Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 29 Nov, 2021 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Although scientists and public health experts still know little about the Omicron coronavirus strain discovered last week in South Africa and classified by the World Health Organization as a “variant of concern,” investors and market participants have reacted to the potential threat.

South African scientists announced the discovery of the latest coronavirus variant in the country’s Gauteng province on Nov. 25. Omicron, which contains 50 mutations not previously seen in combination, could be more contagious than other variants—although the illness it causes could be less severe. Global leaders have said that it could take weeks to develop a full profile on the variant. Pfizer-BioNTech and Moderna have already announced that they will recalibrate their COVID-19 vaccines to address Omicron.

Markets reacted to the discovery, with the S&P 500 and Dow Jones Industrials Average plummeting on Nov. 26. Friday’s sell-off piled more pressure on the European high-yield pipeline, which bankers estimate holds roughly €10 billion in underwritten deals going into 2022, according to S&P Global Market Intelligence.

“Black Friday was supposed to be about shopping; at least there was a sale: the S&P 500 had its worst day in nine months, retreating 2.3% to move into the red month-to-date. Meanwhile, VIX saw its fourth-largest single-day percentage increase ever, rocketing up to close above 28 from a sub-19 reading the day before,” Benedek Vörös, director of index investment strategy at S&P Dow Jones Indices, said in a Nov. 29 market note. “The elephant in the room has stamped its foot. New genetic variants of COVID-19 are practically guaranteed by its global endemic status; this is precisely why longer-dated volatility expectations have remained persistently elevated even as the global economy tentatively unlocked. Last week’s identification of the new ‘Omicron’ strain—during a traditional U.S. Thanksgiving lull in liquidity—roiled global markets.”

Now, “it looks as if the return of Stateside traders to their desks will accompany a slight recovery of some of Friday’s losses, with S&P 500 futures indicating a roughly 1% gain at the open” this morning, Mr. Vörös said.

"Given the lack of information on the latest variant, one could probably question the scale of Friday's selloff and whether it is really justified," ING analysts Warren Patterson and Wenyu Yao said in a note, according to S&P Global Platts. "The market seems to be coming to that realization in early morning trading today, with a relief rally underway. Initial reports suggest that symptoms from the Omicron variant are mild, but there are still question marks around how effective current vaccines will be against this latest variant.”

The U.K. quickly called for restrictions on travelers visiting from South Africa and several other African nations. The next day, the EU ordered a travel ban on seven countries in the region, followed by similar actions from Canada and the U.S. Some market observers have questioned whether putting restrictions on movement from South Africa and other African economies wrongly punishes such countries with lower COVID-19 infection rates and less equitable vaccine access for sharing critical information with the world.

Global restrictions on movement could derail the mobility and oil recovery seen across Asian markets like India and South Korea. An OPEC+ committee on Dec. 2 could incorporate concerns over Omicron into the group’s market actions for demand growth and a possible oil surplus, although Russia has insisted that the group not make hasty decisions over the new variant, according to S&P Global Platts.

"I'm not sure they are going to react with an about turn quite as quickly as this unless more information [about the new variant] comes to light … Will they err on the side of caution also? I think they might and that seems to be the consensus out there. They seem a lot more concerned about demand concerns, about economic shocks, about question marks about economic growth in China and about stats from India,” Mike Muller, the head of the energy and commodities trader Vitol Asia, said during a Nov. 28 Gulf Intelligence webinar, according to S&P Global Platts. "I think in a world without Omicron, we were looking at an ever-tightening supply picture where the world needed OPEC to put extra volume into the market … If they don't and this turns out to be a false alarm, a false scare … and this virus doesn't turn out to be of concern to energy demand, then the market needs ongoing supply."

Today is Monday, November 29, 2021, and here is today’s essential intelligence.

