elevated home prices, a booming leveraged loan market, advancing fintech, and an impending change in monetary policy.

—Read the full report from S&P Global Ratings

Nordea Plans Series Of Regular Share Buyback Programs After ECB Green Light

Nordea Bank Abp's upcoming €2 billion share buyback program will be followed by a series of regular repurchases as the bank seeks to reduce its substantial excess capital after two years of pandemic-driven restrictions from the ECB.

—Read the full article from S&P Global Market Intelligence

How Financial Institutions Are Managing Exposure To U.S. Municipals

Financial Institutions have been facing challenges when accounting for U.S. municipal exposures to both rated and unrated issuers given the impact of the COVID-19 pandemic. During the pandemic, 90% of U.S. cities saw lower revenues and 76% higher expenditures, leaving potential for reserve deterioration and a negative impact on credit quality.

—Read the full article from S&P Global Market Intelligence

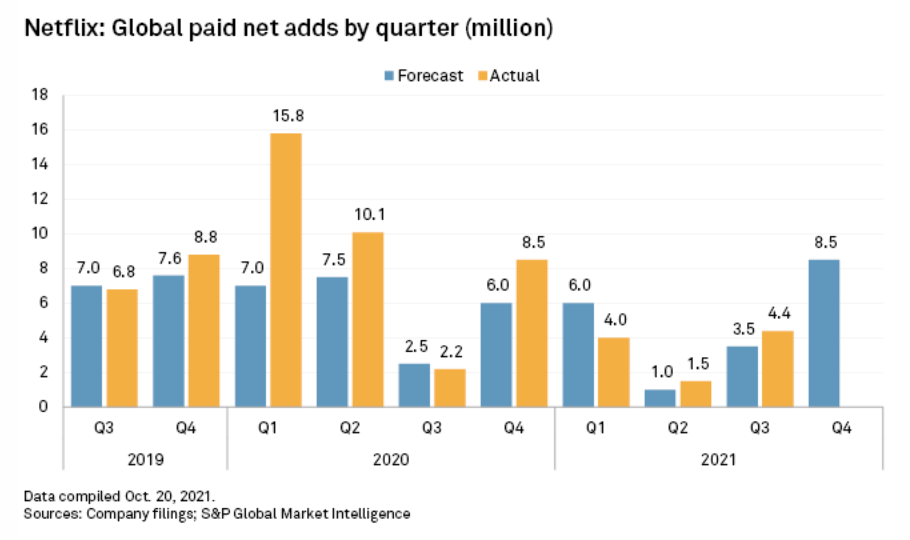

Analysts Question Netflix Valuation As 'Squid Game' Drives Stock

Content is king, and Netflix Inc. is still the seat of the empire. The company reported a membership beat in the third quarter and offered fourth-quarter guidance almost twice the third-quarter result.

—Read the full article from S&P Global Market Intelligence

Facebook Earnings To Remain Unscathed By Scandals, But Apple May Bite

The negative headlines plaguing Facebook Inc. this past month are unlikely to hamper the social media giant's third-quarter financial performance, analysts say.

—Read the full article from S&P Global Market Intelligence

Internet Service Providers Collect Sensitive Consumer Data, FTC Says

The Federal Trade Commission on Oct. 21 released findings from a study it conducted on the privacy practices of six major internet service providers and raised concerns over how sensitive data collected by these companies can be used to harm and discriminate against consumers.

—Read the full article from S&P Global Market Intelligence

Cable Operators, Telcos Battle On Pricing, Phone Subsidies As Mobile Adds Soar

As cable operators and telcos increasingly compete for the same customers, analysts expect the battle to hinge on two things: pricing and subsidies.

—Read the full article from S&P Global Market Intelligence

Investors With $60 Trillion In Assets Call On Utilities To Decarbonize By 2035

Climate Action 100+, a leading coalition of five investor groups with $60 trillion in assets, is adding pressure on the world's leading utilities — including Duke Energy Corp., Dominion Energy Inc., Southern Co. and American Electric Power Co. Inc. — to decarbonize by 2035 in line with the Paris Agreement on climate change.

—Read the full article from S&P Global Market Intelligence

Mining Sector 'Wildly Unprepared' For Energy Transition – Black Mountain CEO

Mining companies will be called on to provide the needs of the growing energy transition, but the sector has been starved of the capital necessary to do so, said Rhett Bennett, the founder and CEO of Texas-based natural resources company Black Mountain.

—Read the full article from S&P Global Market Intelligence

Asset Owner Perspectives On Climate Change Measurement, Management, And Reporting In Australia

Following the tragic mega-fires of 2019–2020, extreme floods and ongoing degradation of the Great Barrier Reef, many Australians are calling for more action on climate change. Much is at stake because the country is a large exporter of liquefied gas and coal.

—Read the full article from S&P Global Market Intelligence

Listen: High Energy Prices Add To Tightness In The European Middle Distillates Complex

High natural gas prices are leading to both a tighter European supply of middle distillates and greater global gasoil demand, while the diesel cargo market was supported by higher demand into Germany and an open arbitrage to the U.S.

—Listen and subscribe to Oil Markets, a podcast from S&P Global Platts

More U.S. LNG Headed To China Amid Disclosure Of Venture Global-Unipec Deal

The trading arm of China's Sinopec has agreed to a short-term deal to buy 1 million mt/year of LNG from Venture Global LNG's Calcasieu Pass liquefaction terminal that is under construction in southwest Louisiana, a letter from the operator to the U.S. Department of Energy that was made available Oct. 21 said.

—Read the full article from S&P Global Platts

European Styrenics Participants Challenge Electricity Surcharge

European styrenics market participants were resisting the scale of recent electricity surcharges, with some labelling them as double accounting, following Trinseo's announcement last week that they would apply a surcharge of Eur200/mt on a range of styrenics products.

—Read the full article from S&P Global Platts

Spanish Pipeline Gas Supply Uncertainty Could Lure Premium LNG Cargoes In Winter

Spanish natural gas prices could find support heading into winter, providing incentives for spot LNG deliveries even with premiums that have been limiting European cargoes overall, after importers nominated zero Algerian supplies for November through the GME pipeline through Morocco.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language