Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 22 Oct, 2020

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

While a breakthrough in Brexit negotiations sent the pound soaring this week, the pandemic has pushed many British businesses into a more precarious position to handle the U.K.’s departure from the EU single market and customs union at the end of this year.

“An agreement is within reach if we are on both sides prepared to work constructively and in a spirit of compromise,” Michel Barnier, the EU’s chief Brexit negotiator, told the European Parliament on Oct. 21.

Downing Street said in a statement that “significant gaps remain between our positions in the most difficult areas, but we are ready, with the EU, to see if it is possible to bridge them in intensive talks.”

EU officials will travel to London today to restart talks after the discussions reached an impasse last week, when U.K. Prime Minister Boris Johnson called for a “fundamental change of approach” and warned of a “no-deal” situation. Hopes on the renewed deliberations pushed sterling up 1.7%, to trade above $1.31 against the dollar on Wednesday. This marked the pound’s biggest rally since March and its first time trading at that rate since early September.

Despite the renewed negotiations, the country’s prospects of an economic recovery from the current downturn remain dim. Overall preparedness amongst businesses for Brexit has been weakened by the combined disruptions of the tumultuous talks that have been ongoing since March 2017 and the unprecedented pandemic that took hold of the U.K. and Europe in March.

S&P Global Ratings forecasts the U.K. economy to contract by 9.7% this year. Although growth is projected to rebound by 7.9% next year, the country is unlikely to return to pre-pandemic levels before at least 2024.

“Despite the promising start, many hurdles are ahead on the path to recovery, and we now see the economy slightly worse off over the next three years. Most importantly, COVID-19 is proving hard to beat,” S&P Global Ratings Senior Economist Boris Glass said in a report this month. “What will further weigh on growth is the switch in 2021 to a bare-bones agreement on trade between the U.K. and EU, which we continue to assume in our forecast. That could curb the recovery's momentum, particularly in first-quarter 2021, when some degree of trade disruption at customs is likely.

Nearly half of U.K. firms reported being less prepared for Brexit due to the pandemic, according to a survey of 557 supply chain managers in the country conducted by the Chartered Institute of Procurement and Supply between Sept. 23 and Oct. 5. Sixteen percent of the survey respondents warned that stockpiles will diminish during the winter due to the COVID-19 crisis’ implications for supply chains.

After Brexit, the U.K. and EU’s asset management industry is “as prepared as it can be” for what comes after Dec. 31, when the departure takes effect, according to lawyers and compliance officers who spoke at the Oct. 14 virtual City & Financial’s Regulation of Asset Management summit. Over time, asset management regulation between Britain and the block are seen as likely to naturally diverge.

"There is still time for a plot twist, given that there is the great poker game going on in respect of the political negotiations," Simon Crown, partner at law firm Clifford Chance, said during the event, according to S&P Global Market Intelligence. Financial services could ultimately be affected by "new views or even nuances that come out of guidance from regulators over the next month or two.”

Today is Thursday, October 22, 2020, and here is today’s essential intelligence.

