Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 18 Oct, 2021 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Credit investors, on the lookout for yield wherever they can find it, are increasing their investment in private debt markets, despite perceived risks around transparency and illiquidity.

Investment in private debt markets has increased tenfold in the past 10 years, alongside a fourfold increase in the market for corporate debt. According to Preqin, a financial data provider, the market for private debt has grown to $412 billion in assets under management, with another $150 billion in available capital for further investment. Private debt is generally priced at a premium compared to syndicated debt in a nod to the absence of leverage guidelines, ratings, and liquidity. As the private debt market has expanded, it has grown in sophistication, including the introduction of ESG measurement.

Private debt markets have grown in the wake of the great financial crisis of 2007-2008. As banks moved to reduce their exposure to riskier forms of debt, nonbank financial institutions stepped in to provide credit. Higher yields have attracted some institutional investors. This increase in interest has led to more borrowers and private equity sponsors entering the market. Due to the illiquidity in the private debt market, investors in this market generally must take buy-and-hold strategy.

A strong market for corporate debt means that most large companies can meet their funding needs through syndicated markets. Private debt borrowers tend to be small- to medium-sized companies with EBITDA between $3 million and $100 million.

Most private debt doesn’t receive a public rating, but S&P Global Ratings does assign credit estimates to nearly 1,400 issuers of private market debt held by middle-market collateralized loan obligations (CLOs). About 75% of these credit estimates, assigned between 2017-2019, for private debt market CLOs had a score of ‘b-‘. In the market for broadly syndicated CLO’s, only around 20% carried a similar score.

While private debt carries increased risk and tends to have less liquidity than syndicated markets, investors and borrowers have been attracted to the increased yield and closer relationships that private debt can off er. Some market observers fear that a further expansion in this market will lead to a decline in the quality of underwriting. Due to a lack of transparency, such a decline might remain hidden for some time.

Today is Monday, October 18, 2021, and here is today’s essential intelligence.

NBCU Lines Up Clients, Agencies, Industry Groups To Weigh Ad Measurement

As it seeks new means to gauge media and advertising effectiveness, NBCUniversal Media LLC has announced a cross-section of clients, agencies and industry organizations as members of its Measurement Innovation Forum. The group aims to bring stakeholders together to learn about measurement solutions. It will supplement efforts being by other industry groups, according to Kelly Abcarian, executive vice president for measurement and impact in NBCU's advertising and partnerships group.

—Read the full article from S&P Global Market Intelligence

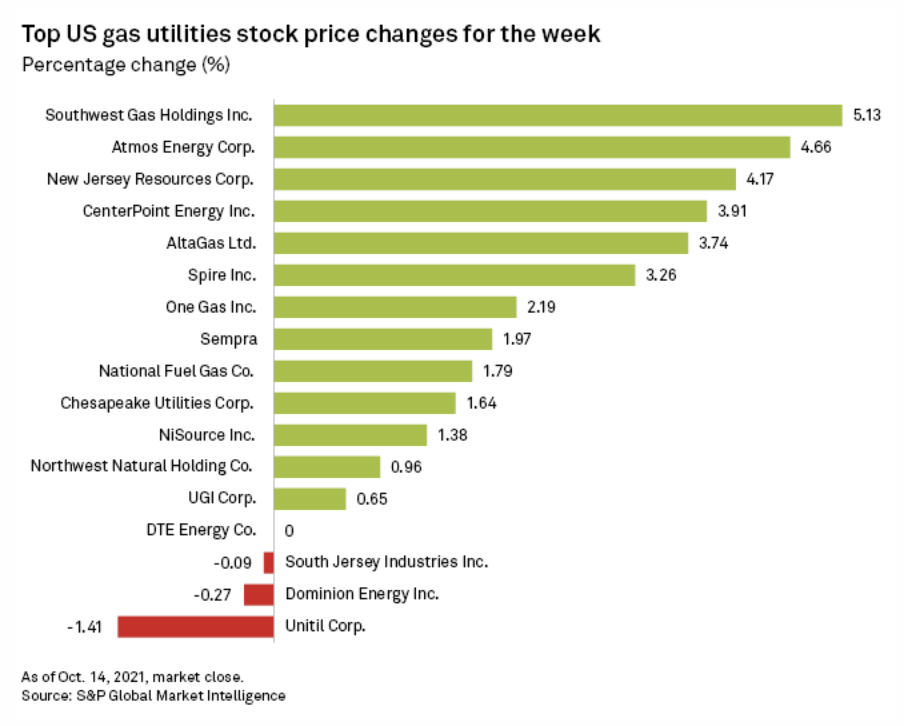

Gas Utilities Navigate Energy Transition While Facing Greater Climate Oversight

Natural gas utilities in the U.S. are working to find their niche in the clean energy transition amid increasing scrutiny as national, state, and federal regulators tackle emissions in the industry through new rules and stricter project reviews. For instance, utilities have announced at least 26 hydrogen pilot projects in the past year as the industry works out how to make and transport the gas, as well as help customers migrate to the low-carbon fuel.

