Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 7 Nov, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

In Brazil, a Familiar Face Confronts a Changed Landscape

On Jan. 1, 2011, Luiz Inácio Lula da Silva left the presidential palace in Brasília with an 83% approval rating. Da Silva, universally known as Lula, handed power to Dilma Rousseff, his former chief of staff and designated successor, anticipating the relaxed and well-remunerated retirement of popular and successful politicians. It was not to be. Scandals enveloped Lula’s Partido dos Trabalhadores, or Workers’ Party. Rousseff was impeached before the end of her term of office, and Lula himself spent time in prison for corruption. Now, Lula has his redemption. He has been reelected to the presidency of Brazil, narrowly beating incumbent Jair Bolsonaro. But the Brazil Lula left and the one he returns to are very different.

In 2010, Lula’s last full year in office, gross domestic product growth in Brazil was 7.5%, and Lula’s governing coalition held solid majorities in the upper and lower houses of Brazil’s Parliament. But Lula returns to a more fractious landscape. The left-leaning political coalitions he relied on have become more complex to maintain, which will limit Lula's ability to advance his economic and social agenda. S&P Global Ratings believes that these political divisions mean it could take time to see what economic policies the new government implements. So much uncertainty may keep necessary private investment on the sidelines.

S&P Global Ratings projects GDP growth for Brazil of 2.5% for 2022. This outperforms the initial projection of 1.2% GDP growth from earlier this year because Brazil has benefited from trade in food and energy commodities. Bolsonaro supported a program of cash transfers to households and a cut in gasoline taxes, which may account for some of the growth. However, S&P Global Ratings has lowered Brazil’s 2023 GDP growth projection to 0.6%, from 1.4% previously. Inflation will remain a drag on the Brazilian economy.

Lula could find he has little flexibility when it comes to raising capital for ambitious programs through debt issuance. According to S&P Global Ratings, Brazil's key credit strengths and vulnerabilities are structural, locking the country into a sovereign credit rating in the BB-/Stable/B range. High government debt levels are exposing Brazil to higher debt costs and increased difficulty in refinancing existing debt. These problems are expected to last, as Brazil’s debt is anticipated to continue rising on trend.

Brazilian banks are already struggling with weakening asset quality, which S&P Global Ratings thinks could negatively impact banks’ profitability. This is expected to continue, but Brazil’s banks are in an enviable position compared with their global peers.

One consistent factor for the Brazilian economy has been the importance of state-owned monopoly Petrobras to its oil and natural gas sector. After Lula’s party lost power due to corruption scandals in 2016, the government worked to sell off refining assets and work with foreign oil companies. Lula is likely to reverse these policies, leading to greater government involvement in developing the country's oil and natural gas resources and the energy transition.

Lula’s followers gave him a narrow victory over Bolsonaro, hoping he has it in him to return Brazil to the growth and liberality of the past. Time will tell if the president can overcome global recession and inflation to deliver on his voters’ hopes.

Today is Monday, November 7, 2022, and here is today’s essential intelligence.

Written by Nathan Hunt.

Week Ahead Economic Preview: Week Of Nov. 7, 2022

A busy week ahead for economic releases is expected with the key focus on U.S. and China inflation figures for October. China will also update October trade figures. The United Kingdom meanwhile releases third quarter GDP figures while Germany's industrial production data will also be due. A series of central bankers' appearances, including those from the U.S. Federal Reserve will be watched intently after this week's Fed FOMC meeting.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

U.K. Bond Market: Insights From The Recent Downturn

The past few weeks have been extraordinary as U.K. politics and financial markets entangled, resulting in GBP-denominated debt becoming both shaken and stirred. Gilts, bonds issued by the U.K. government, were hit particularly hard on the back of collateral calls in the liability-driven investment pension crisis. Gilts saw their yields reach multi-year highs, especially in the long duration segment.