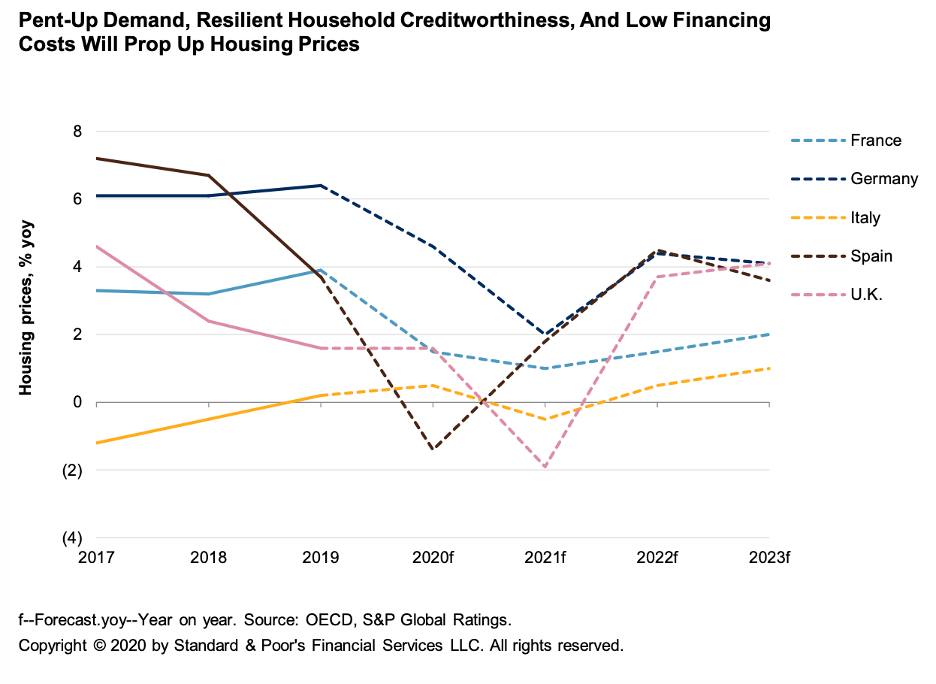

Economic Research: Pandemic Won’t Derail European Housing Price Rises

Three months of lockdowns to contain the COVID-19 pandemic and a sharp economic contraction in the second quarter of 15% in the eurozone and 22% in the U.K. year on year have failed to derail housing prices in Europe. Accumulated pent-up demand for homes, the need for home space, resilient household creditworthiness, and low financing costs all contributed to a fast recovery of transactions and a dynamic property market in the latter part of the year. In this context, S&P Global Ratings expects price increases to soften only a little this year, while foreseeing a more pronounced slowdown next year.

—Read the full report from S&P Global Ratings

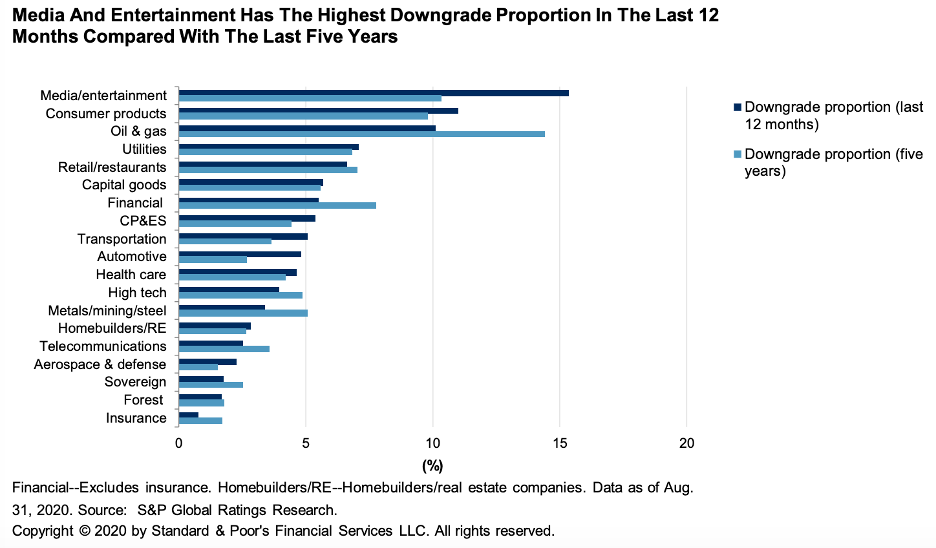

Credit Trends: Downgrade Potential Eases But Remains Above Pre-Pandemic Levels

In August, the number of potential bond downgrades decreased to 1,349 after hitting a historical high of 1,365 in July. This was the first decline in 15 months. (Potential bond downgrades are issuers rated 'AAA' to 'B-' by S&P Global Ratings with either negative rating outlooks or ratings on CreditWatch with negative implications.) In August, S&P Global Ratings added 42 companies to the list of potential downgrades, while removing 58. Of these, 36 were removed because of outlook and CreditWatch revisions, and 18 because they were downgraded. In previous months, removals from the list were mostly due to downgrades.

—Read the full report from S&P Global Ratings

APAC's Costly Catastrophes: Reinsurance And More Required

The Asia-Pacific region's insurance and reinsurance sector saw its fair share of weather-induced woes over the past two years. And now, the pandemic is adding to this list. After seeing significant catastrophe losses, insurance and reinsurance price hikes seem inevitable. However, S&P Global Ratings believes the need for reinsurance protection has strengthened amid the successive catastrophes. This need has become more urgent with the unfolding of the COVID-19 pandemic.

—Read the full report from S&P Global Ratings

Global Structured Finance: Credit Concerns Loom On COVID-19 Resurgence

Economic activity rebounded strongly in the third quarter, though momentum has begun to fade and recovery will take time. Top global risks include extended containment measures and transition to post-COVID-19 policies as well as corporate solvency risk and new highs in government debt.

