Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 21 May, 2021

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

Geopolitical risk is evolving as the global economy races into a post-pandemic world and countries confront tensions within their own borders while aiming to foster international diplomacy.

This week, political tensions—along with economic, supply chain, and energy security issues—have intensified in some countries and dissipated in others. Such risks can have material implications on everything from credit conditions to equity performance.

The U.S. and Iran reached a sanctions-relief agreement, taking steps toward resolving a dispute that has been ongoing since 2015. The U.S. waived sanctions against the Russian developers of the Nord Stream 2 pipeline, but could still implement sanctions on other Russian actors. Israel and Hamas agreed to a ceasefire that will halt the 11-day conflict that has killed at least 230 Palestinians and 12 Israelis.

Iranian President Hassan Rouhani said May 20 that Tehran and Washington reached a “main agreement” under which U.S. sanctions on Iran’s oil, petrochemical, shipping, insurance, and banking sectors will largely be lifted. Negotiators from the two countries and the EU will meet next week for a fifth round of discussions to determine the final details of the nuclear deal, according to S&P Global Platts. The breakthrough could open the floodgates for Iranian crude to the tune of 2 million barrels of oil output per day by 2022.

The Biden Administration eased sanctions against Russian natural-gas giant Gazprom, which owns the 95% completed Nord Stream 2 pipeline, in the spirit of appeasing the U.S.’s Western allies like Germany that support the energy project. But the country’s sanctions aimed at "targeting aggressive and harmful activities by the Government of the Russian Federation” imposed on April 15 are still in effect. These penalties restrict U.S. purchases of ruble-denominated sovereign debt—which could send ripples through Russia’s energy sector, will likely increase Russia’s focus on supporting short-term oil prices through OPEC+ cohesion, and creates the possibility that stricter penalties are to come despite the U.S.’s recent reliance on Russian oil, according to S&P Global Platts. Former U.S. government officials told S&P Global Market Intelligence that the Russian metals and mining sector is at risk of future sanctions if tensions between the countries escalate.

Israel and Hamas agreed to a ceasefire on May 20 to end the bloodshed that has torn through Gaza and drawn international attention. The violence affected energy production in Israel as rockets reportedly hit oil tanks, and the U.S. energy major Chevron suspended operations at its Tamar gas platform offshore of Israel.

Today is Friday, May 21, 2021, and here is today’s essential intelligence.

Indonesia Developers: Stronger Sales Won't Fix Everything

The credit quality of Indonesian real estate developers is unlikely to recover to pre-pandemic levels in 2021. Persistent negative discretionary cash flows will constrain meaningful liquidity improvement and deleveraging for the rated Indonesia developers. This is despite improved marketing sales and cash collection in 2021.

—Read the full report from S&P Global Ratings

Why This Time Really Is Different for Europe

From a European sovereign credit-risk perspective, the COVID-19 pandemic differs from other recent crises, for two reasons. First, the current economic crisis arose from recession-inducing lockdowns to combat a viral contagion, rather than from an asset-market contagion caused by a failing financial system.

—Read the full article from S&P Global Ratings

Nordic Property Companies and Banks Can Cope With Mixed Market Conditions In 2021-2022

Nordic countries seem set for growth this year after an economic decline due to COVID-19. In Sweden, for example, GDP is forecast to increase by 3.0% in 2021 after a 2.8% contraction in 2020 and the Norwegian and Finnish economies are expected to expand by 3.2% and 2.0% respectively.

