Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 28 May, 2021

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

Creating a sustainable future requires sustainable finance. The prospect of the former is becoming more of a reality as the latter continues to grow into the mainstream.

During the intersecting global health, social justice, environmental, and economic crises in the past year, issuance of green, social, and sustainable bonds has boomed, and sustainability-linked debt solidified as a new asset class. Market participants and observers expect the sustainable finance market to continue expanding strongly as the forthcoming decade marks countries’ and companies’ defining actions against climate change and drive toward net-zero.

Last year, the global economy saw a record $312.70 billion in green bond issuance, and many analysts expect global issuance this year to surpass 2020 levels, according to S&P Global Market Intelligence. Data from the U.K. nonprofit Climate Bonds Initiative, which tracks and promotes green investment, shows that, globally, $106.86 billion of green bonds came to market in the three months ended March 31—the strongest quarter on record—with more than half of the volume originating in the U.S., France, China, Germany, and Italy.

Europe is the world’s leading market for green and sustainability-linked bonds. But U.S. President Joe Biden’s aggressive climate policy and finance ambitions and China’s recent net-zero commitments and rebounding green bond issuance signal that those markets could soon become more competitive.

"In 2020 there was strong issuance across the EU, U.S., and Asian markets, and we expect each of these markets to continue to expand in 2021, with EU issuances leading the way," Maressa Brennan, associate director on the innovative finance team at the U.S.-based Milken Institute, told S&P Global Market Intelligence. "Improving the regulation around data quality and availability will be key in sustainably growing the green bond market.”

"We're moving to a market where, if you're a company that is not embracing ESG, accessing debt will cost you more," a banking industry source told S&P Global Market Intelligence. "But this isn't about greenwashing, and we are not going to tell clients that they can just include green language and save a quarter-point on their deal. You can't wrap a terrible credit in green paper and pay less for it — it all has to start with the credits themselves."

Investors are also turning to sustainable versions of popular broad-market equity indexes to gauge ESG performance and outcomes. S&P Dow Jones Indices’ S&P Europe 350 ESG Index is designed to measure the constituents that meet sustainability criteria from the headline S&P Europe 350, which tracks 16 major European markets and covers approximately 70% of the region’s market capitalization. The S&P 500 ESG Index was recently rebalanced to include Tesla, Walmart, and Disney and drop Facebook, Wells Fargo, and Costco.

“Though the aim of the S&P 500 ESG Index is not to outperform but provide exposure and performance broadly in line with the benchmark, these results [of the rebalance] show that a rules-based selection process, driven by ESG principles, has yielded greater exposure to high-performing companies,” Mona Naqvi, senior director and head of ESG indices for North America at S&P Dow Jones Indices, said in a recent commentary. “At least for the foreseeable future, Sustainability is King (or Queen) … And so, without other explanatory challengers to usurp the performance throne, long may the reign of our sustainability monarch continue.”

To be sure, while green bonds may be booming and financial markets are moving rapidly toward sustainability , private financing for environmental, social, and governance outcomes hasn’t kept pace.

"It is disturbing that the issue of guarantees, or sweeteners, is still a recurrent theme in private sector discussions," Carmen Reinhart, vice president and chief economist of the World Bank Group, said at the inaugural S&P Global Sustainable1 ESG conference. "We have to work on devising more incentives for the private sector before it is fully engaged on the financing side."

Today is Friday, May 28, 2021 and here is today’s essential intelligence.

U.S. Inflation Pressure Gives Value Stocks Another Edge Over Growth Stocks

Inflationary pressure is giving investors another reason to shift their dollars into better-performing value stocks and move away from tech-heavy growth stocks.

—Read the full article from S&P Global Market Intelligence

Short-Sellers Bet Against Electric Vehicle Companies Amid Competition, Shortages

Short interest in electric vehicle companies jumped through the end of April, the latest S&P Global Market Intelligence data shows. With sellers speculating that profitability for EV manufacturers will be increasingly difficult due to supply constraints and competition, the bets against these companies may quickly increase, analysts said.