—Read the full report from S&P Global Ratings

As Wall of Debt Looms, S&P Global Ratings has Gloomy Outlook on Oil, Gas Lending

Despite a raft of bond refinancings and spending cuts, many oil and natural gas companies will not survive the wall of debt coming due in the next three years, S&P Global Ratings said Oct. 15. "A Saudi-Russia price war combined with the unprecedented demand destruction stemming from COVID-19 have reduced crude prices to levels not seen in many years," Ratings credit analyst Paul Harvey said.

—Read the full article from S&P Global Market Intelligence

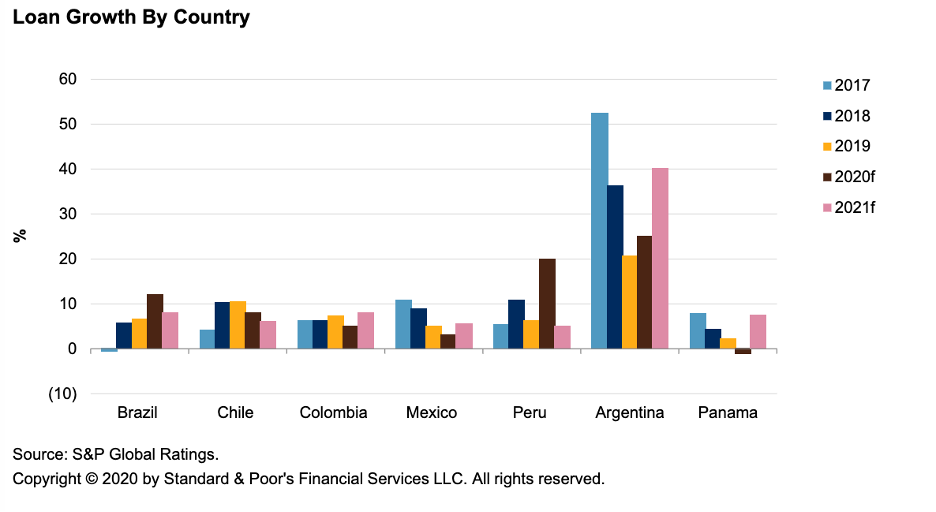

LatAm Financial Institutions Monitor 3Q2020: Climbing Out of A Deep Plunge

Banks in Latin America continue to navigate through the COVID-19 storm. Asset quality will weaken, credit costs are on the rise, and profitability is falling due to the pickup in provisions, along with lower fees and compressed margins, especially in countries where the government-guaranteed and low-margin loans represent a high share.

—Read the full report from S&P Global Ratings

UK Banks Can Afford to Pay Dividends but Doing so Might not be Easy, Say Experts

British banks might be able to afford to pay dividends in 2021 but in the wake of regulatory easing and massive support from the Bank of England such payouts could prove politically fraught, say analysts. The BoE has begun an assessment on whether to extend the suspension on payouts such as dividends and share buybacks beyond the end of 2020. In March, the leading banks in the U.K. said they would cancel their dividends for 2019 and refrain from setting cash aside for this year.

—Read the full article from S&P Global Market Intelligence

Wall Street Forecasts More Asset Managers Will Merge to Survive

Having faced the COVID-19 pandemic on top of years of pressure from shrinking fees and shifting investor preferences toward the industry's giants, money managers are debating whether to stick it out on their own or enter the deal market in search of scale or complementary products, Wall Street investment bankers, analysts and other experts say. All the while, the likes of BlackRock Inc. and Vanguard Group Inc. keep gobbling up assets.

—Read the full article from S&P Global Market Intelligence

Wall Street Hopes for Quiet Q3 from Shale Gas Producers, but EQT May Buck Trend

Wall Street analysts think the best news U.S. shale gas producers can deliver in their third-quarter earnings announcements is no news at all: no new spending, no production growth, no new debt. Instead, analysts want shale gas drillers to continue to play defense so they can fatten their cash flows on higher commodity prices this winter. Still heavily in debt after years of outspending cash flows, producers are expected to use whatever small gains they can eke out of near-record low commodity prices this summer to keep paying down debt and revamping themselves into low-cost gas manufacturers.

