Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 2 Nov, 2021 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

The 2021 United Nations Climate Change Conference, or COP26 , began with calls for immediate action to control global warming—but lacked early signs that the international community is ready to commit to collaborative action.

Although global leaders in Glasgow (many of which arrived on carbon-intensive private planes) warned of an impending climate catastrophe and apologized for promises that haven’t resulted in policies during the first two days of discussion, their initial optimism about climate collaboration led toward typical tension.

"Let's have no illusions: if commitments fall short by the end of this COP, countries must revisit their national climate plans and policies,” Mr. Guterres said on Nov. 1 at COP26, according to S&P Global Platts. “Not every five years. Every year. Until keeping to 1.5 degrees is assured. Until subsidies to fossil fuels end. Until there is a price on carbon. And until coal is phased out.”

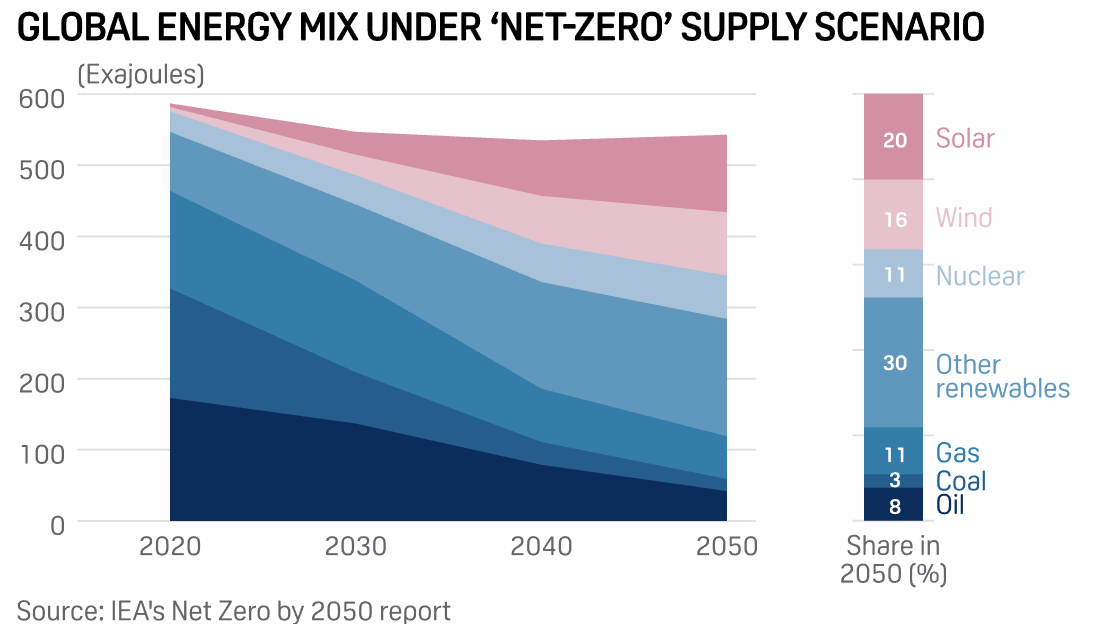

Calls for advanced economies that are responsible for the most greenhouse gas emissions to do more in the face of global warming and assist emerging economies who suffer the existential effects of climate change intensified. China and Russia’s leaders didn’t attend COP26, although the United States did, despite pulling out of the Paris Agreement under the Trump Administration and rejoining under President Joe Biden. To help close the divide, European leaders reenergized appeals for the annual delivery of $100 billion in climate financing for developing nations over the next five years, to be followed with capital increases. But the focus appears to remain on the future rather than the now. India, which isn’t a top global emitter but is one of the world’s most fossil fuel-dependent economies, announced new net-zero targets for 2070 that will keep coal centered in its energy mix for decades.