—Read the article from S&P Dow Jones Indices

Access more insights on capital markets >

The ‘A’ Factor: The Role Of Algorithmic Trading During An Energy Crisis

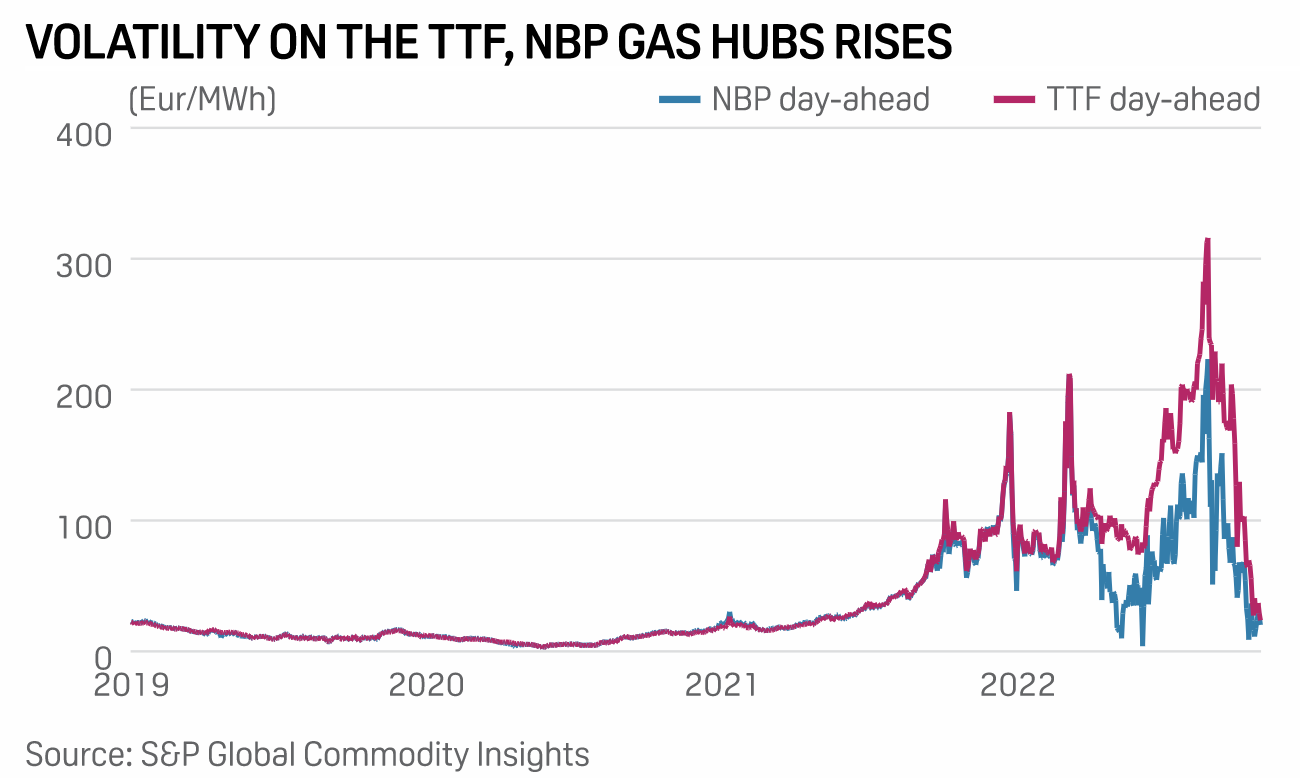

Algorithmic trading is becoming increasingly common in European natural gas and electricity markets, with traders often blaming the innovation for extreme volatility, as regional prices have been swinging this year on the back of tight supply and accelerating uncertainty. European gas and power prices that already were above historical levels early this year surged after Russia's military invasion in Ukraine late February.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: At COP27, How To Make Progress In The Face Of Uncertainty

