Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 11 Oct, 2021 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

In order to reduce emissions, many countries are prioritizing liquefied natural gas (LNG). As a result, global demand for LNG has soared. Market participants are now confronting record-high LNG prices and shipping constraints due to supply shortages and high demand.

Because LNG is the cleanest-burning fossil fuel, many countries are exploring its potential to become a bridge between legacy and renewable energy sources. Momentum is building for several U.S. LNG export projects and pipeline investments. Adoption of LNG is increasing in Latin-American economies such as Brazil, Middle Eastern energy heavyweights like Qatar, and key Asian-Pacific players including Australia, China, and Malaysia. Vietnam has said it will begin importing LNG next year as a key fuel to lower its emissions, according to S&P Global Platts. As a marine fuel, experts believe LNG can accelerate the shipping industry’s decarbonization efforts as the cleaner bunker market matures in the short-term.

Tight demand and supply fundamentals, supply disruptions, a lack of investment, and extreme weather conditions in recent months have propelled LNG prices to record highs that could last into winter for many markets and even temper long-term interest in the fuel.

"The impact of the pandemic, supply disruptions, and lack of investments, coupled with extreme weather conditions have doubled national gas prices to record levels over the past few months," Qatar's energy minister Saad Kaabi said Oct. 5 at the 10th LNG Producer-Consumer Conference, according to S&P Global Platts. "The Northern Hemisphere winter is around the corner, and the demand is expected to continue to rise … I can tell you that this is not a healthy situation to be in as it puts heavy burdens on both producers and consumers. Producers must find supplies that may not exist due to the lack of investment and consumers are helplessly paying record prices as a result of the complex situations, not entirely within their control.”

"LNG is now being looked upon as a commodity with volatile prices,” E.S. Ranganathan, the marketing director of the India-based natural gas transmission company GAIL, said Sept. 23 at the Gastech conference, according to S&P Global Platts. If the volatility persists for more than six months, it could begin to have an impact on the use of LNG, but “if the price settles in the next three months, that would be good for the industry,” he added.

Despite higher and more volatile prices, many market participants foresee LNG remaining a key component of the energy transition.

"High prices and the market out of balance would not be helpful for buyers or suppliers," Andrew Walker, vice president for LNG strategy and communication with U.S. producer Cheniere said during S&P Global Platts’ recent Asia Pacific Petroleum Conference. "We would like to see the market back to balance and LNG showing its affordability and reliability as a fuel in the fight against climate change.”

Carbon-neutral LNG cargoes—which use carbon markets to counteract the greenhouse gases emitted throughout the natural gas supply chains—can provide greater clarity on the fuel’s emissions profile as market competition for more sustainable fuels increases, according to S&P Global Market Intelligence.

"Until we can get to the point where we can mitigate [emissions from] every single molecule [of LNG supplies], what is important is to find a way to offset it and supply what is deemed as carbon neutral LNG so as to allow market forces around these offsets to drive the improvements along the entire value chain," Alan Heng, the interim chief executive of Singapore-based Pavilion Energy, which is building out a carbon offsets business to drive decarbonization across the LNG value chain, said Sept. 27 during another APPEC session. "Some efforts include taking carbon offsets from specific, high-quality suppliers that can be packaged with our LNG cargoes.”

Today is Monday, October 11, 2021, and here is today’s essential intelligence.

