Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 19 Nov, 2020

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

Two days after Massachusetts-based biotechnology company Moderna reported its coronavirus vaccine to have nearly 95% efficacy after its first interim analysis, New York-headquartered drug maker Pfizer announced on Nov. 18 that final Phase 3 trials show its vaccine candidate, created in partnership with the German biopharmaceutical firm BioNTech SE, to also be 95% effective. Last week, the company’s late-stage analysis showed its BNT162b2 vaccine to have 90% efficacy.

Both companies announced that they will apply for emergency use authorization with the U.S. Food and Drug Administration, which requires coronavirus vaccines to be at least 50% effective, to allow for the vaccines to receive expedited federal approvals. Moderna is expected to submit its application to the regulator once 151 cases of COVID-19 in the trial are confirmed and after a final interim analysis is conducted, while Pfizer said it intends to apply "within days." The candidates use new vaccine technology, called mRNA, that has never before been approved in humans or for widespread use.

The milestone comes one year after the first case of coronavirus was confirmed in China—offering a light at the end of the tunnel of the pandemic, and showcasing the unprecedented speed of vaccine development and the dramatic technological advancements deployed during this crisis.

But while the world may soon see widespread immunization against the virus that has infected 56.1 million and killed 1.3 million people, according to Johns Hopkins University data, the challenge will be far from over. Manufacturing and distributing high-quality batches of the vaccines comes with complications.

“Supply chain is definitely going to be a major challenge for these COVID-19 vaccines,” Arthur Wong, a director of healthcare corporate ratings at S&P Global Ratings, told the Daily Update. “While there is a lot of focus, rightly so, on the success thus far on the two vaccine candidates, and the manufacturing capacity estimates are encouraging, the difficult distribution challenges may be underappreciated.”

Moderna aims to produce 500 million to 1 billion doses this year for at least the U.S., U.K., and Japan, and has secured manufacturing agreements with other pharmaceutical companies to produce batches at scale. Pfizer and BioTech plan to produce 50 million doses this year and 1.3 billion next year. Their vaccine will be supplied to the U.S., EU, U.K., and Japan. While both use the mRNA technology, they differ drastically in their storage needs. Moderna’s vaccine can be stored at temperatures of negative 20 degrees Celsius and can remain stable for one month at typical freezer temperatures of 2 to 8 degrees, while Pfizer and BioNTech’s candidate requires storage at negative 70 degree Celsius—which is colder than the typical winter in Antarctica. Pfizer has designed packaging made with dry ice that allows for the treatment to remain at extremely cold temperatures for a few weeks outside of the needed specialized freezers.

Larger medical centers can more easily accommodate the storage temperatures for preserving Pfizer’s vaccine, but the dry ice packaging could allow for other centers to distribute it, S&P Global Ratings pharmaceutical credit analyst Tulip Lim told the Daily Update.

“While both [vaccine candidates are] based on the same technology, both have very different temperature requirements in that Pfizer’s vaccine needs to be maintained at -70 degrees Celsius during transport and storage, while Moderna’s is at a more manageable -20 degrees,” Mr. Wong, S&P Global Ratings’ director of healthcare corporate ratings, said. “So far, assuming that these candidates, as well as potential others, are approved, there hasn’t been enough details as to the distribution plan, with a number of unknowns such as manufacturing capacity and availability, and which populations and/or geographies get priority.”

Moderna CEO Stéphane Bancel said the company is increasing its manufacturing output to accommodate the urgent global demand. “We don’t have a billion-dose manufacturing capacity sitting idle somewhere,” he told Science Magazine on Nov. 16. “So if we pull them [the company’s key engineers] out and say, ‘Hey, you have to go and get on a plane on the other side of the world to teach somebody else how to do it,’ they won’t be able to scale up manufacturing in the U.S. or in Switzerland.”

Because both Moderna’s and Pfizer’s candidates are two-dose vaccines, this adds greater complexity to their distribution because of the timing of the second dosage within a certain window after the first, Mr. Wong said. He acknowledged that unprecedented circumstances of manufacturing and distributing large quantities and varieties of vaccines with different transportation and storage needs creates challenges so quickly poses specific challenges.

