Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 5 Nov, 2021 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

On the fourth day of COP26, 46 countries and 26 companies pledged to cease both using coal-fired power and building new plants—with advanced economies promising to kiss coal goodbye by the 2030s, and developing economies by the 2040s. But with China, India, the U.S., Australia, Japan, and some of the world’s other biggest generators and consumers of the dirtiest fossil fuel declining to sign onto the Global Coal to Clean Power Transition Statement, how soon can the end of coal come?

"These are enormous, enormous, enormous shifts in countries that, until very recently, saw reliance on coal as an absolute necessity and, in the case of Vietnam, were still going to expand it dramatically," Lauri Myllyvirta, a lead analyst at the climate think tank Center for Research on Energy and Clean Air, wrote on Twitter, according to S&P Global Market Intelligence. "I would say politically and economically, it's as big a step for [certain signatories] to decide to phase out coal as it would be for China … It's setting a new norm.”

Even without the endorsement of major coal consumers, the climate commitment marks a monumental moment in the energy transition from fossil-fuel generation and consumption alongside an acceleration of the trend away from coal that has for years put the industry on the decline. Leading up to this agreement and including its signatories, 190 countries and organizations have committed to ending their coal use—including 18 countries that have declared to do so for the first time and the largest financiers of coal pledging to end financing of coal projects abroad by the end of this year, according to S&P Global Platts’ and S&P Global Market Intelligence’s reporting. Signatories to the Global Coal to Clean Power Transition Statement include, among others, Vietnam, Poland, Ukraine, Morocco, and the U.K., as well as the French nuclear power company Electricité de France and U.K. power generation firm Drax Group. In addition, Western economies have pledged approximately $8.5 billion in the next five years to help South Africa phase coal out of its energy mix.

Poland and Germany’s participation in the agreement points to a breakthrough in Europe’s energy transition. Poland is one of the EU’s biggest coal economies, accounting for 96% of the EU’s total hard coal production and 43% of the bloc’s total hard coal consumption last year, according to Eurostat. Poland's biggest banks told S&P Global Market Intelligence that they are planning to phase out exposures to coal and have already stopped offering new loans to the coal mining sector and coal-fired power stations. Germany, another coal crusader, set 2038 as its intended coal closure timeline, but environmental groups and investors told S&P Global Market Intelligence that Germany's biggest banks aren’t as aggressive in curbing coal financing as they should be to assist the country in cutting out coal.

"I've been in multiple [European] bank dialogues as an investor...and I continue to be frustrated at the lack of robust expectations … Especially on coal, the timeline needs to be accelerated and expectations need to be put in place now with corporate clients,” Lauren Compere, director of shareowner engagement at Boston Common Asset Management, told S&P Global Market Intelligence. "Ultimately, what we as investors are asking for and really, truly trying to understand is how banks are reducing and accelerating the timeline to exit coal … If a bank has adopted a net-zero strategy, what does that mean at all levels, including at the origination level and those that oversee those client portfolios?"

The next frontier to remove coal from the global energy mix could be focus on the private sector to pressure financial institutions to entirely end their fossil fuel financing and instead support low-carbon projects and climate finance, as well as to push energy companies to match surging energy demand with renewable resources.

"The world is moving in the right direction, standing ready to seal coal's fate and embrace the environmental and economic benefits of building a future that is powered by clean energy," U.K. Business and Energy Secretary and U.K. COP26 President Kwasi Kwarteng said Nov. 4, according to S&P Global Platts.

Today is Friday, November 5, 2021, and here is today’s essential intelligence.

