Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 9 May, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Bumper Crops and Falling Inflation Mark Lula’s Return in Brazil

President Luiz Inácio Lula da Silva returned to the official Brazilian presidential residence, the Palácio da Alvorada, in Brasília this year, having been reelected to the office he vacated in 2011. His timing was fortunate, with record harvests of corn and soybeans and falling inflation marking the president’s first few months in office. Brazil is economically dependent on agricultural exports, and its agribusiness helped to meet worldwide demand when exports from Argentina and the US fell because of drought and international relations, respectively. The only question for Brazil is whether the harvests have been too good, depressing prices and squeezing farmers.

In March, Brazil’s annual inflation fell to 4.7%, its lowest rate since January 2021. The Central Bank of Brazil’s (BCB's) target rate for inflation is 3.25%, with an additional tolerance band of 1.5%. This target rate is higher than those of the US Federal Reserve or the European Central Bank, but consistent with the needs of an economy dependent on agricultural exports. A weaker Brazilian real is good for exports and is partially responsible for a trade surplus of almost $142 billion. S&P Global Market Intelligence’s outlook for Brazil anticipates the BCB will look to cut rates in the third or fourth quarter of this year due to slowing inflation.

Brazilian agribusiness has been booming. Agricultural exports from the subsectors that produce soy, corn, cotton, beef, poultry, pork, sugar and ethanol generated $114 billion in export revenues in 2022. Brazil has been less affected by supply disruptions and geopolitical conflict than some agricultural exporters. According to S&P Global Ratings, Brazil is the world's largest soybean, poultry, beef and sugar exporter, and it should reach the top position in corn exports this year.

Both the past and present administrations in Brasília have tried to avoid being drawn into diplomatic tensions in Russia, China, Western Europe and the US. As a result, Brazil enjoys a wider export market. China receives close to 70% of Brazil's soybean exports and 30% of its cotton exports. China previously purchased more than 90% of its corn from the US, but the country’s corn imports from Brazil jumped from nearly zero in 2021 to $325 million in 2022. That number is expected to grow following a recent high-level summit in Beijing, at which many new agreements were announced.

The ironic challenge for agribusiness in Brazil is that its sheer abundance of corn and soybeans has driven down global prices. Soybean case premiums in Brazil have , and Brazil’s corn prices have fallen significantly. Brazil has been looking at alternatives to absorb the surplus corn and to control prices, including increasing the amount of ethanol blended with gasoline at the pump.

Challenges remain for da Silva as he navigates the first year of his return to the presidency. His relationship with the often-fractious Brazilian legislature is still developing, and his attempts to influence the monetary policy of the BCB have drawn criticism.

