Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 3 Nov, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

The Data Gap in Private Equity

Private market data is difficult to gather and to analyze. This is partly by design. Companies in public markets are required to provide data on many aspects of their business, which is then used by investors and risk managers. Some economists believe that when all market participants have access to company data, equity and debt are priced accurately. However, this also limits the opportunity to use information asymmetry to generate alpha, or absolute returns, or “beat the market,” since everyone presumably has the same information.

The appeal of private markets for investors is that data can provide a competitive advantage. Every market participant is incentivized to maintain their data advantage. They do this by amassing as much data as possible about other participants in private markets while sharing as little data as possible about their own investments.

Collecting data in an "investable universe" made up of 10 million private companies globally is challenging for private equity investors. According to a recent Coalition Greenwich study, 62% of investors in the U.S. and Europe said they have difficulty examining the details of the private companies in their portfolios.

To meet this challenge, 83% of senior executives at U.S. private equity firms claimed that Big Data had become more important to their business, according to a recent survey conducted by Mergermarket on behalf of S&P Global Market Intelligence. Private equity firms and their investors have tried to improve the sourcing, standardizing and visualizing of private company data. But challenges remain in applying insights derived from that data.

The biggest opportunity for data use in private equity is in sourcing investments and deal origination. According to the survey, most private equity firms have not integrated data analytics into deal origination. Only 14% of respondents believed that their organization was leveraging data to automate deal sourcing and due diligence. Meanwhile, 43% of private equity executives agreed that better use of data in deal origination was a priority for their firm.

The lack of standardized data means clients of private equity firms must accept the valuations provided by those firms on their investments. This uncertainty forces CFOs at private equity firms to focus heavily on investor relations and outreach, rather than on traditional financial functions. Nearly two-thirds of CFOs who responded to the survey claimed their role had become more outward facing compared with just a few years ago.

An absence of data can also lead to slower and fewer decisions to invest. According to S&P Global Market Intelligence, private equity fund managers have plenty of investable capital at their disposal, but they've been treading cautiously in a challenging macroeconomic environment.

Today is Thursday, November 3, 2022, and here is today’s essential intelligence.

Written by Nathan Hunt.

