Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 18 Nov, 2020

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

Despite the global battle cry to build a more sustainable marketplace, the pandemic-prompted economic downturn has pushed some investors to reduce their focus on environmental, social, and governance (ESG) factors during this year of difficult market conditions.

Nearly 80% of U.S. institutional investors are deprioritizing ESG as investment criteria due to the pandemic’s economic implications, according to an Edelman survey of 600 financial analysts, chief investment officers, portfolio managers, research directors, and investment stewardship stakeholders. More than three-quarters of the investors surveyed said the companies they invest in have also deprioritized ESG initiatives.

This is not the prevailing sentiment among all market participants.

"Across the globe, the vast majority of investors say they are incorporating ESG into their decision-making. ESG activity in capital markets has stepped up significantly as investors focus on the longer term prospects for a sector in the light of an increased focus on climate impacts, changing consumer needs, and technological change," S&P Global Ratings Global Head of Sustainable Finance, Business, and Innovation Susan Gray told the Daily Update. "These considerations have also elevated the importance of management and the board’s role in aligning ESG considerations with business strategy."

During the 2020 BSR Virtual Conference earlier this month, Anheuser-Busch InBev Global Vice President of Investor Relations Lauren Abbott said that expectations from corporate ESG efforts have grown exponentially during the coronavirus crisis, according to S&P Global Market Intelligence. State Street Global Advisors Global Head of ESG Investment Strategy Nathalie Wallace said at the event that investors are interested in companies’ impacts on the environment and society, as well as ESG issues’ long-term implications on firms’ financial performance.

“The modern age of ESG investing which in many respects was an outgrowth of the 2008 financial crisis had not been challenged with a sustained contracting share price environment until Q1 2020,” S&P Global Senior Managing Director and Global Head of ESG Evan G. Greenfield told the Daily Update. “As the global health, economic, and societal ramifications of the pandemic became clear, there was a significant market contraction with increased volatility, which yielded a resounding endorsement of ESG integrated strategies. In the first quarter, global sustainable funds had inflows of approximately $50 billion while the broader fund universe had outflows of approximately $400 billion.”

Nonetheless, institutional investors’ reduced attention on ESG risks and opportunities comes as the global health pandemic has heightened interest in combating systemic issues such as climate change and inequality. In response, coalitions in advanced nations have put sustainability at the center of their crisis recovery plans—as evidenced by the EU’s €750 billion recovery package explicitly tied to green principles and U.S. President-Elect Joe Biden’s $2 trillion climate plan aimed at investing in renewable energy generation and creating green infrastructure.

The importance of ESG in investment decisions has evolved during the pandemic thus far, and are anticipated to accelerate in a post-pandemic world.

“Certain investors saw the volatile markets resulting from the COVID-19 pandemic as a testing period for the new breed of ESG indices, like the S&P 500 ESG Index, which aim to provide a benchmark-like return. These indices did extraordinary well, not just performing in line with the market and achieving their objective, but also providing some welcome outperformance,” S&P Dow Jones Indices Head of ESG Indices Reid Steadman told the Daily Update. “In ESG, we’ve seen that institutional investors first observe and measure, and then invest. We expect U.S. institutional investors to follow this same pattern in this case, increasing their allocations to ESG as we emerge out of this crisis.”

Following the pandemic, corporates and investment managers are expected to increase their ESG integration as ESG regulatory and policy requirements emerge and demand from asset owners for ESG-integrated strategies and consumers for companies to increase their sustainability practices rises, Mr. Greenfield said.

Almost all (96%) of the institutional investors surveyed by Edelman said they believe their firms will increase prioritization of ESG as the coronavirus crisis is controlled, and 93% said the companies they invest in will likely take the same approach.

Within the next six months, investors surveyed by Edelman said they will accelerate their engagement on climate risk—targeting the effects that physical risks have on their firms, resource scarcity, and the eco-efficiency of their companies’ operations.