Today is Tuesday, May 9, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

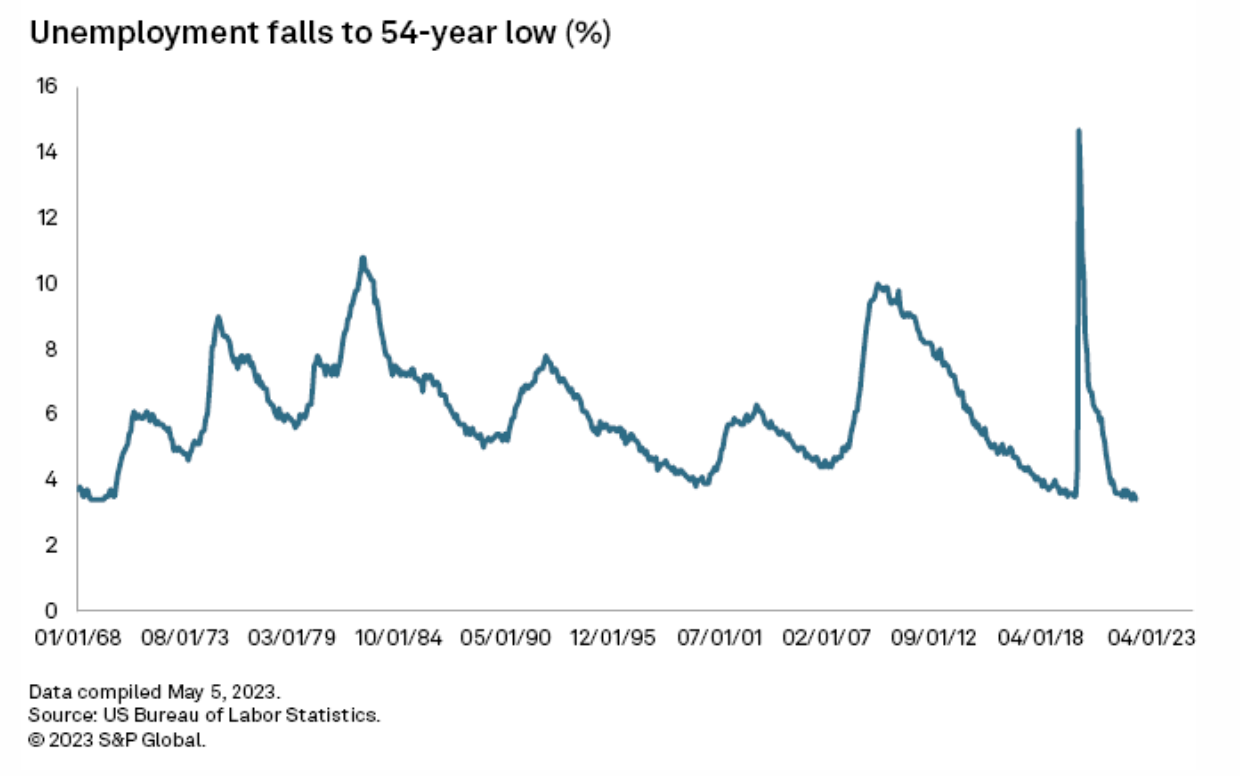

Employers Hoard Labor As Economy Weakens, Boosting Odds Of A Job-Loss Wave

US employers are largely holding tight to their workforces and paying more to retain workers, setting up a potential broader wave of job losses as interest rates remain high and the threat of recession looms. Unemployment fell to 3.4% in April, the lowest monthly figure since 1969, while the labor force participation rate for workers ages 25-54 climbed to 83.3%, the highest level since 2008, according to the latest government data released May 5. Average hourly earnings jumped 4.4% year over year in April, and 0.5% from March, the highest monthly increase since the Fed started its current rate push in March 2022.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