—Read the full article from S&P Global Market Intelligence

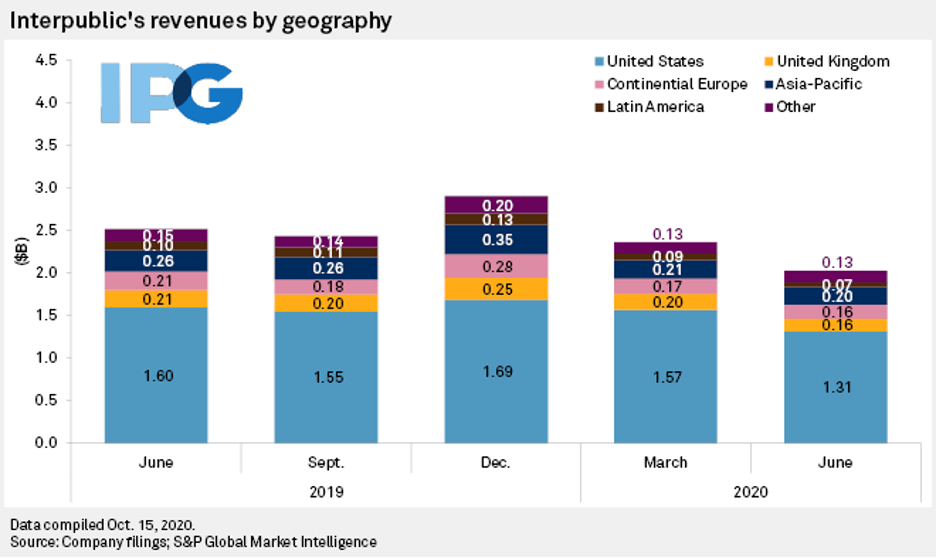

Pandemic Continues to Weigh on Ad Agencies, Though Some Q3 Improvement Expected

The continuation of the pandemic is expected to weigh on the advertising market through the rest of the year, though analysts anticipate third-quarter earnings at ad agencies to show some sequential improvement. Europe's Publicis Groupe SA, the first of the major agency holding companies to report quarterly results, registered a 9.1% decline in revenue to $2.34 billion for the period ended Sept.30, with organic revenue off 5.6%, versus a 13.0% decrease in the second quarter. Analysts predict a similar story for U.S.-based Interpublic Group of Cos. Inc. and Omnicom Group Inc., which have yet to report September results.

—Read the full article from S&P Global Market Intelligence

Ride-Share App, Blockchain, Telehealth Spur Digital Health Renaissance

Leaders from across the digital health and technology spaces met virtually for the HLTH 2020 conference to give updates on partnerships and new digital tools for combating COVID-19, reducing healthcare inequities and transforming primary care. HLTH is a five-day conference that brings together leaders in pharmaceuticals, healthcare services, technology and government to discuss innovations and the future of health.

—Read the full article from S&P Global Market Intelligence

Mobile Payments, Mini-Programs are Key Features of Chinese Super Apps

Chinese consumers use super apps such as WeChat and Tiktok less for social media and more for mobile payments and various service bookings, according to Kagan's 2020 Asia Consumer Insights survey. WeChat and Tiktok are among a growing roster of mobile apps in China and the rest of Asia-Pacific that brand themselves as "super apps." While there is no widely agreed-upon definition of what a super app is, S&P Market Intelligence defines it as a single app that allows users to do multiple, often seemingly unrelated functions without leaving the app.