“A plan will also have to include which vaccines get allocated where, assuming the more complex to transport Pfizer vaccine will be sent to larger urban areas that have the population and infrastructure and the less complex to distribute candidates are sent to more rural areas,” Mr. Wong said. “There are a number of other vaccine candidates in late stage development, many that may not have as complex a distribution challenge that with their added manufactured dosages, that could lend greater flexibility in the distribution of the vaccines. But it looks like the vaccines will be initially in short supply, given the estimates from Pfizer and Moderna on manufacturing capacity.”

Today is Thursday, November 19, 2020, and here is today’s essential intelligence.

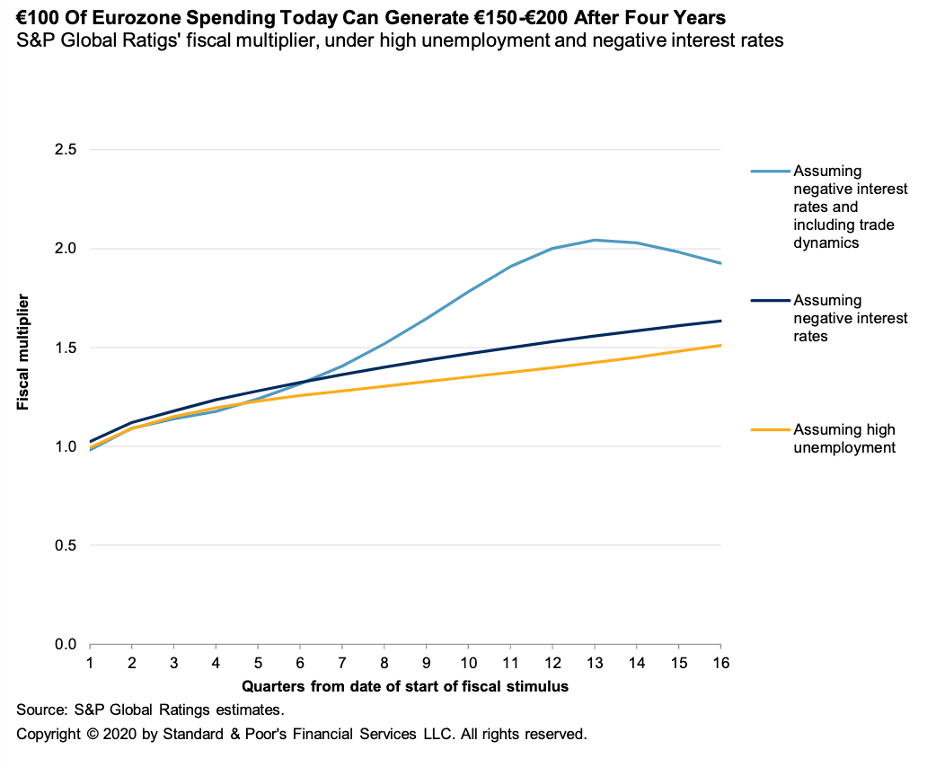

Economic Research: The Case for Bold Fiscal Stimulus In the Eurozone

With monetary policy in the eurozone close to as loose as possible and the economy contracting, central bankers and governments have been talking about what power increased state spending could have to boost a recovery.

—Read the full report from S&P Global Ratings

Economic Research: Real Time Economic Data Tracker: An Odd Juncture

COVID-19 cases have surged, risking fourth-quarter growth that bleeds into an early leading portion of the first quarter next year.

—Read the full report from S&P Global Ratings

Money Managers, Officials Rebuke Labor Department's Proxy Voting Proposal

A torrent of opposition from Wall Street, Capitol Hill and pension funds across the country has hit the U.S. Department of Labor over its plan to restrict proxy voting for some financial advisers.

—Read the full article from S&P Global Market Intelligence

The Post-Election Landscape for U.S. Public Finance

With the presidential election over, S&P Global Ratings offers a focus on the post-election landscape and what will be the key drivers related to credit across the broad and diverse U.S. municipal market.

—Read the full report from S&P Global Ratings

U.K. Insurers: Steering Through A Chaotic World

Although S&P Global Ratings anticipates that profitability at rated U.K. insurers will be dented in 2020 across the industry, profitability is expected to normalize in 2021 and the impact on ratings will be limited.