The pandemic has exposed the structural challenges to addressing issues such as climate change, according to David Parham, Director of Research Projects at the Sustainability Accounting Standards Board. In a Nov. 17 webinar hosted by S&P Global Market Intelligence, Mr. Parham said that this exposure is because both crises directly affect people's lives and the economy.

Investors and firms alike look set to pay exceptional attention to social factors, as nearly all of Edelman's survey respondents said that businesses and their leaders must wield their influence to advocate for positive societal change. Social factors are now the most important ESG consideration, according to Edelman’s Trust Barometer special report.

"Our experience across the global investor market is that the pandemic and focus on social and racial inequality has highlighted the importance of ESG in investor decision-making and in fact cast a spotlight on 'S,'" Ms. Gray said.

Companies' boards are likely to see an influx of engagement from investors on climate risk, corporate culture, and diversity and inclusion during and after the recovery from the pandemic, according to Edelman.

"While the global pandemic has forced some companies to temporarily deprioritize ESG efforts, investors clearly believe that a robust ESG strategy has a positive impact on share price and resilience," Lex Suvanto, Global Managing Director of Financial Communications at Edelman, said announcing the report on Nov. 17.

Today is Wednesday, November 18, 2020, and here is today’s essential intelligence.

Obama’s Memoir Drives Boom for Penguin After Publishing’s Pandemic Pause

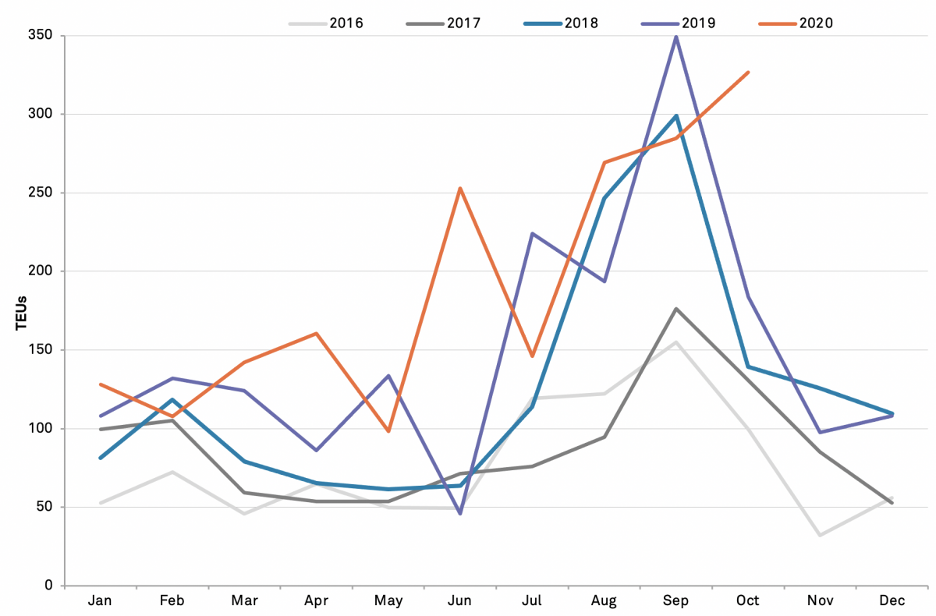

The release of the first part of former President Obama’s presidential memoir has required the production of three million copies of the book, including the shipping of copies from Germany, The Economist reports. Panjiva data shows that U.S. seaborne imports of printed books linked to the publisher Penguin Random House jumped 77.8% year over year in October, likely reflecting the shipments of Obama’s books among others. A 69.7% spike in shipments in September 2018 likely came as a result of the release of Michelle Obama’s “Becoming”.

—Read the full article from Panjiva, part of S&P Global Market Intelligence

Pharma Peers Cheer Moderna's Unexpectedly Strong COVID-19 Vaccine Results

Unexpectedly strong results for Moderna Inc.'s coronavirus vaccine drew commendation from the CEO of pharmaceutical peer Pfizer Inc., underscoring the common goal among the industry to find a solution for a disease that has devastated economies across the world and killed more than a million people.