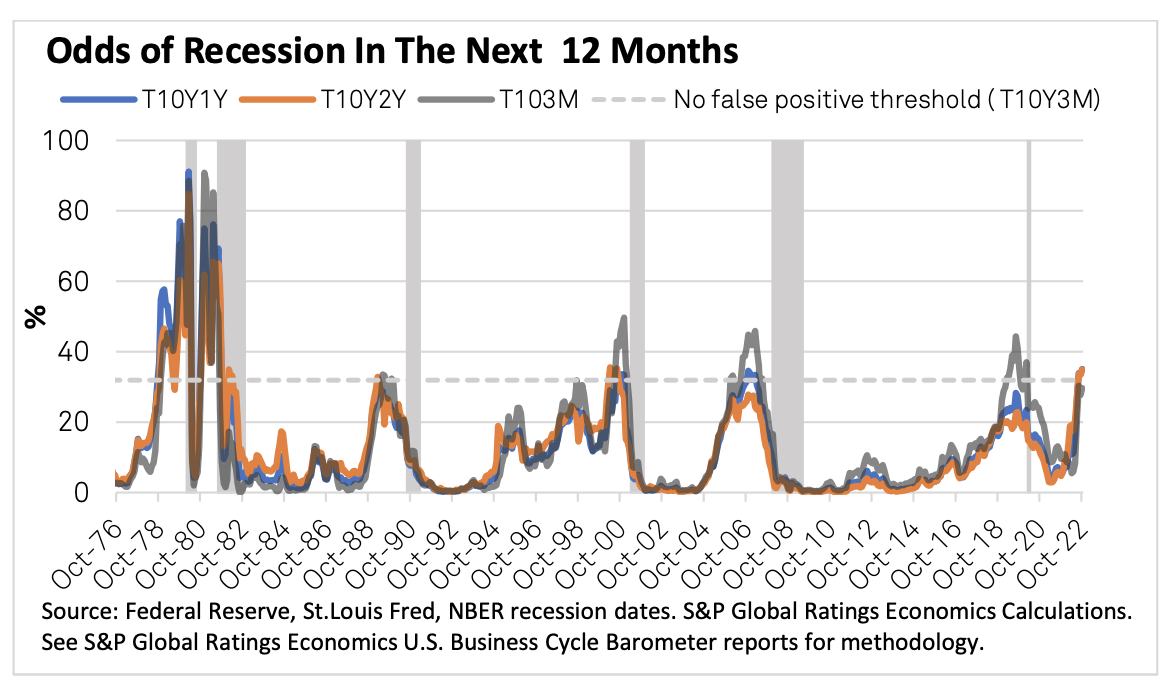

Economic Research: 10-Year/3-Month Yield Curve The Latest Domino To Fall

S&P Global Ratings believes the strong positive third quarter GDP reading is the expansion's last stand with a recession on the horizon. Recent indicators support its view, as rising prices and interest rates eat away at private sector purchasing power. Indeed, its dashboard of leading indicators from its Business Cycle Barometer report still has only one of the nine indicators it tracked in September in positive territory — six were negative and two neutral.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

U.S. Banks Close 159 Branches, Open 73 In September

U.S. banks shuttered 159 branches and opened 73 in September, resulting in 79,065 active branches, according to S&P Global Market Intelligence data. September net closures were 86, down from 88 in August and notably lower than the trailing-12-month average of 207 net closures. From the beginning of October 2021, banks have closed 3,521 branches and opened 1,035.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

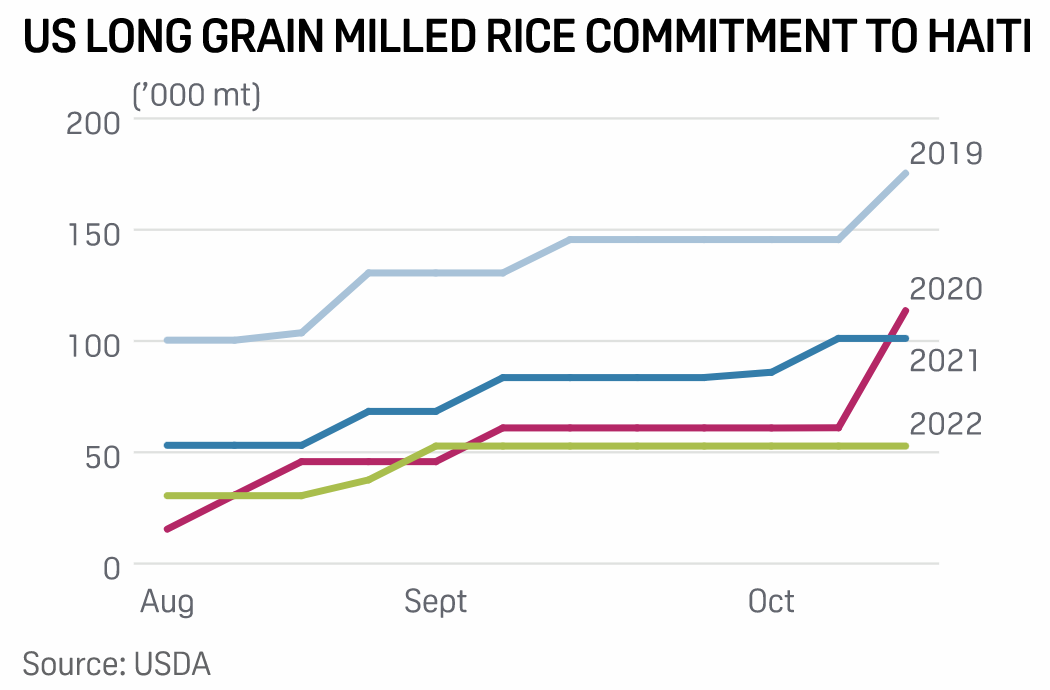

U.S. Rice Sales To Haiti Dip Amid Political Crisis, Historically High Prices

The U.S. rice industry is looking on with increasing apprehension as the crisis in Haiti continues to worsen, threatening U.S. market share in this key destination. Social unrest and gang violence have been an increasing issue in Haiti for some years. However, the assassination of the country's president, Jovenel Moise, in July 2021 and the ongoing blockade of the country's main fuel terminal by armed gangs have made the issue particularly acute.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