—Read the full report from S&P Global Ratings

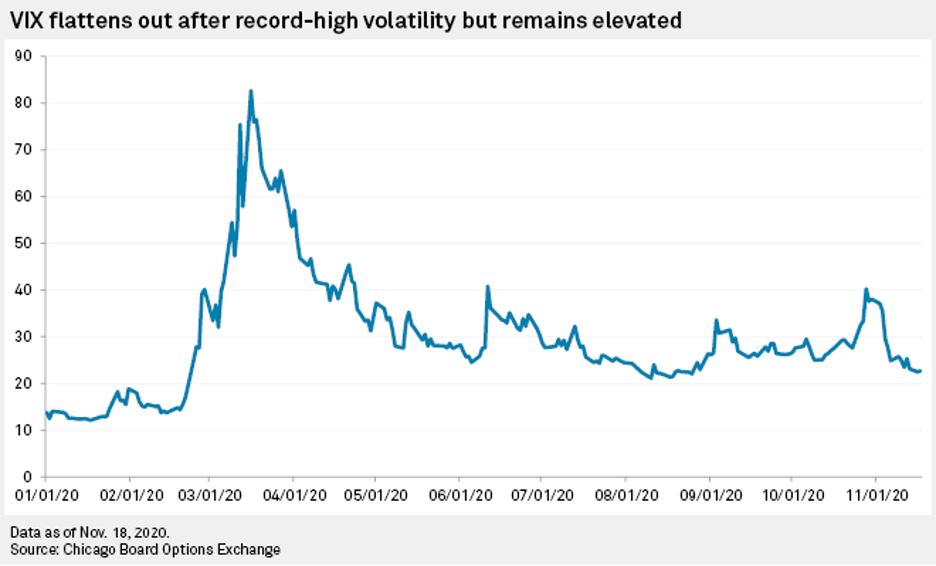

VIX at 3-Month Low Points to Calmer Path Ahead for S&P 500 - Risk Monitor

Investors are anticipating a calmer path ahead for U.S. equities as the prospect of two highly effective vaccines takes precedence over the immediate concern of a spike in daily new COVID-19 cases in the U.S. to beyond 150,000.

—Read the full article from S&P Global Market Intelligence

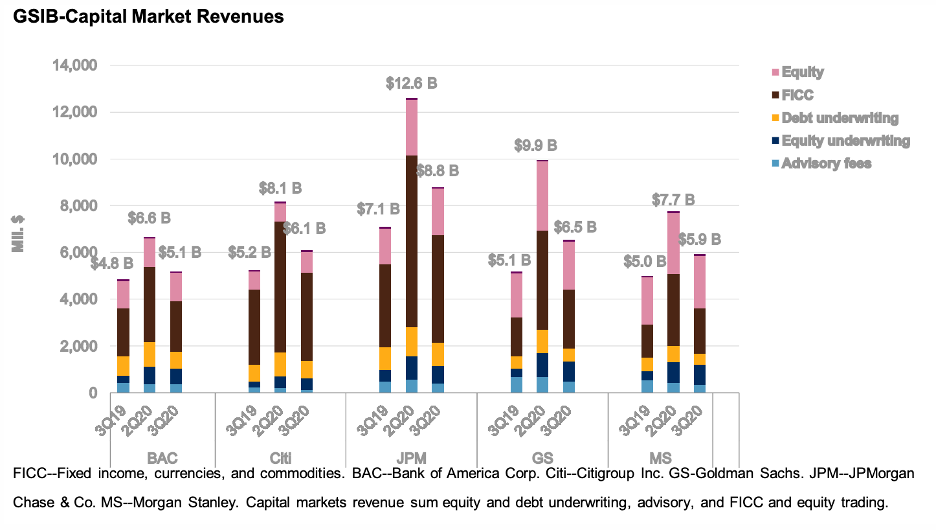

Earnings Among Large U.S. Banks Rebounded In Third Quarter, but Uncertainty Remains High

The third-quarter earnings of most of the U.S. global systematically important banks fell from the prior-year levels on lower net interest income, but improved sharply from the second quarter on reduced provisions.

—Read the full report from S&P Global Ratings

Global i-bank Revenue Growth Slows in Q3 as FICC Surge Lessens – Coalition

Revenues at the world's leading 12 investment banks grew at a more moderate pace in the third quarter of 2020 as trading in fixed income, currencies and commodities, or FICC, began to normalize from the record highs seen in the first half of the year, research company Coalition said in its latest sector index.

