Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 25 Nov, 2020

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

The world is battling a pandemic, but mounting debt may pose a longer-term risk for the global economy.

The pandemic has helped drive global debt-to-GDP ratios to record highs as governments, companies, and households increase borrowing to function through the crisis. But this surge in leverage, especially for governments, is a necessary ingredient in the economic recovery that will add to borrowers’ ability to pay off debt. Nonetheless, global debt growth was rising before the pandemic; the global health crisis has merely accelerated the pace.

While the Institute of International Finance anticipates the world’s “debt tsunami” to total $227 trillion, or 365% of global GDP, by year-end, S&P Global Ratings foresees global debt-to GDP to grow to 265% this year—although it doesn’t anticipate a debt crisis within the next two years. By 2023, global debt will ease to 256% of GDP as governments rebuild their balance sheets and corporates rethink their business opportunities.

“This is based on our base-case assumption of a continuing, albeit choppy, global economic recovery. The recovery, in turn, is predicated on the wide availability of a COVID-19 vaccine by mid-2021, continuing accommodative financing conditions, and adjustments in corporate, government, and household spending and borrowing behaviors,” S&P Global Ratings said in a recent report. Risks to the scenario include “economic shocks slowing the return to pre-pandemic income levels, accelerated infection rates or poor vaccine distribution, rising interest rates and a sustained dramatic widening of credit spreads, continuing debt growth, and consumption demand rebounding less than we expect as a result of structural shifts.”

Sovereign debt is largely centralized in G-7 countries, which account for two-thirds of this year’s debt accumulation. These countries are generally wealthier, and enjoy more flexible monetary policy and stronger financial markets. The U.S., Eurozone, and Japan are likely to be responsible for half of the world’s increase in debt this year, according to S&P Global Ratings.

“The key assumption for all rated sovereigns is that these large amounts of new debt will fund productive activity and help boost national incomes and government revenues in the medium to long term,” S&P Global Ratings said. “However, we could lower ratings if events lead us to lower our expectations for economic performance and policies.”

Since January, 210 corporates globally have defaulted. The global oil and gas sector leads, with 45 defaults year-to-date. While missed interest and principal payments account for the bulk of the year’s defaults, those in the fourth quarter have primarily been distressed exchanges.

The number of defaults for corporates rated ‘B-’ or below, known as “weakest links,” remains above pre-pandemic levels in all regions, excluding Latin America. Such corporates tend to default at a rate eight times higher than speculative-grade companies as a whole.

The global 12-month trailing speculative-grade corporate default rate reached 4.9% this September. S&P Global Ratings projects the U.S. rate to increase to 9% by September next year, from 6.3% as of this September, and to 8.5% in Europe, from 4.3%.

“There is significant uncertainty about how the global economy can deleverage in the future without significant adverse implications for economic activity,” the IIF said in its debt forecast.

Today is Wednesday, November 25, 2020, and here is today’s essential intelligence.

Brewers Tap Off-Premise, Sell More Hard Seltzer to Offset Lockdown Impact

Large brewers beat market expectations in their most recent quarters as they sold more drinks to homebound consumers amid the pandemic and found success with newer product categories, like hard seltzer.

