Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 13 Oct, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Making Sense of the Saudis

On October 5, the Organization of the Petroleum Exporting Countries and its allies, known as OPEC+, convened in Vienna on short notice for the alliance’s first in-person meeting since March 2020. Despite pressure from the U.S. and others, OPEC+ members voted to slash their production quotas by 2 million barrels of oil per day for the next 14 months to stabilize prices. The move, taken with the full support of Saudi Arabia, has been interpreted as a rejection of President Joe Biden’s attempt to improve the damaged relationship between the U.S. and Saudi Arabia in favor of closer ties with Russia. Biden travelled to Saudi Arabia on July 15 to meet with Crown Prince Mohammed bin Salman and encourage the Saudis to increase oil production. While it is not clear whether the Saudis intended the move to be a repudiation of the current U.S. administration, there are practical, domestic reasons for them to want higher oil prices.

Saudi Arabia released its official economic forecasts for 2022 and 2023, which are similar to projections shared by the International Monetary Fund. The government forecasts decade-high economic growth of 8% for 2022, based largely on high oil and energy prices. Anticipating the effects of a global economic slowdown, the Saudi government is projecting 3.1% gross domestic product growth in 2023. While these numbers will look enviable to other nations confronting nominal or negative growth in 2022 and 2023, they are dependent on oil and energy prices remaining high.

Saudi Arabia has been clear about its intention to diversify its economy away from oil and upstream crude production. This year, the non-oil private sector accounted for well over half of Saudi GDP, according to S&P Global Ratings. However, this diversification is not as decoupled from the oil and energy sector as it might appear.

Much of the non-oil sector is in petrochemicals and hydrocarbon-related activities, specifically chemical companies. According to S&P Global Ratings, many Saudi chemical companies depend on deeply discounted natural gas as a feedstock. The continued success of Saudi chemical companies relies on both subsidized feedstock for Saudi companies and on European chemical companies paying significantly higher prices on the open market.

In addition, the few areas of the Saudi economy that are not oil or oil-related require massive government investment to become viable. Neom, Saudi Arabia’s planned futuristic city, is estimated to cost $500 billion alone. These initiatives depend on oil revenues. Saudi banks have experienced stronger profitability in 2022, due in large part to oil prices. However, the corporate loan growth that Saudi banks anticipate in 2023 count on further government investment in Vision 2030 initiatives such as Neom.

The cuts in oil production will cause prices to rise in a global economy on the brink of recession. This is concerning. But focusing too much on the relationship between two world leaders may be missing the larger picture. Many OPEC+ countries, including Saudi Arabia, have been pumping under their stated quotas for months. So, these production cuts are, in some ways, just an acknowledgement of reality. Also, the U. S. is no longer the dominant customer for Saudi oil it once was. In 2021, Saudi Arabia was the largest supplier of oil to China.

Today is Thursday, October 13, 2022, and here is today’s essential intelligence.

Written by Nathan Hunt.

