Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 20 Nov, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Surveying Australia’s Banking Sector

Watchers of the night sky in Australia can enjoy views of the Southern Cross, Centaurus and Sagittarius — constellations that are hard, if not impossible, to see from the Northern Hemisphere.

Observers who cast their gaze toward the country’s economic growth, interest rates and financial sector will find a more familiar pattern on the horizon.

As with other developed economies, Australia has endured inflation and weak economic growth since the reopening of its economy from lockdowns amid the COVID-19 pandemic. Like elsewhere, this has been accompanied by higher-for-longer interest rates. In November, the Reserve Bank of Australia tightened its cash rate target by 25 basis points to 4.35%.

Higher interest rates have been beneficial for banks and insurers, with large lenders such as Australia and New Zealand Banking Group and National Australia Bank reporting increased first-half earnings. “All of the business [has] been growing up until the last six months, helped by interest rate movement for the first time in 12 years going up, not down,” National Australia Bank CEO Rob McEwan said in a video discussing the bank’s results.

However, bank executives have voiced concerns about the impact of higher rates on competition in the retail banking market, which has been heating up. “The next six months will be more difficult than the last,” Australia and New Zealand Banking Group CEO Shayne Elliott said. “Competition in retail banking is as intense as it has ever been, both in Australia and New Zealand.”

Another worry is the impact of higher-for-longer rates on banks’ customers. While discussing Commonwealth Bank of Australia’s better-than-expected results in fiscal 2023, CEO Matt Comyn pointed to “signs of downside risk” from cost-of-living pressures and the effect of higher interest rates on mortgage borrowers. The bank’s book of troublesome and impaired assets for the year ended June 30 grew to A$7.1 billion, up from A$6.4 billion the previous year.

Rising rates have fanned fears of a fixed-rate mortgage cliff, in which higher repayments hit borrowers after they come to the end of a period of fixed rates. Many mortgage borrowers scrambled to secure low rates during COVID-19, as the cash rate target dipped as low as 0.10%. With fixed-rate deals typically lasting one to five years, some homeowners are seeing their rates rise dramatically.

The recent uptick in nonperforming housing loans was raised during a July webinar hosted by S&P Global Ratings. While some borrowers would struggle to service their mortgages, the overall picture for banks was positive, according to Sharad Jain, S&P Global Ratings’ director for financial institutions. The Australian banking system would “weather the stresses from rising interest rates very well,” Jain said.

A March report by S&P Global Ratings also expressed optimism about Australian prudential regulation and the strength of banks’ business models, noting they were less exposed to the problems that befell US regional lenders First Republic Bank and Silicon Valley Bank earlier this year. Australia’s banks were less reliant on generating interest income from debt securities and more heavily focused on conventional banking, the report said, reducing the risks of an asset-liability mismatch and unstable deposits.

Developments in Europe’s banking sector could have an impact though. The merger of Credit Suisse and UBS in March upset many investors as Swiss regulators wrote down additional Tier 1 bonds issued by Credit Suisse. While the prospect of a similar scenario unfolding in Australia is unlikely, according to S&P Global Ratings, the episode could put pressure on the banks’ cost of regulatory capital. Australia’s major banks need to refinance an unusually high amount of debt in the next two years.

Finally, interest rates could be yet to reach their zenith. Australia’s consumer price index indicator rose 5.6% year over year in September, according to the Australian Bureau of Statistics. Michele Bullock, the new governor of the Reserve Bank of Australia, warned that more increases may be required to ensure inflation returns to the central bank’s target. Further rate hikes might darken the skies, but for now, the star of Australia’s banking sector continues to burn brightly.

Today is Monday, November 20, 2023, and here is today’s essential intelligence.

Written by Mark Pengelly.

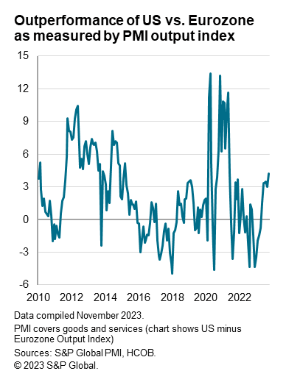

Week Ahead Economic Preview: Week Of November 20, 2023

A busy data week includes November flash PMIs, GDP readings from Germany and Thailand and inflation figures for Canada, Japan and Singapore. Nestled among which are meeting minutes from the US Fed and RBA, shedding light on their latest decisions. Additionally, more central bank meetings unfold in Turkey and Indonesia. Flash PMI releases across major developed economies will offer the earliest clues on growth and inflation trajectories. Inflation in both the US and in Europe has fallen faster in recent months than many had expected, though the data have merely fallen in line with the signals from the PMI price indices. Hence the survey price gauges will be carefully monitored to assess the speed with which inflation targets may come into view.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Private Markets Monthly, November 2023: Understanding The Risks Inherent To Private Credit, With David Tesher And Paul Watters

As investors increasingly allocate capital across private debt markets, they want greater transparency in a relatively opaque space. Private Markets Monthly is S&P Global Ratings' new research offering, where Head of Thought Leadership Ruth Yang interviews subject matter experts on what matters most across private markets — now and moving forward. In this edition, Ruth talks with David Tesher and Paul Watters, the Credit Conditions Committee (CCC) chairs for North America and Europe, respectively, about the risks inherent in private markets, the differences between the US and European markets and whether private credit poses a systemic risk. The CCCs set S&P Global Ratings' house views on risk.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