—Read the full article from S&P Global Market Intelligence

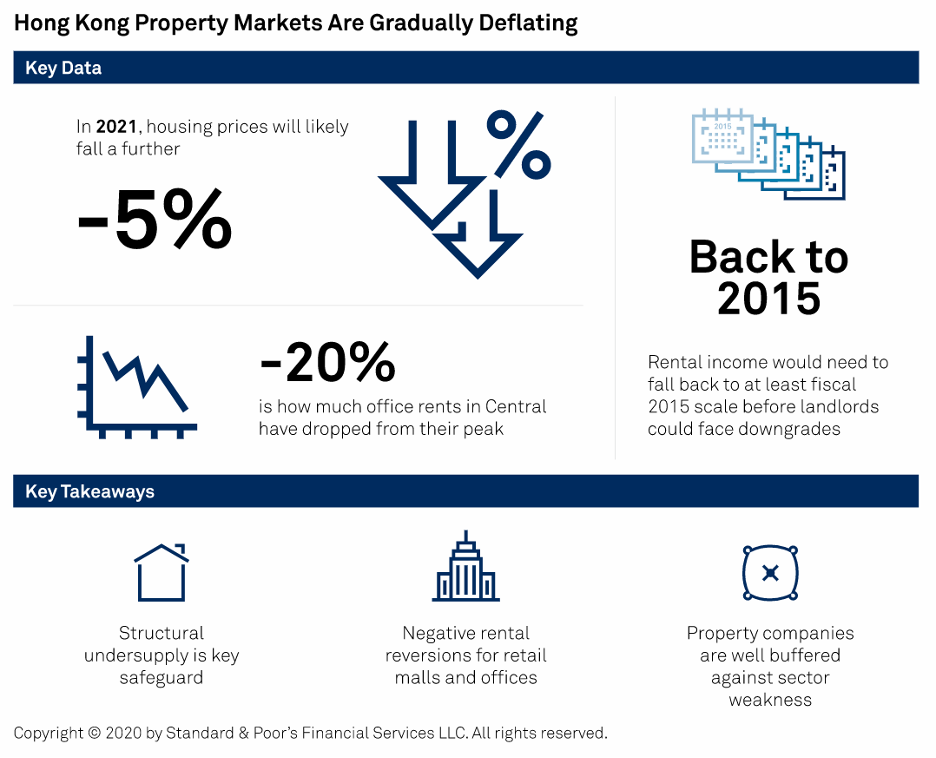

Hong Kong's Tight Property Supply Becomes an Advantage

Hong Kong's limited housing supply has long been a burden for home affordability. Now it's helping to save the city's residential market from a sharp correction amid COVID-19 fallout.

—Read the full report from S&P Global Ratings

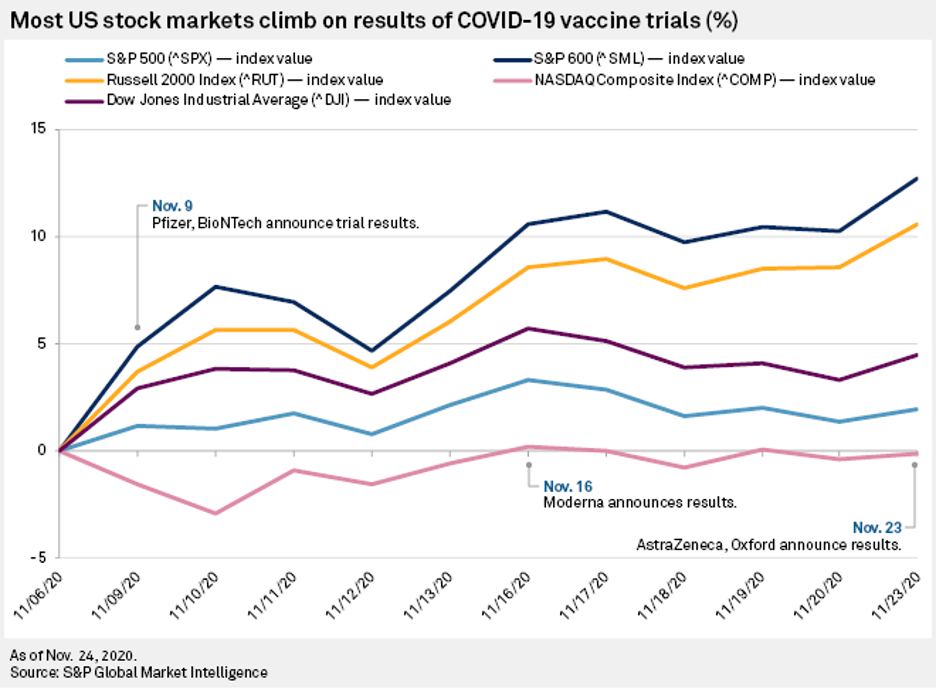

S&P 500, Dow Hit All-Time Highs Even as COVID-19 Cases Spike

Two of the top indicators of U.S. stocks closed at record highs Nov. 24, continuing a rally driven by coronavirus vaccine developments and reduced political uncertainty, even as new coronavirus cases surge across the U.S.

—Read the full article from S&P Global Market Intelligence

Investors Return to U.S. Refiners in Q3, With Blackrock Placing Big Bets

Large institutional investors were net buyers of U.S. oil refining stocks in the third quarter, despite the challenges the industry continues to face from the coronavirus pandemic.