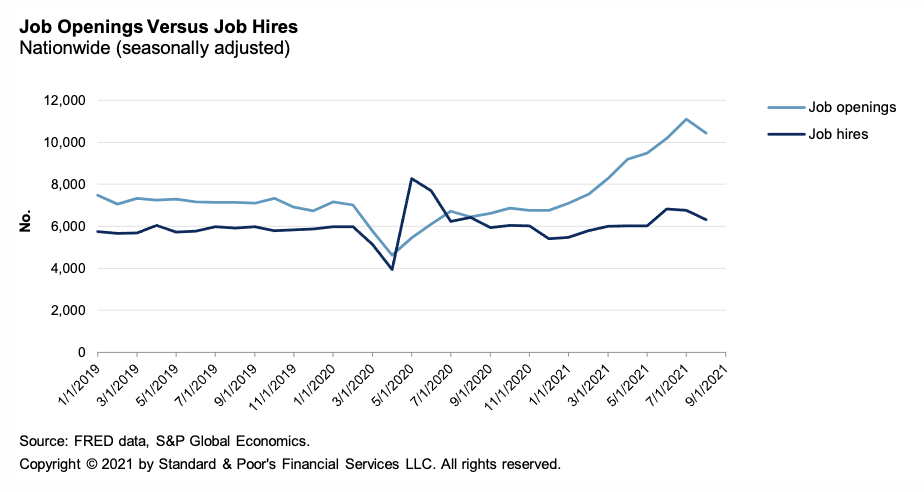

Economic Research: Where Are The Workers? Three Explanations Point To An Answer

Approximately five million people in the U.S. are unemployed or have left the workforce since the pandemic began, and it is difficult to predict whether their decision was short term or permanent. It has been suggested that extended federal unemployment benefits offered during the pandemic have kept workers on the sidelines. S&P Global Ratings analysis indicates this is not the case.

—Read the full report from S&P Global Ratings

Economic Research: European Housing Market Inflation Is Here To Stay

European house prices are this year increasing at their fastest pace since 2006, by 6.9% annually in Q2 2021. A large pool of household savings, a shortage of housing supply, and low borrowing costs are all contributing to dynamic property markets across Europe.

—Read the full report from S&P Global Ratings

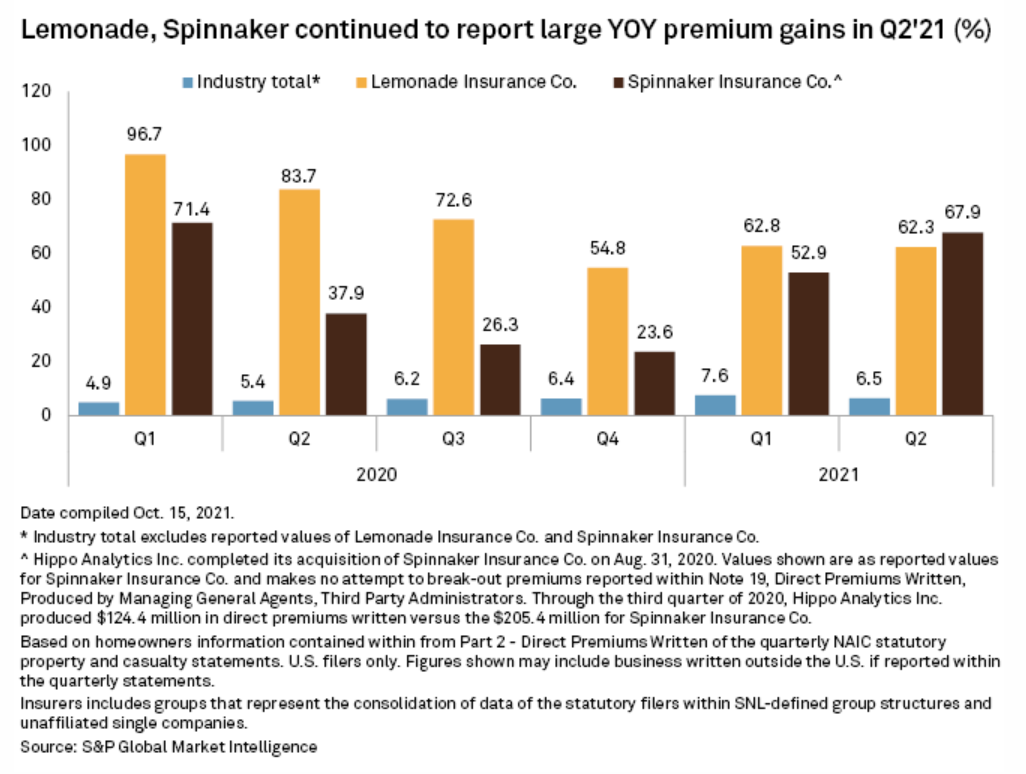

Hippo, Lemonade Homeowners Premiums Continue To Grow At Exceptional Pace

Direct homeowners premiums written were relatively small for the underwriting subsidiaries for Lemonade Inc. and Hippo Holdings Inc. compared to its traditional insurer peers, but year-over-year growth was the highest in the industry for companies with at least $50 million in quarterly premiums.

