Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 1 Nov, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

‘Japanification’ Brings Benefits Too

Due to declining birth rates and slowing economic growth, some market observers have suggested that several Asian countries may be on the path to “Japanification.” The term refers to economies that have slow growth and low inflation despite loose monetary policy and fiscal stimulus. The implication is that these economies have in some way stalled, as Japan did in the early 1990s after decades of rapid growth. However, if Japanification is to mean something, it should be related to the real and current experience of the Japanese economy. While Japan’s economic growth is modest and its inflation is relatively subdued compared with other developed economies, there is a lot to like about Japanification.

Japan’s monetary policy has been beyond loose. The current policy rate, as set by the central bank, stands at negative 0.1%. This means that, in practical terms, borrowers are paid to borrow money even before inflation is factored in. However, S&P Global Ratings anticipates that the policy rate will increase by 10 basis points this year and by another 10 basis points next year. That remains absurdly low by US or European standards, but inflation in Japan is also much more modest, standing at approximately 3.2% for 2023. Next year’s inflation is forecast to be 2.0%, with the following two years boasting even lower inflation. In addition, Japan’s unemployment is estimated to be 2.6% and labor force participation is up. While economic growth is nice, for the average Japanese citizen, vanishingly low unemployment and vanishingly slight inflation have their benefits.

Some of the economic news is more mixed. The latest Purchasing Managers’ Index data out of Japan indicates that an eight-month streak of private sector growth that began in January has ended. Manufacturing output is down, but so are the cost pressures that were affecting the manufacturing and service sectors. Consumer services are up, helped by good tourism numbers.

Analysts at S&P Global Ratings believe that, in general, Japanese corporates will struggle to improve their creditworthiness. This isn’t all bad news. Japanese corporate creditworthiness had improved steadily since 2021, and there wasn’t much room for further progress. The domestic economy remains strong enough to support many Japanese corporates, and financial positions remain healthy in many cases. However, a number of risks — such as geopolitical tensions, higher energy prices or a downturn in the US, Europe and China — could further limit the creditworthiness of Japanese corporates.

As Japanese interest rates rise — however modestly — the higher cost of capital will impact corporate profits. For banks, higher rates are a story of haves and have-nots. For banks that rely on lending rates for income, higher rates bring more profit. For banks that are investment-oriented, higher rates will create some short-term pain. According to S&P Global Market Intelligence, five Japanese banks experienced large declines in their liquidity coverage ratios. Liquidity coverage ratios, which are sometimes used as a measure of a bank’s health, represent average high-quality liquid assets as a percentage of average net cash outflows over a 30-day period.

The overall picture is of an economy that grows slowly but supports high domestic consumption, low unemployment and low inflation. Japan may lack the high-flying growth rates of some emerging market economies, but Japanification doesn’t sound that bad.

Today is Wednesday, November 1, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

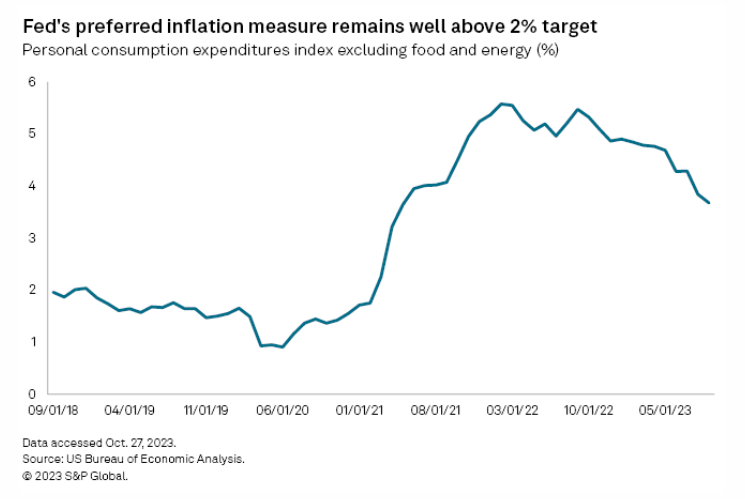

Fed Staying The Course In Face Of Sticky US Inflation, Robust Growth

The US Federal Reserve is likely to hold steady on monetary policy at its rate-setting meeting this week, even as inflation remains well above target, the economy continues to grow at a robust pace and the job market remains short of labor supply. Investors and market watchers predict the Federal Open Market Committee (FOMC) on Nov. 1 will again keep its benchmark federal funds rate in the current range of 5.25% to 5.5%, where it has been since July. Fed officials will probably leave interest rates at elevated levels until inflation shows a meaningful move down, though there is still some chance of another hike before the end of the year.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

This Week In Credit: Central Banks Will Be Front And Center

Last week saw the highest weekly default count (four) for this October, led by two North American health care defaults. Looking ahead, central bank meetings will dominate this week. Markets expect the US Federal Reserve, Bank of England, Norges Bank and Bank of Japan all to keep rates on hold, although the latter's yield curve control policy and inflation forecast changes will be closely watched.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