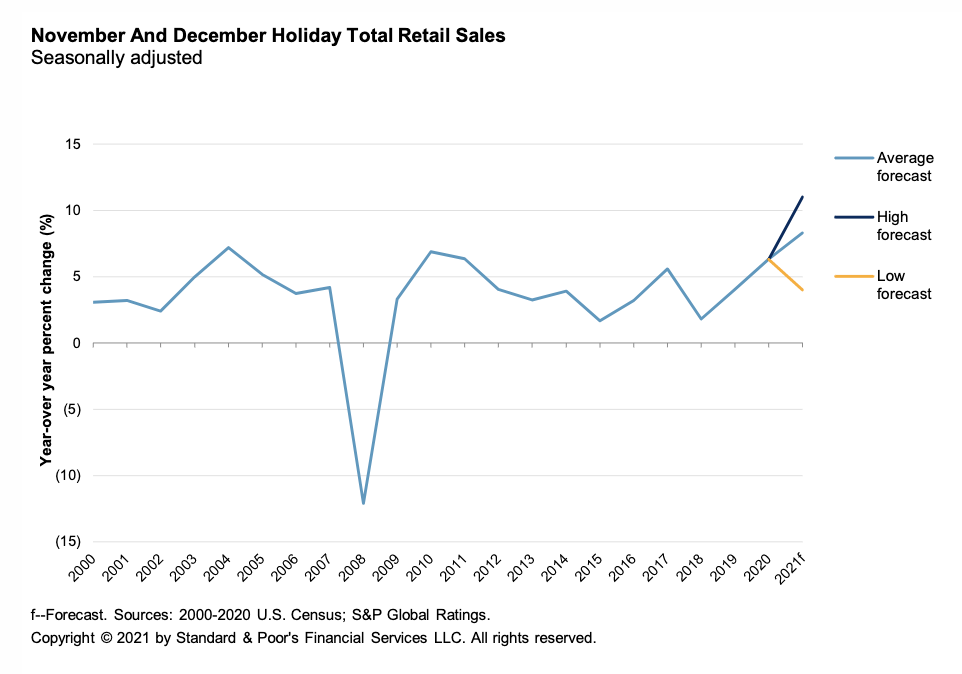

Holiday 2021 Sales Outlook: Santa's Bag Is Filled This Holiday Season, Thanks To Deep Consumer Pockets

S&P Global Ratings analysts in the retail, restaurant, and consumer goods sectors collectively forecast an 8.5% increase in retail sales during the November and December 2021 holiday season. An elevated consumer saving rate continues to support spending across categories, underpinned by consumers' desire to make the most of in-person celebrations this year.

—Read the full article from S&P Global Ratings

Customer Success: A $200 Million Market Poised For Dramatic Growth

Customer Success represents an emerging segment within the broader Customer Experience & Commerce market with the potential to benefit from the increasing focus on retaining existing customers and driving annual reoccurring revenue. This report leverages 451 Research’s deep knowledge of and relationships within the Customer Success market, resulting in a proprietary forecast based on a bottom-up analysis of current revenue and growth expectations by participating vendors through 2025.

—Read the full article from S&P Global Market Intelligence

UAE's Dubai Airport Close To Returning To Full Operational Capacity As Demand Picks Up

Dubai International Airport will return to full operational capacity in the coming weeks as the world's busiest hub for international travel in 2019 reopens a purpose-built facility for Airbus A380 due to rising demand, its operator said Nov. 24.

