Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 3 Nov, 2021 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

The world is watching COP26 to see if words turn into action. Will the climate conference result in the creation of an international carbon market?

"I think there's a major confidence issue. If there is a deal out of this COP, it will provide a major confidence boost in the use of markets to deliver on the objectives of the Paris Agreement," Hugh Salway, head of environmental markets at the standards-setter Gold Standard, told S&P Global Platts in an interview yesterday. "The main thing for me is that if you look at the Nationally Determined Contributions [national climate targets], over two thirds of them say they plan to use Article 6. And most haven't made use of that yet … One of the outcomes is that governments may start to make use of this once there is agreement.”

Nations, financial institutions, and companies around the globe have been outspoken with their 2050 net-zero targets, but near-term action, progress, and accountability are needed, according to S&P Global Sustainable1. Participants and investors feel positive that this COP could result in a deal on Article 6 of the Paris Agreement, which has been a sticking point of international indecision for the past six years due to disagreements over the viability of carbon credits in a new global trading system. Finalizing Article 6 of the Agreement would provide a foundation for countries to leverage an international carbon market to finance their net-zero ambitions, alongside kickstarting negotiations for a global carbon price instead of disparate assessments, according to S&P Global Market Intelligence.

“Several regions have established carbon markets as part of their decarbonization strategies. Europe, California, Northeast U.S., Quebec, and Korea all have carbon markets, with the U.K. and China being notable recent additions. Carbon prices in these markets have generally surged because of the combination of stricter climate policies and economic recovery, which has tightened the supply, and demand for carbon emission allowances,” Deb Ryan, head of Low Carbon Market Analytics at S&P Global Platts, said in a recent guest opinion editorial for S&P Global Ratings. “Investor interest in the markets has also increased. Despite many similarities, the markets differ in their sector coverage, mechanisms of price control and supply, and use of carbon offsets. The design of carbon markets can influence their impact, as well as short- and long-term behavior.”

More opportunities are on the horizon for carbon markets. Sources told S&P Global Platts that demand for carbon credits certified under the Clean Development Mechanism has surged in the past several days as discussions at COP26 revolve around the continuation of certifying and issuing standardized carbon credits under the Paris Agreement.

"The sheer volume of emissions credits that will be needed by companies to achieve net-zero emissions goals means the supply from projects is unlikely to be able to keep up," Ariel Perez, head of Environmental Products at the environmental services company Vertree Partners, told S&P Global Platts in an Oct. 29 interview. "We are seeing more demand than there is supply, and more capital wanting to come into the market than there are opportunities … It is becoming more transparent, and more credibility is coming into this market.”

Today is Wednesday, November 3, 2021, and here is today’s essential intelligence.

