Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 11 Oct, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Riding Out China’s Property Storm

China’s housing boom in recent decades was a major driver for the country's meteoric rise to a global economic power. But after years of soaring home prices, the housing bubble has deflated, and the country is in the middle of a prolonged property market downturn with effects spilling over into the banking sector.

The real estate industry, which accounts for about 30% of China’s gross domestic product, is facing a liquidity crunch. Home prices and sales are declining, many developers are unable to repay their debts and several residential construction projects are left unfinished. About 40% of property builders in the world’s second-biggest economy are suffering from financial strain, according to S&P Global Ratings’ estimates., These debt-ridden developers present a key credit risk for banks. S&P Global Ratings analysts predict that the property sector’s nonperforming loan ratio will rise to 5.5% by the end of 2022 and expect developers to see an L-shaped recovery.

The property market downturn stems from slowing economic growth largely driven by the country’s strict zero-COVID policy, coupled with the Chinese government’s effort to deleverage the highly inflated real estate sector. In an attempt to cool the country’s housing frenzy and make homes more affordable for the middle class while curbing developers’ dependence on debt to drive growth, Chinese authorities introduced measures in August 2020 that cap how much a company can borrow if it breaches any of three key conditions called “red lines.”, known as red lines. This deleveraging drive led to some of the biggest builders defaulting on loans and halting construction projects.

The developers’ financial difficulty further eroded consumer confidence, contributing to a slump in property sales. The delayed projects also prompted a wave of protests by homebuyers to suspend mortgage payments. The mortgage strikes, are expected to have a limited direct impact on the country’s banks. In a base- case scenario, the strikes are forecast to add about 980 billion yuan to Chinese banks' at-risk loans, accounting for just 0.5% of the country’s total loan book. The boycotts are therefore not expected to pose a serious systemic threat to the banking sector.

Despite their exposure to the property market, China's four biggest banks reported net profit growth of between 5.0% and 6.0% during the first half of the year. Thanks to sufficient buffers for potential bad loans in the property sector, the four megabanks are confident they can overcome threats to their asset quality. Regional banks, however, could face more pressure as the country’s economy slows.

Across Asia-Pacific, large mainland Chinese banks led their peers in terms of year-over-year capital, liquidity and leverage ratio improvements during the second quarter, according to data compiled by S&P Global Market Intelligence. Large banks in China also fared better than their regional peers in increasing loans and deposits at a faster pace during the second quarter. The outlook, however, is still uncertain amid tepid borrowing demand.

To revive housing loan demand, the Chinese government recently eased mortgage costs through interest-rate cuts, encouraged banks to lend more to homebuyers and relaxed certain rules on multiple property ownership. Additional stimulus measures aimed at averting a possible property crash, including potential special loans to beleaguered housing projects and government rescue funds, are expected to follow.

Today is Tuesday, October 11, 2022, and here is today’s essential intelligence.

Written by Pam Rosacia.