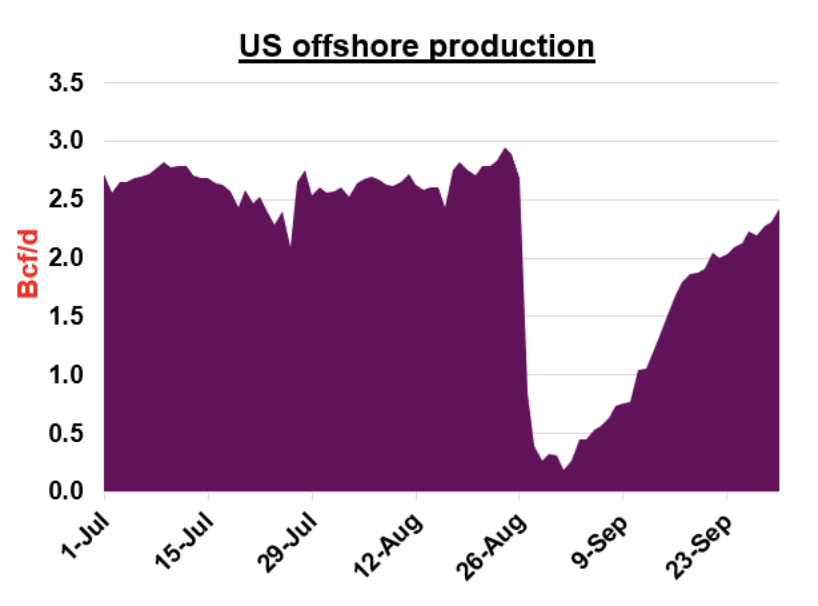

Spotlight: More Than A Month Later, Southeast Is Almost Fully Recovered From Hurricane Ida

Just over a month after Category 4 Hurricane Ida made landfall on August 29, the Southeast fundamentals have nearly recovered fully, however, prices continue to strengthen in both the spot and forwards markets.

—Read the full article from S&P Global Platts

Mining Sector Weighs Vaccine Mandates After Pandemic Measures Bolster Output

Miners are eyeing COVID-19 vaccine requirements as they reap the success of their earlier mitigation measures, especially in the wake of BHP Group's Oct. 7 adopters to set a mandate for its Western Australia operations.

—Read the full article from S&P Global Market Intelligence

Economic Research: Stock-Flow Confusion Yet Again: QE And Tapering

As we begin to exit the pandemic, economies recover and central banks reduce or taper their asset purchases, we sometimes hear that this means the end of QE. Unfortunately, this is incorrect.

—Read the full report from S&P Global Ratings

Credit Trends: 'BBB' Pulse: M&A Rebound Could Put The Corporate Credit Recovery On The Back Burner

Mergers and acquisitions are on the rise. With plentiful cash on hand and abundant financing opportunities, 'BBB' issuers in the U.S. and in Europe, the Middle East, and Africa could contribute to an increasing pace of deal-making.

—Read the full report from S&P Global Ratings

Listen: The Upgrade Episode 15: The Medline Industries LBO

In the latest episode of The Upgrade podcast, guests discuss the recent large LBO of healthcare sector company Medline. Topics include views on the company’s business, financial and debt recovery prospects, as well as how Medline compares to existing CLO collateral.

—Listen and subscribe to The Upgrade, a podcast from S&P Global Ratings

Insurance Pricing Direction In The Balance As Market Faces 'Delicate Situation'

Commercial insurance prices could start softening in 2022, but lingering economic uncertainty and the potential for claims inflation could counteract any downward pressure.