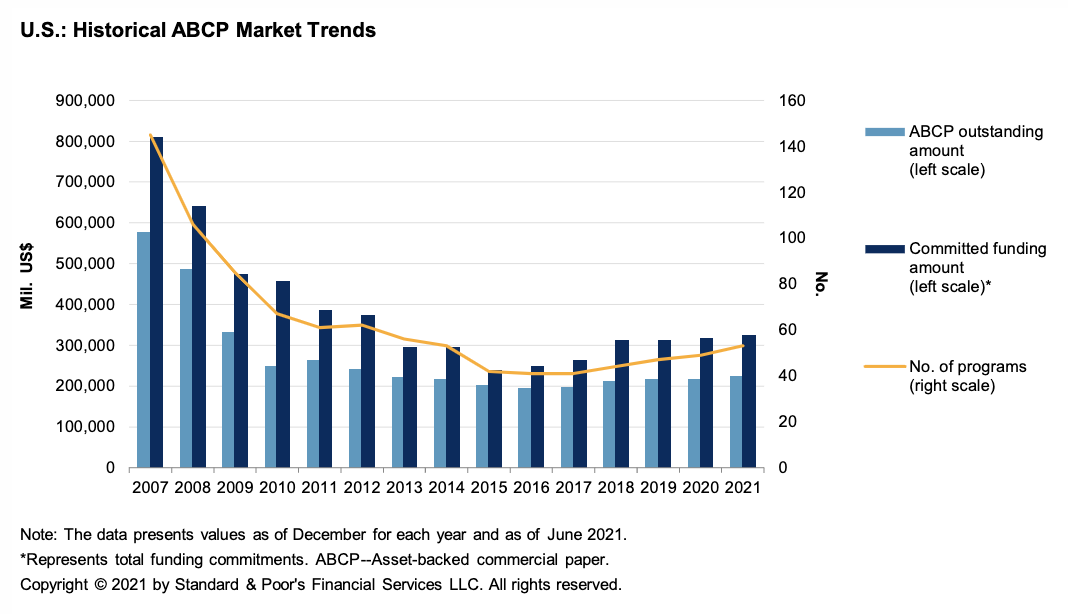

Inside Global ABCP: Stable Ratings And Modest Issuance Growth Likely As Economy Rebounds

Asset-backed commercial paper outstanding in the U.S. remains in the range of $240 billion-$250 billion, as the economy continues to heal despite the COVID-19 pandemic persisting. The low interest rate environment, along with robust levels of bank deposits relative to loans, is likely to limit ABCP growth.

—Read the full report from S&P Global Ratings

Credit Trends: U.S. Corporate Credit Recovery Remains An Uphill Climb

U.S. corporate upgrades surpassed the prior one-year record in 2021 as credit quality continued its incremental recovery from last year. Third-quarter downgrades fell to 47 (from 51)—the lowest quarterly total since 1997. However, ratings still have an uphill climb to recover from the downgrades in 2020, as net upgrades in 2021 still only equal about one-fifth of 2020 net downgrades.

—Read the full report from S&P Global Ratings

Default, Transition, and Recovery: Signs Of Weakness Among Lowest-Rated Homebuilder And Real Estate Issuers

The number of weakest links—issuers rated 'B-' or lower by S&P Global Ratings with negative outlooks or ratings on CreditWatch with negative implications—decreased to 242 as of Sept. 30, 2021, from 260 as of Aug. 31, 2021, the lowest count since August 2019.

—Read the full report from S&P Global Ratings

Evergrande And The Wider Impact: A Sentiment Analytics-Based Perspective

Evergrande recently experienced a liquidity crunch as the firm was unable to sell their property holdings at the asset values they had on their books; this cascaded into their inability to pay their interest payments on their debt. This event leads to several questions that need to be answered.

—Read the full article from S&P Global Market Intelligence

Bank M&A's Near-Term Outlook Unclear As Fed Operates Without Supervision Chief

The Federal Reserve has been operating without a vice chair for supervision since Governor Randal Quarles' term expired on Oct. 13, which industry observers say could complicate bank deal approvals.

—Read the full article from S&P Global Market Intelligence

Columbia, Umpqua Avoid Merger-Of-Equal Label But Still Get MOE Treatment

Columbia Banking System Inc. and Umpqua Holdings Corp. did not call their deal a merger of equals, but investors are acting like they did. The stock prices of the companies tumbled in the immediate aftermath of the Oct. 12 announcement of their $5.15 billion tie-up, and in the weeks since, the share prices of Columbia and Umpqua have not completely caught up with peers.

—Read the full article from S&P Global Market Intelligence

Amazon, Large Retailers Well Positioned To Weather Holiday Supply Chain Pain

Persistent supply chain constraints are expected to have an uneven impact on e-commerce this holiday season, with Amazon.com Inc. and other large retailers better positioned to meet demand than smaller merchants, retail experts say.

—Read the full article from S&P Global Market Intelligence

AI Could Exacerbate Inequalities If Misapplied, Healthcare Sector Warned

The growing use of artificial intelligence and machine learning across the healthcare industry could lead to greater disparities if applied incorrectly, experts have warned. These technologies can now be found at all levels of the healthcare ecosystem from helping clinicians sort through electronic medical records and interpret data from connected medical devices to aiding life science companies in their clinical trials and modeling the effectiveness of vaccines.