—Read the full article from S&P Global Market Intelligence

Northeast Gas Prices Lead Triple-Digit YOY Growth Among U.S. Regions In October

The average price of natural gas for day-ahead delivery in October continued to record triple-digit growth year over year in all the regions of the U.S., with the Northeast region posting the highest yearly increase of more than 200% to a spot gas price index of $4.999/MMBtu.

—Read the full article from S&P Global Market Intelligence

Activision's Stock Sinks On Game Delays, Weak Outlook Amid Harassment Scandal

Activision Blizzard Inc.'s shares plummeted as much as 17% Nov. 3 after the game publisher confirmed two of its major title releases would be delayed due to leadership changes amid ongoing allegations of sexual discrimination and harassment within the company.

—Read the full article from S&P Global Market Intelligence

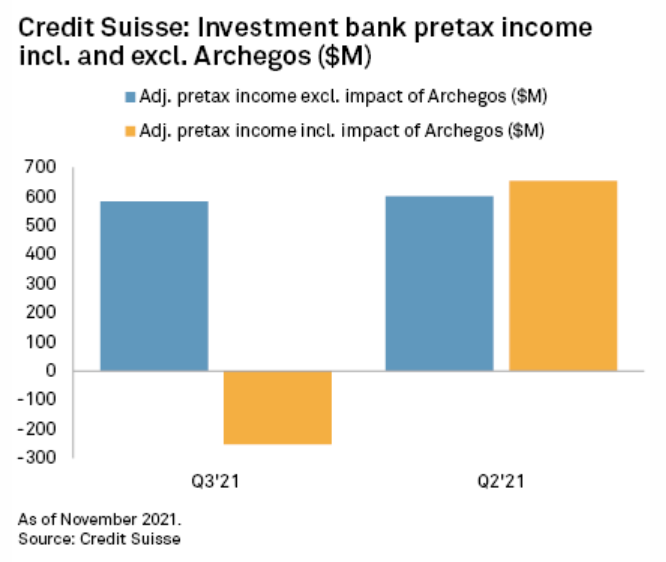

Credit Suisse's Numerous Scandals Hit Earnings, Lead To Restructuring

Credit Suisse Group AG's third-quarter earnings were overshadowed by the continuing toxic effects of its dealings with Archegos Capital and Greensill Capital (U.K.) Ltd., a fraudulent loan to Mozambique and a corporate spying scandal. Over the past year, the bank has reported $5.5 billion in losses following its dealings with hedge fund Archegos.

—Read the full article from S&P Global Market Intelligence

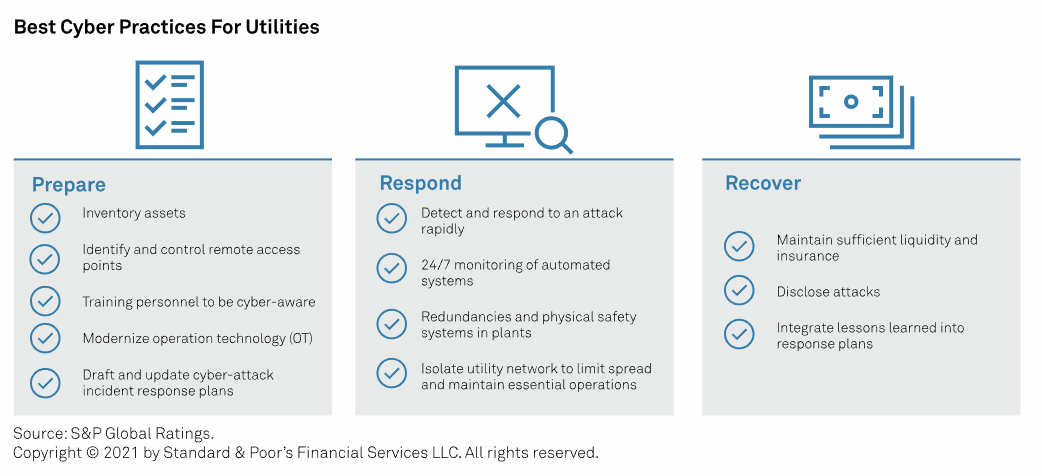

Cyber Risk In A New Era: U.S. Utilities Are Cyber Targets And Need To Plan Accordingly

Given that water and sewer services are critical to health and safety as well as the economy, the sector is particularly attractive to bad actors and cyber-attacks could be devastating if not properly managed. Many U.S. utilities have historically prioritized the maintenance of their physical assets over their data-related systems, but the allocation of resources will need to be rebalanced to fully mitigate cyber risk.