—Read the full article from S&P Global Market Intelligence

Premium Alcohol Beverages Flow Generously Amid The Global On-Premise Dry Spell

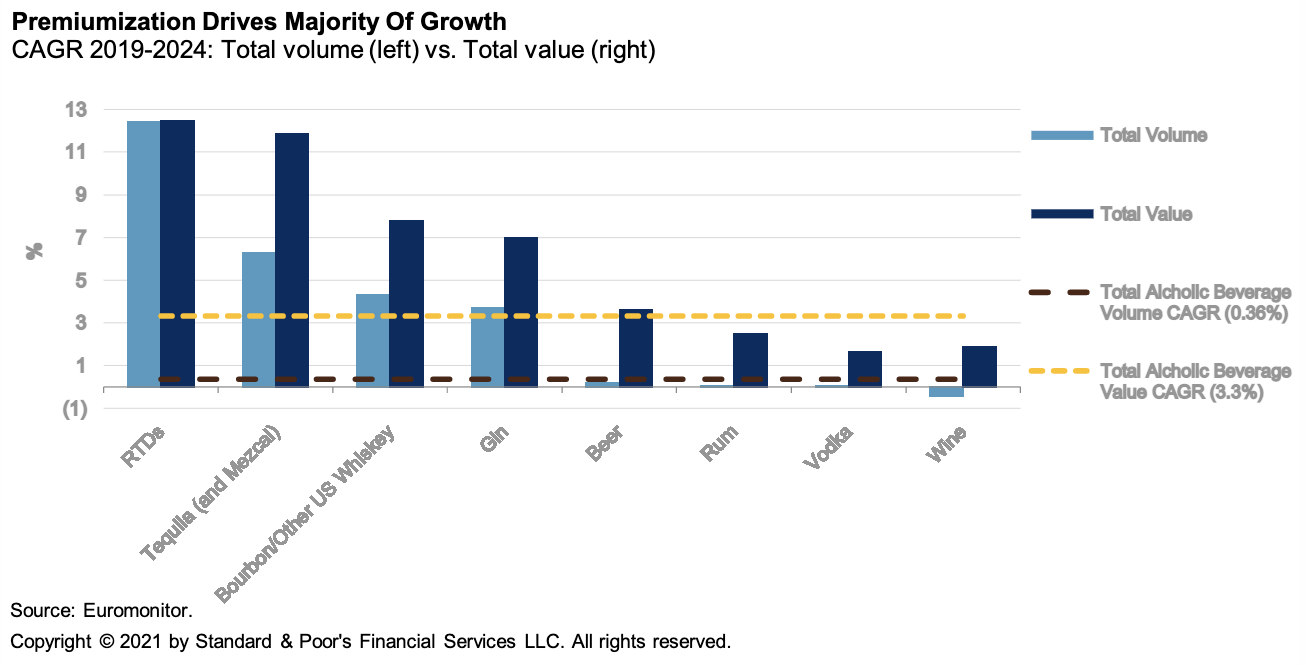

Most beer and spirits companies we rate continue to benefit from strong brand equity, premiumization, and well-diversified portfolios by product and location. The pandemic has demonstrated the sector's highly variable cost structure, which has enabled it to stem the bleeding in the on-premise channel, pivot to retail, and grow online delivery.

—Read the full report from S&P Global Ratings

'Back To School' Will Take On New Meaning This Fall

COVID-19 caused unprecedented drops in college and university enrollment numbers, but not all schools were affected similarly. Public universities fared better than private universities, on average, in fall 2020. Many schools will admit more students for fall 2021 to ensure their freshmen class, but the most selective schools will admit fewer and remain very competitive.

—Read the full report from S&P Global Ratings

COVID-19 Vaccine--Patent Waivers, Falling U.S. Shot Rates, And Thoughts On Potential Pharma Ratings Upside

The COVID-19 vaccine remains in the spotlight, as the U.S. and the world continues to grapple with the COVID-19 pandemic. While there has been significant improvement in supplies and availability of the vaccine, many parts of the world experiencing outbreaks in infections are still struggling to secure enough vaccine.

—Read the full report from S&P Global Ratings

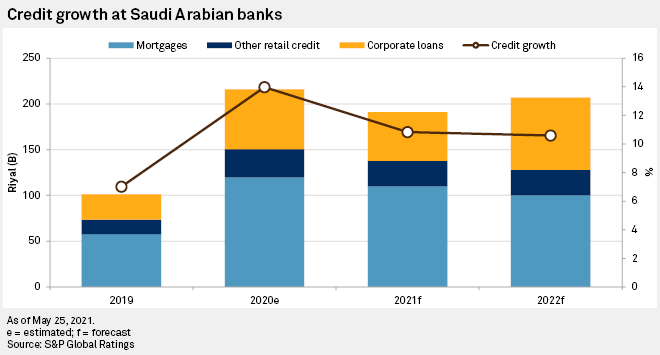

Saudi Arabia's 'Fannie Mae' To Boost Portfolio, Issue MBS

Saudi Arabia's state-backed mortgage refinancer expects to double or triple its balance sheet and begin issuing mortgage-backed securities in 2021 as a domestic home loan boom shows little sign of easing.