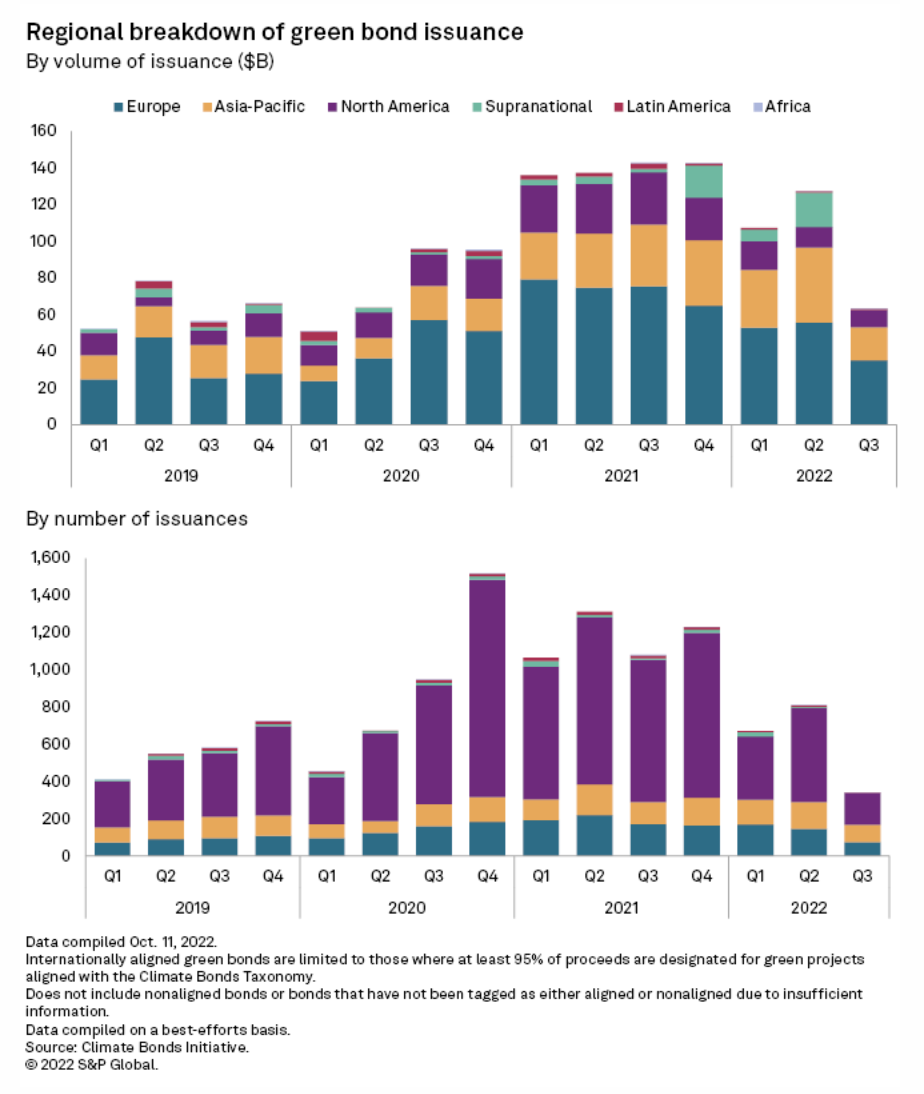

Global Green Bond Rout To Stay After Volume Falls To 2-Year Low

The global green bond market is set to slow further after issuances in the third quarter fell to the lowest level in more than two years. Global green bond issuances fell 55.6% to $63.49 billion in the third quarter from $142.99 billion in the same period last year, according Climate Bonds Initiative, a U.K.-based green debt tracker. The volume was the lowest since the second quarter of 2020. Europe remained the highest-contributing region to green debt globally at 55.5%, followed by Asia-Pacific at 28.4%.