—Read the full article from S&P Global Market Intelligence

Europe's Consumer Companies Brace for New Pandemic Curbs

Europe's consumer sector stalwarts such as LVMH Moët Hennessy - Louis Vuitton Société Européenne, Kering SA, H & M Hennes & Mauritz AB (publ), Pernod Ricard SA and Anheuser-Busch Inbev SA, which reported signs of recovery in the most recent quarter, now face another hit to demand as several European countries impose new restrictions to fight a surge in COVID-19 cases.

—Read the full article from S&P Global Market Intelligence

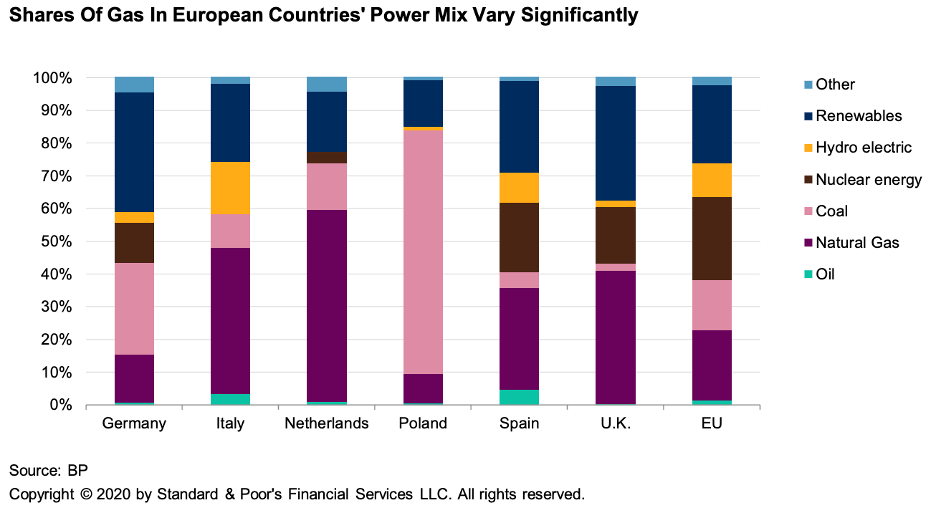

As Europe's Gas Markets Slowly Stall, Gas Producers' And Utilities' Business Risks May Rise

S&P Global anticipates that gas will remain an important part of the European energy mix during the next decade. Most countries plan to retire very large coal and nuclear generation capacity and their energy mix will still need options that complement intermittent renewables.

—Read the full report from S&P Global Ratings

Commodities 2020: Global, Russian, And CIS Rating Trends

Ratings on Russian and CIS commodity producers were not significantly affected by COVID-19, but headroom has reduced. The key challenges for the global oil & gas sector are increased volatility and the energy transition. Given that the pandemic has hurt the fiscal position of sovereigns, governments could seek to raise taxes on national oil companies or cancel some of their benefits.