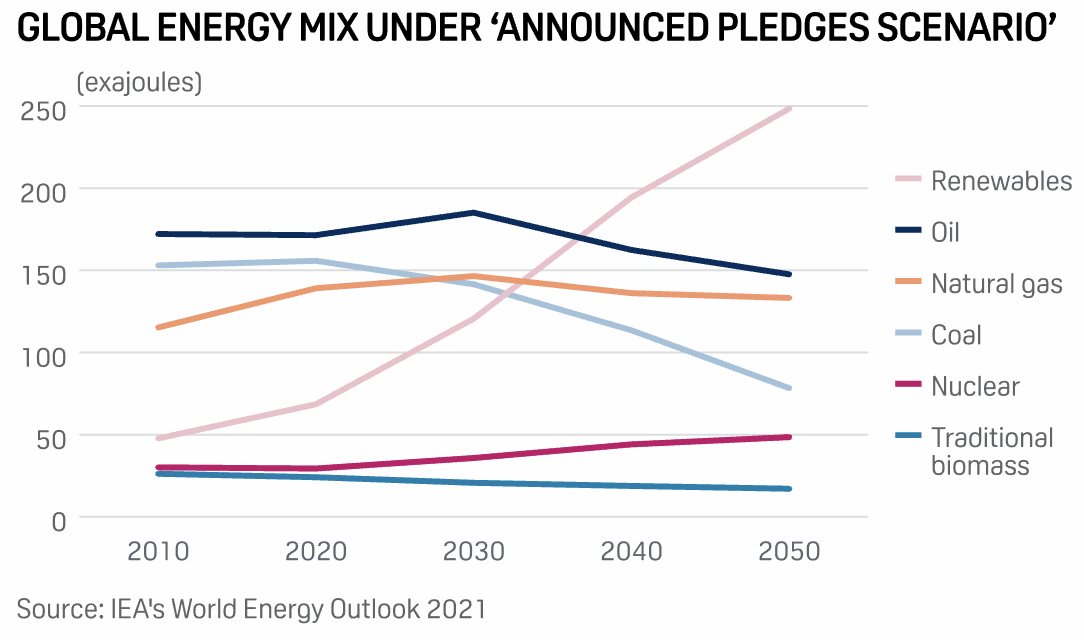

"We're hearing a crescendo of voices calling for action on the climate, the phase-out of fossil fuel, and other sustainability goals … At the same time, we are also hearing a lot about near-term pressures needed to keep the lights on and the economy growing, and this is where the role of fossil fuels hasn't been very obvious,” S&P Global Platts Analytics' head of energy scenarios, policy and technology Roman Kramarchuk told S&P Global Platts. "There will clearly be tensions about how we get there [to the Paris Climate goals], particularly if there are perceptions that addressing long-term policy goals will complicate and make the here-and-now more expensive … The key questions are around the pace of change, new investments, the stranding of assets, around how quickly fossil fuels may be phased out and what roles they can continue to play under different outlooks."

Eyes and ire are not only on public actors and governments. U.N. Secretary General Antonio Guterres announced ambitions for a group of experts to set transparent standards for private sector market participants and analyze non-state actors’ net-zero commitments. The U.K. government announced that starting in 2022 companies registered in the country will face mandatory climate risk and opportunities disclosures.

"What difference does it make if you pledge something at a high level if the accounting and reporting is not accurate?" Kevin Conrad, a climate negotiator for Papua New Guinea, told S&P Global Market Intelligence in an interview. "It makes a total disconnect."

Today is Tuesday, November 2, 2021, and here is today’s essential intelligence.

Economic Research: Lasting Effects of Temporary Inflation: Higher Prices, Lower Purchasing Power