Week Ahead Economic Preview: Week Of October 10, 2022

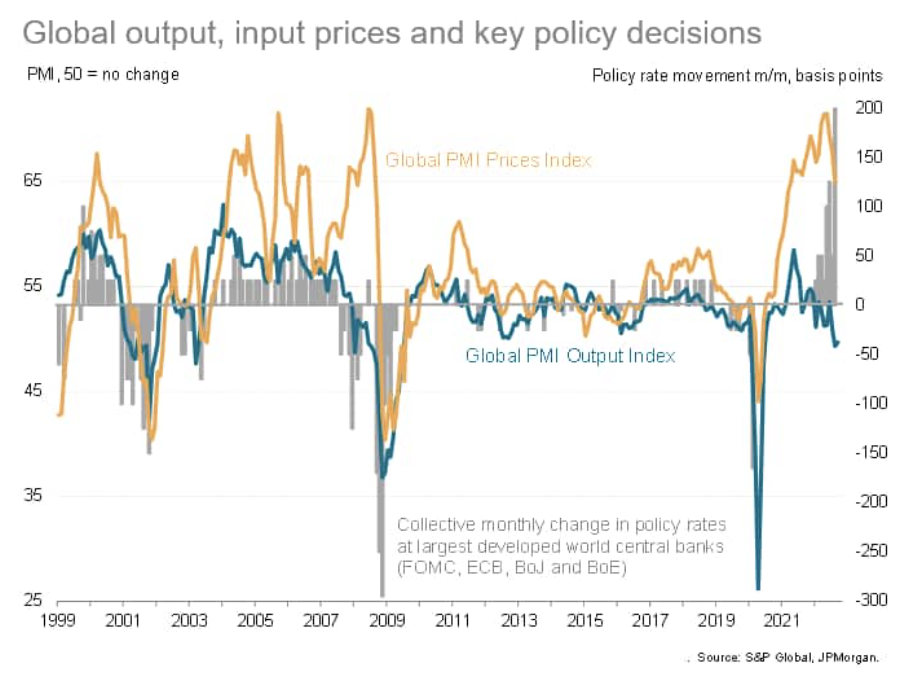

This week, a number of key economic releases will add insights to macroeconomic conditions in the U.S., U.K. and Eurozone after PMI survey data hinted at further global recession risks and persistent inflation, albeit with some encouraging rays of light. U.S. retail sales and inflation data will be high on the agenda for many this week. Retail sales figures in the U.S. have been hard hit by the growing cost of living, though inflation data should indicate a further moderation in inflationary pressures, notably after easing cost pressures were indicated by PMI surveys.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

PE Test Drives Blockchain; High Risk Continues In Consumer Discretionary Sector

Blockchain technology is increasingly looking like the key that could unlock a huge new market for private equity: the global mass affluent, a group that holds about $80 trillion in investable capital, according to one oft-cited estimate by Blackstone Inc. President Jonathan Gray. KKR & Co. Inc. in September became one of the latest and largest private equity firms to tokenize a portion of one of its funds on blockchain. Each token represents a fraction of a stake in the fund, meaning individual investors can buy in at a sliver of the typical ticket size.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