—Read the full article from S&P Global Market Intelligence

WPT Gets Court OK For Blackstone Buyout; Starwood Capital Buying $407M Portfolio

Companies in the real estate sector have increasingly been adopting carbon-neutrality goals across their portfolios in recent years, outlining various measures to cut energy usage and to use renewable sources, among other things. A company can purchase carbon offsets and renewable energy credits, in theory neutralizing its own carbon footprint by slashing emissions somewhere else.

—Read the full article from S&P Global Market Intelligence

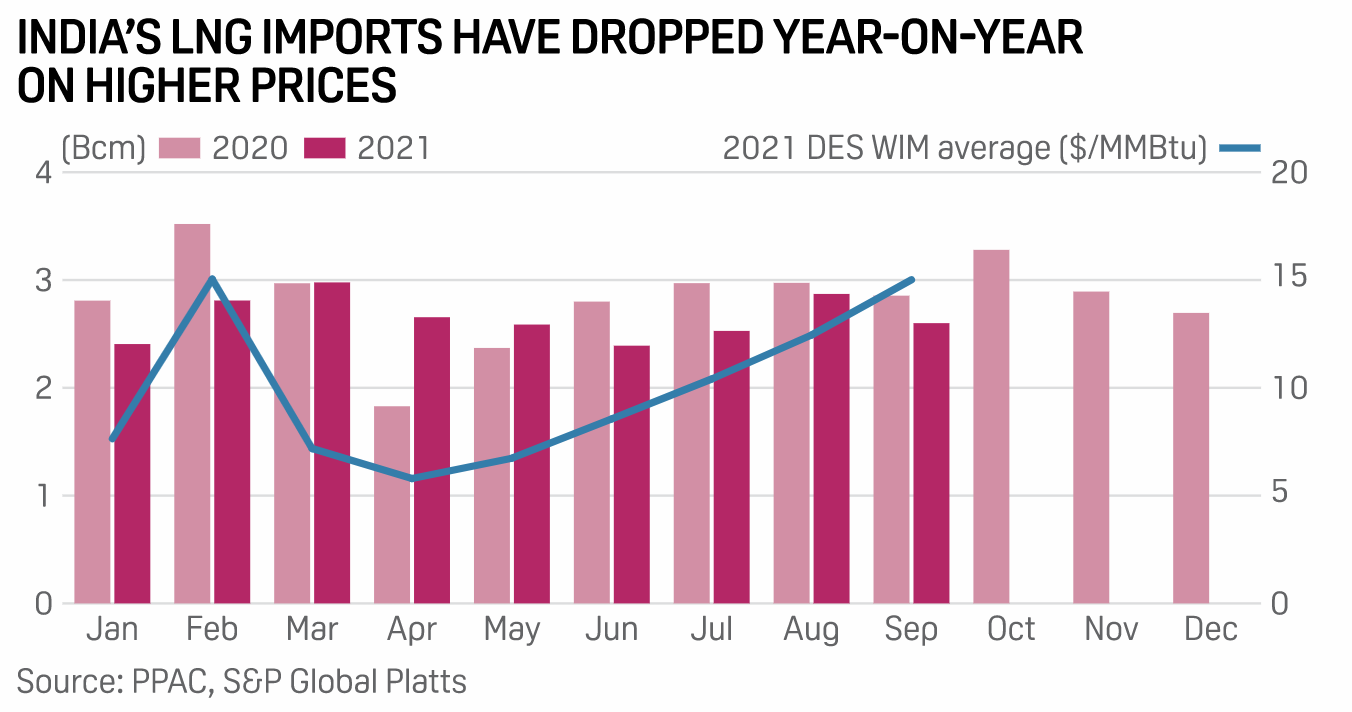

High LNG Prices Put Spotlight On India's Exposure To Global Gas Market Volatility

Indian LNG importers are turning away from spot purchases due to high LNG prices and are likely to start considering deeper changes in their fuel procurement strategies, as well as their exposure to long-term contracts as the upward pressure on global gas prices persists.

—Read the full article from S&P Global Platts

Iran LPG Exports To Reach Around 450,000 Mt In October, Rebound In November: Sources

Iran's LPG shipments are set to reach around 440,000-450,000 mt in October compared with 556,000 mt exported in September, largely to Asia, and are expected to rebound in November, trade sources said. Exports up to Oct. 13 were around 220,000 mt, the sources added.

—Read the full article from S&P Global Platts

Singapore's Power Utilities May Switch To LNG On Indonesian Piped Gas Curtailments

Singapore's power utilities may have to switch to using LNG due to curtailments in piped gas supplies from Indonesia, the country's energy regulator the Energy Market Authority said in a statement Oct. 15. The reduction in pipeline gas supply comes after prices of spot electricity futures on the Singapore Exchange, or SGX, spiked in recent days and the operator of the LNG terminal, Singapore LNG Corp., said it was looking to boost gas inventory to bolster energy supplies.

—Read the full article from S&P Global Platts

China's Shenghong Refining Complex To Receive First Crude Cargo Late October

China's private refining complex, Shenghong Petrochemical, is likely to receive its first crude cargo in late October, according to trade sources Oct. 15. The greenfield refining complex with a capacity of 16 million mt/year, got its first round of quota of 2 million mt Oct. 15, which will enable the refinery to bring in its crude imports on time.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language