Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 17 May, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Two Competing Economies, Two Diverging Monetary Policy Pathways

The central banks of the world’s two biggest economies in the are taking starkly different actions to address current market conditions—with each set to bring forth distinct effects for the global economy.

Roaring persistent inflation in the U.S. and the economic implications of coronavirus-containment measures in China, among other factors, have contributed to global market volatility. In response, the Federal Reserve is implementing its most aggressive monetary-policy tightening in decades, increasing interest rates by 50 basis points at its recent May meeting and indicating similarly substantial rate hikes are to come. Conversely, the People's Bank of China is expected to continue lowering its benchmark interest rates to combat signs of slower economic growth as climbing COVID cases keep Shanghai and other regions under lockdown.

As the global macroeconomic outlook darkens, the distinctly diverging approaches from the U.S. and China’s respective central banks are prompting equally contrasting responses from market participants.

Investors have become more risk-averse in response to and in anticipation of the Fed’s tightening, with global bond issuance overall likely to notably contract this year, according to S&P Global Ratings. But in China, monetary policy easing is set to spur a surge in global green bond growth, according to S&P Global Market Intelligence.

"The substantial monetary policy divergence between China and the U.S. is helping China avoid the current global bond market rout as central banks across the globe raise interest rates to stem inflation," Anish Ailawadi, senior director and head of investment banking at the research and analytics firm Acuity Knowledge Partners, told S&P Global Market Intelligence.

U.S. banks are starting to see deposit outflows accelerate as the Fed increases rates and begins to shrink its balance sheet. Meanwhile, the People’s Bank of China’s calibrated easing will alleviate some pressure on margins and ensure that Chinese banks’ earnings likely remain steady, according to S&P Global Market Intelligence.

“As prices continue to soar and the Russia-Ukraine conflict makes inflation pressures even worse, the Federal Reserve is sharpening its tools to fight the run-up in prices,” S&P Global Ratings Chief North America Economist Beth Ann Bovino said in research earlier this month. “We do recognize that recession risks have increased—our qualitative assessment of recession risk over the next 12 months is now 30% (within a 25%-35% range), with greater risk in 2023 as cumulative rate hikes start to bite.”

“Continued strict lockdowns of [China’s] cities and towns are hitting economic activity, leading to weaker growth. S&P Global Ratings believes this will be a key development affecting domestic employment, investor sentiment, supply chains, and broader capital markets,” S&P Global Ratings Asia-Pacific Head of Credit Research Eunice Tan and Asia-Pacific Credit Research Managing Director Terry Chan said in research yesterday. “On the monetary side, the possibility for capital outflows and hefty currency weakening amid rising U.S. interest rates prevent the People's Bank of China from cutting interest rates significantly. The Chinese renminbi has depreciated 5.8% against the U.S. dollar since early April amid outflows, and some further depreciation is likely. The central bank can use quantitative levers to support credit growth.”

Today is Tuesday, May 17, 2022, and here is today’s essential intelligence.

Written by Molly Mintz.

Office Space For Sublease Ticks Up In Q1; Duke Realty Turns Down Prologis Offer

Office space available for sublease in the U.S. rose 3.6% in the first quarter to 159 million square feet, surpassing levels seen before the pandemic, The Wall Street Journal reported, citing CBRE Group Inc. data. Landlords are already facing decreasing rents and rising vacancies due to low demand in office space and an elevated amount of lease expirations, the publication added. Markets with near-historic high sublease availability include New York, San Francisco, and Washington, D.C. In Manhattan, N.Y., there was more than 20 million square feet of office space available for sublease in the first quarter, the publication reported, citing Savills.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Weekly European CLO Update

In response to investors' growing interest following the coronavirus pandemic and ongoing credit effects on companies and European CLOs, S&P Global Ratings is publishing a regularly updated list of rating and recovery actions it has taken globally on nonfinancial corporations that have had an effect on European CLOs, and a summary of how European CLOs have been affected with key benchmarks.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

