Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 12 Nov, 2020

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

Following Monday’s announcement that Pfizer and BioNTech have produced a vaccine that has proven in late-stage clinical trials be more than 90% effective at preventing COVID-19, technology stocks that have been riding high throughout the pandemic suffered two straight days of losses. On Wednesday, as markets processed the news that the vaccine won’t be widely available for months at the earliest, tech companies bounced back. Microsoft (MSFT) gained 2%, with Apple and Salesforce rising 1.7% and 3%, respectively.

While major tech companies have benefited from perceptions that the coronavirus and associated lockdowns have accelerated the adoption of digital platforms, they’ve also suffered from increased scrutiny from regulators around the world.

On Nov. 10, the European Commission brought antitrust charges against Seattle-based Amazon, claiming the company violated EU rules by using data from third-party sellers on the Amazon platform for the benefit of its own retail business. U.S. lawmakers have made similar allegations.

On Oct. 20, the U.S. Department of Justice (DOJ) filed an antitrust suit against Google, charging that the company used its dominance in online search and search advertising to stifle competition. Policy experts believe that antitrust enforcement isn’t likely to change significantly under President-elect Joe Biden. Some experts expect a similar action against Amazon in the near future.

"I would not be surprised to see something from the (Federal Trade Commission) or the DOJ along these same lines," Alex Petros, policy counsel at the Washington, D.C.-based nonprofit public-interest group Public Knowledge said in an interview with S&P Global Market Intelligence. "I think you are going to see some bills out of the House, I think you are going to see some bills out of the Senate. You'll see some serious movement in this area in 2021."

On Aug. 25, S&P Global Ratings published an overview of the regulatory exposure for U.S. big tech firms, concluding that “over the longer term, we believe companies such as Apple, Alphabet, Amazon, and Facebook will accept more regulations and rules on the tech industry and its participants, as it will provide a clear operating framework.”

In China, the dual listing of Ant Group in Shanghai and Hong Kong was suddenly suspended on Nov. 3 following a meeting between China’s central bank and top financial regulators and Ant’s senior executives. The meeting was also attended by Jack Ma, controlling shareholder of the Ant Group, an affiliate of tech behemoth Alibaba, which controls Alipay. It’s been reported that Chinese regulators, uncomfortable with the size and risk controls of the growing fintech market, wanted to delay the IPO pending further regulation.

"It is natural that no regulators of any country are prepared for a fintech company that is today valued at over $300 billion globally, ” Shirley Ze Yu, a political economist and a fellow at Harvard Kennedy School's Ash Center told S&P Global Market Intelligence. “It is likely that Chinese regulators will be in a position to build a new regulatory framework for the rest of the world in global fintech governance."

Today is Thursday, November 12, 2020, and here is today’s essential intelligence.

A Wave of Semiconductor Consolidation Drives Big Tech Valuations in October

After a return to growth in September, the information technology sector saw deal volume drop year over year in October, even as transaction values remained robust.

—Read the full article from S&P Global Market Intelligence

EU Charges Against Amazon Could Accelerate Big Tech Antitrust Scrutiny in the U.S.

European regulators' decision to bring antitrust charges against Amazon.com Inc. could be a harbinger of developments in the U.S., with regulatory uncertainty likely to extend well into 2021, legal and industry experts say.

—Read the full article from S&P Global Market Intelligence

Hong Kong Exchange Expects Tech Volatility to Persist, but IPO Pipe Unscathed

Hong Kong Exchanges & Clearing Ltd. expects volatility in Chinese technology companies' shares to continue, as investors digest a series of regulatory changes that led to a rout in stocks of internet majors this week and the suspension of the world's biggest IPO earlier in the month.