—Read the full article from S&P Global Platts

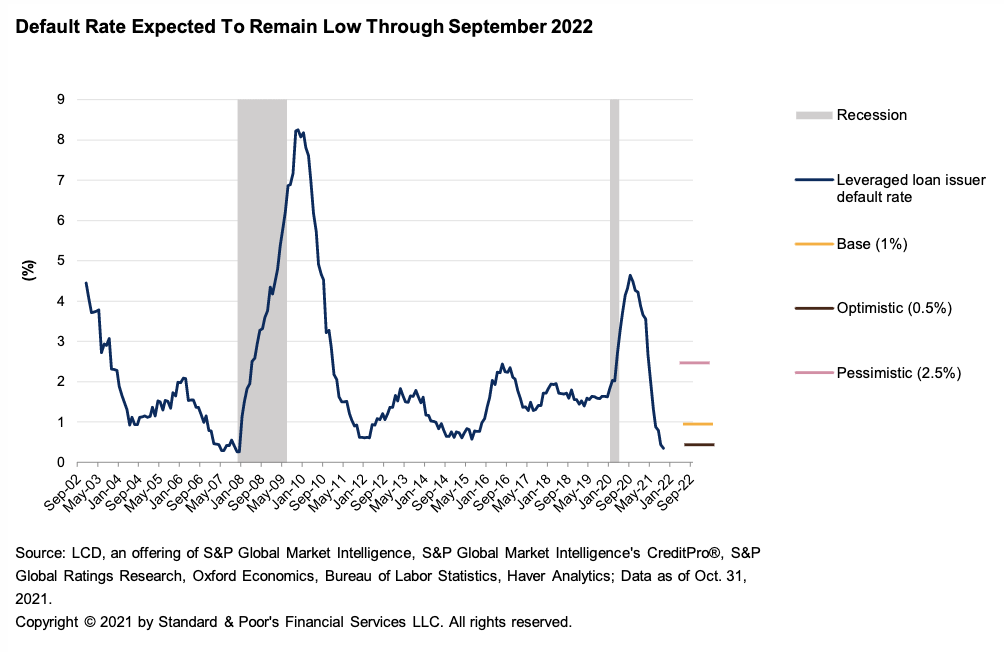

Default, Transition, and Recovery: The S&P/LSTA Leveraged Loan Index Default Rate Is Expected To Remain Near 1% In September 2022

S&P Global Ratings Research expects the S&P/LSTA Leveraged Loan Index trailing-12-month default rate (by number of issuers) to remain near previous cycle lows and reach 1% in September 2022. The default rate fell to 0.4% in October, just slightly above the all-time low for the index.

—Read the full article from S&P Global Ratings

Credit Trends: Global State Of Play: Speculative-Grade Debt Grew Faster Than Investment-Grade In First-Half 2021

The global financial and nonfinancial corporate credit market's debt growth slowed to 3.1% in the first half of 2021 from 3.8% in the first half of 2020. Speculative-grade debt grew by 7.9% as leveraged finance issuance (speculative-grade bonds and leveraged loans) reached a midyear high.