—Read the full article from S&P Global Market Intelligence

The Future Of 5G Lies In Enterprise — And Robot Dogs

Consumer 5G mobile service is available in many U.S. markets, but enterprise 5G is where the real potential lies. With a few exceptions, telecommunications executives and experts speaking at Mobile World Congress last week highlighted not the potential for consumer 5G as it builds out, but for enterprise 5G, which is only on the cusp of coming online.

—Read the full article from S&P Global Market Intelligence

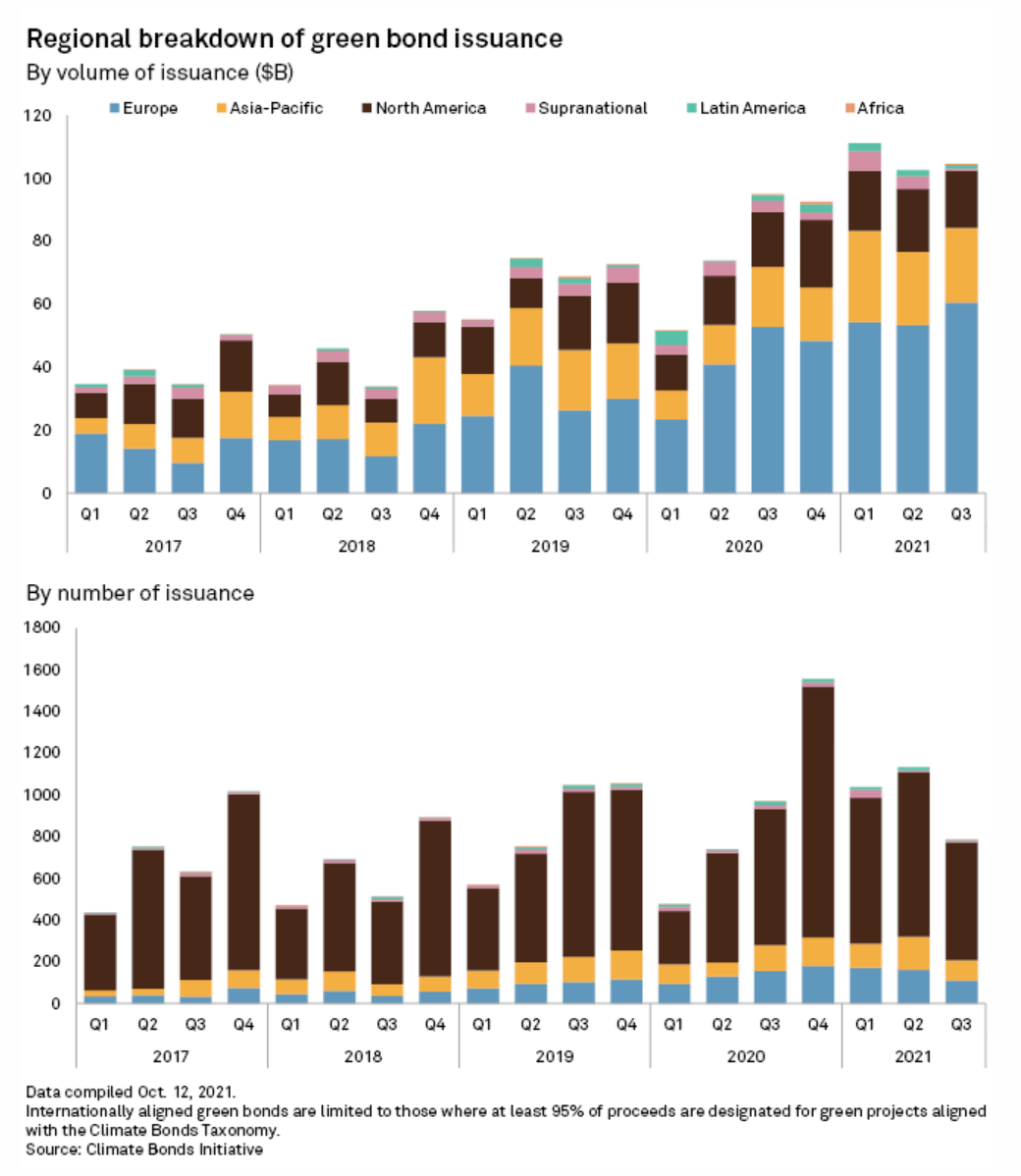

More Sovereign Green Bonds Expected As Nations Brandish Green Credentials

More nations and international bodies may follow the U.K. and Spain in offering green bonds as a way of highlighting commitment to the environment, and in order to provide an impetus for greater issuance by private companies.

—Read the full article from S&P Global Market Intelligence

Deficit Of Credibility': UN Deepens Benchmarking Of Corporate Net-Zero Pledges

As world leaders took to the stage at the COP26 climate summit in Glasgow, Scotland, on Nov. 1, United Nations Secretary-General António Guterres announced the creation of a new expert panel to analyze net-zero emissions pledges in the private sector.

—Read the full article from S&P Global Market Intelligence

COP26: Denmark's CIP Green Energy Fund Targets Eur100 Billion Investment Portfolio By 2030

Copenhagen Infrastructure Partners aims to deploy Eur100 billion ($116 billion) into green energy investments by 2030, a six-fold increase from its current portfolio, it said Nov. 1. CIP's development portfolio includes 30 GW of offshore wind as well as 20 GW onshore wind, solar, and so-called power-to-X projects involving green hydrogen, it said.

