Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 20 Oct, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Big Oil Gets Bigger in the Permian Basin

The Permian Basin straddles the rugged boundary between West Texas and New Mexico. The area, which earned its name from the large quantity of rocks from the Permian geologic period, is best known today for being the highest-producing oil field in the US. Permian oil is abundant and relatively inexpensive to extract, making the basin an attractive acquisition target for oil majors looking to expand.

On Oct. 11, ExxonMobil announced a deal to buy US shale exploration company Pioneer Natural Resources for $59.5 billion and said adding Pioneer to the fold would more than double its Permian Basin footprint. By 2027, ExxonMobil believes that Permian crude production from its expanded footprint would reach 2 million b/d of oil equivalent. The cost of supply from Pioneer’s assets would be $35/b, which should make double-digit returns practical under current and anticipated future oil prices. Currently, Pioneer has more than 850,000 net acres in the Permian Basin, whereas ExxonMobil has 570,000 net acres.

According to analysts from S&P Global Commodity Insights, ExxonMobil pursued the agreement because of the importance of the Permian Basin in global oil and gas markets. Permian Basin production is expected to continue to grow in 2024, and crude and condensate from the region will lead US output growth. China, South Korea and the Netherlands are the largest buyers of US crude, with other customers throughout Europe and Asia.

One challenge for continued growth in Permian crude production is that the pipelines transporting crude to processing facilities in Corpus Christi, Texas, are already running at nearly 100% capacity. Further rises in Permian production may send excess barrels to Houston and Nederland/Port Arthur, which have spare capacity.

With US oil majors currently flush with cash due to higher global oil prices, analysts at S&P Global Commodity Insights believe further merger and acquisition activity may be in store. ExxonMobil continues to have substantial cash reserves, as do Chevron and ConocoPhillips. Diamondback Energy, Coterra Energy, Devon Energy, Marathon Oil and Permian Resources are all potential targets for oil majors looking to expand their presence in the Permian Basin.

"We continue to see consolidation in the North American upstream sector," Dan Pratt, vice president for upstream research and consulting for S&P Global Commodity Insights, said recently. “As the shale plays continue to mature, consolidation is a logical path for companies to add to and extend their drilling inventory."

Today is Friday, October 20, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

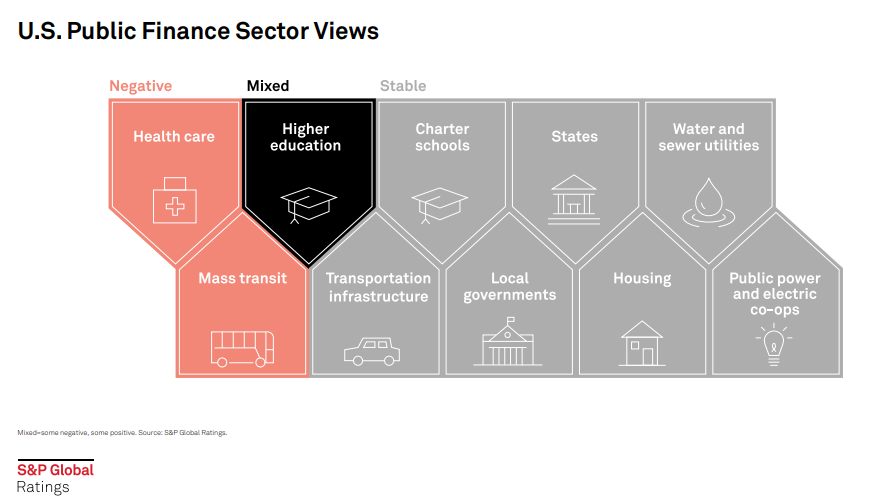

US Public Finance Quarterly Update Q4 2023

For most US public finance issuers, higher interest rates and inflation remain headwinds from a debt issuance and operating/capital budget perspective.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

Asia-Pacific Banking Country Snapshots: Outlook Stable, Strains Manageable

S&P Global Ratings’ outlook for the Asia-Pacific financial institutions sector remains steady. As of Sept. 28, 2023, 83% of bank rating outlooks were stable. While property is a key risk, it views the unfolding property market strains as broadly manageable across Asia-Pacific banking systems at current rating levels. Other key risks are an economic downside significantly outside its base case, and high public and private sector indebtedness.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

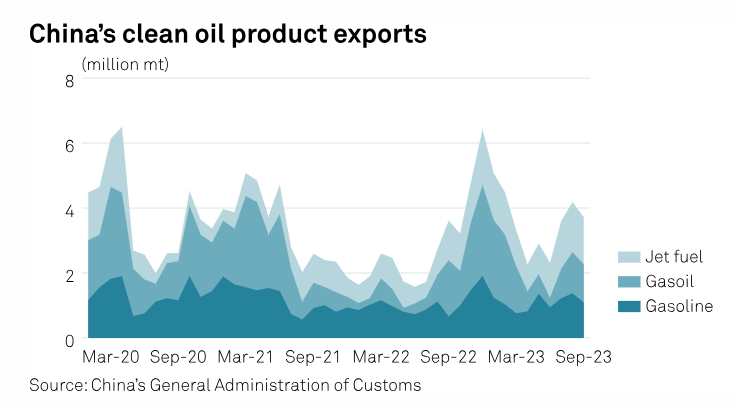

Clean Oil Product Exports Fall 11% To 3.72 Mil Mt In Sep

China's clean oil product exports retreated 11.2% to 3.72 million mt (1.03 million b/d) in September from the six-month high in August, General Administration of Customs data showed on Oct. 18. The outflow was expected to hover in October before falling in the rest of the year amid tight export quota availability, market sources and analysts said.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