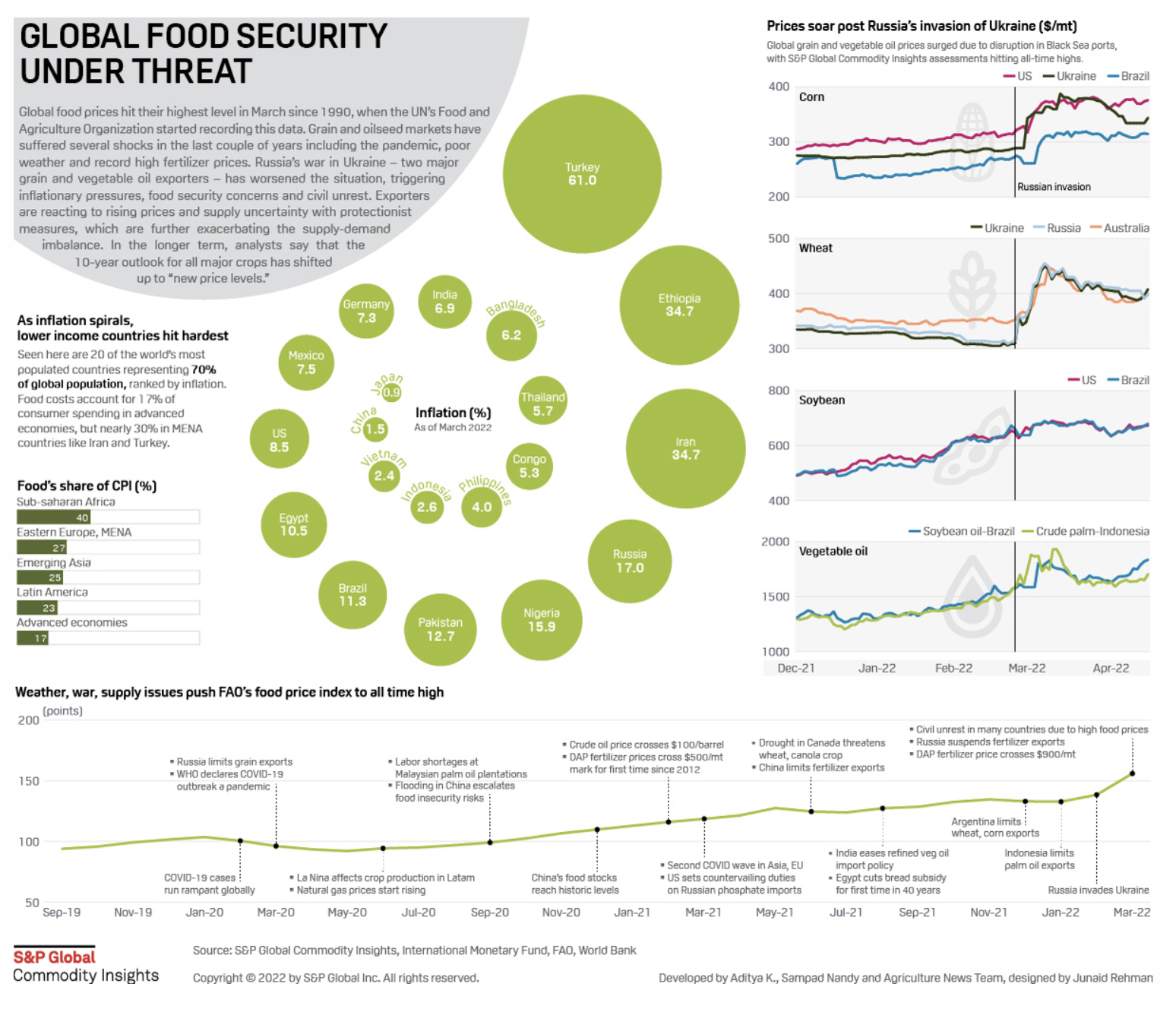

Global Agriculture Markets Jittery On Worsening Food Inflation Outlook

This famous line hits home in the current play as Russia's invasion of Ukraine set open a can of worms for agriculture producers and consumers worldwide. Supply disruptions are coming at a crucial time when the world is in the midst of months-long high energy and input cost environment, which are playing into the inflationary pressures and forcing governments to take policy actions such as export curbs. Coinciding with this, prolonged unfavorable weather conditions at major grains and oilseed countries have worsened the production outlook and added pressure to the already-strained supply pipeline.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: What’s Been Driving Recent Volatility In Global Clean Tanker Freight?