—Read the full report from S&P Global Ratings

Cable TV Carriage Deals Revenue Estimates

Affiliate fees from multichannel operators remain important to U.S. cable networks despite the prevalence of cord cutting and cord shaving. Kagan tracked 132 multiyear carriage agreements between cable network owners and traditional multichannel operators since 2013, with an aggregate value of $28.19 billion of affiliate revenues per year on average.

—Read the full article from S&P Global Market Intelligence

How Wireless Carriers, Cable Companies Can Sustain Record Phone Adds

With some wireless carriers reporting historic growth in the third quarter, it is hard not to wonder how long the momentum can last. With 928,000 additions, AT&T Inc. postpaid phone subscribers in the third quarter were nearly double analyst predictions and at the highest rate in nearly 10 years.

—Read the full article from S&P Global Market Intelligence

Facebook's Facial Recognition About-Face Sparks Renewed Calls For U.S. Federal Law

While many applauded Facebook's acknowledgement of public concerns regarding the technology, they noted that its use on the Facebook platform was already limited. Meta Platforms Inc., Facebook's new parent company following a recent reorganization, also cited a lack of clear guidance from regulators about how facial-recognition technology should be used as factoring into the decision.

—Read the full article from S&P Global Market Intelligence

UN Climate Conference Seeks Concrete Steps To Tackle Dirty, Energy-Hungry Buildings