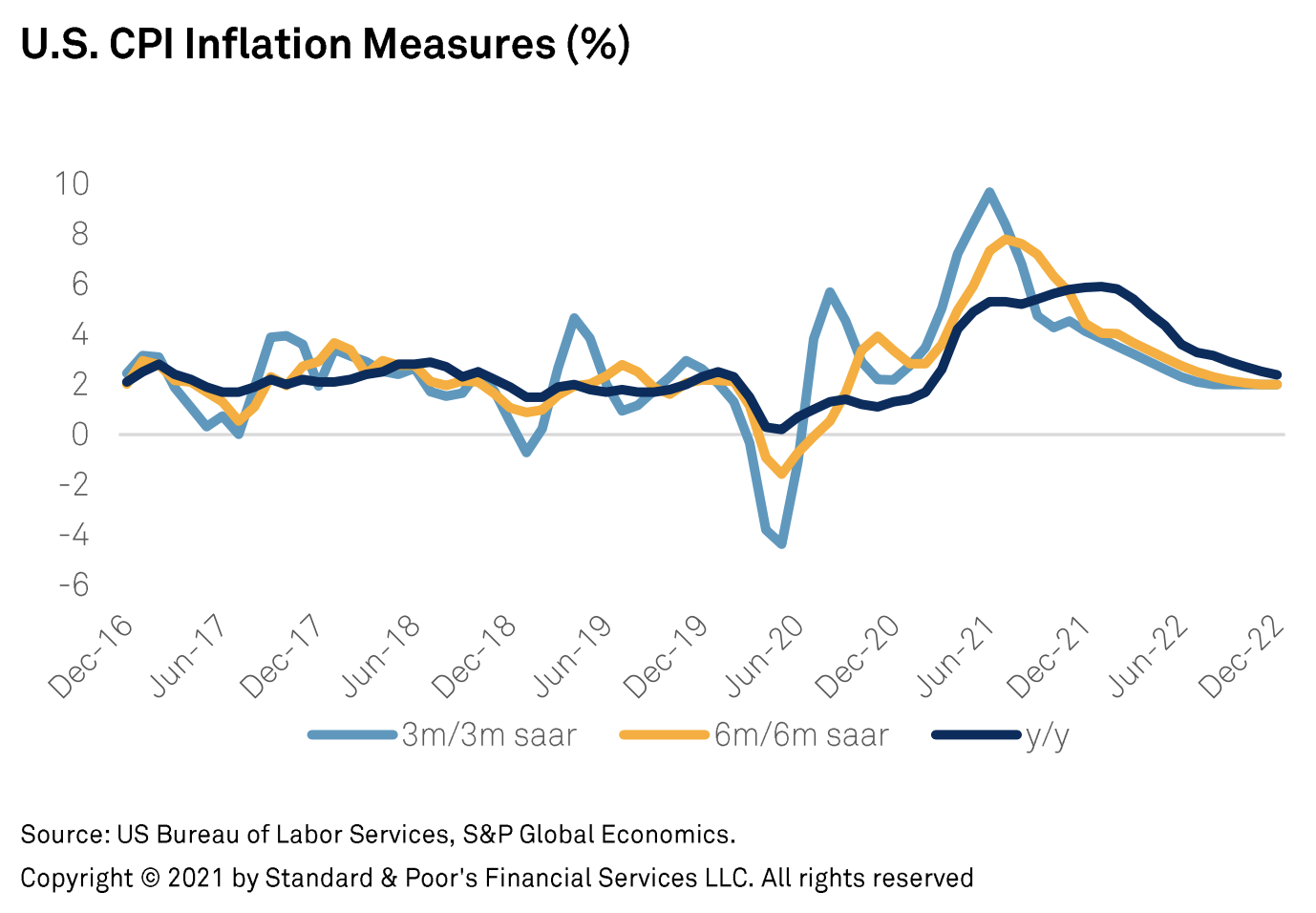

S&P Global Ratings continues to believe that U.S. inflation pressures are largely transitory, meaning that under the Fed’s currently announced policy settings inflation will come back to the target rate of an average of 2%. However, inflation will be stronger and last longer than initially forecast.

