Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 27 Nov, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Environmental Data and Climate Disclosure

Stakeholders have clamored for consistent, comparable and complete data on climate and sustainability-related risks and opportunities for years. As Mindy Lubber, CEO and president of investor advocacy group Ceres, put it: “[L]eading investors have for many years pushed for better information about how companies are working to prepare for and address climate-related financial risks."

In June, the International Sustainability Standards Board responded by issuing its first two sustainability disclosure standards. In October, California Gov. Gavin Newsom signed two bills, S.B. 253 and S.B. 261, requiring more than 15,000 companies to report on emissions and climate-related financial risks beginning in 2024.

But large gaps remain in company-level disclosures, and, as a result, financial institutions and corporations may lack key information when allocating capital and selecting supply chain partners.

How big are these gaps? S&P Global Sustainable1 analyzed environmental performance data from over 17,000 companies, representing 99% of global market capitalization, across six aggregated categories: greenhouse gases , waste, water, air pollutants, land/water pollutants and natural resource use. S&P Global Sustainable1 then assessed these six categories across 11 major equity indexes to see where environmental information is and is not being reported.

The analysis showed that disclosure rates varied from as low as 37% up to a high of 96% for the most sustainability-related indexes. The lower disclosure rates were found mainly with small-cap and emerging markets companies.

New standards and a patchwork of regulations may eventually fill these gaps, but in the meantime, S&P Global Sustainable1 is using robust data modeling to paint a more comprehensive picture. Its Environmentally-Extended Input-Output (EEIO) model calculates the environmental impacts of revenue associated with more than 450 distinct business activities. EEIO then combines quantitative macroeconomic data on the flow of goods and services to estimate a company’s climate consequences at a granular level.

Missing data is not the only problem stakeholders have in making informed decisions. S&P Global Sustainable1 uncovered and adjusted errors in 47% of company disclosures. Its analysts helped companies correct 5,009 reporting errors in 3,060 environmental performance reports. The largest problem with data quality was “partial disclosure” from companies just starting out on their sustainability journey as they learn to use the correct calculation methodology.

There are wide variations as to how companies report climate-related risks, depending on their location or the type of climate-related metrics they are disclosing. As these disclosures become mandatory in more places, companies will need to improve on reporting emissions, physical and transition risks, and adaptation plans more consistently.

Today is Monday, November 27, 2023, and here is today’s essential intelligence.

Written by Ken Fredman.

Economic Research: Economic Outlook Asia-Pacific Q1 2024: Emerging Markets Lead The Way

China is coping while its neighbors step up. A property downturn is still a pain point for the Chinese economy, but growth momentum has slightly improved because of policy support. Outside of China, economies have generally held up well. Asia-Pacific as a whole continues to grow despite meagre support from external sources. Emerging market economies with solid domestic demand are posting the strongest growth.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

Accounting For Regional Volatility When Assessing Home Price Appreciation: A Portfolio Management Theory Approach

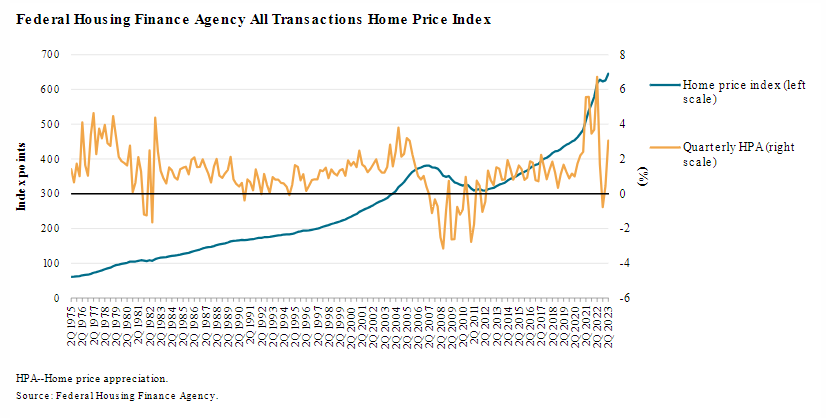

Despite a recent interest rate-related slowdown between the third and fourth quarters of 2022, home price appreciation (HPA) has remained strong in most regions across the US for the past decade, particularly during the period immediately following the onset of the COVID-19 pandemic. The Federal Housing Finance Agency (FHFA) All Transactions Home Price Index for the US has recently surpassed the record-high level of 2022 as a supply-constrained housing market copes with demand from the millennial generation.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

Listen: Maritime And Trade Talk Episode 22: Trade And Supply Chain Outlook

The supply chain story of 2023 so far has been one of normalization. Demand has slowed down with US seaborne imports of consumer goods falling in the first eight months of the year. The seasonality of shipping patterns also appears to be returning to normal and global trade activity is likely to stabilize. But as ever, we see risks on the horizon. Trade policies are becoming more restrictive and sustainability policies are starting to have real consequences for supply chains. Water stress and labor action also threaten supply chain stability. What is driving the return to normal in supply chains? What strategies are companies exploring to build resilience?