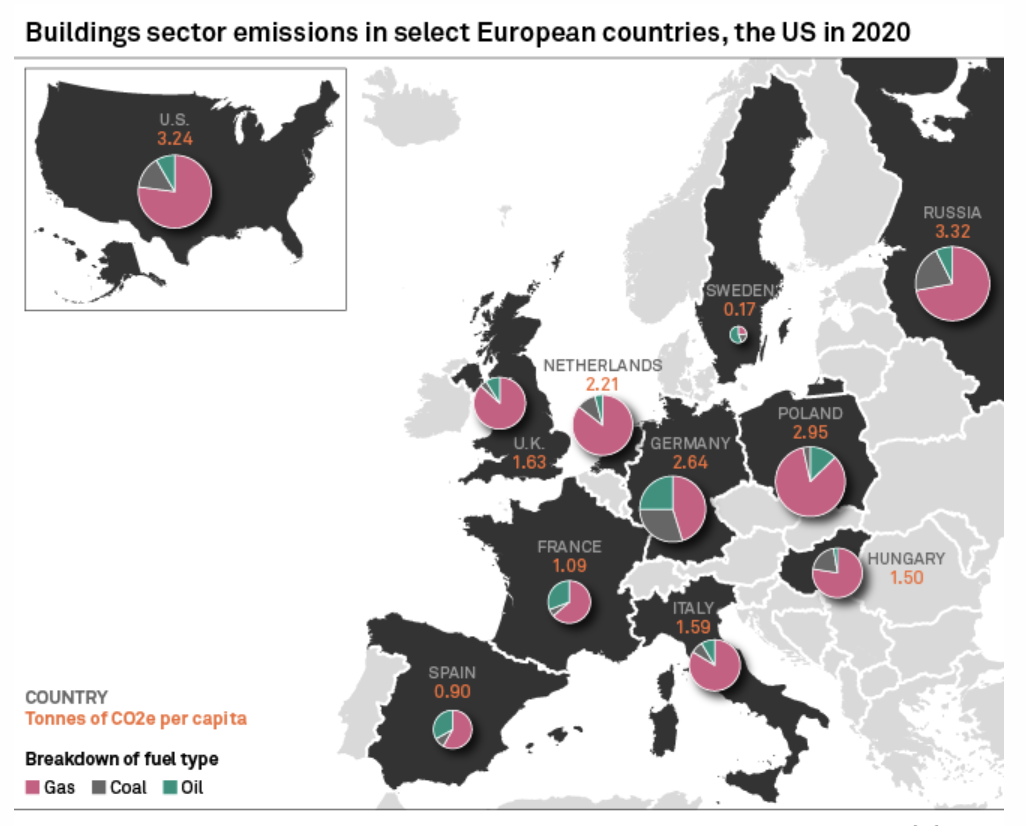

Global emissions from buildings must fall by 56% over the next 30 years to help limit global warming to 2 degrees C, according to S&P Global Platts Analytics modeling. On the current trajectory, emissions from buildings would decline only 7%. The COP26 meeting in November is the first to properly call attention to the challenge of decarbonizing buildings, which are collectively responsible for 40% of energy-related carbon emissions. Europe has launched a particularly aggressive plan to taper emissions and energy use from buildings, requiring 35 million structures to be renovated by 2030.

—Read the full article from S&P Global Sustainable1

Economic Research: Green Spending Or Carbon Taxes (Or Both): How To Reach Climate Targets, And Grow Too, By 2030?

The U.S. and EU have added green spending of about 1.4% and 3.9% of 2019 GDP to their COVID-19 recovery plans. With fiscal multipliers of 1.4-1.6, this could add up to 2 percentage points to U.S. GDP and 6.6 points to EU GDP by 2030. While environmental policies tend to have a small overall economic impact, the costs of the transition to green energy may become more material. S&P Global Ratings’ carbon tax scenario shows that a sharp rise in the price of carbon to $100 by 2030, as recommended by the High-Level Commission on Carbon Prices, would represent a more negative shock for economies with low carbon prices and reliance on carbon-intensive energy sources. The impact on GDP, without offsetting measures, could be over 8% for China by 2030, and closer to 5% if tax revenues were reinvested by the government. It's less for the U.S. at 3% and Europe at 2%, and about 1% or less after reinvestment for both.

—Read the full report from S&P Global Ratings

A Super Fund Charts Its Path To Net Zero

The Net Zero Asset Managers initiative is an international group of asset managers committed to supporting the goal of net zero greenhouse gas emissions by 2050 or sooner, in line with global efforts to limit warming to 1.50C. To date, there are 128 signatories and $43 trillion U.S. in assets under management.

—Read the full article from S&P Global Market Intelligence

Why COP Matters To Everyone

Committing to net zero reduction targets by 2050 may seem like a relatively easy target to agree to, given it’s almost 30 years away—but it isn’t. Long-term targets require short-term milestones. One of the key asks at this year’s COP is that countries come forward with ambitious 2030 emission reductions targets.

—Read the full article from S&P Dow Jones Indices

Net-Zero Insurance Alliance Aims To Bring Brokers, Trade Bodies On Board

A group of global insurers that have pledged to reduce carbon emissions in their underwriting portfolios wants brokers and industry trade bodies to join the cause. The Net-Zero Insurance Alliance, convened by the United Nations Environment Programme and chaired by Axa SA, was formed in July with eight founding insurers and reinsurers.

—Read the full article from S&P Global Market Intelligence

Major U.S. Energy Legislation Nears House Vote, Would Boost Renewables Deployment

The U.S. House is poised to vote on the most significant clean energy and infrastructure package in the history of Congress as soon as Nov. 4, Representative Kathy Castor said Nov. 3, with power industry participants highlighting renewable energy tax credit extensions as a major piece of the legislation.