—Read the article from S&P Global Market Intelligence

Access more insights on sustainability >

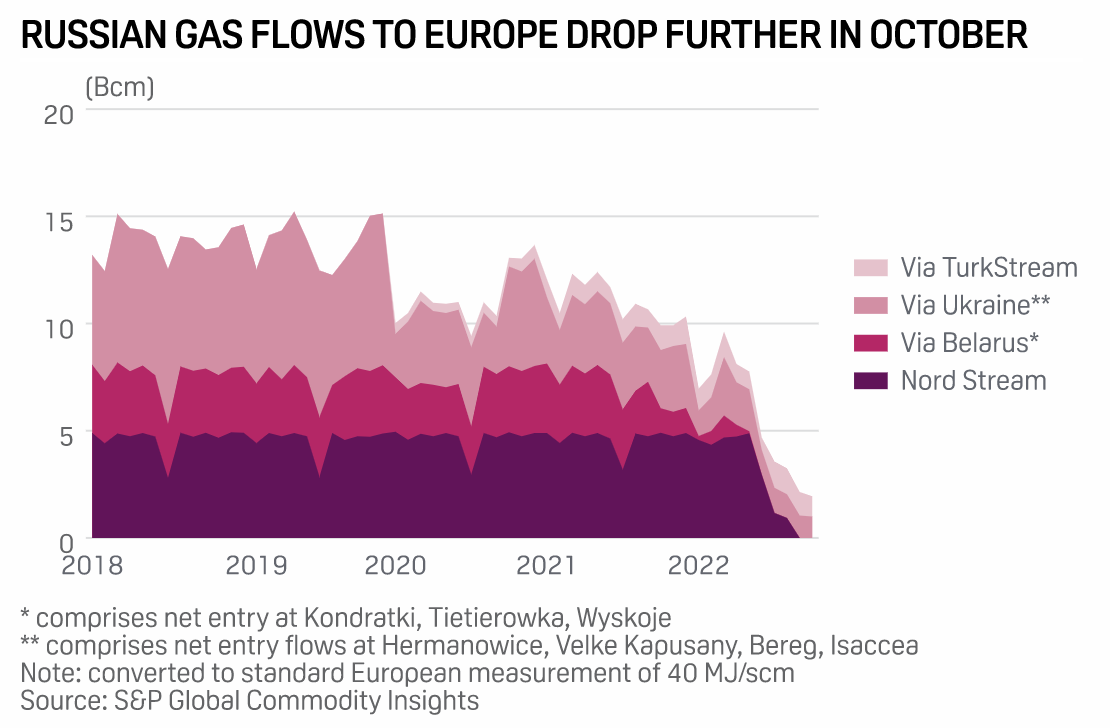

Russian Gas Flows To Europe Slide Further In October, Fall Below 2 Bcm

Russian gas flows to Europe slipped further in October, dropping below 2 Bcm for the month, an analysis of data from S&P Global Commodity Insights showed Nov. 2. Total Russian pipeline exports to Europe in October via the only remaining supply routes — TurkStream and the Ukrainian network — totaled just 1.94 Bcm, down 9% compared the September total. Russia gradually choked its gas supply to Europe over the summer, ending deliveries via Yamal-Europe and Nord Stream, and sharply cutting exports via Ukraine.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