—Read the full article from S&P Global Ratings

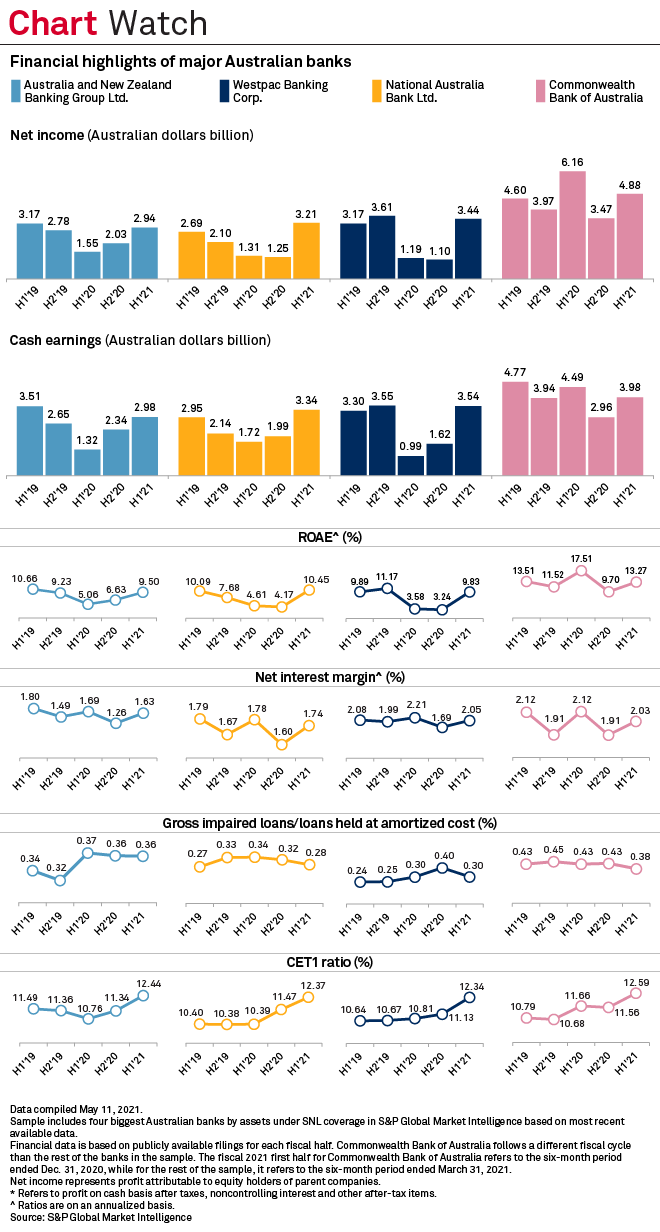

Australia's Rebounding Economy to Boost Bank Earnings

The ongoing earnings recovery at Australia's major banks may gather steam as the economy bounces back from its first recession in 30 years and global demand for commodities such as iron ore, copper and natural gas rises.

—Read the full article from S&P Global Market Intelligence

Italian Banks Have Room to Plump Up Capital Cushions with Hybrid Securities

Italy's banks could significantly improve their capital structures by issuing more hybrid securities like Additional Tier 1, or AT1, bonds, according to analysts. More issuance would likely be well-received by investors — but only if the banks are in robust financial shape and have wrestled bad debts down to manageable levels.

—Read the full article from S&P Global Market Intelligence

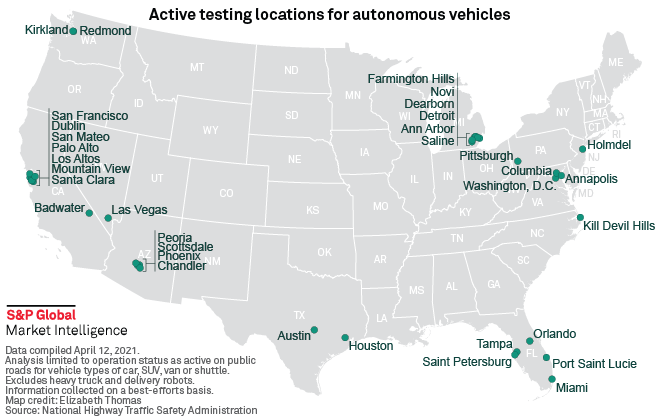

As Autonomous Cars Hit the Road, Insurers Must Navigate Complicated Future

With the prospect of car navigation shifting in the coming years from total driver control to full machine guidance, auto insurance underwriting looks likely to become more complex as well.