—Read the full article from S&P Global Ratings

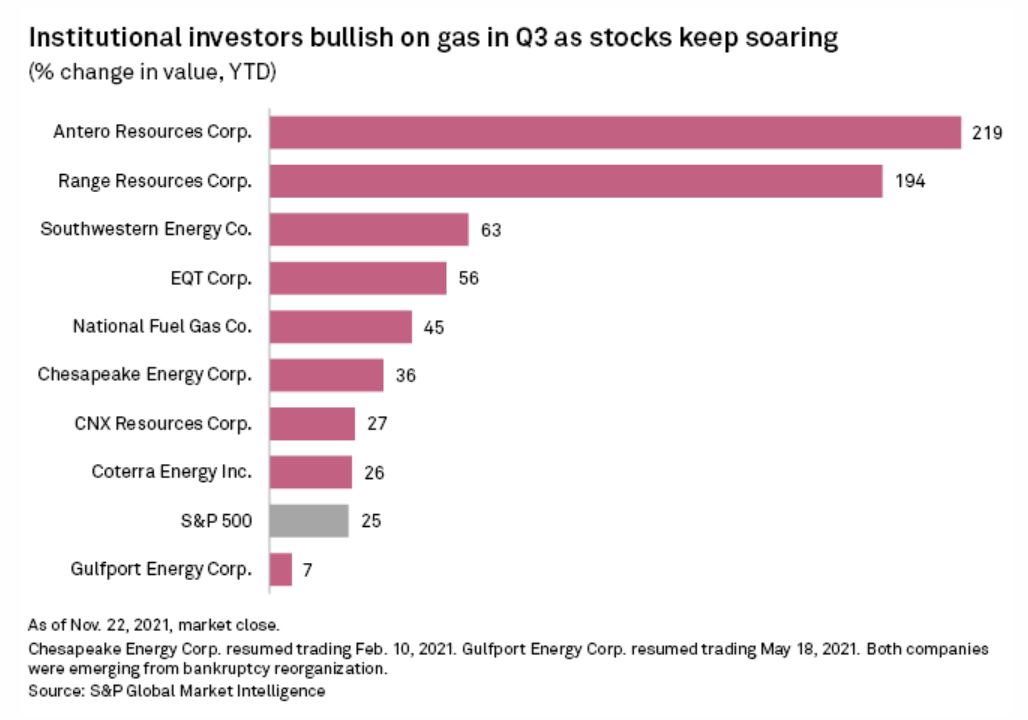

Institutions Buy Into Shale Gas Stocks In Q3 As Commodity Prices Shoot Higher

Led by Blackstone Inc., several private equity firms and Stanford University's endowment fund began to dip into pure-play shale gas stocks in the third quarter as commodity prices for natural gas shot higher. Overall, institutional investors were net buyers of pure-play shale drillers as share prices climbed higher.

—Read the full article from S&P Global Market Intelligence

'Catastrophe' For Turkish Polymer Markets As Lira Plunges To Historic Lows

The rapid depreciation of the Turkish lira in recent days is a "catastrophe" for the country's polymer markets, with market sources expecting spot trade to be severely limited into the key import hub at least until the end of year. The value of the lira against the dollar has plunged by as much as 20% so far in November and fell by some 15% on Nov. 23 alone.

—Read the full article from S&P Global Platts

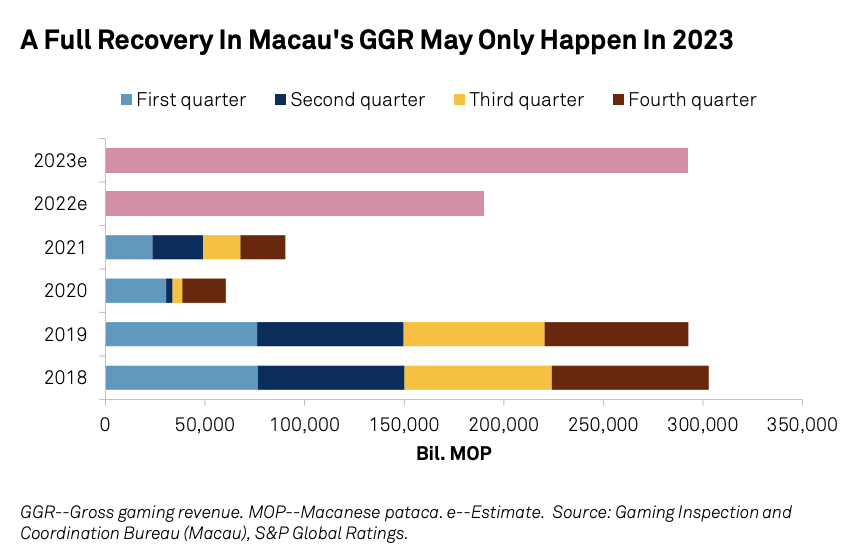

Macau Gaming: COVID Remains The Wild Card

The biggest near-term threat for rated Macau casino operators is a slow recovery in gross gaming revenue because of COVID-19-related travel restrictions. Regulatory risk is rising, but the immediate credit impact is limited for now.

—Read the full article from S&P Global Ratings

Searching For Clues On Who Spent What In Latest Mid-Band Spectrum Auction

After 151 rounds and $21.9 billion in total proceeds, the Federal Communications Commission's auction of 100 MHz of contiguous spectrum in the 3.45 GHz band concluded its clock phase earlier this month. Mid-band spectrum is a critical component of 5G networks and allows for better speed and coverage than high-band and low-band spectrum.