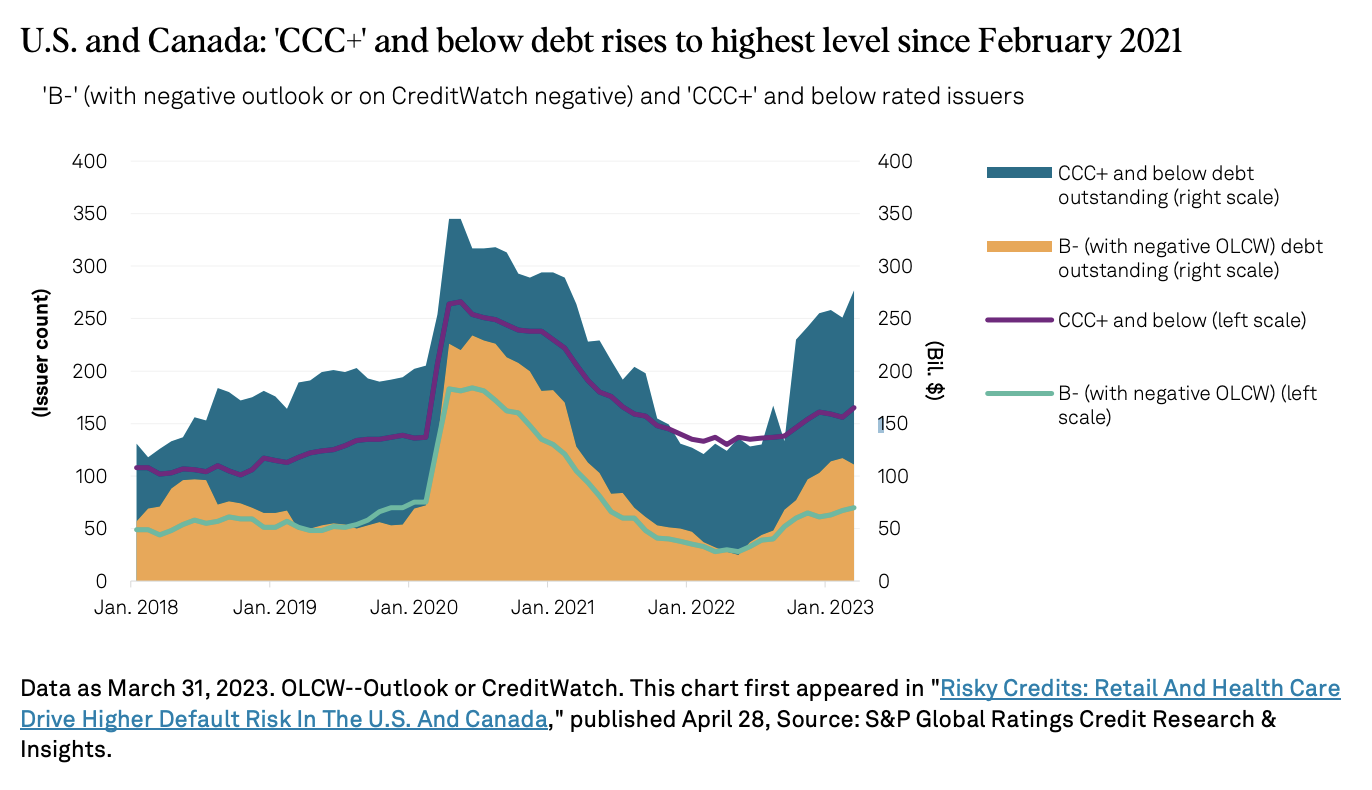

This Week In Credit: Another Rough Week For Banks

Rating actions were quiet last week despite broad market volatility. Uneasiness grew after the California Department of Financial Protection and Innovation took possession of First Republic Bank, and guidance from the Fed and ECB did not answer all of investors' questions on the possibility and timing of easier policy conditions. Last week's drop in unemployment rates may suggest higher interest rates for longer. Also, today's release of the Fed's Senior Loan Officer Opinion Survey will be in the spotlight — with market participants continuing to assess the impact of tighter bank lending standards — as will Wednesday's release of CPI data.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

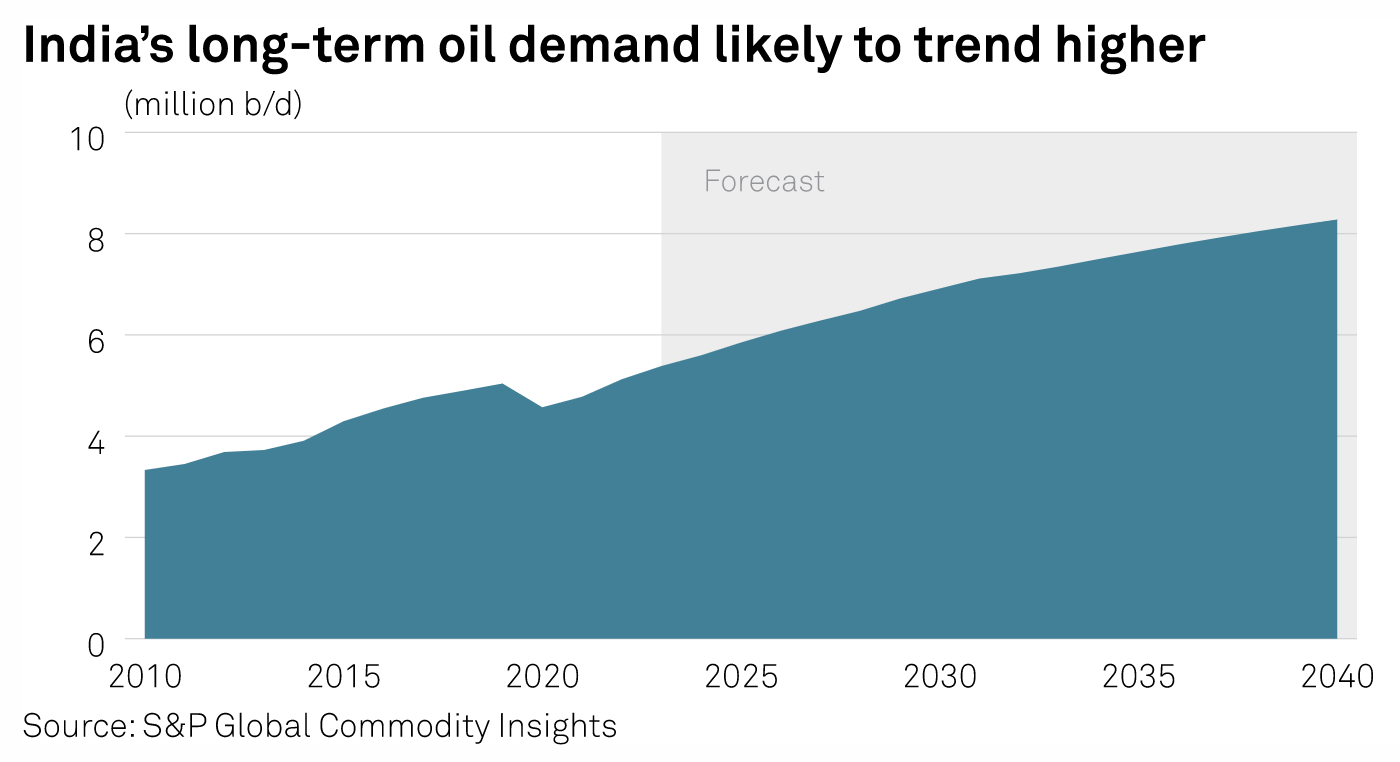

India's Crude Strategy A Cushion For Both Global, Domestic Prices, Says Puri

India's crude import diversification, including purchases from Russia and other new suppliers, has helped to ease the pressure on other mainstream oil producers and keep world prices in check, while also helping to keep fuels affordable in the domestic market, petroleum minister Hardeep Singh Puri told S&P Global Commodity Insights in an exclusive interview.