—Read the full report from S&P Global Ratings

Introduction To Supranationals Special Edition 2021

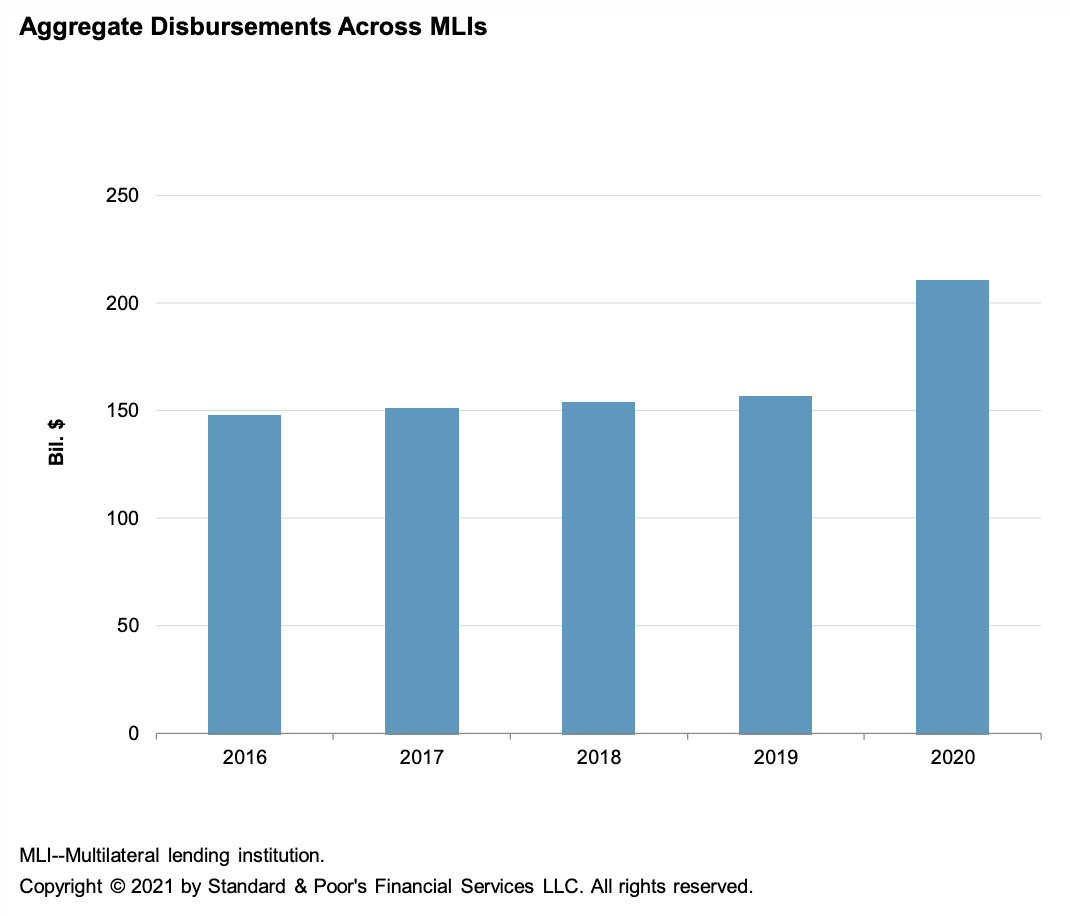

Multilateral lending institutions stepped up disbursements in 2020, which reached $210 billion, and while demand will remain high for multilateral resources, we believe MLI balance sheets will be somewhat constrained, accentuated now by the pandemic.

—Read the full report from S&P Global Ratings

Basel III Bank Capital Rules In Europe: Delayed And Diluted

The European Commission has announced its eagerly awaited proposal on how policymakers should implement the Basel III capital standards in the EU. If implemented as proposed, the net effect would be a modest erosion in regulatory capital metrics for European banks, with the final implementation of Basel III spread over an even longer horizon than previously envisaged.

—Read the full report from S&P Global Ratings

Islamic Finance Outlook: 2022 Edition

S&P Global Ratings believes the global Islamic finance industry will expand 10%-12% in 2021-2022. The expansion of Islamic banking assets in some Gulf Cooperation Council countries, Malaysia, and Turkey and sukuk issuances exceeding maturities explain this expected performance.