In this episode of ESG Insider, hosts Lindsey Hall and Esther Whieldon talk to Jenny Davis-Peccoud, a Partner at management consulting firm Bain & Co., about the role of the private sector at COP. Taryn Fransen, Senior Fellow in the Global Climate Program at the World Resources Institute, talks to them about where countries stand on climate pledges known as Nationally Determined Contributions, or NDCs. And they speak with Capitals Coalition CEO Mark Gough about how the private and public sectors are working together toward goals related to climate change as well as nature and biodiversity.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Sustainable1

Access more insights on sustainability >

COP27: Middle East Producers To Defend Oil, Gas, While Grappling With Own Climate Pressures

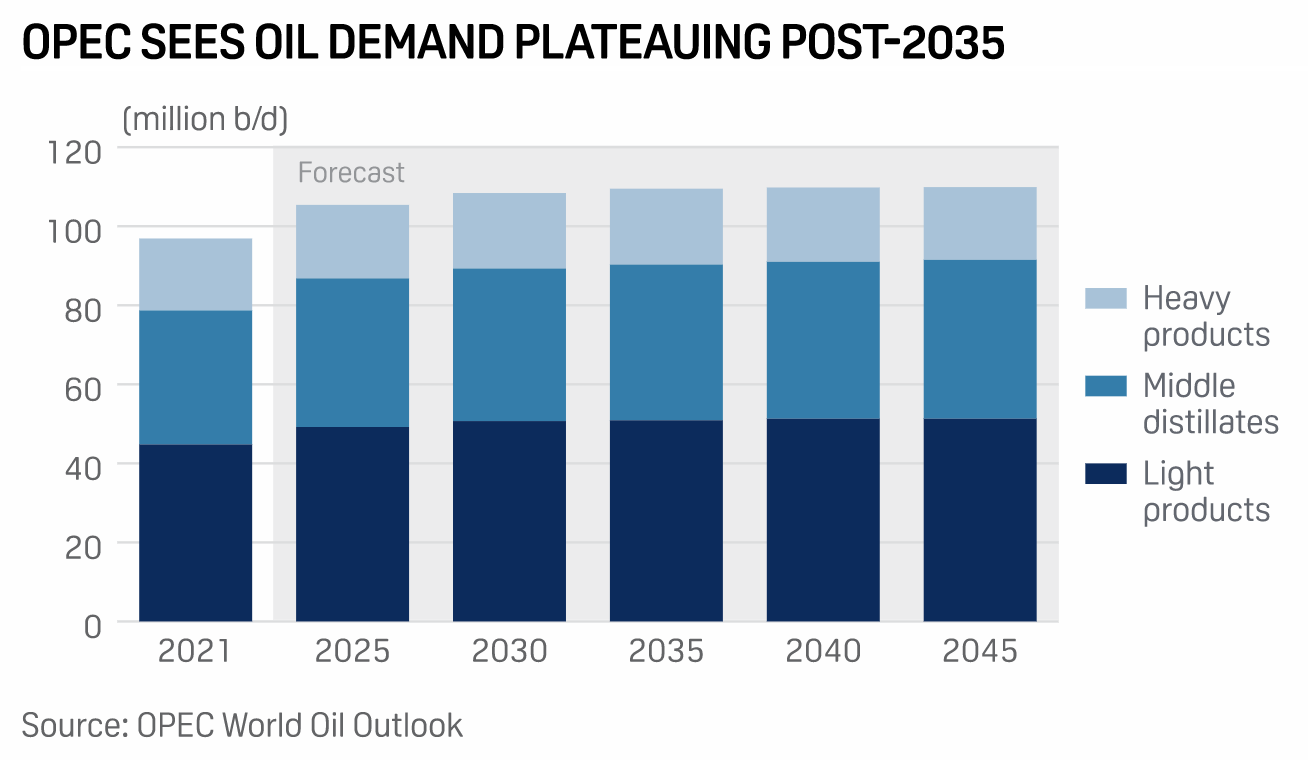

Hydrocarbons-rich Middle East countries attending the UN Climate Change Conference in Egypt want to steer the narrative on energy security and transition at a time when they are boosting their oil and gas output in a race to avoid having stranded assets as the globe eyes net-zero emissions. Gulf countries have made it clear that oil and gas will be needed for decades to come, and that the region has the least carbon-intensive barrels to fuel a global economy seeking to lower its emissions.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