—Read the full article from S&P Global Market Intelligence

Concentrating on Technology

After the dominant performance of large-cap technology stocks in 2020, concentration concerns naturally come to mind. The strong performance of large-cap Tech names last year led to an increase in the sector’s concentration levels. History tells us that after peaks in concentration, equal-weighted Tech has tended to outperform. We can look to history to provide perspective on these trends.

—Read the full article from S&P Dow Jones Indices

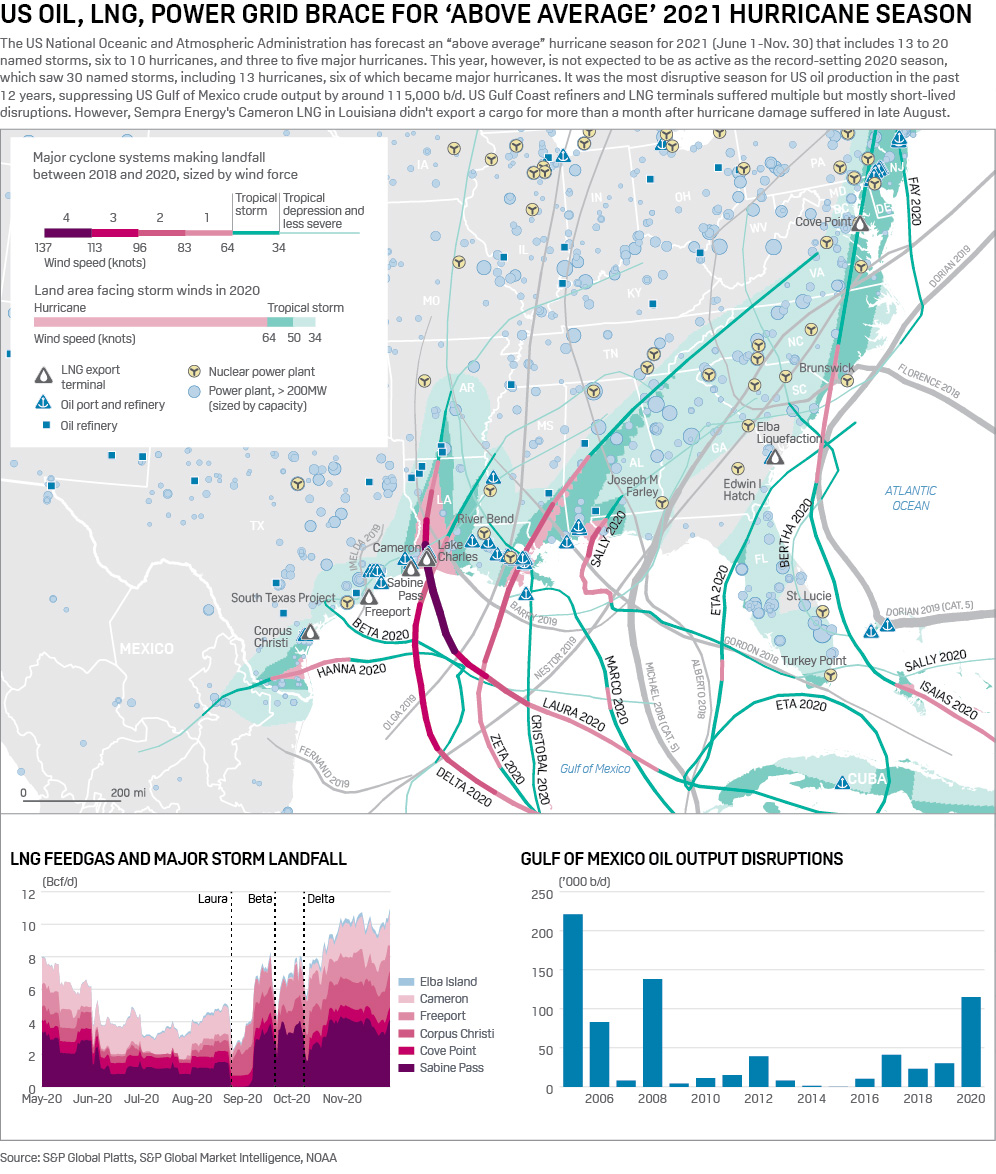

More Active Hurricane Season Than Normal Forecast, But Less Than 2020's Record

The National Hurricane Center on May 20 forecast a more active Atlantic hurricane season than normal as being most likely in 2021, but not as active as 2020's record-setting storm season, and power markets appear likely to take the forecast in stride.