—Read the full report from S&P Global Ratings

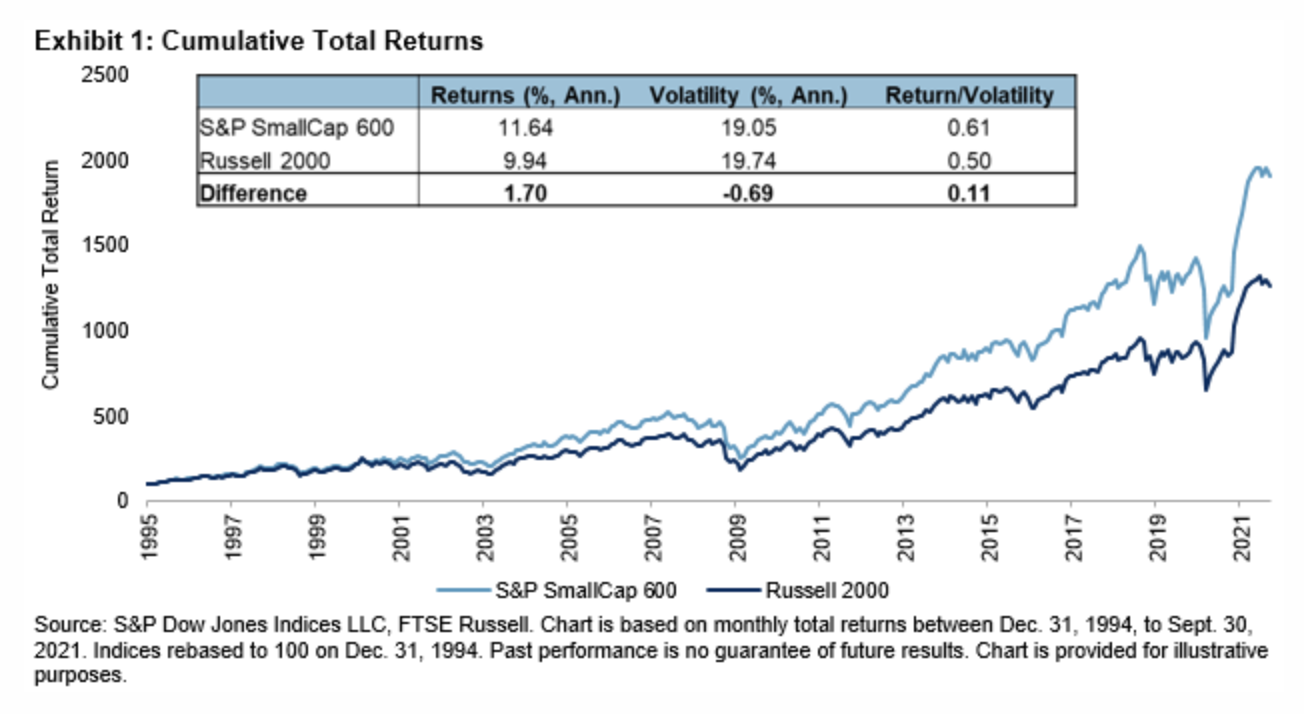

The S&P SmallCap 600 – A Sector-Led Bounce Back

Despite the long-term track record, there have been periods where the S&P 600 has underperformed. For example, the S&P 600 underperformed by 8.86% and 8.65% in 1999 and 2020, respectively. These were the two worst calendar year periods for the S&P 600, based on relative returns. However, both examples were followed by substantial bounce backs in the following year.

—Read the full article from S&P Dow Jones Indices

Nomura Beefs Up Risk Control After Surprise Provision On Legacy U.S. Deals

Nomura Holdings Inc. is taking steps to strengthen risk management after the largest Japanese brokerage booked a surprise ¥39 billion provision from transactions years ago while reeling from its losses related to the collapse of U.S. family office Archegos Capital.

—Read the full article from S&P Global Market Intelligence

COP26: Climate Talks Face Fossil Fuels Dilemma As Supply Crunch Weighs

As world leaders meet in Glasgow, Scotland, for the closely-watched UN Climate Change Conference of the Parties, policymakers face squaring a big circle over pledges to relegate fossil fuels to history and the global need for reliable, low-cost energy supplies.

—Read the full article from S&P Global Platts

U.S. House Unveils New Reconciliation Bill Loaded With Climate, Clean Energy Money

Democrats in the U.S. House of Representatives released text of new legislation Oct. 28 to carry out President Joe Biden's Build Back Better agenda. The nearly 1,700-page bill was stuffed with major climate and clean energy provisions.