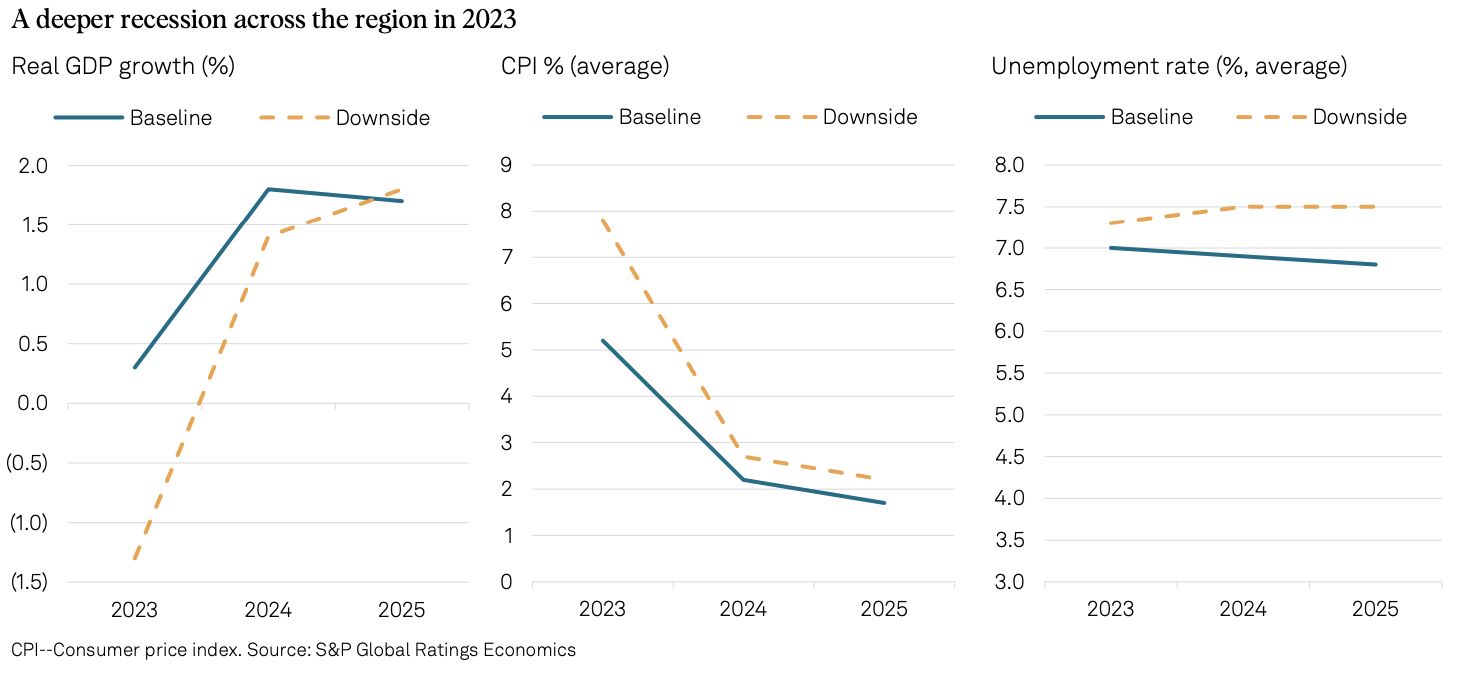

Economic Research: Global Credit Conditions Downside Scenario: Recession Risks Deepen

The potential for a prolonged period of rising inflation and low economic growth is increasing globally, with many factors weighing on already-waning economic prospects. Considering increasing risks and the potential for materialization, S&P Global Ratings have developed a downside scenario — with a roughly one-in-three likelihood of occurring — based on a consistent set of downside projections presented for key regional economies for the period 2022-2025.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