EU Plans To Tighten Shipping Reporting Rules Under Russian Oil 'Price Cap'

The European Commission is proposing to tighten reporting requirements for shippers and their insurers as part of a clampdown on the circumvention of the G7 oil price cap on Russian oil exports and other sanctions measures against Moscow, according to reports. According to a widely leaked proposal, the European Commission hopes to introduce a "requirement for attestations to also include itemized ancillary costs, such as insurance and freight," on top of a declaration on the price paid for the Russian oil.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

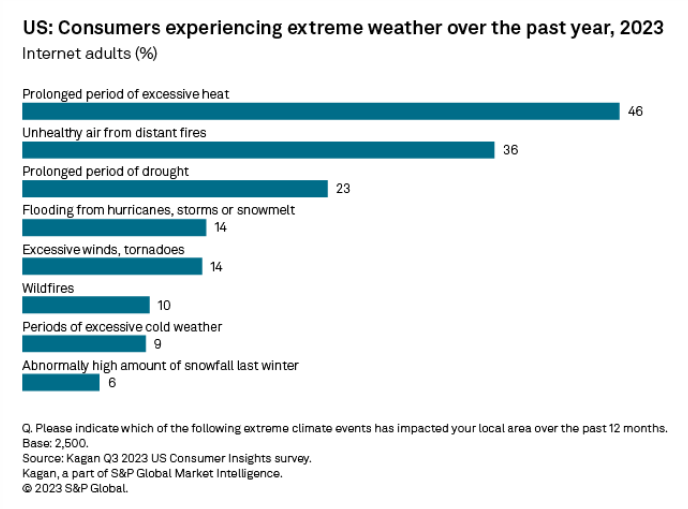

Three-Quarters Of US Consumers Experienced Extreme Weather Events In 2023

Extreme weather events, ranging from searing heat waves to frigid cold, from flooding to extended drought, have become common news headlines in the US over the past year. No geographic region has been spared. With this as a backdrop, the Kagan US Consumer Insights third-quarter 2023 survey asked internet adults to identify the types of extreme weather events they experienced over the past year and how they were impacted by extreme weather.

—Read the article from S&P Global Market Intelligence

Access more insights on sustainability >

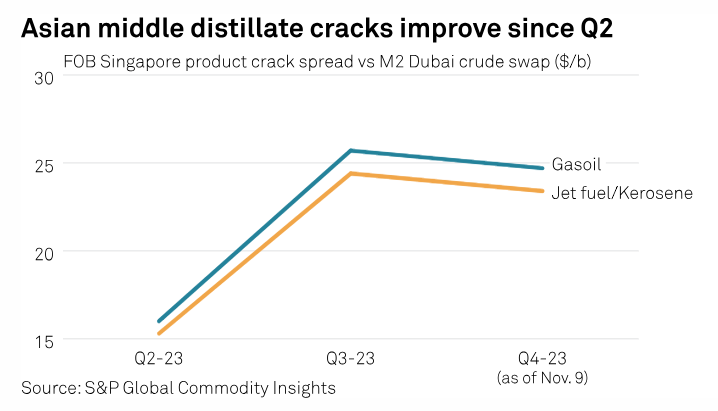

South Korea's SK Innovation To Raise Q4 Crude Runs But Still Cautious On Fuel Demand, Margins

South Korea's SK Innovation plans to raise run rates and crude throughput in the fourth quarter of this year as the country's top refiner expects oil product cracks to remain healthy, though macroeconomic challenges pose a threat to domestic and regional fuel demand outlook, company officials and fuel marketing managers said over Nov. 9-17. SK Innovation refineries' average run rate in the third quarter was 84%, up from 80% in Q2, a company official said.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

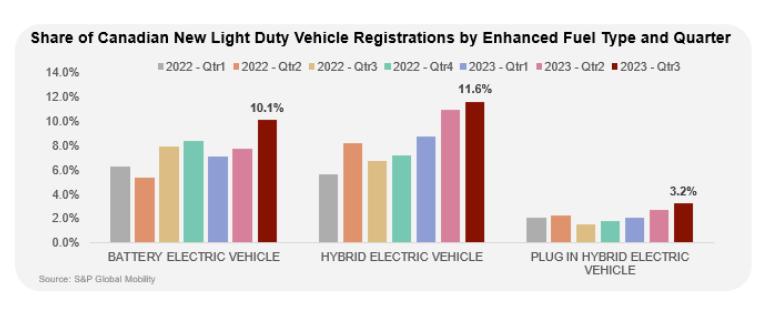

Automotive Insights — Q3 2023 Canadian EV Information and Analysis

The third quarter of 2023 marked a significant milestone in the Canadian automotive industry, with Battery Electric Vehicles (BEV) volumes reaching unprecedented levels. According to S&P Global Mobility's analysis, new vehicle registrations surpassed the 42,000 mark, accounting for 10.1% of all new vehicles. This represents the largest quarterly volume ever recorded for BEVs.

—Read the article from S&P Global Mobility