—Read the full article from S&P Global Market Intelligence

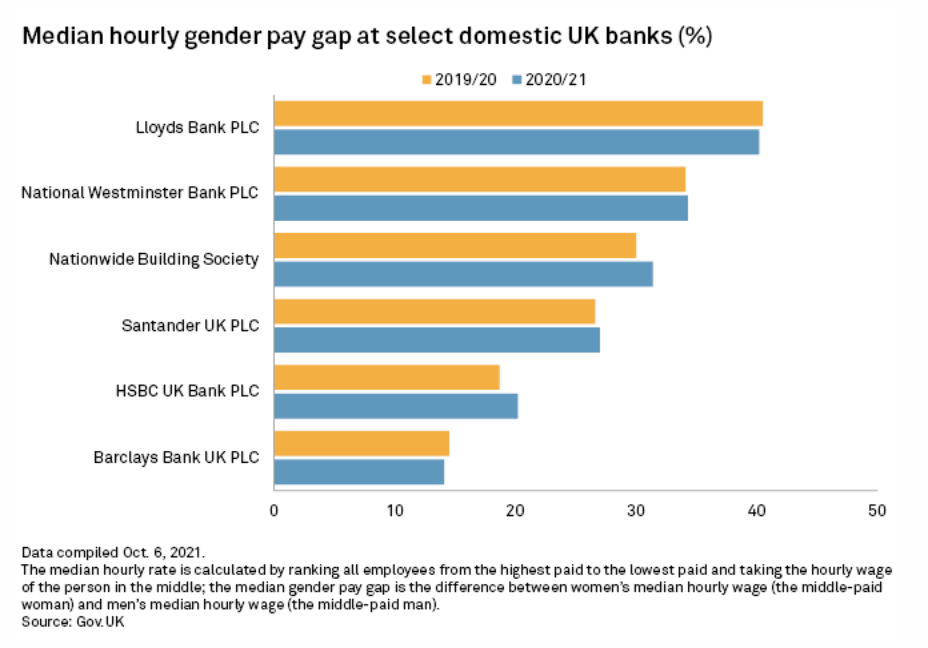

U.K. High Street Banks Fail To Make Significant Progress On Gender Pay Gap

NatWest Group PLC CEO Alison Rose may be the first woman to lead a major U.K. bank, but female staff at the lender's high street bank division still earn a third less than their male colleagues.

—Read the full article from S&P Global Market Intelligence

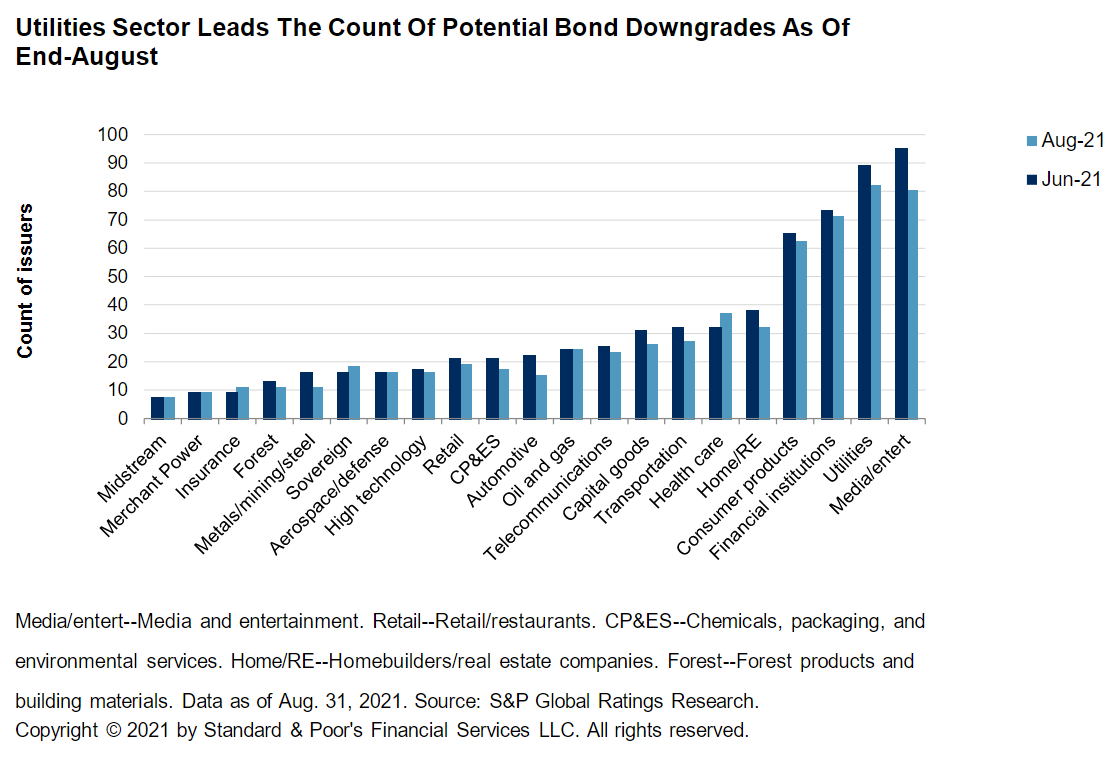

Credit Trends: Utilities Outpace Media And Entertainment As The Sector With The Most Potential Downgrades

