Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 18 Nov, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Two Bright Spots in U.K. Economic Turmoil

In Britain’s recently unveiled Autumn Statement, Finance Minister Jeremy Hunt exchanged tax relief for tax hikes and unfunded spending for budget cuts. It’s a dramatic change from the scrapped Sept. 23 mini-budget proposed by then-Chancellor Kwasi Kwarteng and supported by former Prime Minister Liz Truss, who resigned after just 44 days in office.

The S&P Global and CIPS Flash UK PMI Composite Output Index was 47.2 in October and showed the pace of U.K. economic decline gathering momentum after these political and financial market upheavals. Business confidence in the country collapsed to a level rarely seen in 25 years of Purchasing Managers’ Index survey history.

On average, prices charged for goods and services are rising at faster rates in the U.K. than in the U.S. and eurozone. U.K. inflation rose above 10% in September and gross domestic product shrunk 0.3% in August.

To fight inflation, the Bank of England raised interest rates in its Sept. 22 meeting to 2.25% and then again to 3.0% on Nov. 3. Subsequently, mortgage rates for some U.K. customers have risen to 6%-6.5% this year from 2.25%-2.55% last year.

A Bank of England bond-buying program launched Sept. 28 sought to calm the markets, and yields have since fallen from a peak of 4.95% on Sept. 27 to 3.76% on Oct. 26, the day Rishi Sunak was declared the U.K.'s next prime minister. But they are still far higher than 1.12% at the start of the year and better than the 2.27% level at the beginning of August.

Rising yields also affect interest rate swaps, which are used to price mortgages. Volatility of the swap market has made lenders wary. "Banks are withdrawing mortgage offers because their cost of funds has gone up so much," said Ray Boulger, senior mortgage technical manager at broker John Charcol.

There are a couple of bright spots. The U.K.’s four major banks are benefiting from rising rates with a forecast to grow their net interest income in 2023, according to S&P Global Market Intelligence consensus analyst estimates.

Additionally, higher bond yields are helping U.K. defined benefit pension schemes. Pension plans are buying bulk annuities from life insurers to help cover their obligations and improve their funding positions. The market could bring in £30 billion "or a bit more" in 2022, according to Charlie Finch, a partner at consultancy Lane Clark & Peacock LLP.

Today is Friday, November 18, 2022, and here is today’s essential intelligence.

Written by Ken Fredman.

Flash PMI Preview: November Flash PMI Data To Provide Insights Into Inflation Trends And Recession Risks