—Read the full article from S&P Global Platts

StanChart's Sustainability Focus 'Paying Off' As It Books Strong Q3 Performance

Standard Chartered PLC delivered a strong performance in the third quarter, with a 44% year-over-year increase in profit, and said its focus on sustainability is paying off after booking an improvement in sustainable finance income.

—Read the full article from S&P Global Market Intelligence

Interview: Sing Fuels Eyes Geographic Forays Amid Decarbonization Efforts

The Singapore-headquartered global bunker trader Sing Fuels’ revenues jumped 45% year on year in the financial year ended September, with its total marine fuel sales volumes up 20% on the year, Sonnich Thomsen, managing director bunkers, said.

—Read the full article from S&P Global Platts

COP26: Southeast Asia Moves On Climate With A$2 Bil Australia Funding, Net Zero Targets

The moves are important because Southeast Asia is one of the world's most vulnerable regions to climate change and rising sea levels, a large percentage of its population lacks access to energy, and technological development suffers from funding scarcity.

—Read the full article from S&P Global Platts

COP26: Global Leaders Sign Up To Reverse Forest Loss And Land Degradation By 2030

Some 110 leaders accounting for more than 86% of the world's forests have committed to halt and reverse forest loss and land degradation by 2030, U.K. Prime Minister Boris Johnson said at the UN's Climate Conference of the Parties in Glasgow Nov. 2.