—Read the full article from S&P Global Market Intelligence

Nordic Bank Loan Loss Reversals Likely Amid Bright Outlook, But Timing Uncertain

Amid an improved economic outlook in Nordic countries, the region's largest banks are well placed in 2021 to reverse some of the pandemic-related loan loss provisions made in 2020, according to analysts, although some lenders may consider a more prudent approach.

—Read the full article from S&P Global Market Intelligence

Spanish Banks' Surprisingly Strong Q1 Lets Focus Turn To Pre-Provision Income

After a nervy 2020, Spain's largest banks began 2021 in a more confident manner. Three of the country's four largest lenders by total assets — CaixaBank SA being the exception due to lower-than-expected accounting gains from its merger with Bankia SA — enjoyed an almost clean sweep of beats against analysts' expectations in the first quarter, according to S&P Global Market Intelligence data.

—Read the full article from S&P Global Market Intelligence

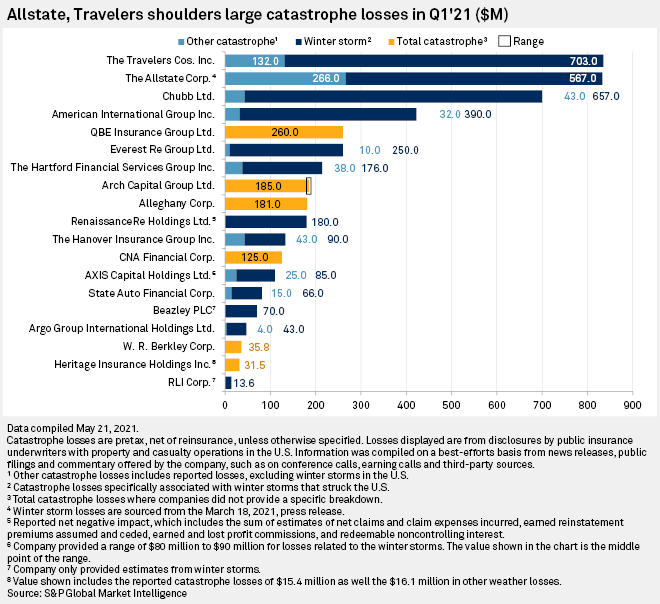

Reinsurance Plays Key Role As P&C Insurers Deal With Texas Freeze In Q1

Insurers and reinsurers sustained significant insured losses in the first quarter, mainly driven by winter weather in February that paralyzed parts of the southern U.S., particularly Texas.

—Read the full article from S&P Global Market Intelligence

Western Utilities, States Battle California Over Summer Power-Sharing Plan

Determined to avoid a repeat of last summer's rotating outages, the California ISO and state energy regulators have rolled out a series of reforms to bolster the Golden State's precarious power supplies.

—Read the full article from S&P Global Market Intelligence

Senate Republicans Agree To Just 2% Of Biden's EV Infrastructure Spending

U.S. Senate Republicans have made a small concession allowing some spending for electric vehicles as part of the massive infrastructure package, but their $4 billion EV proposal is only 2% of what the Biden administration wants to spend to electrify transportation.

—Read the full article from S&P Global Platts

Listen: Strong Demand, Supply Shortfalls Drive Steel Prices Across Europe And Asia

Prices have been soaring in most of the major steel markets, driven by high demand and insufficient supply. S&P Global Platts Lead Steel Analyst Paul Bartholomew, Associate Pricing Director for Metals Keith Tan, and Managing Editor Laura Varriale examine the factors in play.

—Listen and subscribe to Commodities Focus, a podcast from S&P Global Platts

PI Oceanconnect Eyes Growth As Bunker Demand Set To Return: CEO

Marine fuel sales worldwide in 2021 will likely grow by 3%-5% compared to 2019 as demand returns despite the challenges posed by the global coronavirus pandemic, with KPI OceanConnect poised to seek expansion opportunities worldwide, according to Soren Holl, CEO of KPI OceanConnect.

—Read the full article from S&P Global Platts

U.S. Aluminum Tariffs Achieved Goal In Saving, Growing Domestic Industry: Panel

The U.S.' 10% tariff on aluminum imports from most countries accomplished its stated purpose of protecting the at-risk domestic aluminum industry in the interest of national security, market analysts and participants said May 26 after the release of a report from the Economic Policy Institute.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language