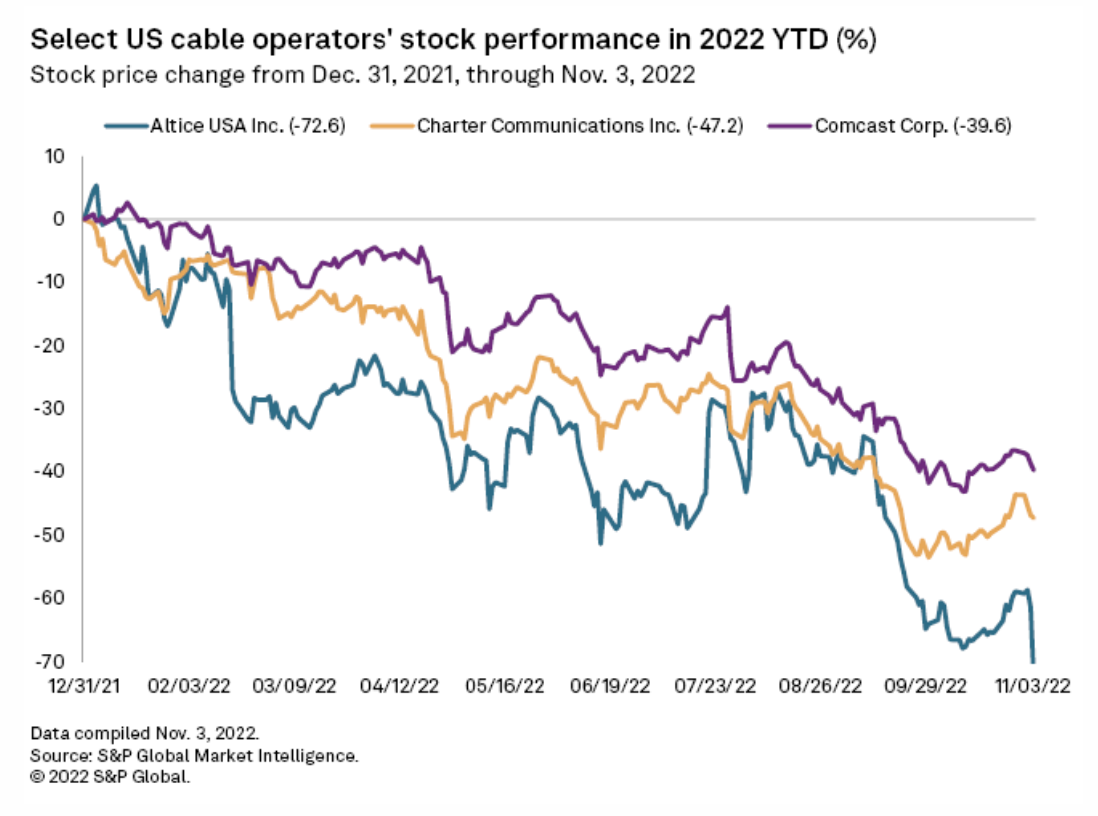

Cable Execs Say ARPU Growth To Offset Broadband Losses To Fixed Wireless

Cable companies struggled to add broadband subscribers in the third quarter as industry competition ramped up and inflation impacted consumer spending. Still, cable executives say increased per-user revenue will make up for slowing subscriber growth. The three largest U.S. cable companies all reported feeling pressure from wireless carriers Verizon Communications Inc. and T-Mobile US Inc., which have both gone all-in on fixed wireless rollouts this year.

—Read the article from S&P Global Market Intelligence