—Read the full article from S&P Global Platts

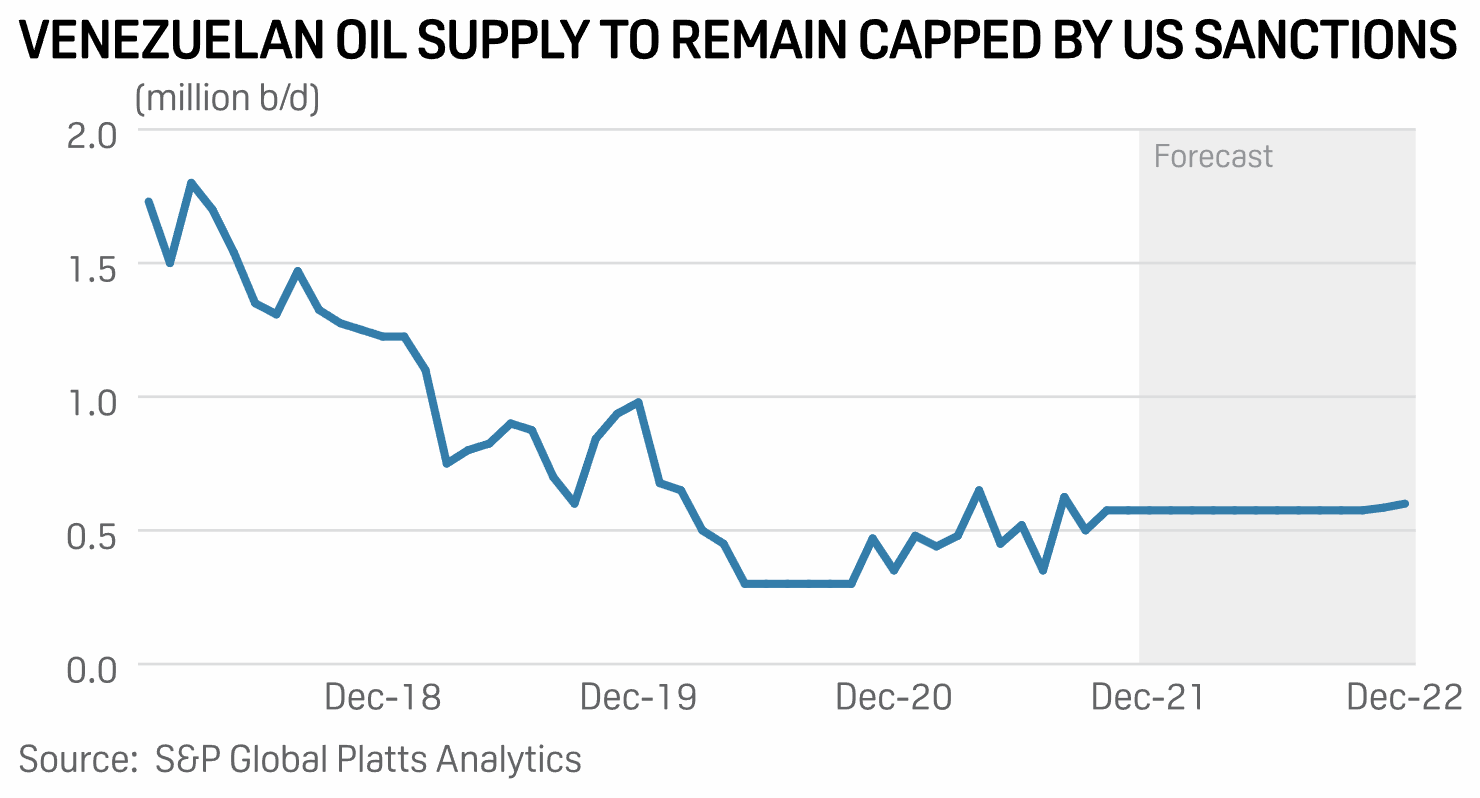

Venezuelan Elections Not Expected To Bring Major U.S. Oil Sanctions Relief

Any major easing of U.S. oil sanctions against Venezuela remains off the table, but the country's Nov. 21 elections could provide a chance for relief around the edges like a restart to crude-for-diesel swaps. Candidates backed by President Nicolas Maduro are expected to sweep the local and regional elections.

—Read the full article from S&P Global Platts

OPEC+ Sticks With 400,000 B/D Oil Output Hike For December, Despite U.S. Pleas

OPEC and its allies are standing firm on boosting crude output quotas by a modest 400,000 b/d for December, shrugging off intense lobbying from the U.S. and other consuming countries for more volumes to bring surging oil prices down.

—Read the full article from S&P Global Platts

Southern CEO Maintains Vogtle Unit 3 Will Start Up In 2022, Despite Latest Delay

Southern Co. Chairman, President and CEO Tom Fanning remains confident the first of two new reactors at the Alvin W. Vogtle Nuclear Plant will be online in 2022, despite another recently announced delay. In July, the plant ran hot functional testing for the 1,117-MW unit 3, which is one of the final, significant reactor tests that places plant systems into normal operating conditions to ensure it is prepared to go online.

—Read the full article from S&P Global Market Intelligence

Written and compiled by Molly Mintz.

Content Type

Location

Language