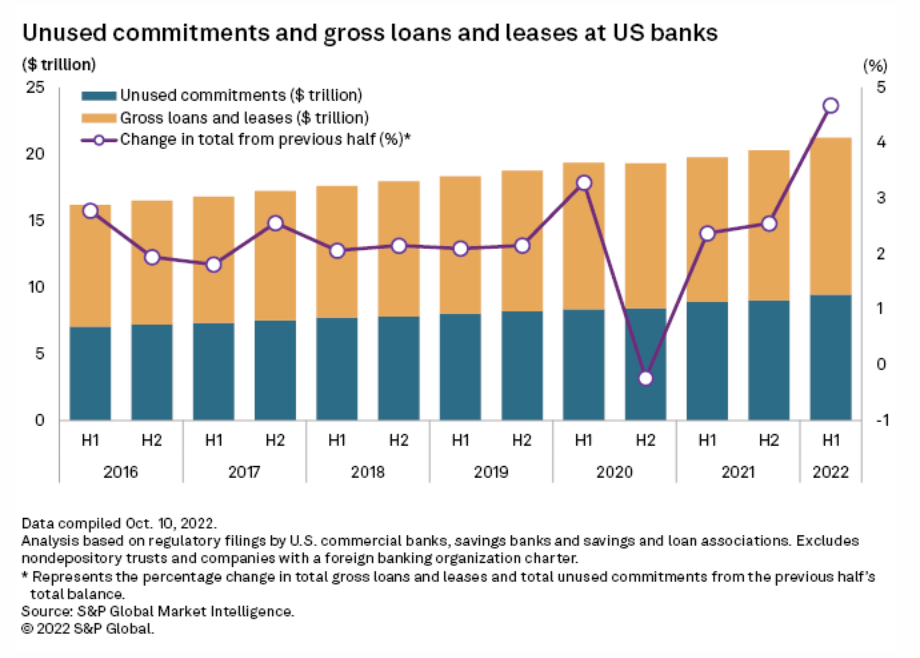

Deposit Outflows In Q3 Put Focus On Potential Bank Funding Strains

A rapid reversal in bank balance sheet flows as the Federal Reserve tightens interest rates was apparent in the third quarter. Lending rose in the period and banks pared holdings of cash and securities as deposits drained out of the industry, raising concerns that some banks with weaker holds on customers' money could get pinched.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

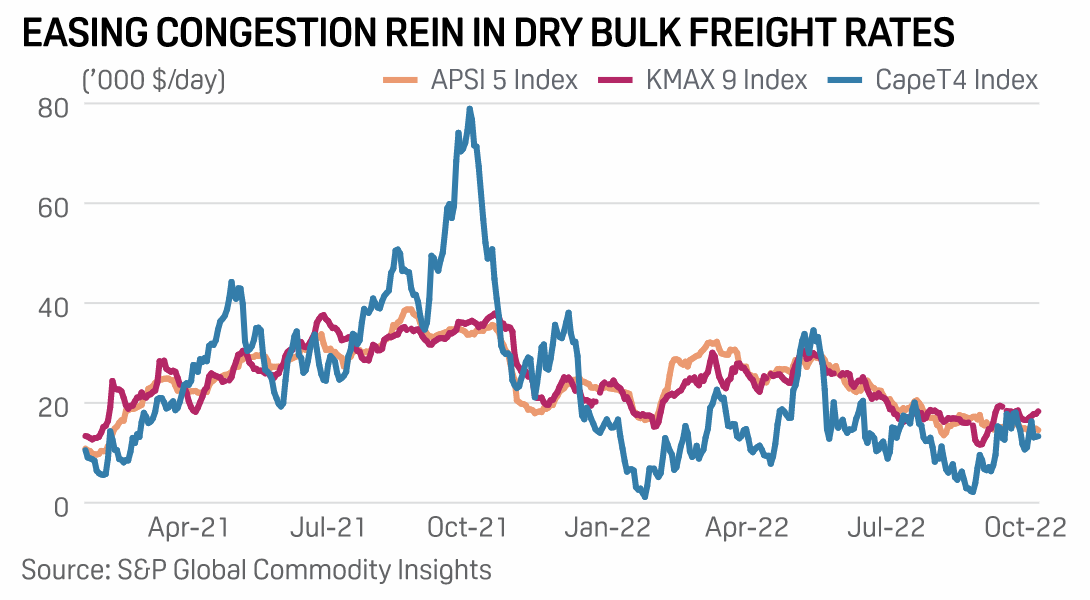

Dry Bulk Quarterly: Gloomy Macroeconomic Indicators May Stall Recovery

Dry bulk shipping may continue to face significant headwinds in the fourth quarter of 2022 on the back of geopolitical uncertainties, China's zero-COVID containment policy and a weak global economic outlook with recessionary risks sparking slowdown fears in key markets, and possibly stemming seaborne trade demand. Over the third quarter of this year, time charter returns for all dry bulk sectors were lower than the year-to-date average and only a fraction of the earnings witnessed during Q3 2021.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Measuring Carbon Intensity: The First Step To Emissions Reduction And Net-Zero Goals

Everywhere you look right now companies are talking about emissions abatement, reaching net-zero targets and buying carbon credits to offset their emissions. But how do organizations figure out exactly how much carbon they are reducing or offsetting? This is where carbon intensity comes in. Carbon Intensity is the measure of how much CO2 and the CO2 equivalent of other greenhouse gases are emitted per unit of production, and it is how organizations can assess the total footprint and impact of their operations.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

