Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 20 May, 2021

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

The trade relationship between the United States and European Union is on the mend after a series of disruptions—the Trump Administration’s tariffs, Brexit, and the coronavirus pandemic, among others—strained the alliance.

At the start of discussions between the trade partners on May 17, American and European representatives said in joint statements that they were seeking solutions to address the global steel and aluminum industry’s overcapacity by year-end, and that their strategic partnership can “hold countries like China that support trade-distorting policies to account.” The trans-Atlantic relationship has been strained since 2018, when former President Donald Trump imposed Section 232 tariffs of 25% on European steel and 10% on aluminum. In response, the European Commission introduced rebalancing tariffs on imports of some U.S. products after the bloc couldn’t come to a deal with the former U.S. administration.

The EU said this week it will temporarily suspend its tariffs on American imports that were set to increase in June until the talks conclude. Earlier this year, newly appointed Commerce Secretary Gina Raimondo said that the Section 232 tariffs had been “effective” but that the Biden Administration would “have a full review of all of these policies and decide what it makes sense to retain.”

"Our joint aim is to put an end to the WTO disputes following the U.S. application of tariffs on imports from the EU under Section 232 under the previous administration," a European Commission spokesperson said in a statement to S&P Global Platts this week. "The U.S. is a valued strategic partner and we are determined to work closely with the Biden Administration to mitigate trade irritants that weaken this partnership … To ensure a constructive environment for this work, we agreed to avoid changes that negatively affect bilateral trade.”

Some U.S. market participants have challenged the steel and aluminum tariffs and welcomed the talks as a means to determine substantive solutions to the global steel shortage. Others have urged the government to keep the tariffs in place and expressed concerns over implications for global trade. Favorable reviews of the trade measures could bolster President Joe Biden to continue the tariffs, according to S&P Global Market Intelligence.

"The EU is an important ally, but in the past, it has been part of the problem, not part of the solution," United Steelworkers President Tom Conway said in a statement, according to S&P Global Platts. "We have more than 40 unfair trade relief measures in place against EU steel and aluminum products that resulted from their dumping and subsidies targeted at our market."

Overall, the EU’s international trade activity is rebounding, according to Panjiva, part of S&P Global Market Intelligence. But aluminum prices have soared, European steel markets are struggling to recover from supply chain and demand disruptions, and steel and aluminum executives across North America see only modest growth for their industry on the horizon. Ultimately, market participants believe U.S. tariffs and trade policy will affect the North American aluminum market this year, according to an S&P Global Platts survey.

Today is Thursday, May 20, 2021, and here is today’s essential intelligence.