The number of potential bond downgrades has decreased for the 13th month in a row, to 614 as of Aug. 31, 2021 from 671 as of June 30. The count peaked at 1,365 in July 2020.

—Read the full report from S&P Global Ratings

FTC Nominee's Research Shows Focus On Facial Recognition, Privacy Rights

The nomination of legal scholar Alvaro Bedoya to the Federal Trade Commission signals the potential for the agency to tackle regulations regarding the use of facial recognition technology.

—Read the full article from S&P Global Market Intelligence

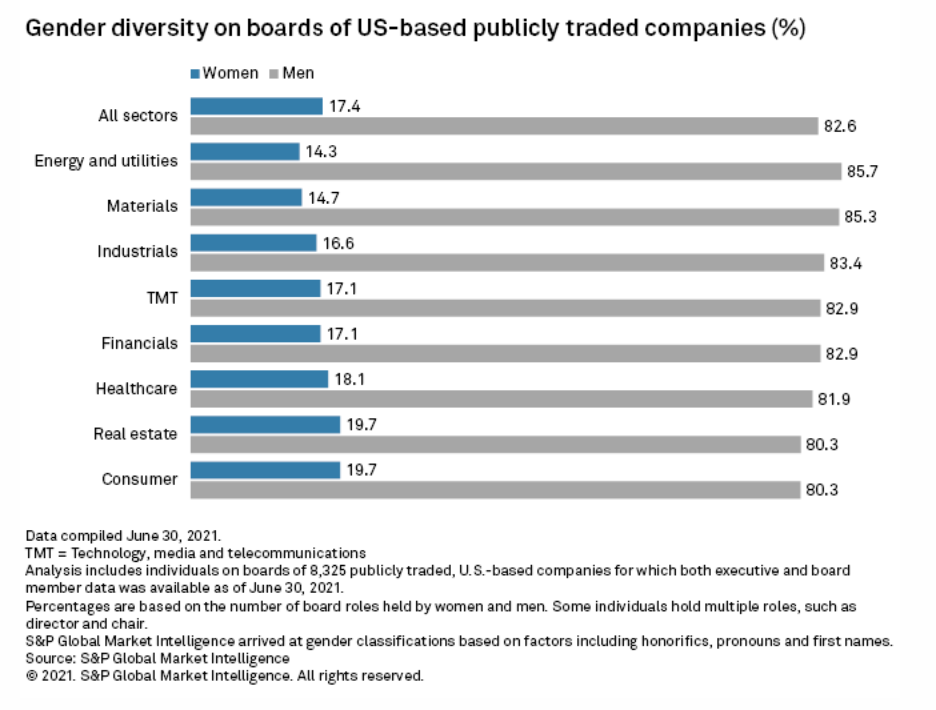

The Importance Of Demystifying, Measuring The ‘S’ In ESG

If you follow ESG headlines, you know that social issues — the ‘S’ in ESG — came into much sharper focus last year: Employee safety and benefits and customer well-being got a lot more attention during the coronavirus pandemic.

—Read the full article from S&P Global

Greenwash Or Hogwash? Defense Against The Criticisms Of Sustainable Investing Approaches

As the world gears up for the 26th UN Climate Change Conference (COP26) this year, never before has more scrutiny been paid to the substance of sustainable investment products. Rightly so, if we are to salvage our last hopes of evading catastrophic and irreversible climate change.

