Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 2 May, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

A Second Copper Age Confronts Supply Shortages

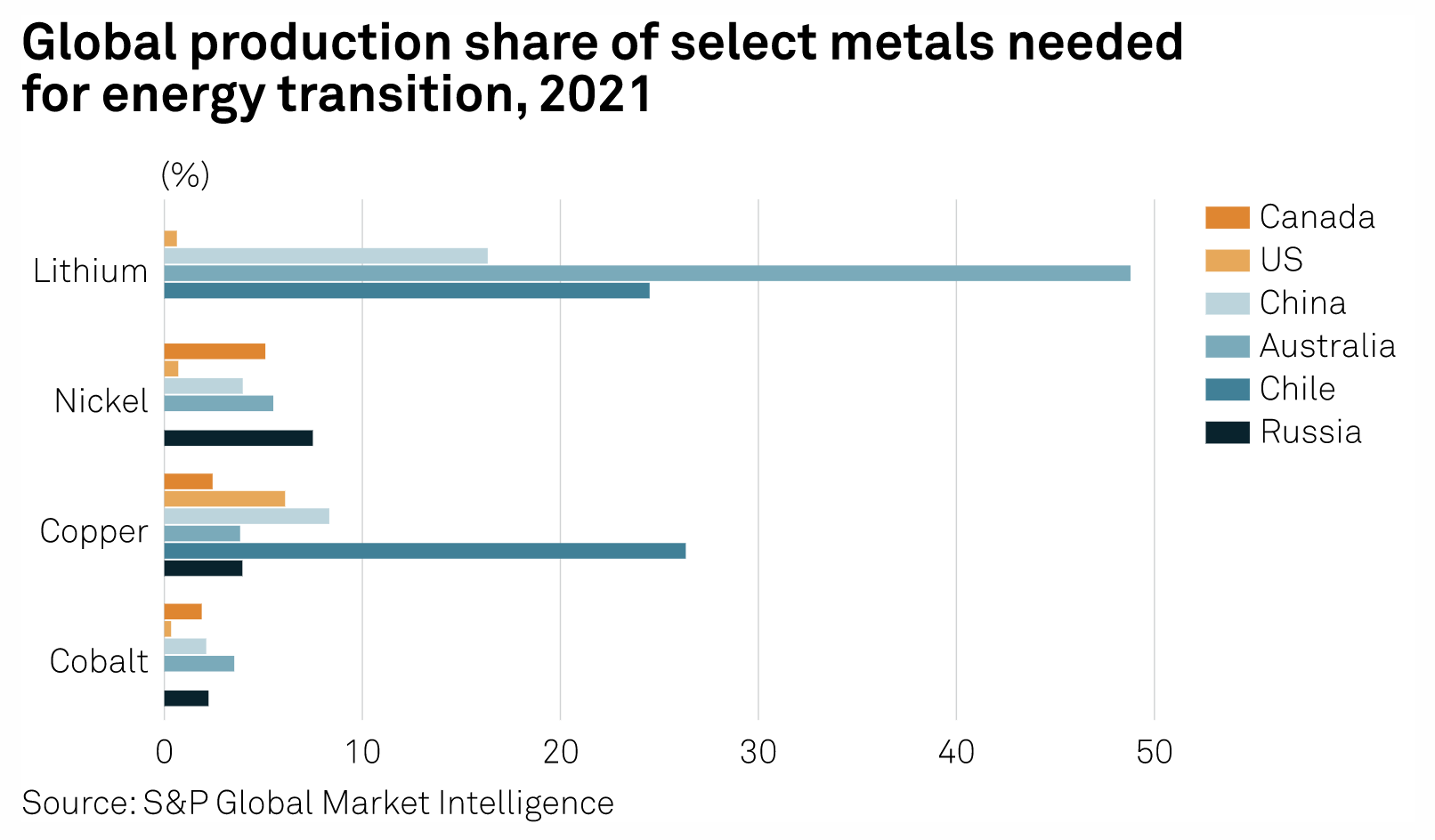

Between the Neolithic and Bronze ages, there was a period known as the Copper Age, during which access to copper provided a strategic advantage to early civilizations. Given the material requirements of the energy transition, particularly around electrification, it stands to reason that the next 30 years may constitute a second Copper Age. Daniel Yergin, vice chairman of S&P Global and author of The New Map: Energy, Climate, and the Clash of Nations, recently wrote an editorial for The Wall Street Journal, pointing out that copper is the “metal of electrification” and that our net-zero goals depend on massive quantities of it for electric vehicle batteries and charging stations, offshore wind, onshore wind, solar panels, battery storage and more. The editorial, “'Net Zero' Will Mean a Mining Boom,” expands on an extensive 2022 report published by S&P Global on copper supply and demand. Given the extraordinary decarbonization commitments of governments around the world, demand for copper looks to double by the mid-2030s, while supply is unlikely to keep up.