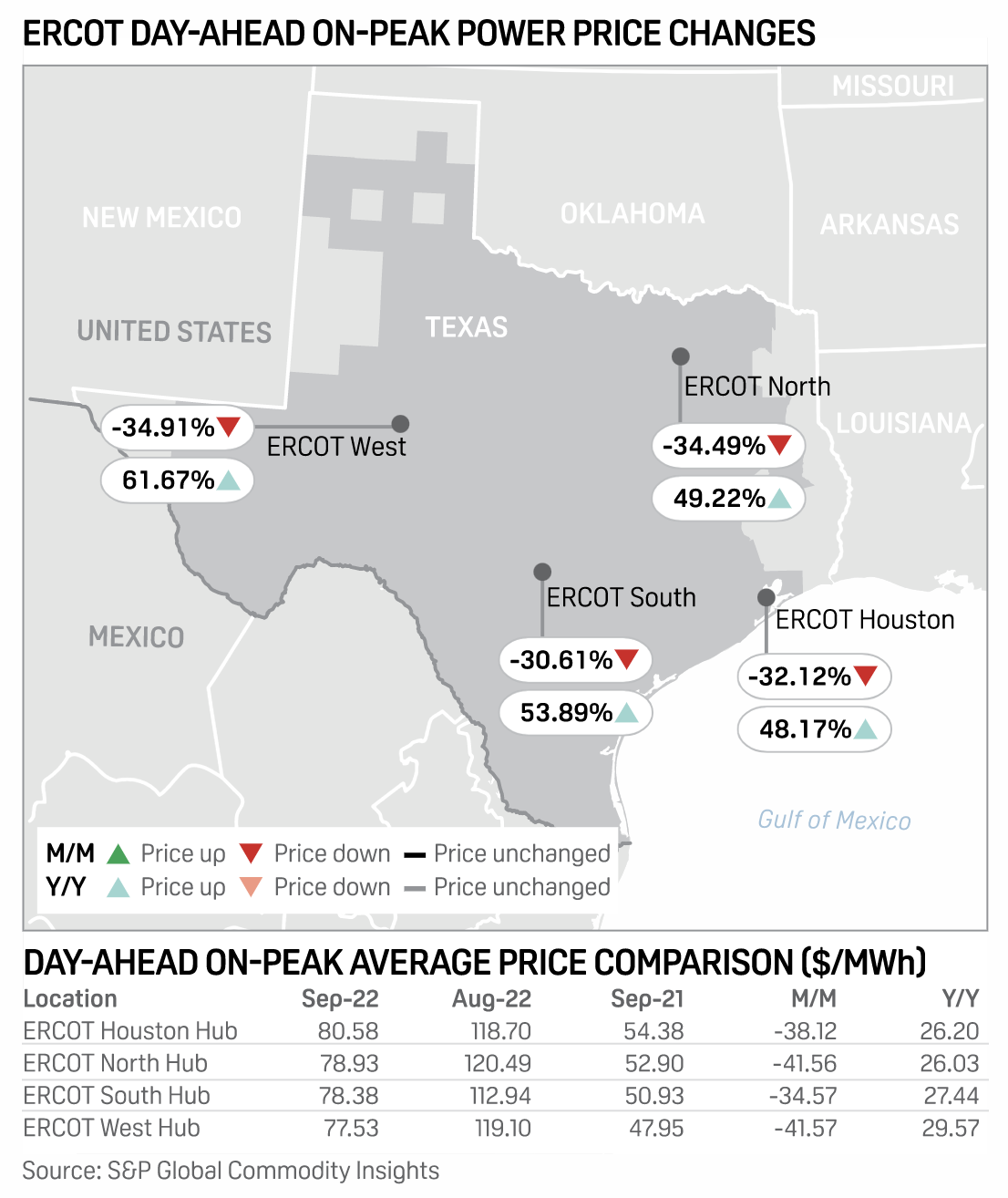

U.S. Power Tracker: Texas Grid Prices Dip On Milder Weather, Weaker Gas

Milder weather, weakening natural gas prices and stronger renewable output brought a steep month-to-month drop the Electric Reliability Council of Texas's September power prices, but they remained much higher than September 2021. Judging by forwards, power traders perceive little risk of prices spiking in November.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