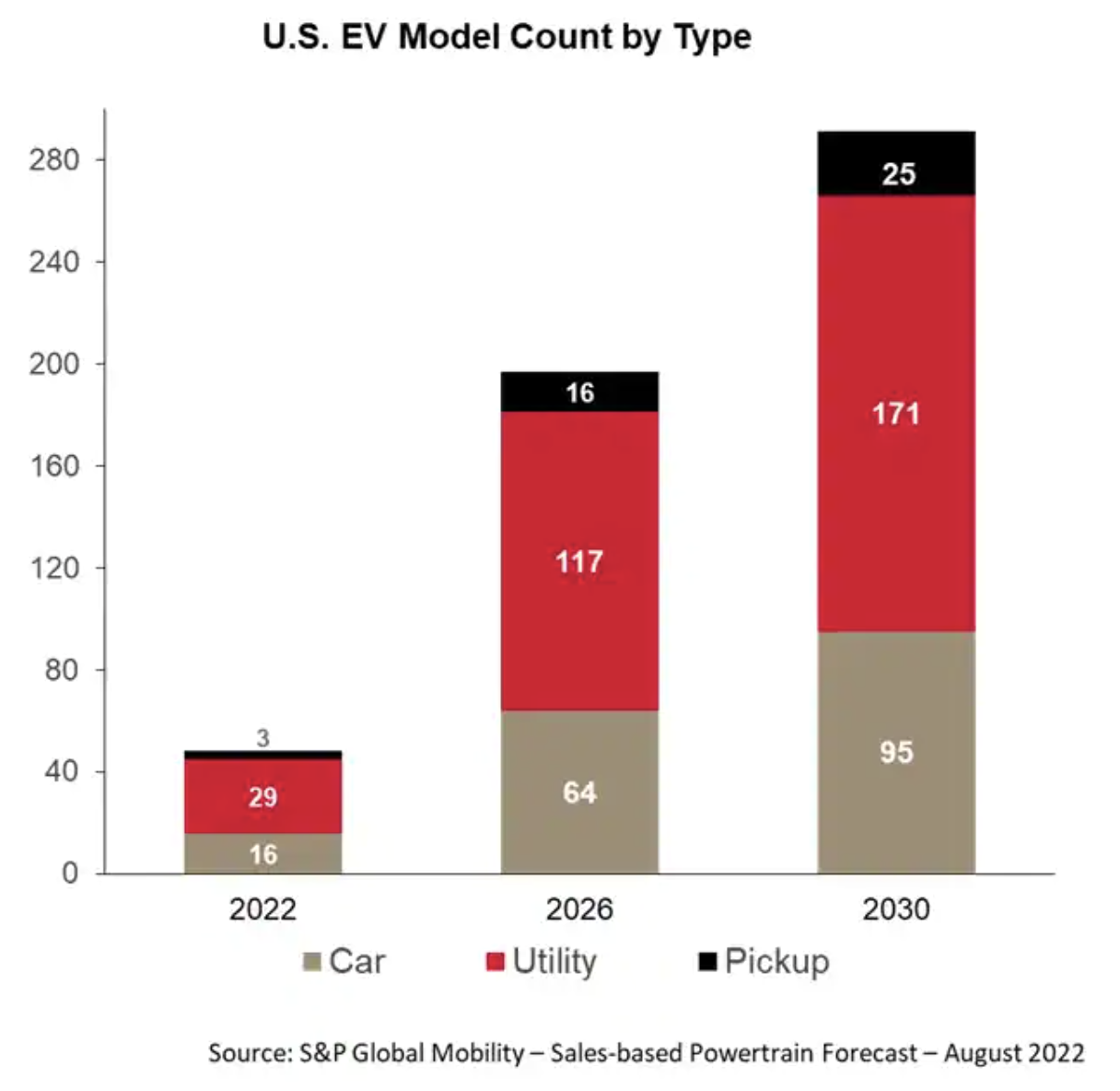

Polk Audiences And The Need For A New EV Taxonomy

One thing is certain whether you are an evangelist or taking a more conservative approach; nobody can stop talking about EV. Timing aside, saying the EV transition delivers a fundamental, tectonic shift in the automotive marketing world is not hyperbole. OEMs — old and new — are working with a clean slate in how to design, source, build, sell and service EV models.

—Read the article from S&P Global Mobility