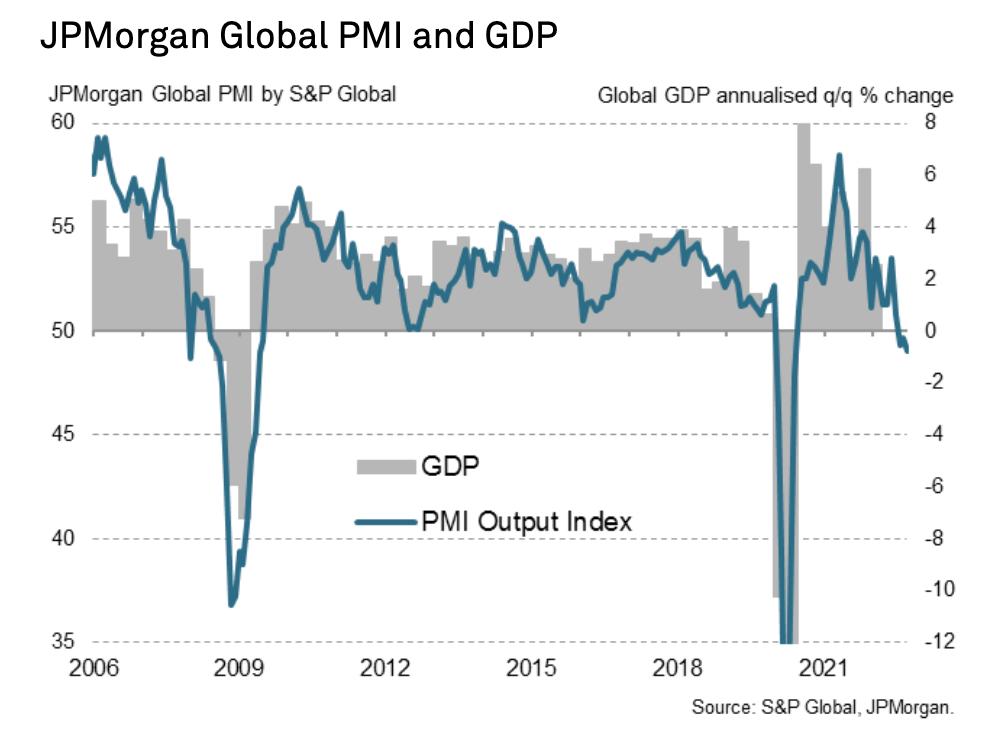

November flash PMI data will be eagerly awaited in the coming week to shed light on inflation, employment trends and risks of recession in the penultimate month of the year. Prior data showed global output contracting for a third straight month and at a faster pace at the start of the fourth quarter. The downturn was underpinned by a sharper contraction in demand in October as business confidence faltered, altogether warranting caution.

—Read the article from S&Global Market Intelligence

Access more insights on the global economy >

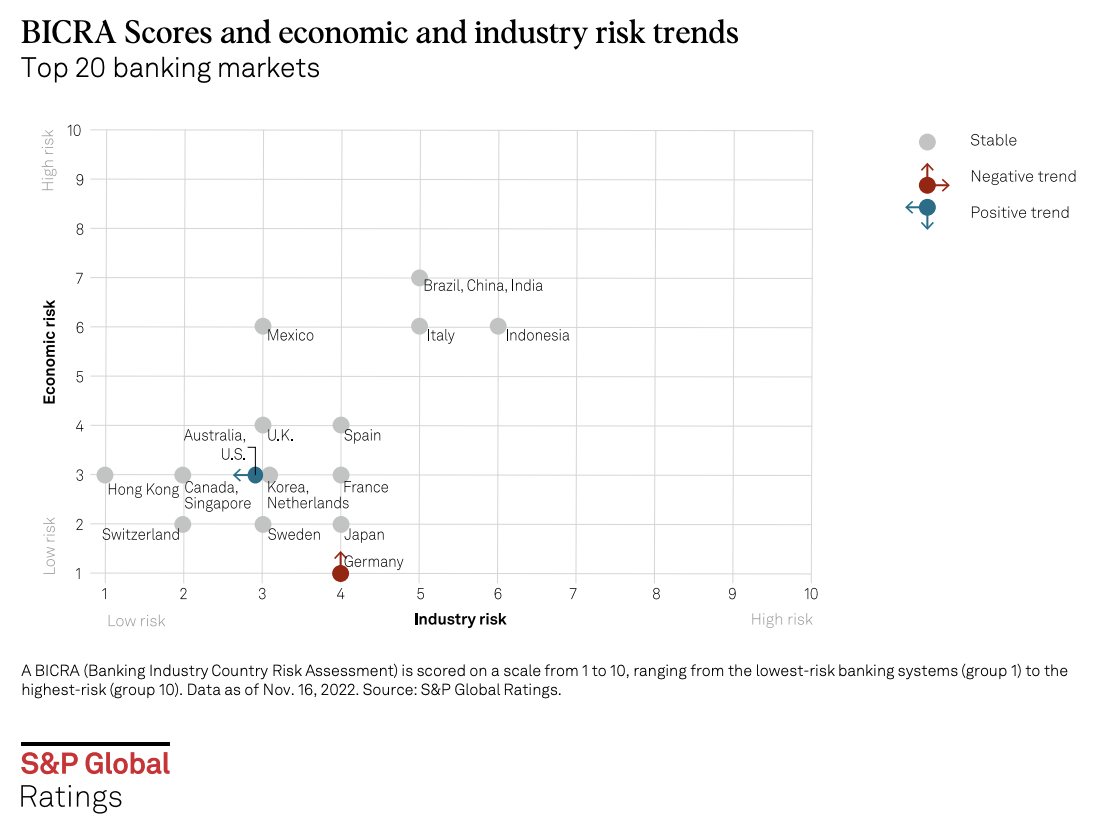

Global Bank Outlook 2023: Greater Divergence Ahead

The darkened economic outlook presents headwinds for banks’ asset quality, business volumes and financing conditions. Positively, earnings greatly benefit from the monetary policy tightening. Rating trends across the global banking sector will be tested in 2023. Our banks’ net outlook ratio is likely to deteriorate from a 6% positive.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