—Read the interview from S&P Global Commodity Insights

Access more insights on global trade >

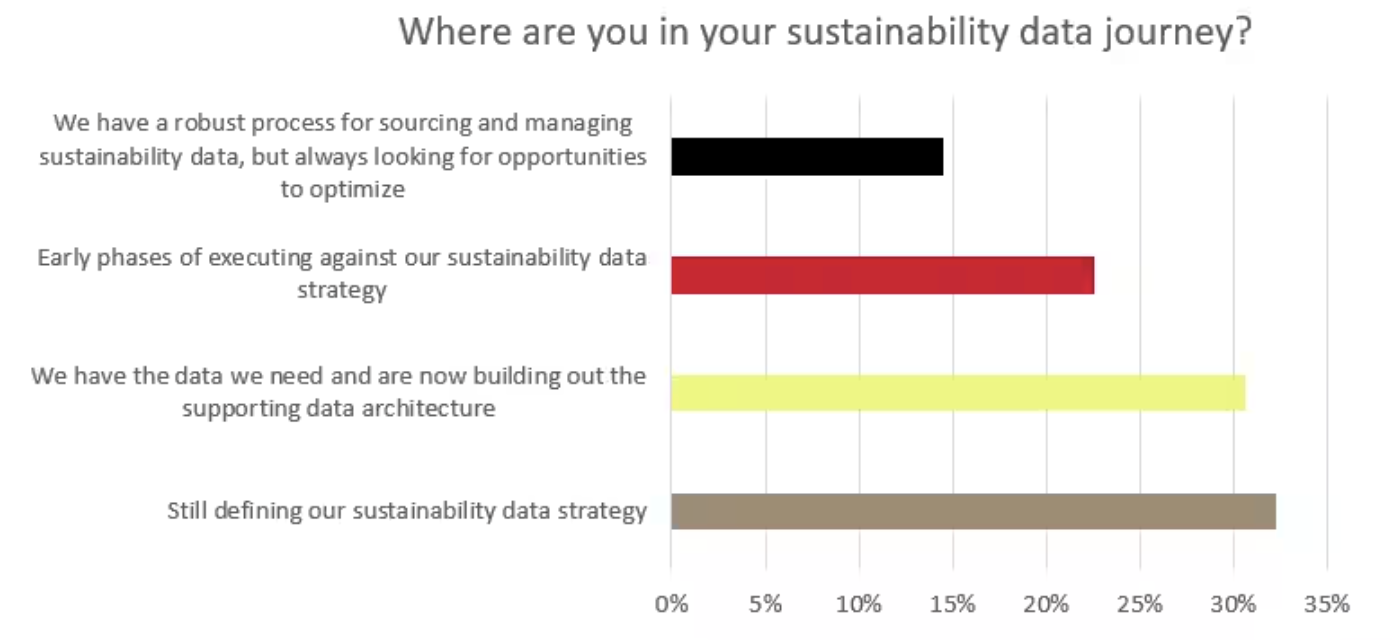

Streamlining Sustainability Reporting Through Effective Data Management

Regulatory authorities in different jurisdictions are developing disclosure requirements to increase transparency in relation to sustainability claims and prevent greenwashing. In Europe, this includes the requirements of the Taskforce on Climate-Related Financial Disclosures, the Sustainable Finance Disclosure Regulation, Corporate Sustainability Reporting Directive and EU Taxonomy, which are intended to enhance transparency, standardize reporting, and promote sustainable investments, while also supplying a clear framework for businesses and investors to integrate sustainability considerations into their decision-making.