—Read the full article from S&P Global Market Intelligence

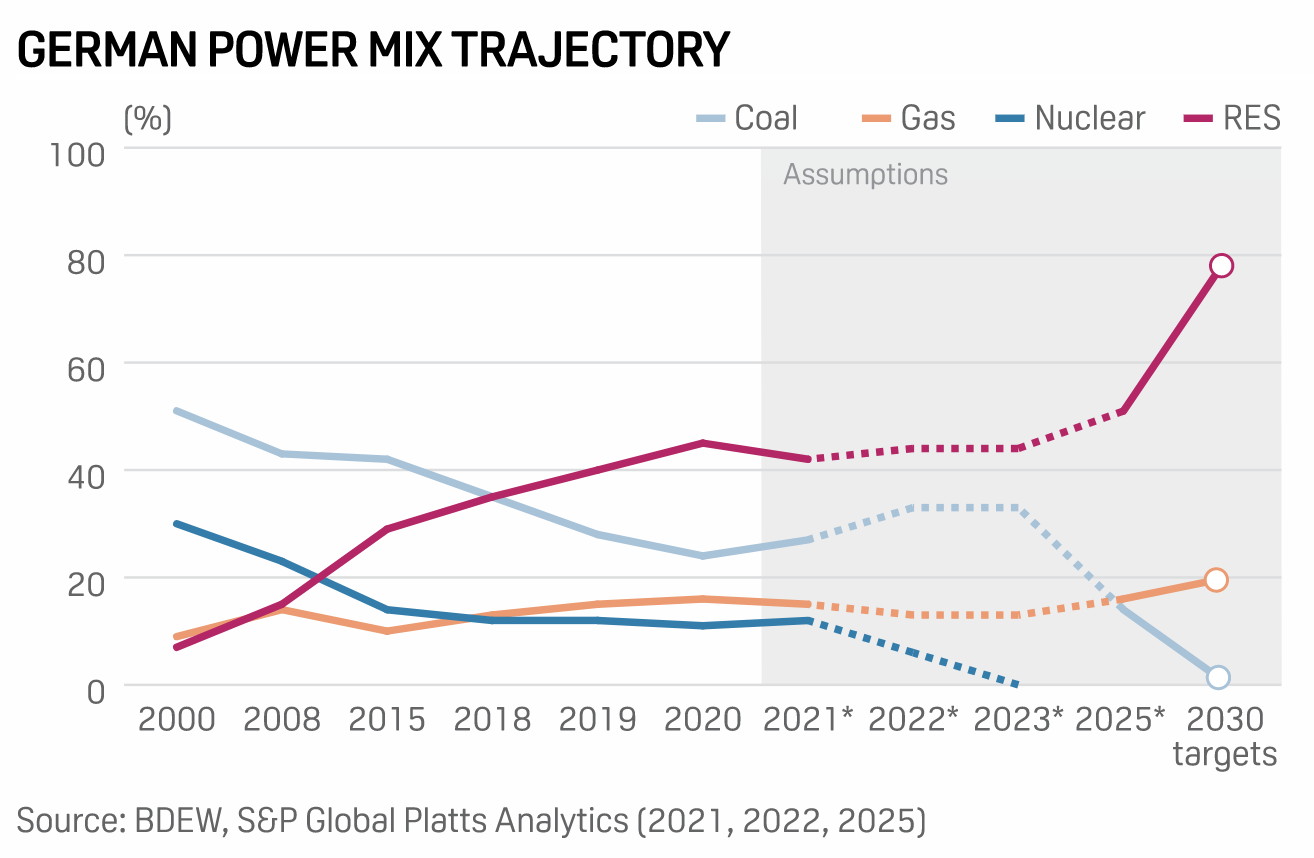

German Coalition Agrees 2030 Coal Exit, Aims For 80% Share Of Renewables

Germany's new coalition of SPD, Greens, and liberal FDP agreed Nov. 24 a coalition treaty that brings forward the country's coal phase-out date from 2038 to 2030. The parties also plan to lift Germany's renewables target for 2030 from 65% to 80% of electricity demand with a massive expansion of wind and solar.

