Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 9 Nov, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Safe as Houses

There is little joy in commercial real estate this year. Long-term trends related to e-commerce and recent trends in remote work have conspired to deprive the commercial real estate market of some of its historical frothiness. On the other hand, US residential real estate is enjoying an unexpectedly strong year. While tighter monetary policy has led to higher mortgage rates, US housing prices remain stubbornly high. According to Craig Lazzara, managing director at S&P Dow Jones Indices, the reason may be a simple case of supply and demand – higher mortgage rates have suppressed demand, but those rates seem to have suppressed supply even more.

US home prices continued to climb in August for the seventh consecutive month. The S&P CoreLogic Case-Shiller US National Home Price NSA Index has risen 5.8% year over year, well above the median for a full year over the last 35 years. The index, which includes 20 cities across the US, provides a good sense of the overall trends in US residential real estate. Chicago home prices increased the most at 5%, followed by New York with a 4.98% increase and Detroit at 4.8%.

The evidence for suppressed supply in the US housing market can be seen in data from the National Association of Realtors. As of August, existing home sales had declined 15.4% year over year to a seasonally adjusted annual rate of 3.96 million units. While new home sales have increased this year, the total number of new home units is much smaller than the number of existing home units.

According to S&P Global Ratings, the current supply tightness is a product of Federal Reserve rate hikes that began in 2022. A rapid increase in the 30-year fixed-rate mortgage shocked the market and led to a sudden drop in new home originations. Despite a rate that is now close to 8%, mortgage holders have generally continued to reliably pay their home loans.

Nevertheless, by some measures, the affordability of a home in the US is at its worst level in almost 40 years. There is lower demand for homes because indebted consumers simply don’t have the money or the credit to buy. Consumer debt has increased about 21% since the fourth quarter of 2019. Debt from residential mortgage loans has increased even more than overall consumer debt at 26%.

Lower demand due to a lack of affordability has affected homebuilder companies. According to S&P Global Market Intelligence data, the median one-year total stock return of homebuilders was 45.4%. Valuations of US residential real estate investment trusts have headed in the other direction, riding higher home prices to outperform REITs in other categories such as retail and office space. In the residential sector, 60% of REITs have announced dividend hikes year to date.

Today is Thursday, November 9, 2023, and here is today's essential intelligence. The next edition of the Daily Update will publish on Monday, November 13.

Written by Nathan Hunt.

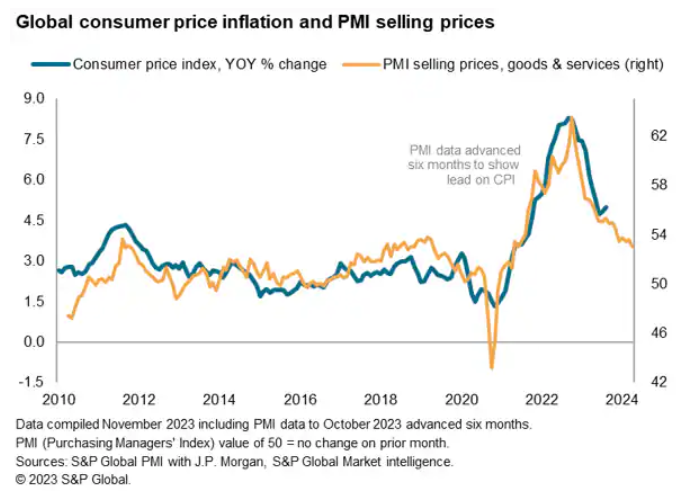

Global PMI Data Show Prices Rising At Slowest Rate Since December 2020

Global inflationary pressures moderated in October to their lowest since late-2020, according to PMI data compiled by S&P Global across over 40 economies and sponsored by JPMorgan. Although the overall rate of inflation of selling prices for goods and services remains above its pre-pandemic average, amid some stickiness of services inflation and a modest upturn in goods prices, there is encouraging news on underlying — or core — price pressures cooling further in the coming months. In particular, wage pressures have moderated markedly in recent months and companies' pricing power has been hit by reduced demand. Demand-pull price pressures are reverting to their long-run average.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

This Week In Credit: UK And China Lead Data-Light Week

With three new risky credits last week, the global count so far this year is up to 89. This is 40% higher than at the same time last year. In the week ahead, the UK will release its preliminary GDP data for the third quarter and China will release its October credit data. Markets are also expecting lower October inflation prints in both Germany and China while Japan's September wage data will be important for its medium-term inflation outlook.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

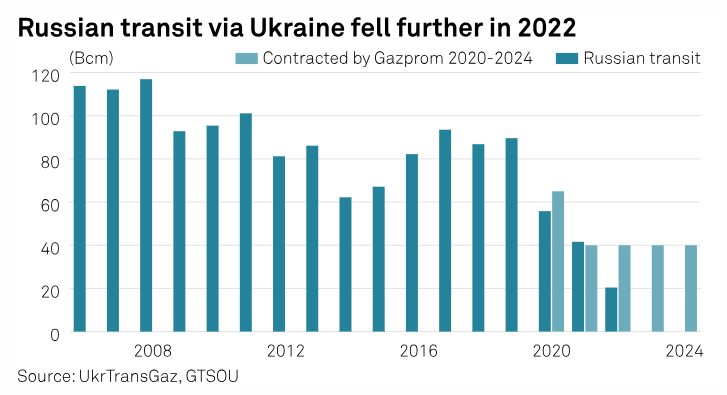

Russian Gas Flows Via Ukraine Total 12.1 Bcm Over Jan-Oct: AGPU

Russian gas deliveries to Europe via Ukraine totaled 12.1 Bcm in the first 10 months of 2023, a decline of 32% year on year and a fall of 66% versus the same period in 2021, Ukrainian gas industry group AGPU said Nov. 7. Despite the ongoing war, Russia's Gazprom has continued to send gas to Europe via Ukraine, with volumes delivered at the Sudzha interconnection point on the Russia-Ukraine border.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