—Read the article from S&P Global Market Intelligence

Access more insights on sustainability >

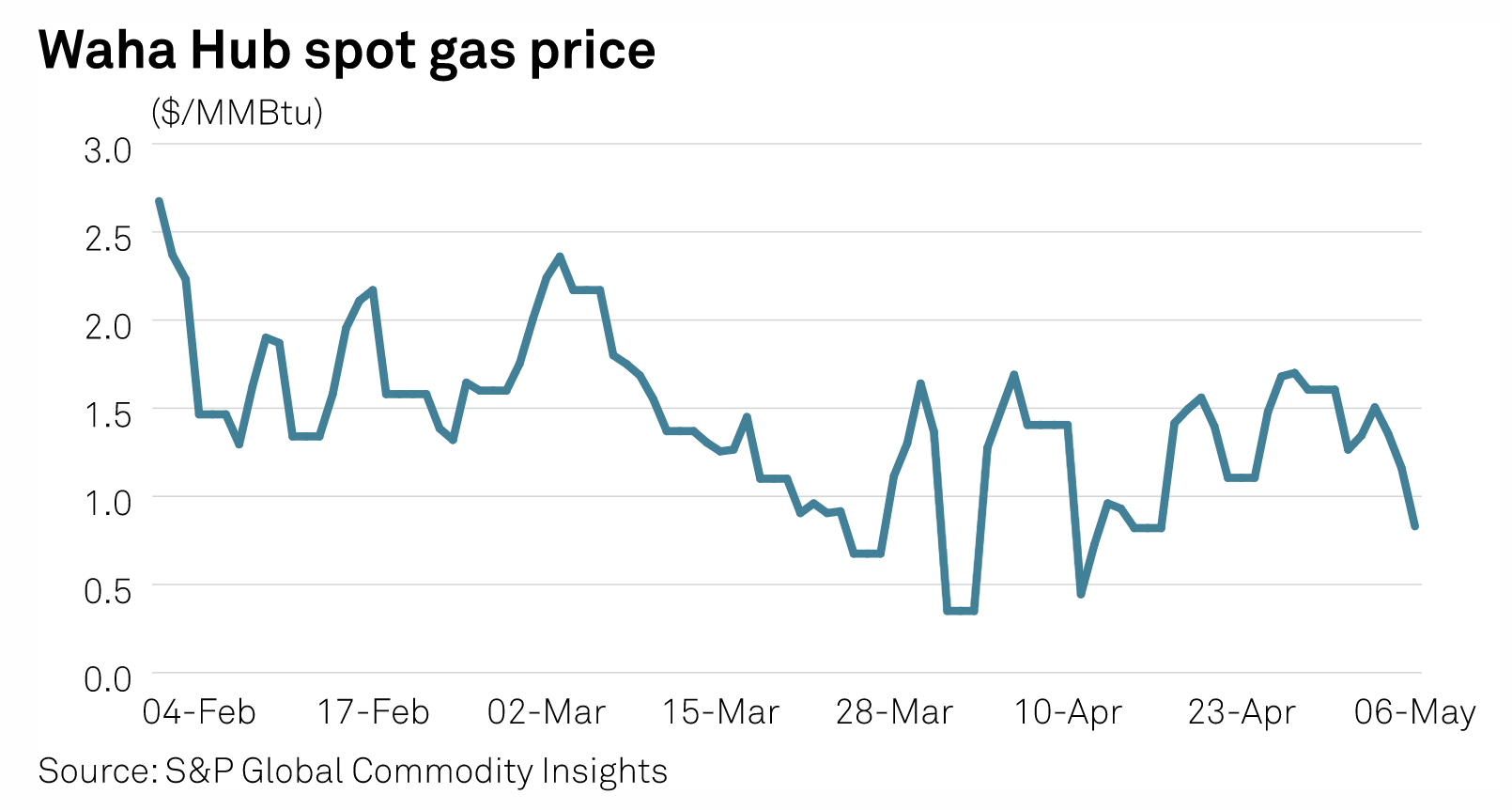

Maintenance, Spring Weather To Keep Pressure On Permian Basin Gas Prices

The start of pipeline maintenance season in West Texas is putting pressure on gas prices in the Permian Basin recently with cash markets at Waha and other nearby locations at risk through late May. In May 5 trading, spot gas prices at Waha sank to just 83 cents to hit their lowest since mid-April, data from Intercontinental Exchange and S&P Global Commodity Insights showed. Since the start of May, gas prices at Waha have fallen from over $1.60/MMBtu, or by nearly 50%, as recent pipeline maintenance and fading seasonal demand keep the gas market under pressure.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: Next In Tech | Episode 115: AI Fundamentals

With all of the furor surrounding generative AI, a more fundamental understanding of the technology can provide better insights. Peter Licursi and Chris Tanner of Kensho return to look at the history and technology on which all of the AI hype rests with host Eric Hanselman. Language models have been with us for years, but the combination of lower-cost computing and the ready availability of large volumes of training data has transformed the types of problems that we’re able to address.

—Listen and subscribe to Next in Tech, a podcast from S&P Global Market Intelligence