—Read the full article from S&P Global Market Intelligence

Institutional Investors Continued to Sell Midstream Stocks in Q3

Only two of the top publicly traded energy pipeline companies in North America saw institutional ownership increase during the third quarter, with Energy Transfer LP again bearing the brunt of investors' selloff, an S&P Global Market Intelligence analysis of SEC filings shows.

—Read the full article from S&P Global Market Intelligence

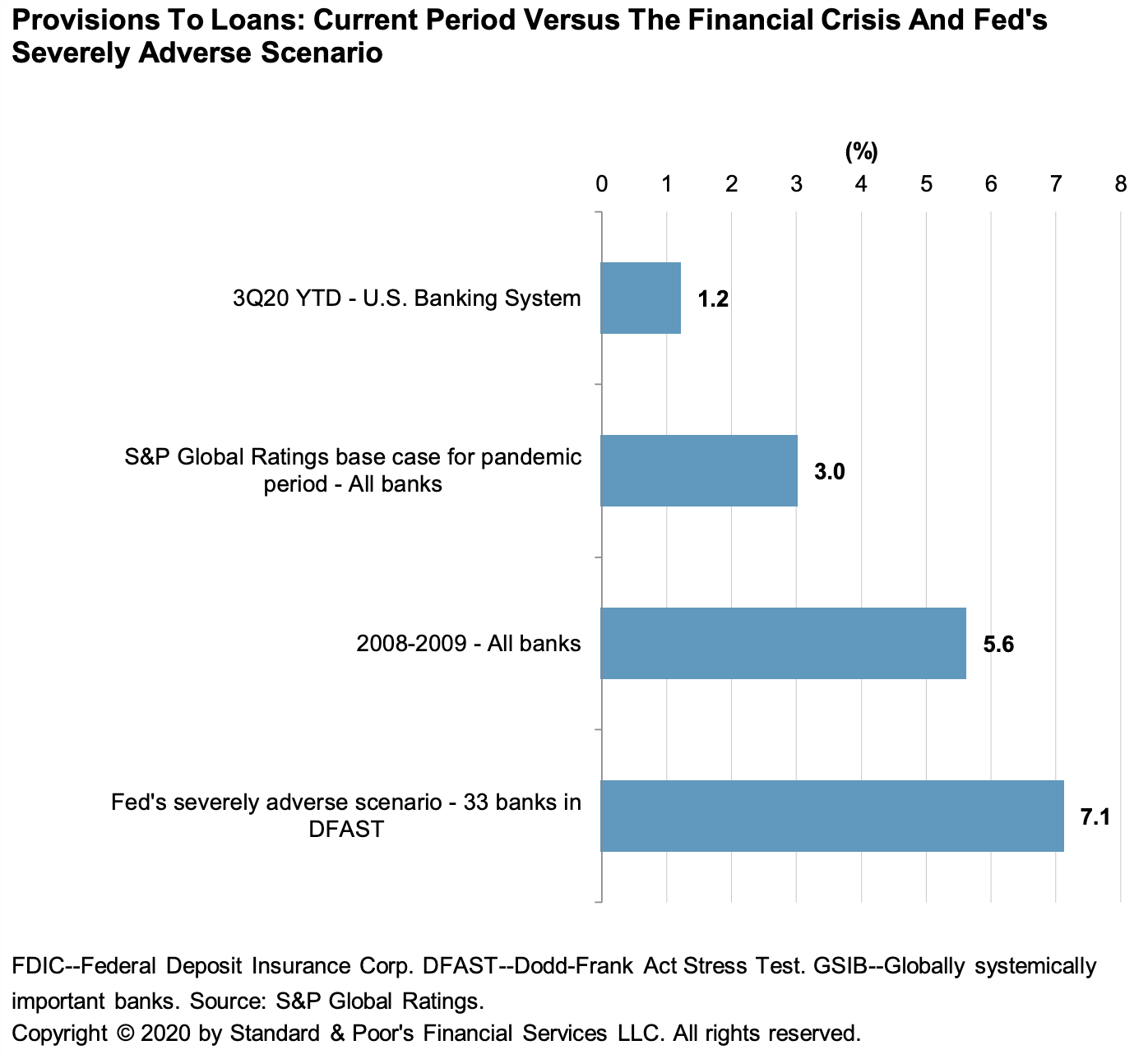

Despite Declining Loss Provisions, U.S. Banks Still Face Asset Quality Risks and Low Interest Rates

U.S. banks' asset quality showed important signs of stabilizing in the third quarter as the economy rebounded briskly.