—Read the full article from S&P Global Market Intelligence

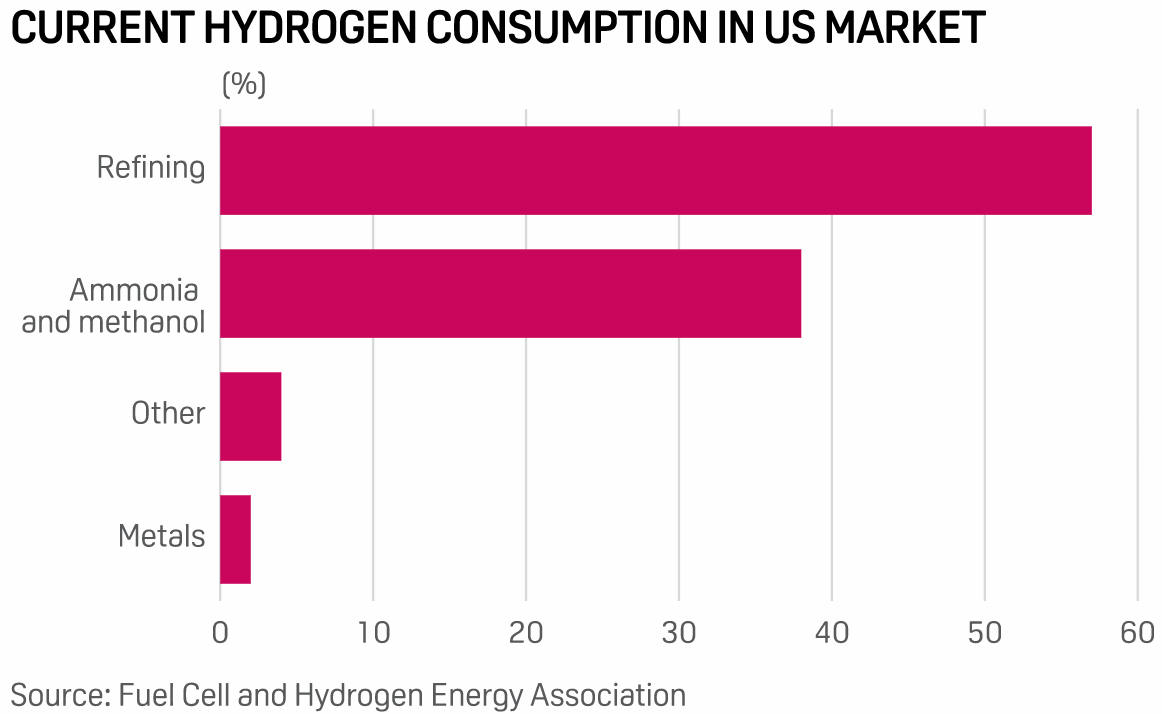

Decarbonization Efforts Driving Low-Carbon Hydrogen Solutions in U.S., Globally

Despite challenges such as transportation costs, hydrogen markets are expected to grow over the next couple of decades for power generation and transportation applications, experts said Nov. 10.

—Read the full article from S&P Global Platts

Biden Announces Energy, Environment Transition Team Members

U.S. President-elect Joe Biden on Nov. 10 named members of his agency review teams who will be responsible for preparing Biden and Vice President-elect Kamala Harris for the start of their administration.

—Read the full article from S&P Global Market Intelligence

Pipeline Opposition, Hurdles Sharpen Focus on Existing Assets: Energy Transfer

With new long-haul natural gas pipelines facing substantial opposition, Energy Transfer is focusing on optimizing existing assets, and seeing growth opportunities mostly in its natural gas liquids segment, according to a company senior executive.

—Read the full article from S&P Global Platts

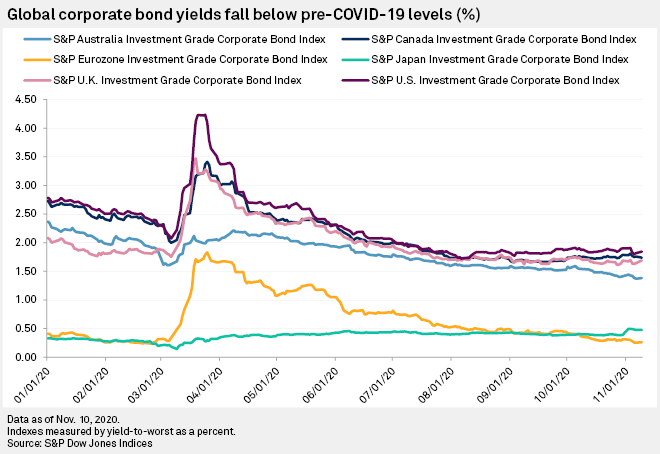

Eurozone Corporate Borrowing Costs Fall Below Japan's to World's Lowest

Borrowing costs for investment-grade companies in the eurozone have fallen below their counterparts in Japan to the lowest in the world.

—Read the full article from S&P Global Market Intelligence

COVID-19- and Oil Price-Related Public Rating Actions on Corporations, Sovereigns, International Public Finance, and Project Finance to Date

The tally of negative actions related to the COVID-19 pandemic and the oil-price dislocation increased slightly to 18 this week--roughly 7% of the peak weekly amount in late March and early April.

—Read the full report from S&P Global Ratings

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Language