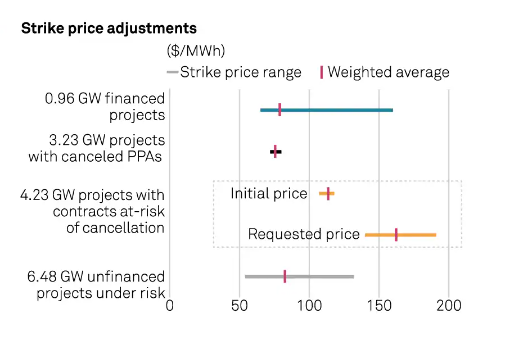

Stormy Seas Ahead For US Offshore Wind

The offshore wind industry is expected to become a major contributor to the United States' net-zero emissions goal by 2050. The country aims to have 30 GW in operation by 2030 and at least 110 GW by 2050. This is a significant push as only 42 MW are currently operational, and the first major project is under construction. To achieve these lofty ambitions, 10 states have already leased a total of nearly 2.5 million acres for future projects, 6 of them having tendered 14.9 GW of capacity.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

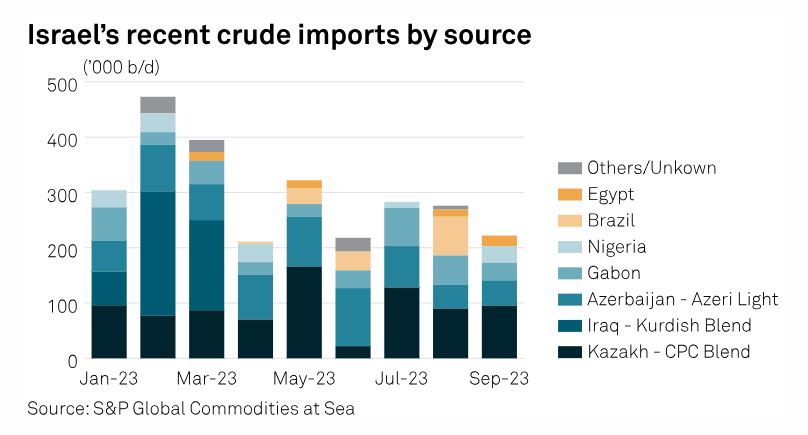

OPEC Plays Down Iran's Call For Oil Embargo On Israel After Hospital Blast

OPEC appears set to sidestep calls by Iran for an oil embargo against Israel Oct. 18 after regional tensions were stoked further following the explosion at a Gaza hospital that killed about 500 people. Both Israel and Iranian-backed Hamas deny responsibility for the blast. Saudi Arabia, the biggest oil exporter in the world, called for a meeting of Muslim countries in the Organisation of Islamic Cooperation to discuss the ongoing conflict in Israel and Gaza. But an OPEC delegate said he did not expect an extraordinary meeting of the oil producers group to be called on the issue.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

C-Suite Must Walk The Cyber Talk

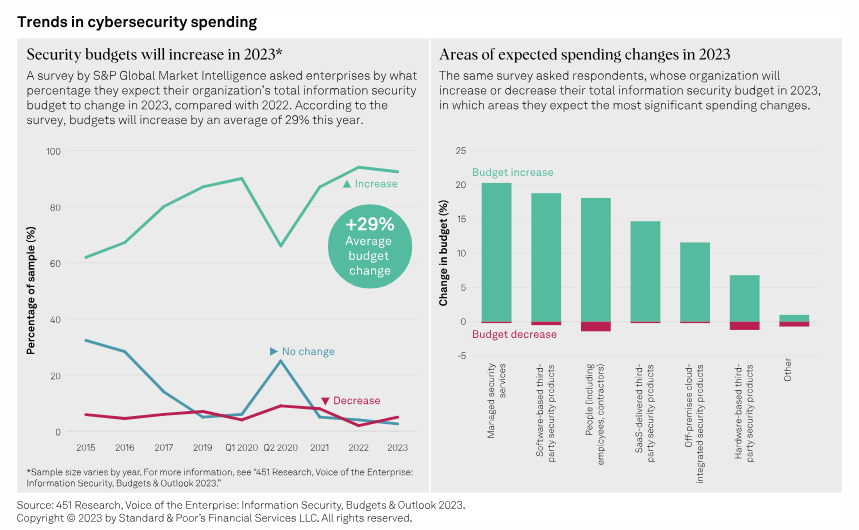

Cyber attacks remain a top credit risk across geographies and asset classes. Amid increasing technological dependency and global interconnectedness, cyber attacks pose a potential systemic threat and significant single-entity event risk. S&P Global Ratings views cyber threats among the most significant structural risks and expects they will increasingly impact the credit landscape in the years ahead.

—Read the article from S&P Global Ratings