—Read the full report from S&P Global Ratings

Tech Short Sellers Poised for Rotation as Vaccine Buoys Value Stocks

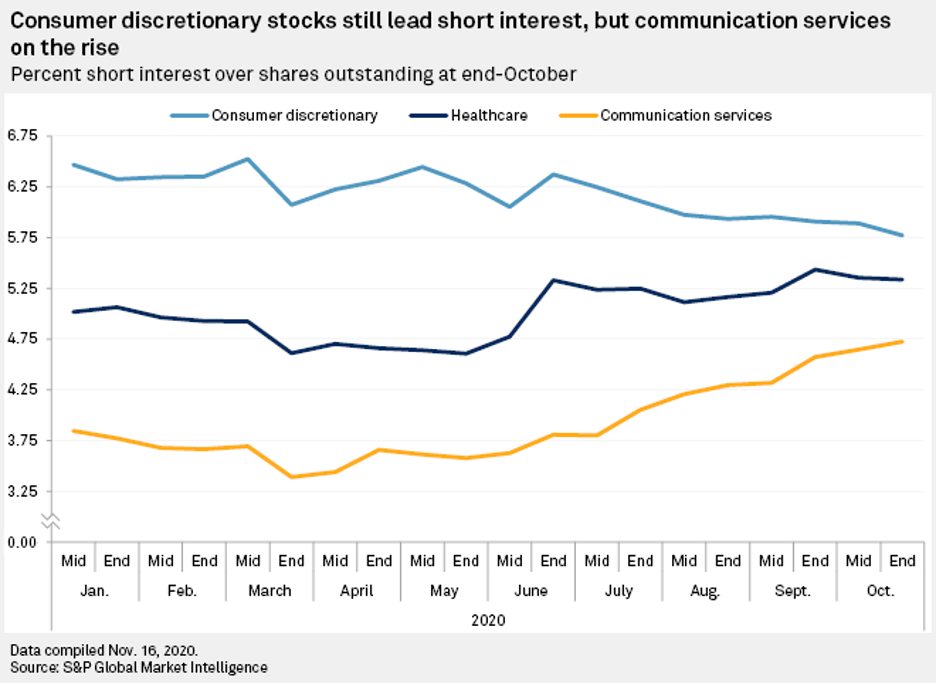

Short interest in U.S. communication services stocks rose to 4.7% at the end of October, leaving them third among the 11 S&P 500 sectors, behind only consumer discretionary and healthcare, the latest S&P Global Market Intelligence data shows.

—Read the full article from S&P Global Market Intelligence

Tesla Added to the S&P 500

S&P Dow Jones Indices announced that Tesla will be added to the S&P 500® prior to the open on Monday, Dec. 21, 2020. The Index Committee has not yet determined which current constituent Tesla will replace, nor how Tesla will be added to the index—because of its size, S&P DJI is seeking feedback through a consultation to answer the latter question.

—Read the full article from S&P Dow Jones Indices

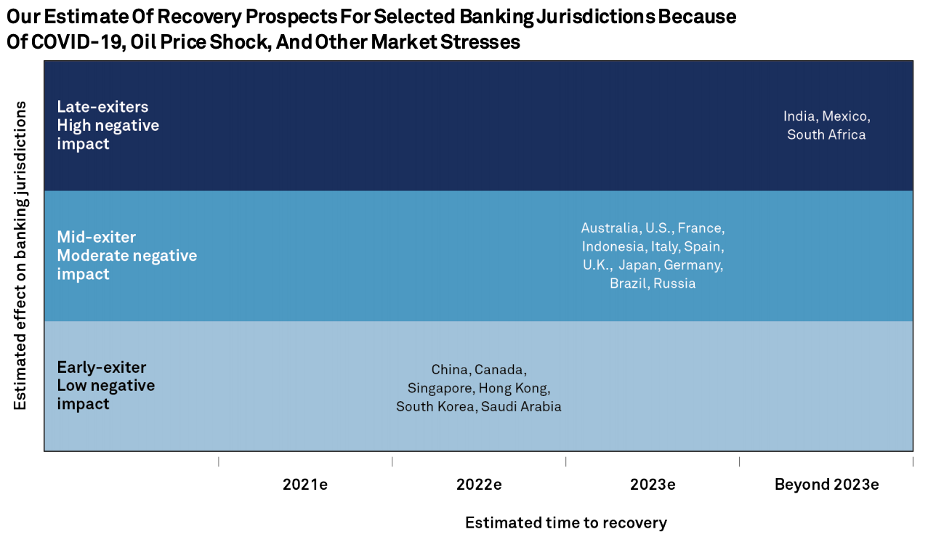

Global Banks Country-By-Country 2021 Outlook: Toughest Test For Banks Since 2009

Next year could be the toughest one for banks since 2009. In this piece, S&P Global Ratings offers a view of the four key risks facing banks globally as well as 87 country-by-country banking outlooks