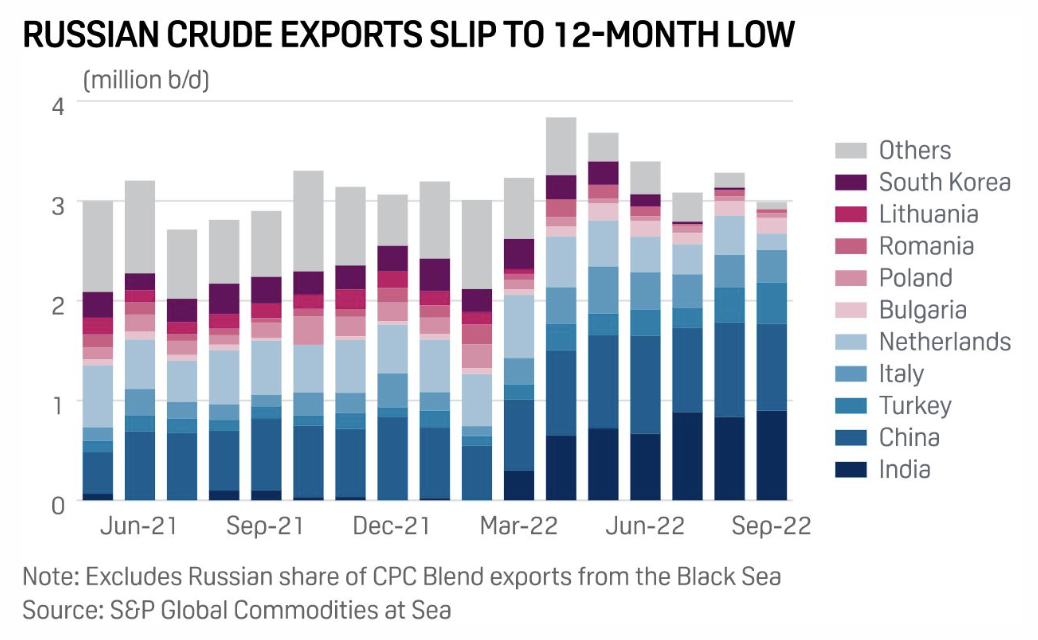

Russian Seaborne Crude Exports Slide To 12-Month Low As EU Ban, Price Caps Loom

Russian crude exports averaged 2.99 million b/d in the month, down 290,000 b/d on the August levels and lowest since September 2021 when global oil demand was still recovering from pandemic lockdowns, according to S&P Global Commodities at Sea data. The data excludes Russia's small share of Kazakhstan's CPC Blend exports. Russian flows to the Netherlands — home to Europe's biggest refining hub — fell by more than half on the month to 165,000 b/d in September, down from 390,000 b/d in August and from pre-war levels of about 525,000 b/d, the Commodities at Sea data shows.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