—Read the full article from S&P Global Market Intelligence

Hit To Mexican Nonbank Financial Institutions' Asset Quality Will Depend On Loan Portfolio Exposure By Sector

Mexican nonbank financial institutions have enacted various relief programs for clients, but in S&P Global Ratings’ view, some clients won't recover.

—Read the full report from S&P Global Ratings

UK Banks Ready For 'Painful' Negative Interest Rates; Market Has Baked Them In

U.K. banks have already run the numbers on possible negative central bank interest rates and foresee big potential cuts to income, but economists wonder if they are the right solution anyway.

—Read the full article from S&P Global Market Intelligence

Spain's BBVA Will Shift Focus to Domestic Market on Potential Sabadell Buy

U.K. banks have already run the numbers on possible negative central bank interest rates and foresee big potential cuts to income, but economists wonder if they are the right solution anyway.

—Read the full article from S&P Global Market Intelligence

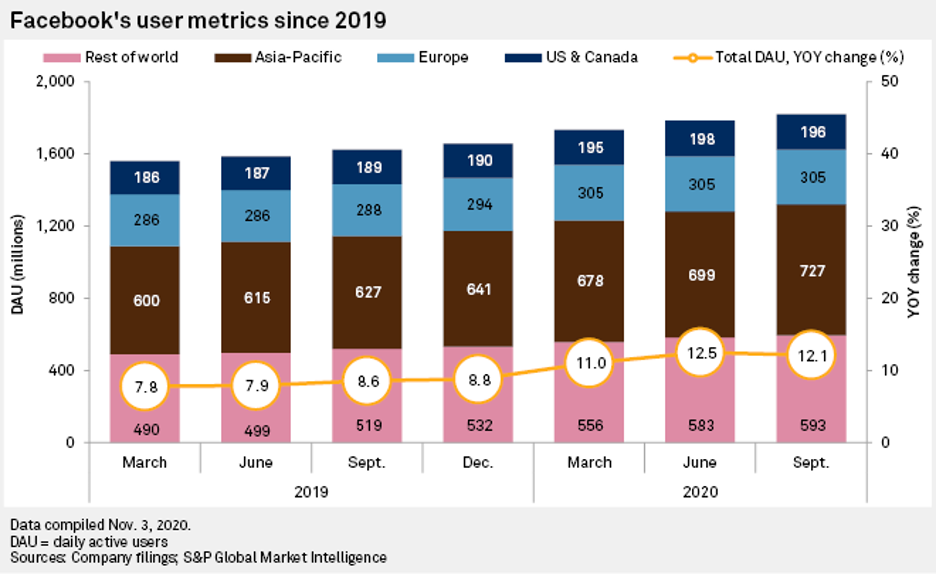

Parler Parlays Conservative Frustration with Facebook, Twitter into Usage Surge

The political debate over content moderation practices at Facebook Inc. and Twitter Inc. has sent some prominent conservatives to Parler — a social network touted as an ideological alternative to those platforms.