—Read the full article from S&P Global Platts

BP CEO Sees IEA's Net-Zero-by-2050 Report as Aligned With Company's Strategy

BP PLC's CEO sees the International Energy Agency's recent report on reaching net-zero emissions by 2050 as well aligned with the company's decarbonization strategies.

—Read the full article from S&P Global Market Intelligence

OPEC Warns IEA Net-Zero Roadmap Would Lead to Unstable Oil Market

The International Energy Agency's advocacy for net-zero emissions could increase oil market volatility and jeopardize needed investment in fossil fuels, OPEC said in a report to its members.

—Read the full article from S&P Global Platts

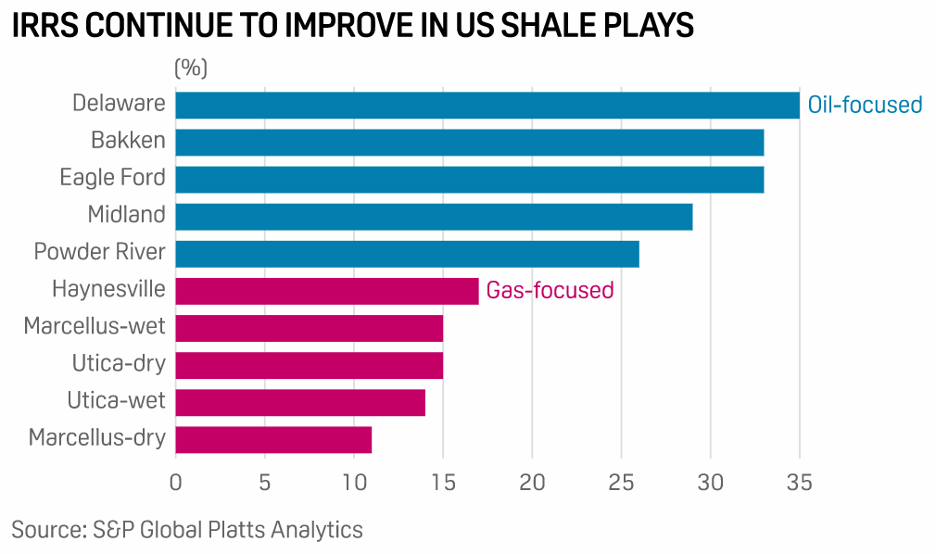

Economics Continue to Improve In U.S. Shale Basins but Operators Hold Steady

Despite ever-improving returns across nearly all US shale fields, publicly traded companies continue to demonstrate restraint in drilling and completion activity with production forecasts showing dips next month in every major basin but the Haynesville and Permian.

—Read the full article from S&P Global Platts

S Korea's SK Energy to Limit Q2 Oil Product Output Amid Fragile Asian Demand

Transportation fuels -- including gasoline, diesel and jet fuel -- saw their refining margins improve sharply from 2020 levels amid a pick up in mobility, but South Korea's top refiner SK Energy plans to maintain a conservative approach in middle distillate production as the outlook for Asia's fuel demand remains fragile.

—Read the full article from S&P Global Platts

ADNOC CEO Says Vaccination Campaigns Helping 'Healthy Rebalancing' of Oil Market

The ramp-up in coronavirus vaccination rates around the world is "very much encouraging" for global economic growth and the recovery in oil demand, Sultan al-Jaber, the CEO of Abu Dhabi National Oil Co., said May 20.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Language