—Read the full report from S&P Global Ratings

Singaporean Banks May See Modest Earnings Recovery in 2021 – Analysts

Earnings at Singaporean banks may start to recover from the pandemic in 2021, although the pace will likely be limited by continued margin pressure amid an uneven economic growth outlook, analysts say.

—Read the full article from S&P Global Market Intelligence

Chinese Banks Set to Clean Up Balance Sheet More Quickly in Q4

Chinese banks are likely to classify more risky loans as nonperforming while writing more bad debts off their books in the fourth quarter, as they heed the government's call to clean up their balance sheet in order to increase lending to the pandemic-hit economy, analysts say.

—Read the full article from S&P Global Market Intelligence

Deutsche Bank CEO Said Overhaul was 'Different This Time' – Q3 Shows it Might Be

Group third-quarter revenues increased 13% year over year to €5.94 billion with costs dropping 10% to €5.18 billion. As a result, Deutsche Bank continued to build positive operating leverage, which it has grown for four consecutive quarters, CEO Christian Sewing told analysts at the earnings presentation Oct. 28.

—Read the full article from S&P Global Market Intelligence

Listen: What A Biden Administration Means for the Energy Transition

President-elect Joe Biden is preparing to enter the White House with big plans to address climate change, a goal with substantial implications for the energy sector. S&P Global Market Intelligence's senior policy correspondent Molly Christian summarizes the key issues facing the energy sector under the next president.

—Listen and subscribe to Energy Evolution, a podcast from S&P Global Market Intelligence

Trudeau's Carbon Neutrality Plan for Canada Comes with Many 'Unknowns'

The potential impact on the mining industry resulting from proposed Canadian legislation reinforcing the federal government's commitment to a net-zero carbon target by 2050 remains unclear, with the possibility of additional regulatory action years away, according to Osler Hoskin & Harcourt LLP partner Sander Duncanson.

—Read the full article from S&P Global Market Intelligence

Which Companies Win from Decarbonizing Electricity?

The power generating sector has been one of the earliest and fastest to decarbonize, yet not all companies within the sector have taken action. This makes power generation an interesting example to see which companies could potentially win from a carbon transition — and which could be left behind. Companies greening their generation today are best poised to do well under multiple climate transition scenarios.

—Read the full article from S&P Global Market Intelligence

Disconnect Between Net-Zero Emissions Targets And Action: South Pole

Companies and governments pledging to reduce greenhouse gas emissions to net-zero need to bridge a gap between their long-term targets and concrete actions, sustainability consulting company South Pole said Nov. 24.

—Read the full article from S&P Global Platts

Listen: Greening Steel Production and Hydrogen’s Potential

S&P Global Platts managing editor Andrew Moore speaks with Platts senior editor for steel raw materials and metals analysis Hector Forster and Platts Analytics' lead hydrogen analyst Zane McDonald on how hydrogen may help transition the steel sector away from emissions-intensive blast furnaces and more toward direct reduction iron- and scrap-fed electric arc furnaces.

—Read the full article from S&P Global Platts

Watch: Market Movers Europe, Nov 23-27: Fuel Demand Sees Hope in Vaccine, as Continent Endures Power Surplus

In this week's highlights: OPEC+ members itch to break free of output constraints; the jet fuel market welcomes news of a potential coronavirus vaccine; returning French nuclear generators contribute to a continental power supply glut, and mild weather is keeping European gas storage withdrawals unusually low.

—Watch and share this Market Movers video from S&P Global Platts

Uneven Recovery Will See Oil Demand Grow by 6.3 Mil B/D in 2021: Platts Analytics

An uneven oil demand recovery across different regions and product types will see oil demand climb by 6.3 million b/d in 2021, according to the latest forecast by S&P Global Platts Analytics.

—Read the full article from S&P Global Platts

Airline Passenger Numbers Down 61% on Year in 2020: IATA

Air passenger numbers are set to have weakened by almost 61% in 2020 on the year to 1.8 billion, the International Air Transport Association said in a statement Nov. 24.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language