—Read the full article from S&P Global Market Intelligence

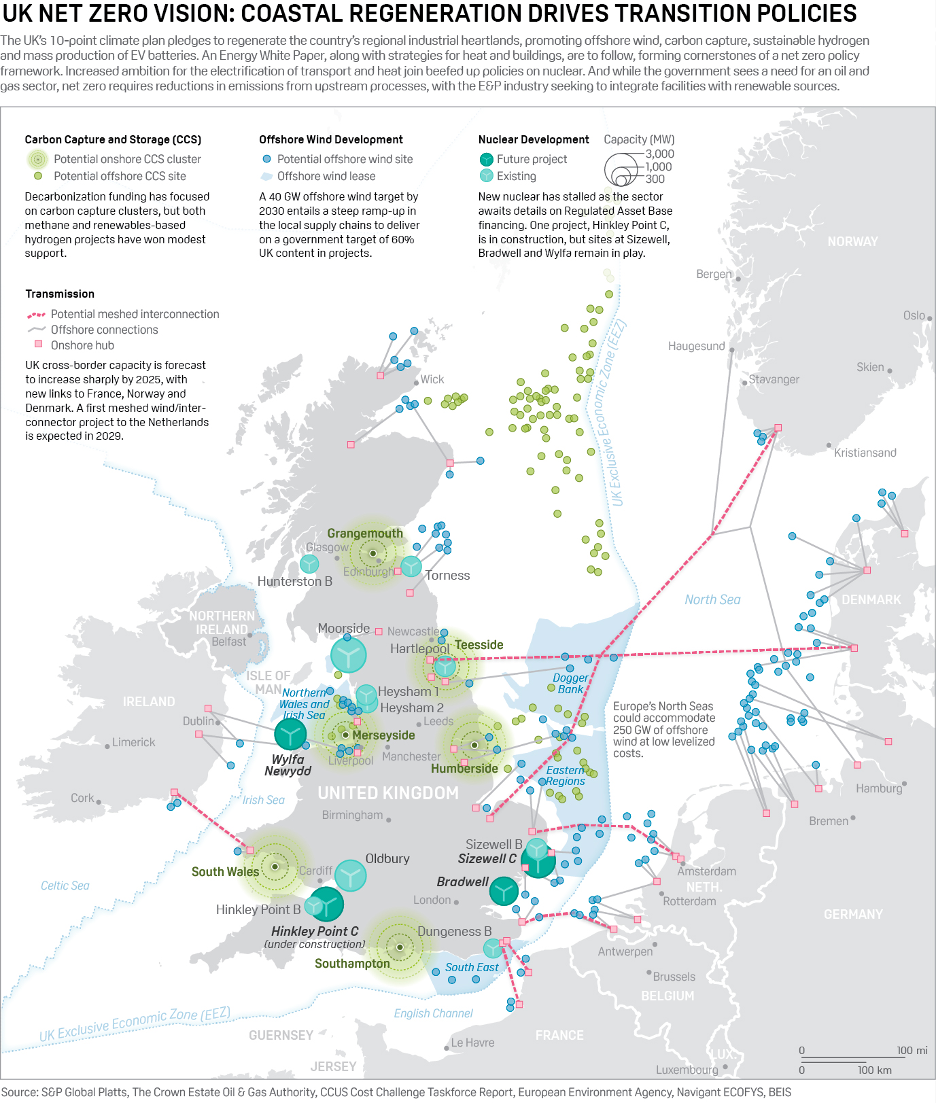

U.K. Net Zero Vision: Coastal Regeneration Drives Transition Policies

The UK's 10-point climate plan pledges to regenerate the country's regional industrial heartlands, promoting offshore wind, carbon capture, sustainable hydrogen and mass production of EV batteries.

—Read the full article from S&P Global Platts

UK Steel, Auto Sectors Welcome 'Green Plan,' See Supply Chain, Local Content Challenges

UK steelmakers and vehicle manufacturing industries have welcomed Prime Minister Boris Johnson's new "green plan" announced Nov. 18, but fear shortcomings in local supply chains in some areas, and stress the need for local content to be maximized amid "immense challenges".

—Read the full article from S&P Global Platts

FERC's Carbon Pricing Statement Draws Criticism, Cautious Support

A draft policy statement issued last month by the Federal Energy Regulatory Commission encouraging carbon pricing rules in wholesale power markets has generated mixed feedback.

—Read the full article from S&P Global Market Intelligence

Bezos Climate Fund Targets Hard-To-Tackle Sectors, Environmental Justice

Amazon.com Inc. CEO Jeff Bezos' initial round of nearly $800 million in climate-focused grants and investments aims to tackle emissions from the transportation, industrial and agriculture sectors, protect forests and other ecosystems, and address environmental justice and racial equity issues.

—Read the full article from S&P Global Market Intelligence

Watch: Market Movers Europe, Nov 16-20: COVID-19 recovery plans at the top of the agenda

In this week's highlights: OPEC+ meeting to focus on the possibility to extend production cuts; lockdowns set the pace for European gas demand; the EU is to discuss green industry investments; and steel markets await the results of Germany's ThyssenKrupp.

—Watch and share this Market Movers video from S&P Global Platts

U.S. Senate Energy Panel Advances Paired FERC Nominees by Voice Vote

Two nominees to the US Federal Energy Regulatory Commission were reported out of the Senate Energy and Natural Resources Committee by voice vote Nov. 18, moving a step closer to confirmation, although some senators opposed their advancement.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language