Listen: Asia, Europe Rush To Secure Supplies As Oil Markets Brace For Sleepless Nights

The tug-of-war between Asia and Europe for sourcing oil is set to intensify as the European Union's ban on Russian seaborne crude inches closer. From Middle East to Africa, suppliers are already feeling the pressure of how to split supplies between different regions. In a wide-ranging discussion with Asia energy editor Sambit Mohanty, S&P Global Commodity Insights' experts Andy Critchlow, head of news for Europe, Middle East and Africa; Paul Sheldon, chief geopolitical advisor; and Kang Wu, head of global oil demand and Asia analytics, share their insights on some of the biggest challenges the market may face after sanctions are imposed, the strategy of OPEC+ and the hurdles in making the G7 price cap work.

—Listen and subscribe to Oil Markets, a podcast from S&P Global Commodity Insights

Access more insights on global trade >

Global Integrated Oil Companies Strategies For Growth In Low-Carbon Sector

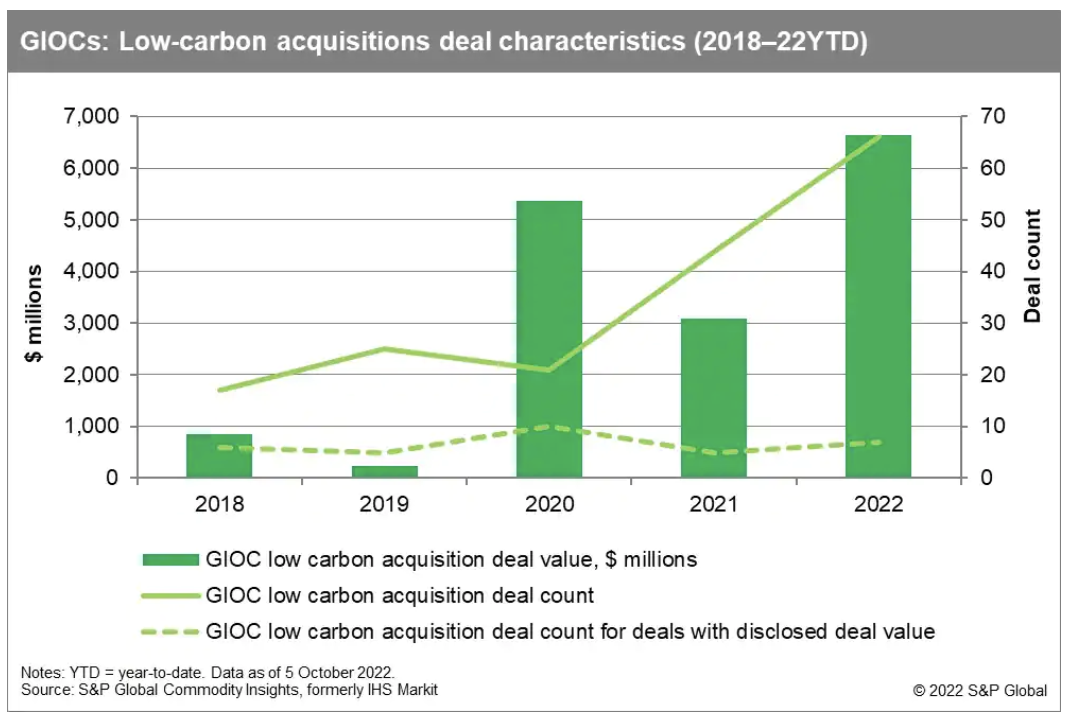

The seven largest Global Integrateds (GIOCs) are becoming meaningful participants in the low-carbon sector, including renewables, owing to stepped up acquisitions and growing organic capex. From 2018‒22 year-to-date, these GIOCs have been low-carbon acquirors in more than 170 deals, worth well in excess of $16 billion, with less than 20% of these deals disclosing deal value.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