The S&P Global report on copper, published in July 2022, projected global copper demand to double to about 50 million metric tons between now and 2035. Once achieved, this high level of demand would plateau, growing slowly to 53 million metric tons by 2050. This surge in demand will be driven by technologies necessary for the energy transition, which tend to be far more copper-intensive than previous technologies in mobility and power generation.

According to the International Energy Agency, it takes about 16 years to develop a new copper mine. Current mining projects in development do not come close to covering the projected doubling in demand. According to the authors of the copper report, there are three possible sources of additional supply: new mines or expansion of existing mines, higher utilization of existing mines, and recycling.

The shortfall in new copper supply has been building for a long time. Since the 2008 financial crisis, mining company executives have been reluctant to invest in new copper mines and exploration. In the mid-2000s, metals and mining equities enjoyed a bull run that collapsed during the crisis. To improve their balance sheets, mining companies reduced their exploration budgets. In 2012, mining exploration budgets peaked at $1.41 billion before enduring a decadelong decline. In 2022, capital spend on the global development of existing and new copper projects stood at $14.42 billion, down from $26.13 billion a decade earlier. Despite projected skyrocketing demand, capital expenditure is forecast to decline another 18.7% in 2023.

Chile and Peru have some of the world's largest copper reserves, but both countries face substantial challenges in expanding their output capacity for the metal. Chile is struggling with regulatory uncertainty and underdeveloped capacity. Chilean copper exports contribute approximately 10% to the country’s GDP. In Peru, lengthy permitting requirements and political unrest will hold back new copper capacity. Peruvian President Dina Boluarte is unlikely to confront mining interests in the south of the country, where she is already deeply unpopular.

Today is Tuesday, May 2, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

US States’ Fiscal 2024 Budgets Expected To Weather Economic Uncertainty

As federal support tapers off, interest rates remain higher for longer and inflation perseveres, while proposed fiscal 2024 budgets generally project slower revenue growth as the economy cools. The Core Consumer Price Index (CPI) is expected to increase by 4.7% in 2023 from 2022's already high levels, which will pressure wage expectations, construction costs, and program costs upward for states.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

US Private Equity Deals In Mainland China Plunge, Set For 5-Year Low In 2023

US private equity and venture capital investments in mainland China fell dramatically in the first quarter, setting 2023 on track to become the worst year for investments in at least five years. Aggregate deal value in the first quarter was $400 million, down more than 86% from $3.03 billion in the same period in 2022, according to S&P Global Market Intelligence data. The number of deals declined to 28 from 61 year over year. First-quarter deal value and volume were also down compared to the fourth quarter of 2022.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

Valero Sees Strong Refined Product Demand, Tight Supply Ahead Of Travel Season

Valero Energy sees the currently strong demand for gasoline, diesel and jet fuel increasing ahead of the peak summer travel season amid tighter supply and low inventories, CEO Joe Gorder said on April 27. "Looking ahead, we expect refining fundamentals to remain supported by low global light product inventories, tight product supply and demand balances as we approach peak air travel and summer driving season," he said during the company's first quarter results call.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: How Mexico’s Sustainable Taxonomy Tackles Both Environmental And Social Issues

In this episode of the ESG Insider podcast we’re continuing our exploration of the sustainable taxonomies developing in countries around the world. Today it’s turning to Mexico, which announced a new sustainable taxonomy in March 2023. According to the Mexican government, the taxonomy is the first in the world to consider social objectives. Achieving gender equality is one of its major goals.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Sustainable1

Access more insights on sustainability >

Fuel For Thought: G7 Sapporo Was Breather For Energy Security, But Headwinds Ahead For Decarbonization

The G7 Sapporo communique was a product of compromise after months of negotiations over sticking points in member states' approaches to climate goals and energy security. The pragmatic agreement that emerged could pave the way for future work, even though it may have looked like little progress to some. The group acknowledged the need to pursue "various pathways" to reach their common goal of net zero, a strategy that could act as a guiding principle for members' approach for energy security and climate goals.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Enterprise 'Shippers' Seek Help With Supply Chain Digital Transformation, Have Budget To Spend

Shippers — often called beneficial cargo owners or BCOs — are eager to outsource their supply chain and logistics technology operations. These enterprises that count the movement of goods as central to their operations have multimillion-dollar digital transformation budgets that are growing at double-digit percentages. Vendors specific to logistics technology, as well as those providing general IT infrastructure and software for industries, could land massive amounts of new business supporting the digitalization of shipping at such firms, spanning a range of industries including consumer-packaged goods, industrial and high-tech components, and food and beverage.

—Read the article from S&P Global Market Intelligence