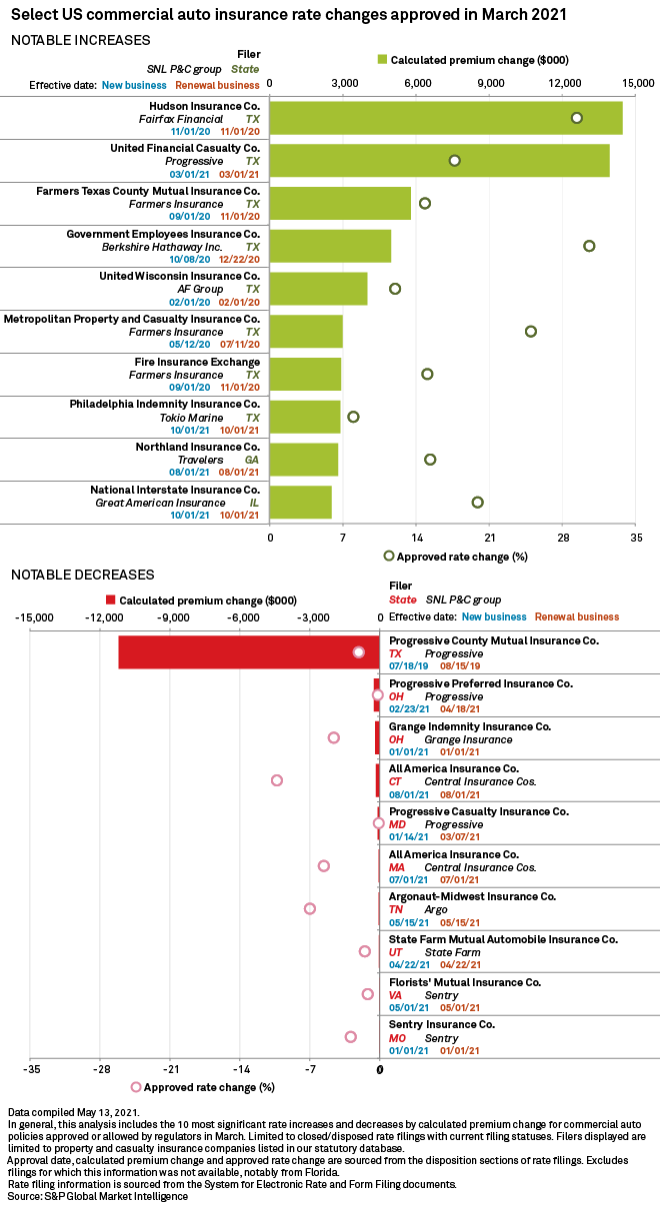

Texas Regulators Approve Significant Commercial Auto Rate Hikes In March

Regulators in the Lone Star State signed off on 33 commercial auto rate hikes in March, which may lead to an additional $66.1 million in premiums written. That projected increase is the largest for any single state for the month.

—Read the full article from S&P Global Market Intelligence

Economic Research: U.S. Real-Time Data: Growing Pains

U.S. real-time economic data continues to indicate the economy is on the mend, supporting S&P Global Ratings’ forecast that U.S. GDP will surge by a hefty 11.3% in the second quarter, after accelerating by 6.4% in the first. But S&P Global Ratings expects that supply-chain constraints on inventories and near-term labor market shortages will be some of the growing pains the economy faces this year as businesses return to normal.

—Read the full report from S&P Global Ratings

Credit Risk Premium in the Equity Market

Firms with low credit risk generally have higher stock market returns than firms with high credit risk. The S&P 500® Higher Credit-Rating Ex Insurance Equity Index is designed to capture the credit risk premium in the equity market. In this blog, S&P Dow Jones Indices introduces the index design, performance, and factor exposure.

—Read the full article from S&P Global Dow Jones Indices

Political Risk: Why It Matters

International opportunities to diversify equity allocations are increasing, along with globalization, and as a result, political risk matters now more than ever. More so, the interplay of macroeconomic policymaking and government instability continues to have far-reaching effects in political risk, augmenting the uncertainty that goes hand in hand with allocating to emerging markets.

—Read the full article from S&P Global Dow Jones Indices

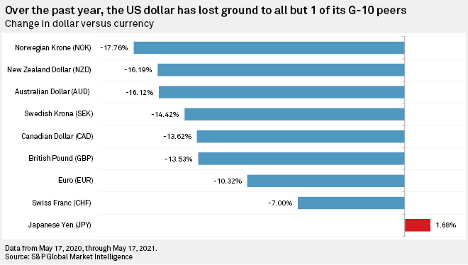

Falling Bond Yields Hit U.S. Dollar as Loose Fed Policy Threatens Further Erosion

Rising inflation, plunging bond yields and the diminishing likelihood of tighter monetary policies in the near term have battered the U.S. dollar, causing it to lose ground against nearly all if its foreign peers. With the Federal Reserve signaling that it has no plans to shift from near 0% rates and $120 billion in monthly securities purchases, currency analysts say further U.S. dollar weakness lies ahead.

—Read the full article from S&P Global Market Intelligence

Japanese Steelmakers: Heavy Investment Tests Industry Mettle

Japan's steel industry will return to profitability in the next couple of years as demand rebounds and companies restructure. Credit quality will take time to improve because of intensifying global competition and rising debt burdens amid growth investment. Japanese companies can compete if they can take a lead in the global industry's drive toward carbon neutrality.

—Read the full report from S&P Global Ratings

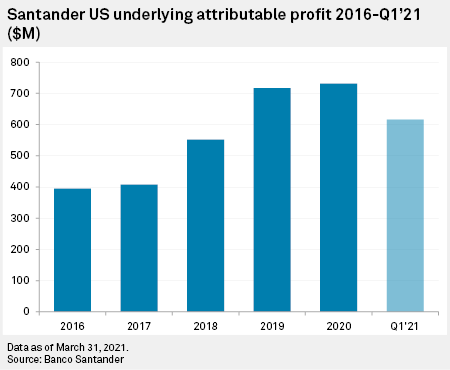

Steady Ascent of Santander's U.S. Business Masks Nagging Doubts Around Retail Bank

The Spanish lender's results were notable for the performance of its U.S. business, which became its largest source of net income, bringing in €660 million of profit for the group. Profits from the U.S. have steadily increased for Santander in recent years, but the market has long trailed Brazil, Spain and the U.K. as a major source of income.