—Read the full article from S&P Global Sustainable1

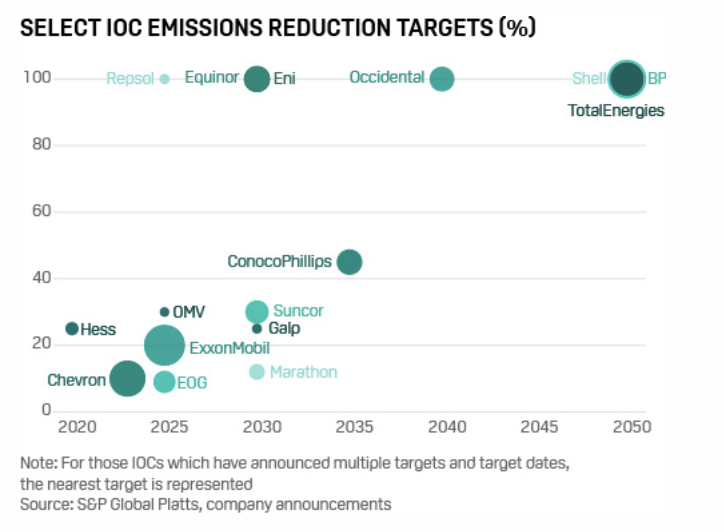

Private Capital A Must In Climate Change Battle; The ESG Price Of Oil And Gas

The battle to tackle climate change is "not going to work without a lot of private investment," and governments must create policy to incentivize private capital to invest, said Lord John Browne, former chief executive of BP PLC and chair of General Atlantic Service Co. LP's BeyondNetZero, which targets growth equity investments related to climate change.

—Read the full article from S&P Global Market Intelligence

U.S. Hydrogen Pilot Projects Build Up As Gas Utilities Seek Low-Carbon Future

U.S. natural-gas utilities have announced at least 26 hydrogen pilot projects in the past year as the industry works out how to make and transport the gas, as well as help customers migrate to the low-carbon fuel.

—Read the full article from S&P Global Market Intelligence

Carbon Intensity Set To Be Major Driver For The Future Of Crude

The need to pursue aggressive decarbonization has become ever more urgent, with the Intergovernmental Panel on Climate Change's most recent report underscoring that climate change will almost certainly breach the 1.5 degree C objective set out in the Paris Climate Agreement within the next 30 years.

—Read the full article from S&P Global Platts

European Gas Market Ponders A Week Of Unparalleled Movements

The Oct. 6 trading day was a historic day on the European wholesale market, and one which is likely to become a reference point for risk managers for years to come.

—Read the full article from S&P Global Platts

Alaska LNG Project GHGs Seen Comparing Favorably To Asia Fuel Alternatives

A report released Oct. 7 by Alaska's state-owned Alaska Gas Development Corp. shows that greenhouse gas life-cycle emissions for its proposed Alaska LNG Project compares well against competing LNG delivered to Asia from the US Gulf Coast and would be significantly lower than for coal-fired power generated in China.

—Read the full article from S&P Global Platts

U.S. Policy Options Dwindle For White House To Ease Gasoline Price Pain

After getting rebuffed by OPEC, the White House is looking at its few remaining options to ease high U.S. gasoline prices that have pressured the Biden administration for months, including quietly asking domestic producers to ramp up output and moderating high RIN prices.

—Read the full article from S&P Global Platts

Hydro Producers To Cash In From Europe's Power Price Rally

An unprecedented surge in power and gas prices is playing into the hands of hydropower producers in central and northern Europe, allowing them to cash in on their exposure to the wholesale market.

—Read the full article from S&P Global Market Intelligence

Sparks Are Flying In The Energy Complex

The broad-based S&P GSCI started Q4 2021 off with a bang; as of October 5 it was up 3.9% for the month and 44% YTD. The spot version of the index has reached its highest level since October 2014.

—Read the full article from S&P Dow Jones Indices

Written and compiled by Molly Mintz.

Content Type

Location

Language