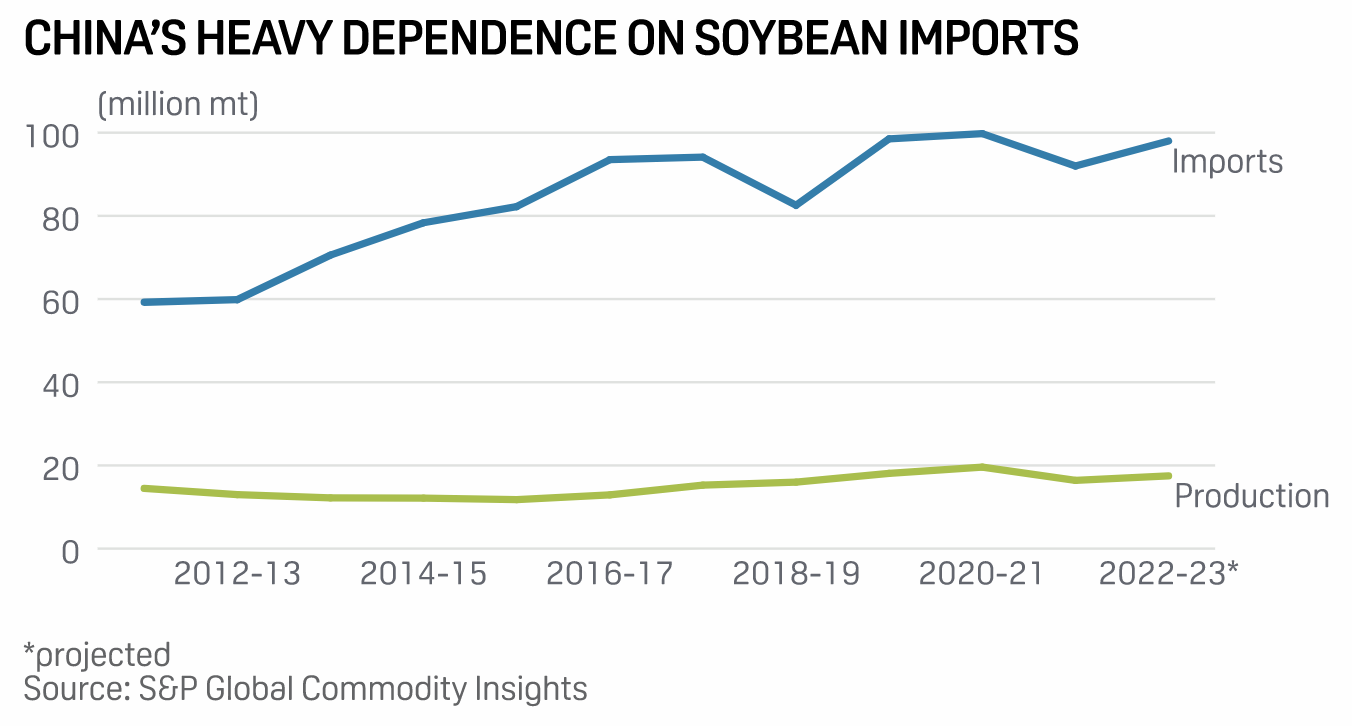

What Xi Jinping Brings To The Table In China’s Quest For Food Security

When it comes to politics and international relations, China's President Xi Jinping divides opinions across the globe, but his re-election as the General Secretary of Communist Party for a record third term Oct. 23 shows the strong grip he has over the country. Some say Xi has emerged as the most powerful leader since the Communist Party founder Mao Zedong. So how does a 69-year-old politician garner so much backing when the official retirement age for the country's top job is 68 years?

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

FIFA World Cup 2022 Nets Ad Gains, Eyes Audience Growth

The 2022 FIFA World Cup from Qatar kicks off Nov. 20, and the monthlong tournament is already generating high interest among advertisers and soccer fans. Ray Warren, president of NBCUniversal Media LLC unit Telemundo Deportes, said the U.S. Spanish-language rights holder has netted record ad sales for the event and expects strong viewership. For the 2018 World Cup in Russia, Telemundo Deportes drew 36.6 million viewers.

—Listen and subscribe to MediaTalk, a podcast from S&P Global Market Intelligence