—Read the full article from S&P Global Market Intelligence

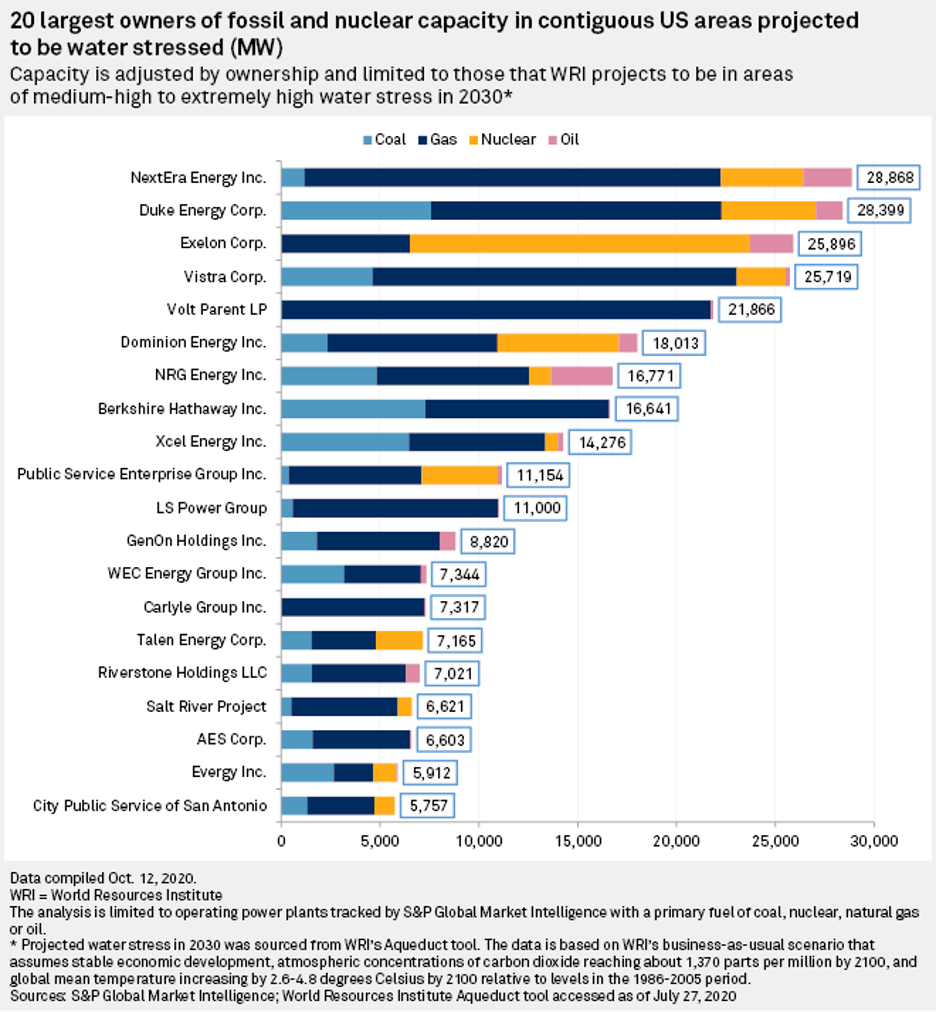

Climate Change Poses Big Water Risks for Nuclear, Fossil-Fueled Plants

As global warming climbs and humanity's water consumption increases, nuclear and fossil-fueled power plants that rely on freshwater for cooling may not be able to perform at their peak capacity or could be forced to shut down temporarily even as demand for their supplies for indoor cooling and other uses increase, according to researchers and industry experts.

—Read the full article from S&P Global Market Intelligence

ANALYSIS: Frigid Western Canadian Weather Could Diminish Natural Gas Exports To U.S.

The onset of colder weather in Canada's Alberta province not only stands to bolster prices at the AECO hub; it also could eat into exports flowing into the US Pacific Northwest as that region also faces higher demand on top of a pipeline maintenance. Sign Up Alberta is on the front end of a cold snap, and by Oct. 24 even colder temperatures, and the end of maintenance limiting how much can flow to the US Pacific Northwest, could drive a sharp price increase at AECO.

—Read the full article from S&P Global Platts

Copper Price Flirts With $7,000/Mt as Market Eyes Renewable Demand

The London Metal Exchange copper price flirted with the $7,000/mt level Oct. 21, as supportive rhetoric continued to reverberate during virtual meetings at the annual LME Week, chiefly focused on the renewables angle. Sign Up Copper is widely touted as one of the integral 'green' metals that will power the renewable energy revolution as the world transitions from traditional sources such as coal.

—Read the full article from S&P Global Platts

Human Rights Allegations In Xinjiang Could Jeopardize Solar Supply Chain

The solar industry's growing dependence on China's autonomous Xinjiang region for a critical raw material poses mounting risks to a wide range of companies as the U.S. government moves to confront Beijing over alleged human rights abuses there. In 2019, when solar ranked as the world's top source of new power generating capacity, about one-third of the polysilicon the industry used to make solar panels came from Xinjiang, according to Johannes Bernreuter of Bernreuter Research.

—Read the full article from S&P Global Market Intelligence

Healthcare Inequity Creates 'Crisis of Trust' Among U.S. Marginalized Communities

Ongoing inequities in the U.S. healthcare system have led to distrust in the medical framework, compounding access disparities for marginalized communities that have been further exposed during the COVID-19 pandemic, according to a study from Genentech Inc. Groups of people in the U.S. are designated as "health disparity populations" due to a series of barriers that prevent equal access to routine care or participation in clinical research based on race, ethnicity, immigrant status, disability, sex, gender or geography, according to the National Institute on Minority Health and Health Disparities.