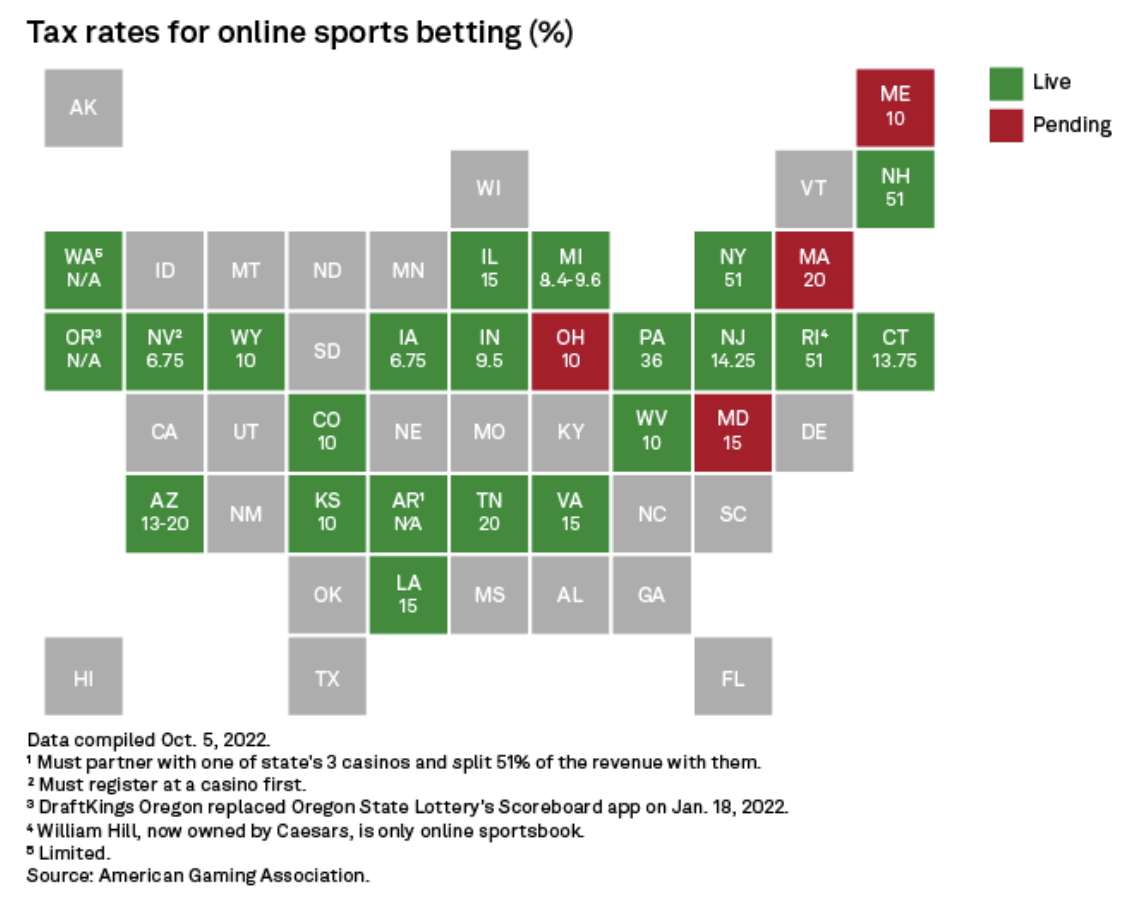

Calif. Sports Betting Ballot Issues Top Senate Races In Midterm Spending

A pair of sports betting ballot issues in California are drawing more political ad spending during this U.S. midterm election cycle than key Senate races. California's Proposition 26 would allow for more gaming activity and online/mobile sports betting at Native American casinos in the state, while Proposition 27 would allow online and mobile sports betting across the state. Together, ad spending for the two measures have totaled some $400 million across various media as of Oct. 5, according to estimates from Kantar Media Intelligences Inc.

—Read the article from S&P Global Market Intelligence