A global dislocation of clean tanker tonnage has driven freight volatility in recent weeks, as charterers scramble for barrels in east and west of Suez markets to satisfy European and South American demand. In the lastest episode of the Commodities Focus podcast, Americas Freight Senior Managing Editor Barbara Troner speaks with EMEA Middle Distillate Editor Rowan Staden-Coats, and shipping editors Sameer Mohindru in Singapore and Chris To in London about how the Russia-Ukraine conflict has exacerbated the global shortage in diesel markets and to what extent the replacement of Russian-origin diesel barrels has driven recent volatility in the global clean tanker markets.

—Listen and subscribe to Commodities Focus, a podcast from S&P Global Commodity Insights

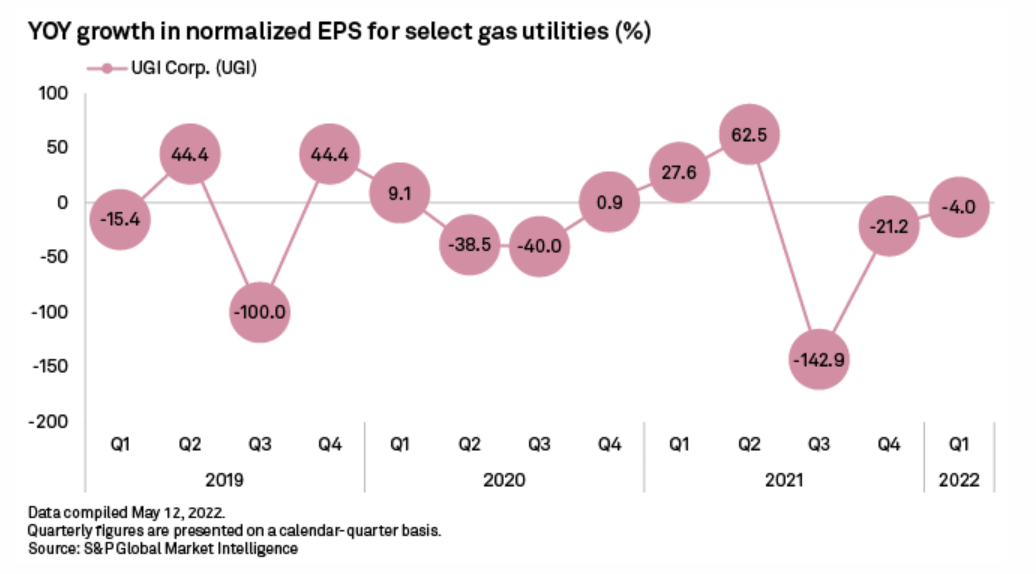

Most Gas Utilities Beat Quarterly EPS Expectations; Few Post YOY Profit Growth

Natural gas utilities largely surpassed Wall Street's expectations during the latest earnings reporting period, though year-over-year profit growth remained elusive for many gas distributors. Six out of nine gas utility operators selected by S&P Global Commodity Insights topped S&P Capital IQ consensus EPS forecasts in the quarter that ended March 31.

—Read the article from S&P Global Market Intelligence

Access more insights on energy and commodities >

Listen: Ep27: Rick Rieder — Blackrock CIO On Crypto, Inflation, Twitter & Parenting Advice

Rick Rieder, chief investment officer of global fixed income at Blackrock, joins Yann Le Pallec, global head of ratings at S&P Global Ratings and host Joe Cass on this episode of Fixed Income in 15. Discussion focused on Rick’s take on the current volatile market conditions, how to approach inflation, Rick’s 30,000 Twitter followers, Yann’s professional experience of the pandemic, insightful individuals, and Rick’s advice to Joe on parenting.

—Listen and subscribe to Fixed Income in 15, a podcast from S&P Global Ratings