—Read the full article from S&P Global Market Intelligence

Denmark as 'Proof of Concept' for Negative Rates – What We Have Learned so Far

A successful experiment by the Danish banking sector to charge negative interest rates on a growing number of retail depositors is likely to draw interest from financial institutions across Europe as they, too, seek tools to withstand the intensifying pressure from a prolonged low-rate environment and record inflows of deposits.

—Read the full article from S&P Global Market Intelligence

Emirates NBD Takes Fight to FAB In Battle for UAE Retail Market

Emirates NBD Bank PJSC's aggressive retail lending has enabled the Dubai-based bank to eclipse larger rival First Abu Dhabi Bank PJSC in the retail banking segment, but the United Arab Emirates' top bank by assets has the resources to claw back market share.

—Read the full article from S&P Global Market Intelligence

Singapore Banks to Face Margin Pressure, but Growth May be Antidote – Analysts

Singapore's three major banks will continue to face pressure on their margins this year, though they may maintain their earnings momentum as the pace of loan growth may improve with the expected economic recovery, analysts say.

—Read the full article from S&P Global Market Intelligence

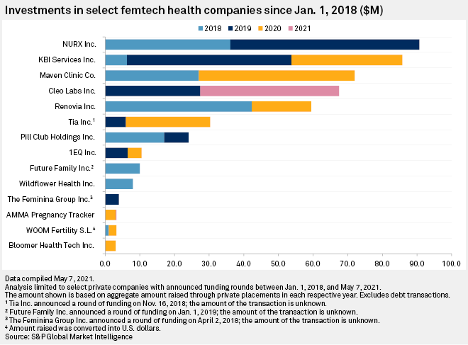

'Femtech' May Have Its Moment as Investors Target Specialized Digital Health

The pandemic-fueled popularity of online tools for primary and chronic care have emboldened investors to seek more specialized opportunities in digital health. Women's health may be their next target.

—Read the full article from S&P Global Market Intelligence

Investors Flocking to APAC Insurtechs with Hybrid Distribution, B2B Models

Asia-Pacific's private insurance technology landscape may be dotted with several unconventional startups seeking to unseat incumbents, but venture capitalists will gravitate toward less disruptive and more collaborative technology startups.

—Read the full article from S&P Global Market Intelligence

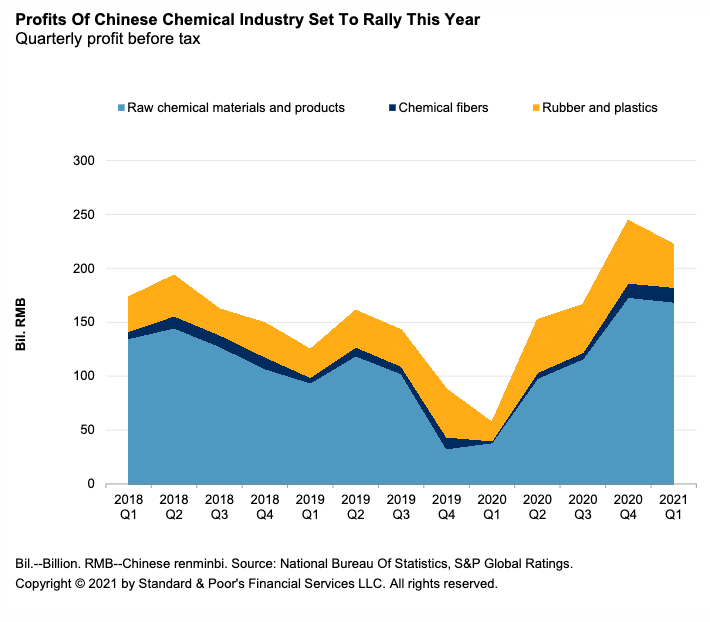

China's Chemical Sector: Bonding Growth to Environmental Goals

Chinese chemical companies will likely channel higher profits into capital projects to seize growth opportunities from industry and environmental policy shifts. Debt-funded expansions will be more measured, in S&P Global Ratings’ view, given government surveillance on leverage trends. This means larger companies with stronger finances and good funding access are best placed to benefit from the transition in China's chemical industry.

—Read the full report from S&P Global Ratings

Lithium Prices Diverge and Defy Expectations as New EV Trends Unfold

Evolving choices around EV battery composition have altered price dynamics in the lithium market, with the two main forms, hydroxide and carbonate, now moving independently to each other, reflecting different use cases and trading patterns.

—Read the full article from S&P Global Platts

Los Angeles Aims to be Nation's 1st Green Hydrogen Hub

At the root of the endeavor, HyDeal LA, are plans to convert four Los Angeles-area gas-fired power plants to run on hydrogen, which would create a large source of demand for the zero-carbon fuel. This demand could serve as a foundation to scale up the supply chain, including a proposal to deploy green hydrogen production equipment, while project partners attract other off-takers eager to decarbonize their businesses.