—Listen and subscribe to Maritime & Trade Talk, a podcast from S&P Global Market Intelligence

Access more insights on global trade >

IEA Warns Of Oil, Gas Sector Over-Investment Risk Under Net-Zero Push

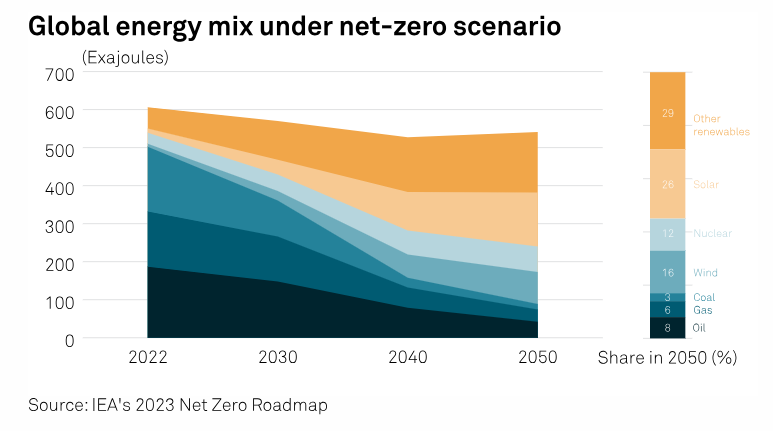

Upstream investment by the global oil and gas industry is at risk of overshooting global demand needs in the coming decades unless the sector aligns its spending with global climate goals, the International Energy Agency said Nov. 23. Oil and gas companies currently account for just 1% of clean energy investment globally, with 60% of that from just four companies, the IEA said in a new report ahead of the COP28 climate conference in Dubai, starting Nov. 30. But producers should be spending half of their annual investment on clean energy projects by 2030 to hit the goals of the Paris Agreement, according to the energy watchdog. Currently, oil and gas sector spending of some $800 billion each year is double what is required in 2030 on a pathway that limits global warming to 1.5 C, the IEA said.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

Rising Tide Of Permian Gas Fuels Price Volatility In Texas Gulf Coast Market

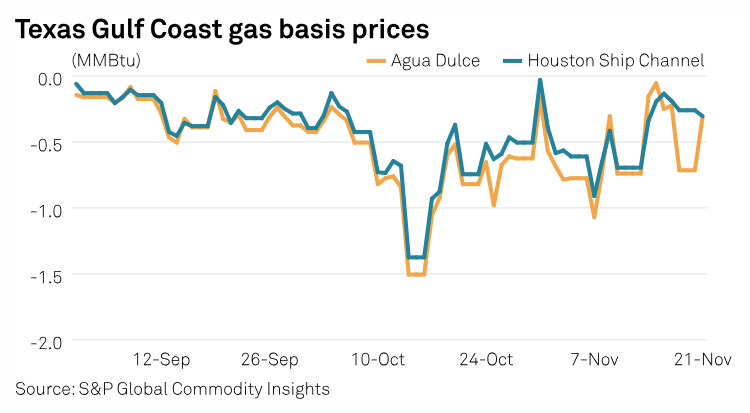

The looming startup of Kinder Morgan's Permian Highway Pipeline expansion is promising to bring a flood of additional supply to the East Texas gas market, adding to recent price volatility there. Over the past five weeks, gas basis prices along the Texas Gulf Coast have been on something of a rollercoaster, fueled by a late third-quarter startup of the MPLX consortium's 500 MMcf/d expansion of Whistler Pipeline, and by recent pipeline maintenance in and around the Permian Basin. Both factors have pushed more Permian gas production eastbound into the Texas Gulf Coast market this fall.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: Next In Tech Episode 143: AI Security Approaches

There are significant concerns about the security of the various publicly accessible generative AI tools that are available. Many organizations have enacted outright bans on their use for fear of exposing sensitive data. There’s a path to access the benefits of these tools while managing the risk and Steve Riley, field CTO for Netskope, joins host Eric Hanselman to explore it. Starting with role-based controls and moving into more specific shades of access can simplify security policies.

—Listen and subscribe to Next in Tech, a podcast from S&P Global Market Intelligence

Content Type

Location

Language