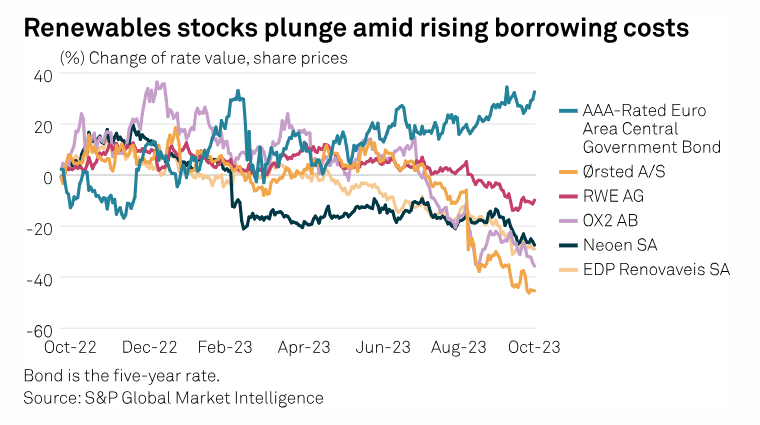

Path To Net Zero: Cost Surge Puts European Utility Targets Under Pressure

European utilities are sticking by their net-zero targets, but the path is getting steeper. Rising interest rates and a surge in costs in parts of the renewables supply chain are making the delivery of new wind and solar capacity more expensive and putting installation targets at risk. Major offshore wind projects, which are central to Europe's energy transition ambitions, have been delayed or even shelved in recent months, with developers struggling to make their business cases stack up in the inflationary environment.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

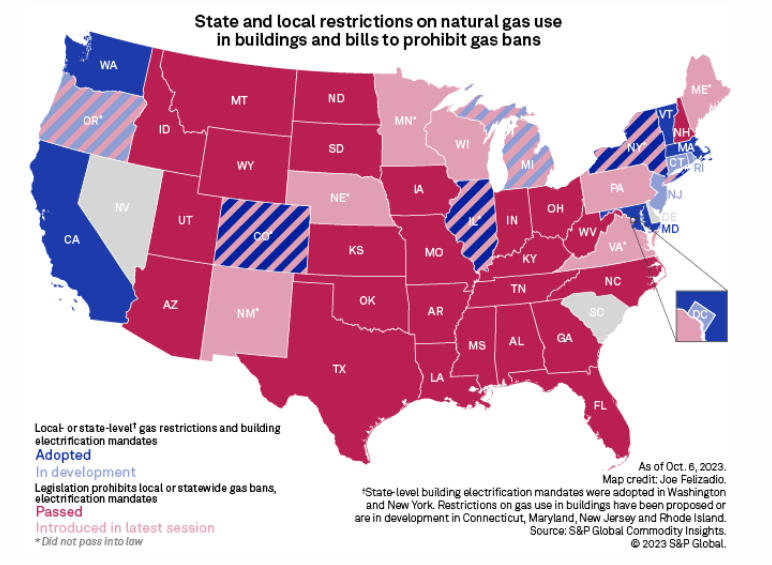

Gas Ban Monitor: Md. Counties Go All-Electric; Vt. Gas Restrictions Expand

Efforts to phase out natural gas use in East Coast buildings ramped up in 2023, marking a shift in momentum after the West Coast dominated policymaking for several years. Climate advocates and local policymakers mounted a coordinated push in Maryland and Washington, DC, to require all-electric construction. Meanwhile, lawmakers in Burlington, Vt., moved closer to restricting fossil fuel combustion in new and existing buildings following years of legislative activity.

—Read the article from S&P Global Market Intelligence

Access more insights on energy and commodities >

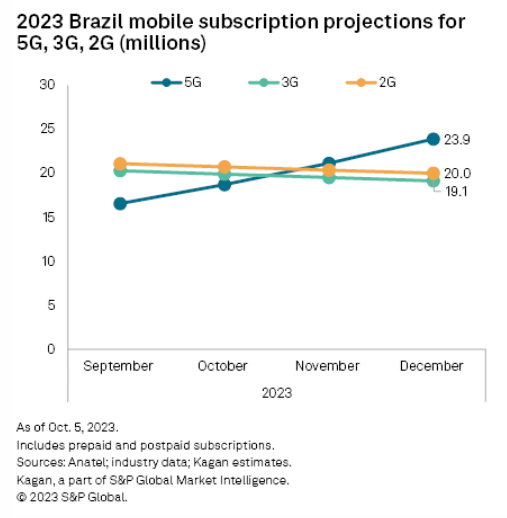

Futurecom 2023: Brazil Plans To Switch Off 2G, 3G Networks

As deployment of 5G networks remains the focus, the Brazilian market seems eager to take a step further to open the mobile market and keep the investments coming, according to speakers at Futurecom 2023, Latin America's biggest telecommunications conference, held in São Paulo on Oct. 3–5. While Carlos Baigorri, chairman of Brazilian telecommunications regulator Anatel, considered 2021's 5G auction the first step toward making spectrum available for small internet service providers, he wants to replicate in the mobile market the asymmetrical rules of the competition goals general plan that drove those companies to dominate fixed broadband in the country.

—Read the article from S&P Global Market Intelligence