—Read the full article from S&P Global Market Intelligence

Lawmakers Debate Biden's Proposal to Double Climate Finance Levels

President Joe Biden's proposed increase in international climate financing came under scrutiny during a U.S. House hearing, with several Republican lawmakers decrying the increased funding levels and some Democrats calling for even more funding

—Read the full article from S&P Global Market Intelligence

February Storm Caused Over $10B In Losses for Investor-Owned Power Companies

The February Arctic blast, which caused prolonged blackouts across the central U.S., cost American and European power companies more than $10 billion, according to an S&P Global Market Intelligence review of more than two dozen first-quarter earnings reports.

—Read the full article from S&P Global Market Intelligence

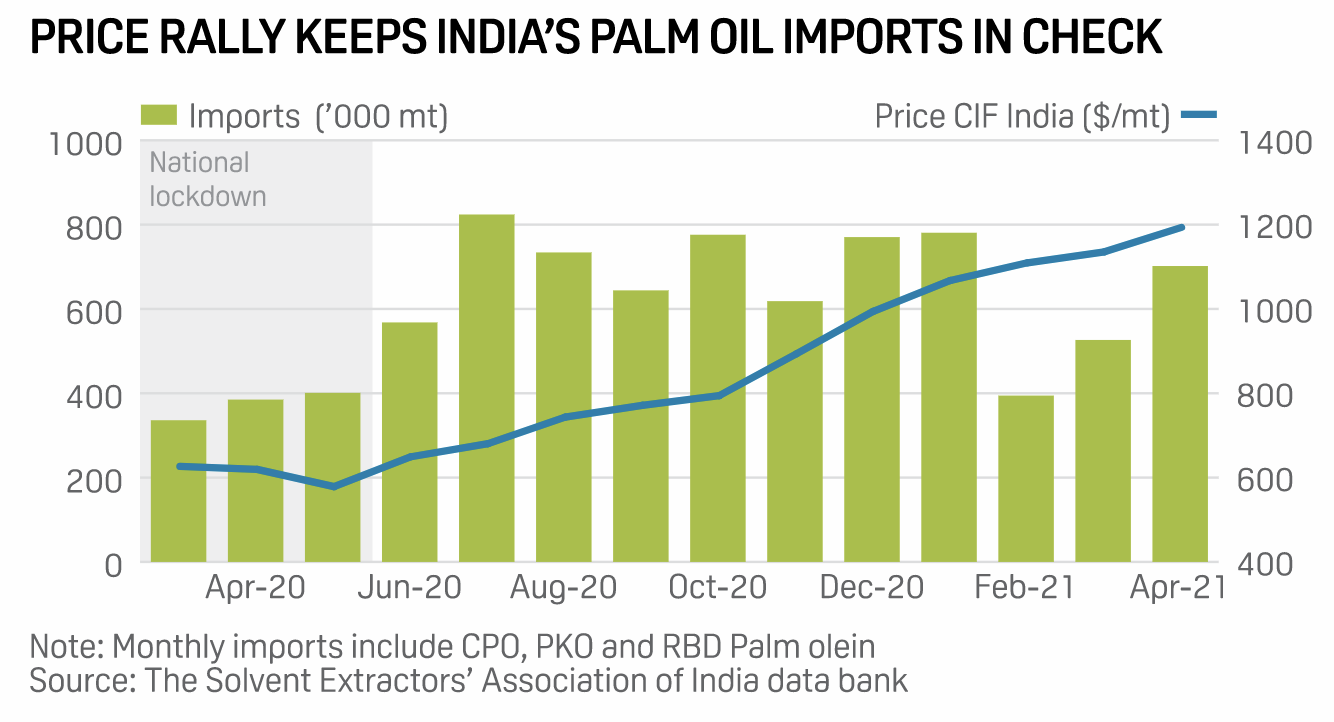

India's Palm Oil Imports Hit Roadblock as Localized Lockdowns Intensify

India's palm oil imports in 2021 are set to fall for the second consecutive year as pandemic concerns continue to unfold in the country, forcing refiners to dial back production and keep stocks at a bare minimum level, sources told S&P Global Platts.

—Read the full article from S&P Global Platts

China's Surprise Consumption Tax Move Creates Room for Additional Crude Inflows

China's surprise move to slap a consumption tax on imports of light cycle oil and mixed aromatics will force refiners to boost output of these products at home, which could lead them to ship in incremental crude oil cargoes as well as divert some feedstock from other oil products.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language