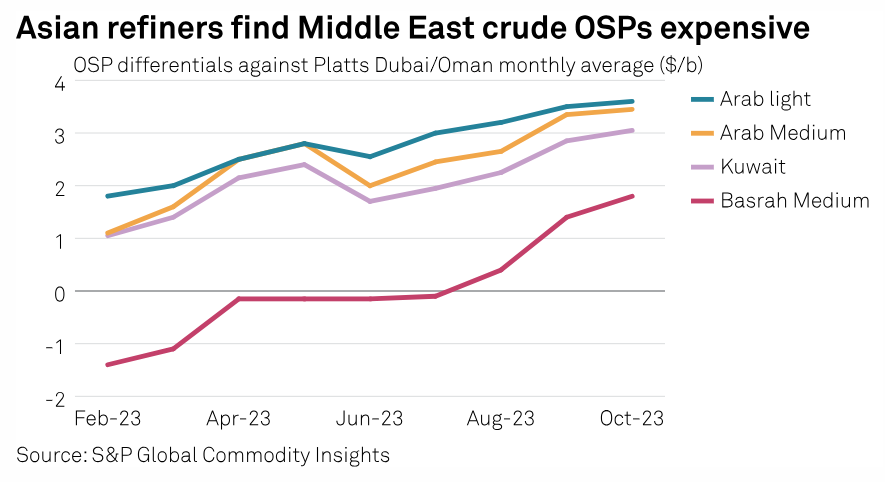

Asia May Have Little To Cheer From Lifting Of Venezuelan Oil Sanctions

Asia may have little to cheer following the lifting of the sanctions on Venezuelan oil as increased competition for those Latin American cargoes could potentially make it difficult for buyers like China and India to source incremental cargoes from the supplier, prompting them to look at the Middle East to fill the vacuum, analysts and sources said. While China's independent refiners have remained active buyers of Venezuelan crude in recent years despite the sanctions, India and other Asian buyers have largely stayed away from those barrels. For the Shandong-based independent refiners, it has been relatively easy to source those barrels in the absence of many takers. But it may not be the case anymore.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: LIVE: What To Expect From The Evolving Climate Disclosure Landscape

Last week, the ESG Insider podcast was on the road for an in-person event in New York City about the evolving climate disclosure landscape. In this episode, hear the highlights from interviews at this ESG Insider Live event.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Sustainable1

Access more insights on sustainability >

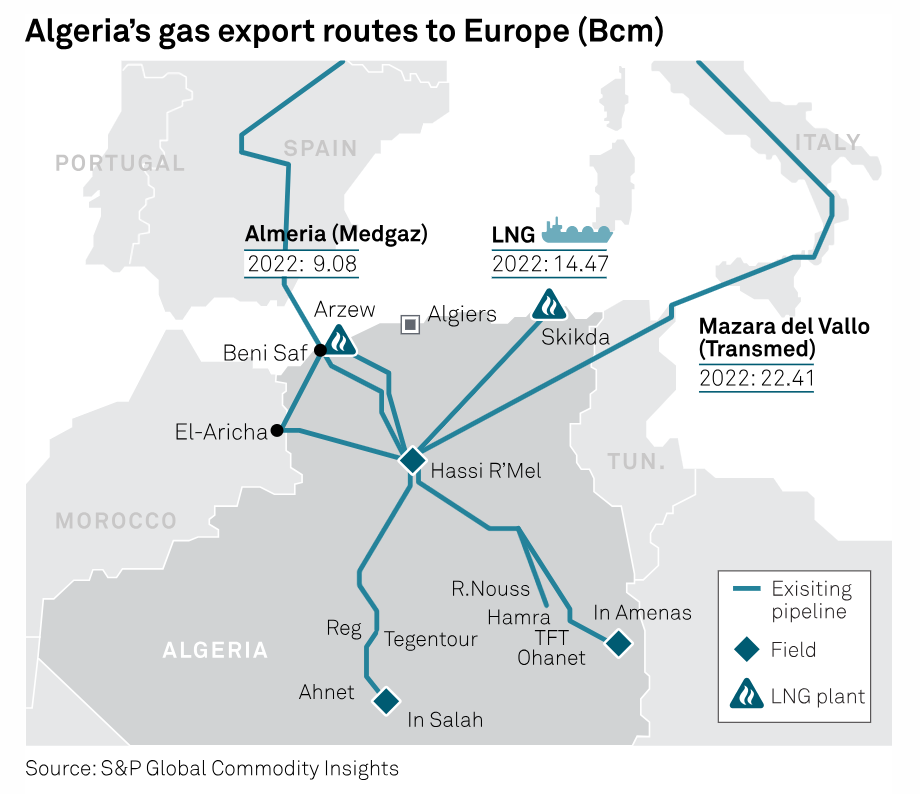

Europe Still Faces 'Multiple' Gas Supply Risks This Winter: Wintershall Dea

Europe still faces "multiple" potential gas supply risks this winter, with ongoing concerns over the affordability of gas, German gas-focused producer Wintershall Dea said Oct. 30. Speaking to reporters following the release of the company's third-quarter earnings, Wintershall Dea CEO Mario Mehren warned against complacency in terms of European gas supply security.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: Power Of AI: Skynet Precursor Or Energy Gamechanger?

Capitol Crude and Energy Evolution join forces to co-host this episode, all about artificial intelligence being deployed in the energy and mining sectors. This week's guests are some of the journalists from the S&P Global Commodity Insights newsroom who worked together to write an expansive series of articles on the impact of AI. The pieces look at predictions around how much electricity demand AI will generate, the ways AI is improving productivity, resource discovery and trading, and more. In addition to the co-hosts and regular contributors to Energy Evolution, the podcast features Commodity Insights reporters Jared Anderson and Kip Keen.

—Listen and subscribe to Capitol Crude, a podcast article from S&P Global Commodity Insights