—Read the full article from S&P Global Platts

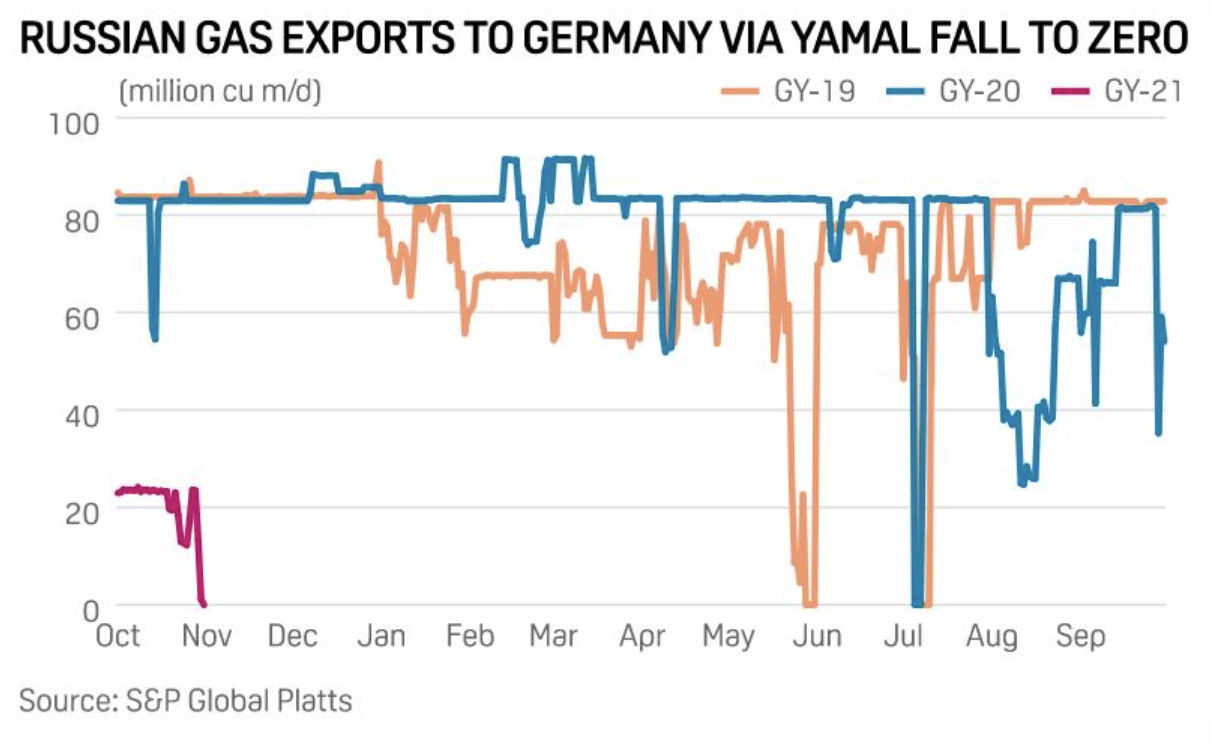

Europe's Energy Crisis Deepens As Russia Cuts Gas Exports

Russian exports of natural gas to Europe fell over the weekend and into Nov. 1, with a complete pause in delivery via the Yamal pipeline deepening the continent's already acute energy crisis. The maneuver also came against a backdrop of ongoing deliberation over the fate of Russia's Nord Stream 2 dual-pipeline system, which is nearing completion but remains in the balance.

—Read the full article from S&P Global Platts

COP26: OPEC's Middle East Heavyweights Make Their Case For Oil In The Energy Transition

A spike in natural gas prices that has spilled into the oil market has consuming countries, including the U.S., India, and Japan, entreating OPEC and its allies to pump a lot more crude—even as world leaders gather in Glasgow to hammer out a climate deal at the COP26 talks.

—Read the full article from S&P Global Platts

U.S., EU Reach Deal To Replace Section 232 Tariffs With Tariff-Rate Quota

Under the tariff-rate quota arrangement, historically based volumes of EU steel and aluminum would enter the U.S. without application of the Section 232 tariffs, according to a Commerce Department statement.

—Read the full article from S&P Global Platts

'Exceptional Market' Conditions In Shipping To Persist Until Q1 2022, Says Maersk

The Copenhagen-headquartered company A.P. Moller-Maersk—the largest shipping company in the world—posted its most profitable quarter in its history in the third quarter of this year, benefitting from the soaring container freight rates caused by COVID-19 and capacity shortages.

—Read the full article from S&P Global Platts

Saudi Aramco's Q3 Average Oil Output At 9.5 Mil B/D, Profit More Than Doubles

Total hydrocarbon production was 12.9 million boe/d in the third quarter, Aramco said in an earnings statement. It didn't provide figures from a year earlier but there was an increase from the first nine months of 2020, when total hydrocarbon production was 12.4 million boe/d, of which 9.2 million b/d was crude oil.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Language