—Read the full report from S&P Global Ratings

Global Banks 2021 Outlook: Banks Will Face The Next Test Once Support Wanes

The sharp rebound in global growth S&P Global Ratings expects in 2021, together with strong bank balance sheets, support from authorities to retail and corporate markets, and regulators' flexibility, should limit bank downgrades in 2021. Deviation from S&P Global Ratings’ base case, if the economic rebound is weaker or delayed, could result in more negative rating actions, particularly in regions with a second wave of infections and the reimposition of restrictions

—Read the full report from S&P Global Ratings

Japan's New Incentive Too Little to Push Regional Banks to Merge – Analysts

Bank of Japan's proposal to reward regional lenders for mergers or more aggressive cost-cutting with an additional interest rate of 0.1% on their deposits at the central bank is too little to incentivize more consolidation of struggling lenders, analysts say.

—Read the full article from S&P Global Market Intelligence

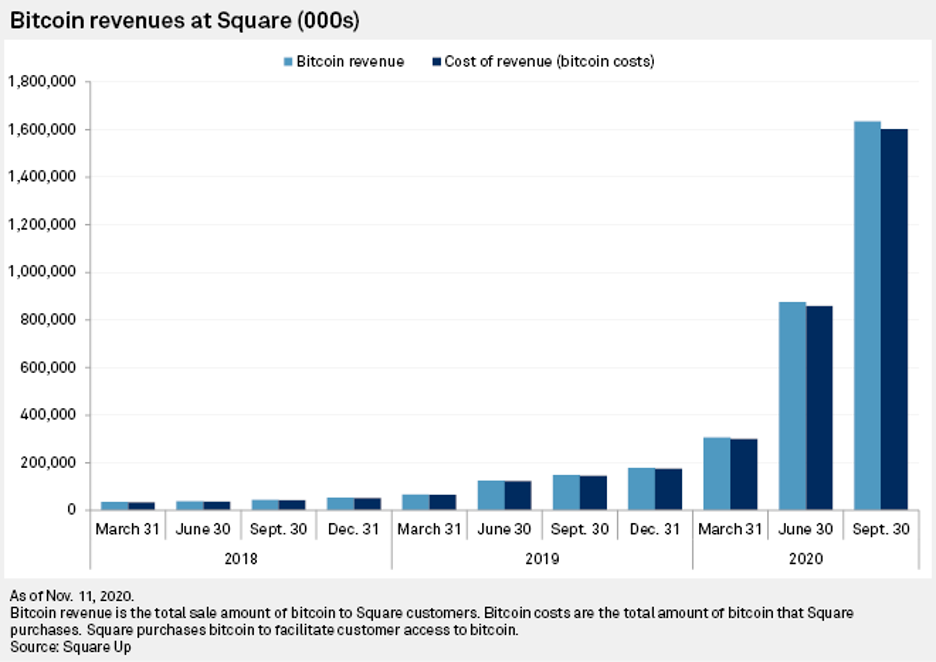

For Paypal, Visa and Mastercard, Cryptocurrencies Could Unlock New Revenues

PayPal Holdings Inc. caused a stir last month when it announced that it will enable users in the U.S. to buy, sell and hold cryptocurrency via their accounts. But it is by no means a first for U.S. cards and payments majors.

—Read the full article from S&P Global Market Intelligence

China's Suspension Of Ant Group IPO Another Sign Of Tightening Fintech Regulations

Proposed rule changes on internet lending cited in the recent abrupt suspension of Ant Group Co. Ltd.'s IPO are in line with Chinese regulatory trends, given technological disruptions in finance are insufficiently captured by the existing regulatory framework.