—Read the full article from S&P Global Market Intelligence

History Converges With Barrett Vote, COVID-19 Vaccines Forum, Final Debate

Americans keeping an eye on the future of the Affordable Care Act at the Supreme Court, the probability of a COVID-19 vaccine in 2020, and factors impacting the U.S. elections had better eat their Wheaties Oct. 22 — or whatever breakfast cereal boosts their stamina — because all three issues will be involved in major events that day. The U.S. Senate Judiciary Committee is set to vote on President Donald Trump's Supreme Court nominee, Judge Amy Coney Barrett, on Oct. 22, putting in play a decision on final confirmation by the full chamber before the Nov. 3 U.S. election.

—Read the full article from S&P Global Market Intelligence

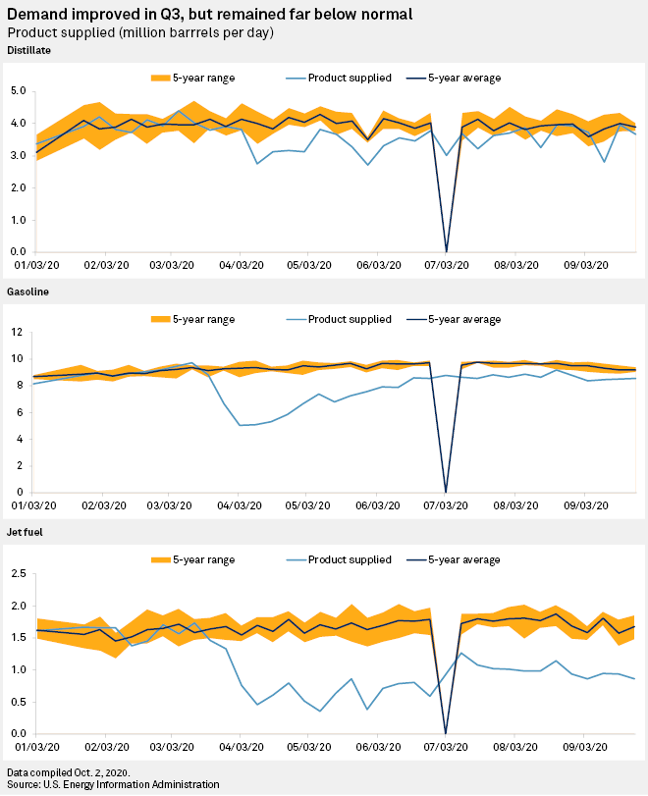

Refiner Profits to Fall Sequentially In Q3 as 'COVID-Related Carnage' Lingers

On the heels of one of the most challenging quarters the industry has faced, analysts expect U.S. oil refiners to report another round of dismal earnings results for the third quarter as the industry continues to endure fallout from the COVID-19 pandemic. In the second quarter, analysts had expected the revenue of the seven largest refiners to fall by $46.89 billion year over year. Instead, the group reported a total revenue decline of $62.03 billion.

—Read the full article from S&P Global Market Intelligence

ANALYSIS: U.S. Gasoline Stocks Climb as Coronavirus-Hit Demand Tests Four-Month Lows

U.S. gasoline inventories showed a surprise build in the week ended Oct. 16 as demand tested four-month lows, US Energy Information Administration data showed Oct. 21. Sign Up Total US gasoline stocks climbed 1.9 million barrels last week to 227.02 million barrels in the week ended Oct. 16, according to the EIA, putting inventories 1.6% above the five-year average and eliminating a deficit that had persisted since late September.

—Read the full article from S&P Global Platts

Nord Stream 2 Developer Tight-Lipped on Schedule After New U.S. Sanctions Move

The developer of the almost complete Nord Stream 2 gas pipeline from Russia to Germany remains tight-lipped on its plans for finishing the 55 Bcm/year line following a move by the U.S. to broaden its sanctions threat against the project. Sign Up The U.S. State Department on Oct. 20 widened the scope of sanctions against the pipeline and warned companies involved in the final installation that they face sanctions if they do not wind down activities.

—Read the full article from S&P Global Platts

Listen: North American Gas Market Eyes Spending Outlook as Q3 Earnings Season Begins

S&P Global Platts senior natural gas writer Harry Weber and S&P Global Market Intelligence natural gas reporter Corey Paul discuss with Platts senior digital editor Jason Lindquist current trends in the North American gas midstream sector as operators of pipelines, processing facilities and liquefaction terminals begin to release third-quarter financial results.

—Listen and subscribe to Commodities Focus, a Podcast from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language