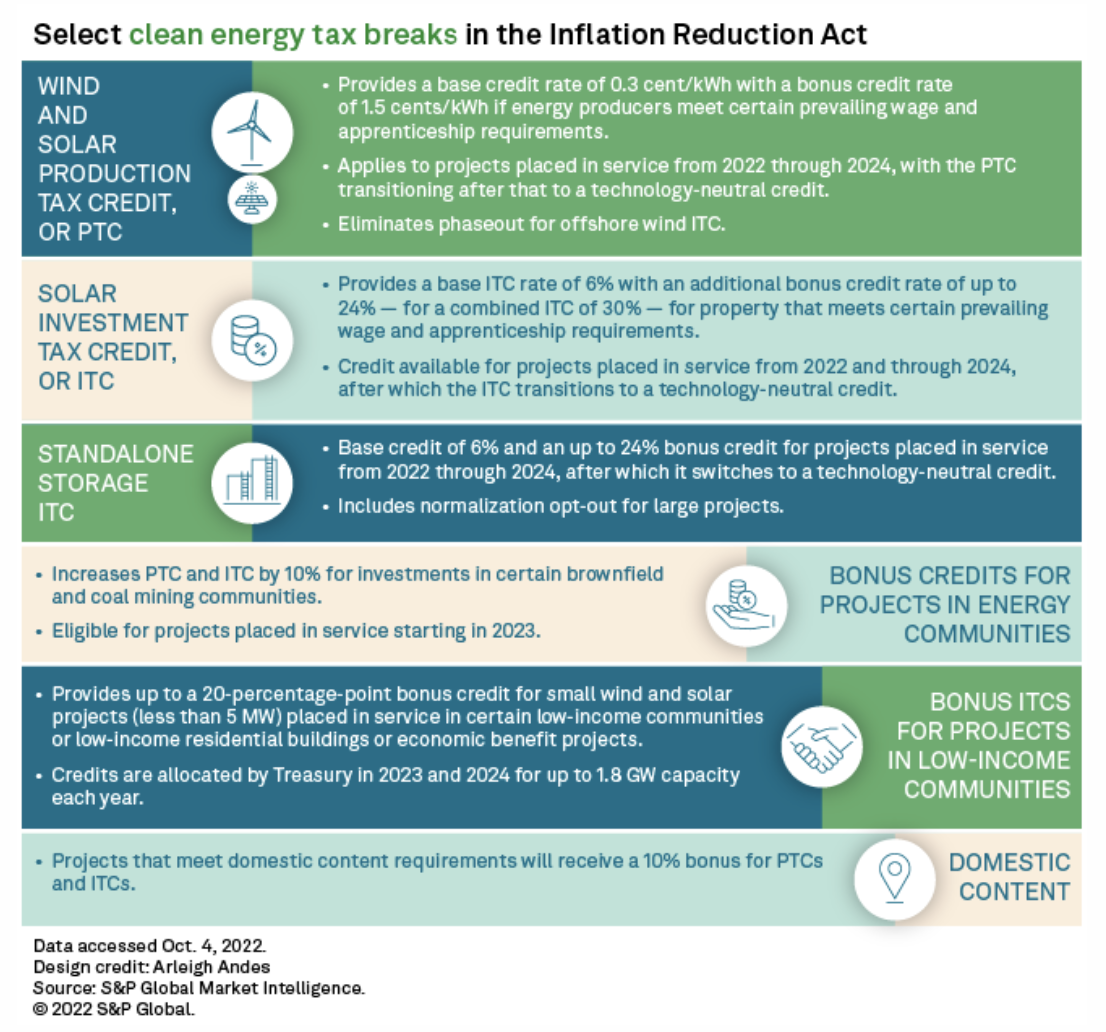

Utilities Taking Up New Tax Tools In U.S. Climate Package To Finance Renewables

U.S. utilities are already moving to take advantage of the new benefits of transferring clean energy extended investment tax credits and new production tax credits contained in the recent federal climate package. But experts expect the traditional tax equity market for financing renewable projects will remain robust. Until recently, developers of large-scale wind and solar installations could only monetize tax credits received from the U.S. government by selling them to large financial firms and other companies with significant tax liabilities, creating partnerships that owned projects.

—Read the article from S&P Global Market Intelligence

Access more insights on sustainability >

Listen: APPEC Buzz Reflects Volatility And Changing Flows

S&P Global Commodity Insights senior leaders Richard Swann and Dave Ernsberger discuss with Joel Hanley the issues highlighted by Singapore's APPEC event, the first fully in-person edition of Asia's leading oil forum in two years. Topics for under discussion included energy security, OPEC+ cuts, the price cap on Russian oil, Chinese quotas and more, showing once again how this important event helps shape the energy conversation.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

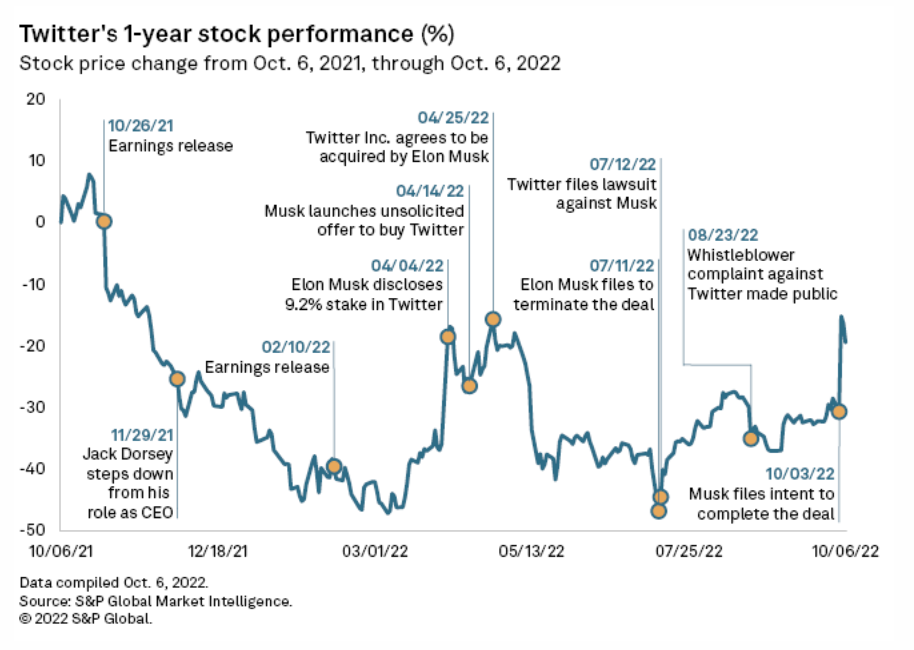

Growth Prospects, Debt Markets Challenge Musk's Twitter Deal

Elon Musk's decision to move forward with his acquisition of Twitter Inc. came as welcome news for shareholders. The concern for industry analysts is that the deal is not a cure-all, especially given the uncertain macroeconomic environment and internal turmoil at the company. Musk sent a letter to Twitter this week saying he intends to close his purchase of the microblogging platform under the deal's original terms, paying $54.20 per share, or $44 billion. The deal is still "pending receipt of the proceeds of the debt financing," according to an Oct. 4 SEC filing.

—Read the article from S&P Global Market Intelligence