—Read the full report from S&P Global Ratings

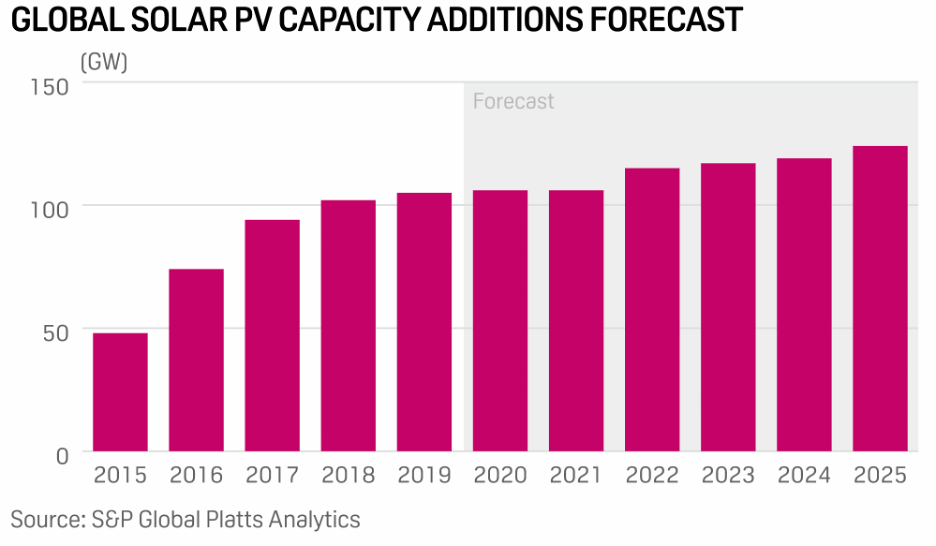

Global Solar Growth Seen 7% Higher for 2020-2025 Period: Platts Analytics

Global solar PV capacity additions are set to rise almost 50 GW more than previously forecast over the next six years, according to a report by S&P Global Platts Analytics.

—Read the full article from S&P Global Platts

Considerable Power Market Design Changes Needed to Decarbonize New England: Study

Ernest Moniz, former US energy secretary, introduced the results of a study Nov. 16 that found getting to net-zero greenhouse gas emissions in New England will need an incremental 93 GW of generation capacity by 2050, which experts said will require significant market design changes.

—Read the full article from S&P Global Platts

Female Insurance Leaders Work Against Odds to Open Doors for Other Women

Progressive Corp. CEO Tricia Griffith is one of just seven female CEOs in the U.S. insurance industry, a space where female representation among leadership has remained extremely low over the past decade. As investors and regulators pay increasing attention to environmental, social and governance issues such as diversity, some industry leaders are looking for ways to bring more women up the insurance ranks.

—Read the full article from S&P Global Market Intelligence

It Is Still Harder for A Woman to Succeed In Insurance Than A Man, CEO Says

Horace Mann CEO Marita Zuraitis said gender diversity in insurance is improving, but she still finds herself the only woman in the room at some industry events.

—Read the full article from S&P Global Market Intelligence

To Boost Female Leadership, Insurers Need to Shuffle Succession Plans, CEO Says

As CEO of NMI Holdings Inc., Claudia Merkle is one of only seven female CEOs in the U.S. insurance industry. In a recent interview with S&P Global Market Intelligence, she discussed diversity in the industry and the importance of having a plan to improve representation of underrepresented groups.

—Read the full article from S&P Global Market Intelligence

Watch: Market Movers Americas, Nov 16-20: Coronavirus Surge Reverses Rally in Refined Products

In this week's Market Movers Americas, presented by Courtney Love: coronavirus surge reverses rally in refined products; E&Ps see split views on US Gulf upstream auction; USGC diesel supported amid continued stock draw; and the pandemic caps clean tanker freight at breakeven earnings.

—Watch and share this Market Movers video from S&P Global Platts

Fuel for Thought: Oil Demand to Hog Limelight Despite OPEC+, U.S. Policy Shifts

The glut in the oil market could prove stubborn to shift. Potential changes in OPEC+ and US policy won't solve the industry's demand problem, while the world's key oil producers will be hard pushed to cut supply further. Only a vaccine can cure COVID-19-induced consumption ills.

—Read the full article from S&P Global Platts

Indigenous Group to Invest In Keystone XL as Biden Set to Determine Pipeline Fate

A First Nations group in Canada will invest up to $764 million in the controversial Keystone XL Pipeline as TC Energy continues its effort to win over a Joe Biden administration that has pledged to reject the project.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language