—Read the full article from S&P Global Platts

After COP26, New Questions Arise Over Carbon Trading As Markets Gain New Prominence

With the UN Climate Change Conference now settling into the rearview mirror, stakeholders questioned Nov. 23 how carbon dioxide removal can be done with climate justice concerns in mind. "The decisions that were made at COP do provide momentum to CDR," said Hunter Cutting, communications director of Climate Nexus, during a panel discussion.

—Read the full article from S&P Global Platts

U.S. Clean Energy Sector Pushes Nine Resource Adequacy Reforms

Various clean energy groups want the U.S. to put an entity in charge of procuring necessary electricity resources, creating "buyers with accountability," among other recommendations aimed at ensuring resource adequacy as the U.S. transitions to cleaner energy sources, according to a Nov. 23 report.

—Read the full article from S&P Global Platts

Maersk Exploring Option For Using Hydrogen As Fuel, In Talks For Green Methanol Supply

A.P. Moller-Maersk, the world's largest shipping company, is looking into the potential use of hydrogen as fuel for some vessels and is also in talks with some green methanol producers to secure supplies as it seeks to decarbonize its fleet, a company official said Nov. 24.

—Read the full article from S&P Global Platts

Interview: Monjasa Issuing CO2 Emissions Receipts To Boost Transparency

Marine fuel supplier Monjasa is giving customers an emissions report on their purchases in a project with Deloitte to facilitate transparency through the bunker supply chain, the company's Group Responsibility Director told S&P Global Platts. "Prior to our CO2 emissions reporting model, we realized was that obtaining upstream data was surprisingly difficult," Jesper Nielsen told S&P Global Platts.

—Read the full article from S&P Global Platts

Listen: Freight And Drought Bite As The Californian Japonica Rice Market Heads Into 2022

The price of the global Japonica market's benchmark, U.S. #1, 4% broken white rice, is reaching highs not seen in ten years at quite an unfortunate time. Freight from California remains incredibly difficult to source, especially at an affordable rate for buyers. Meanwhile, other Japonica origins, such as Australia and China continue to steadily chip away at market share amid pressure to export their increasingly robust stockpiles.

—Read the full article from S&P Global Platts

Industrials Group Again Pushes U.S. DOE On LNG Exports, Seeks 'Consumer Safety Valve'

A group of industrial manufacturers wrote U.S. Energy Secretary Jennifer Granholm Nov. 22 to offer 12 reasons why it believes a "consumer safety valve" is needed before more LNG exports flow to non-free trade agreement countries. The letter continues ongoing pressure from the Industrial Energy Consumers of America, which seeks to limit the scale of LNG exports.

—Read the full article from S&P Global Platts

TC Energy Seeks $15 Billion In Keystone XL Damages From U.S. Government

TC Energy is seeking $15 billion in damages from the U.S. government for the cancellation of the Keystone XL pipeline project, having filed a formal request for arbitration under the North American Free Trade Agreement. The filing late Nov. 22, which had been expected, shows TC Energy is moving forward in its bid to recoup costs after President Joe Biden yanked the federal permitting for the project on his first day in office in January.

—Read the full article from S&P Global Platts

U.S. Power Transmission, Distribution Costs Seen Outpacing Electricity Production Costs

U.S. utility transmission and distribution costs have been rising faster than electricity production costs over the past decade, with utility spending on power delivery 65% higher in 2020 than in 2010, a trend that could continue as utilities invest in grid modernization.

—Read the full article from S&P Global Platts

Bypassing Ukrainian Gas Transit 'The Only Goal' Of Nord Stream 2: Vitrenko

The circumvention of Ukrainian natural gas transport for Russian exports to Europe is "the only goal" of the recently completed Nord Stream 2 dual-pipeline system, CEO of Naftogaz Ukrainiy Yuriy Vitrenko told delegates at the S&P Global Platts European gas and LNG conference Nov. 24.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Language