—Read the full article from S&P Global Market Intelligence

Sinopec Sees More Opportunities Than Threats In China's Emissions Peak Action Plan

China's State Council on Oct. 26 released the nation's action plan to peak carbon emissions, including targets to have around 40% of incremental vehicles in the country fueled by new energy sources and reach peak petroleum consumption for land transportation by 2030.

—Read the full article from S&P Global Platts

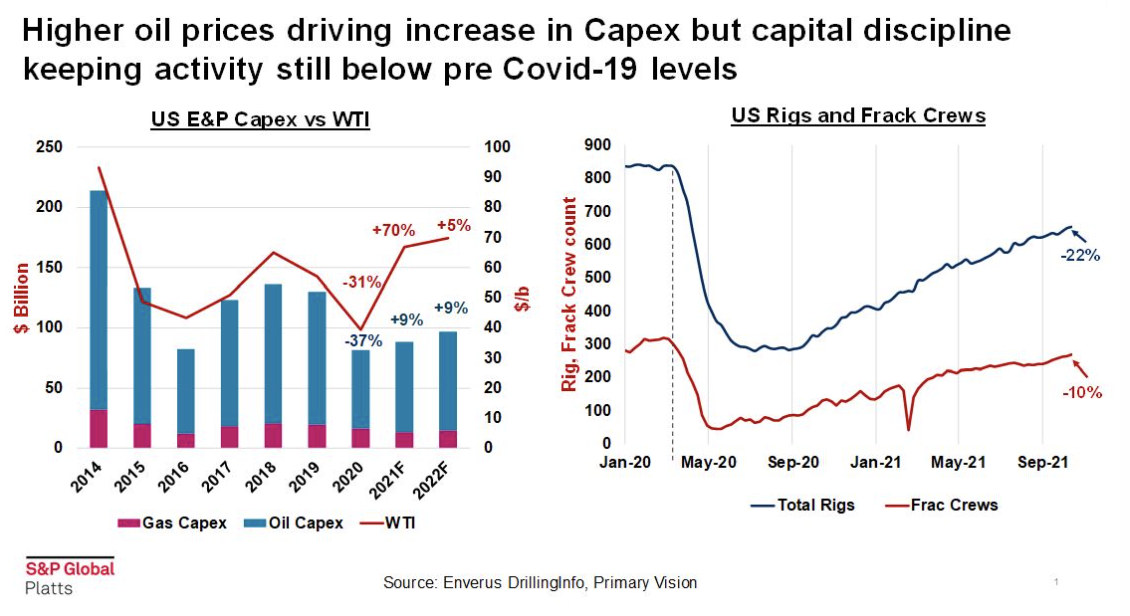

Push For Energy Transition, Underinvestment In Traditional Energy Fueling High Prices: Speakers At Forum

The push for energy transition and underinvestment in traditional energy sources are fueling the current high prices, speakers at the Eurasian Economic Forum said Oct. 28. Rosneft CEO Igor Sechin said that many OPEC+ countries are unable to increase output due to sanctions, and insufficient investment, driven by growing climate concerns.

—Read the full article from S&P Global Platts

Spotlight: Will U.S. Shale Oil Operators Forget Capital Discipline And Produce A Lot More Oil Next Year As Oil Prices Reach A Seven-Year High?

Despite high oil prices, capital discipline has held drilling and completion activity in check as most public operators have focused on paying down debt and returning cash to shareholders instead of growing shale oil production.

—Read the full article from S&P Global Platts

Floating Forties Cargoes Competing With Urals Into Europe

Aframaxes that have been floating in the North Sea after loading Forties crude are expected to compete with Urals into European refineries, sources said. While Forties is a North Sea grade, it is considered sour by many local refiners and as a result they can look towards the grade as an alternative to Urals.

—Read the full article from S&P Global Platts

Analysis: Australia's Jet Fuel Demand Looks Up As It Readies For Border Reopening

Australia's jet fuel demand is set to accelerate as Qantas and Jetstar gear up for an accelerated border reopening while COVID-19 vaccination rates hasten, a move which is set to significantly increase travel demand after a long hiatus, sources said.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Language