Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 17 May, 2021

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

The unevenness of vaccine rollouts worldwide and application of coronavirus containment measures is resulting in an equally as uneven economic recovery. Nowhere is this more evident than in emerging market economies.

The health of the global economy is predicated on the health of the global population. Optimistic outlooks have anticipated a strong economic rebound worldwide in the second quarter or later this year. But these outlooks are closely connected to both an efficacious COVID-19 vaccine deployment and collective control over the spread of new variants. Current vaccination efforts and levels of activity vary too greatly across regions.

Because emerging market economies are suffering the worst of the latest waves of infections, despite intermittent lockdowns, such countries will continue to be highly vulnerable to pandemic-prompted setbacks, according to S&P Global Ratings. Such conditions could continue even after emerging market economies return to pre-pandemic GDP levels.

“In some emerging market (EM) economies where output recovers faster, debt and external metrics worsen more than in EMs with slower recoveries, which could have negative implications for economic growth down the line,” S&P Global Ratings said in a recent report. “Brazil, India, Poland, Thailand, and Turkey are examples of EMs that outperform in terms of the return to their pre-pandemic real GDP, but have debt or external metrics that have worsened more than those of their EM peers. Based on our projections, this dynamic will persist for several years following the COVID-19-related downturn.”

Higher inflation could likewise adversely affect emerging market economies. S&P Global Ratings expects the recent spike in U.S. inflation, which is believed to be transitory, to filter out of the economy over the year. But central banks in emerging market economies could tighten their monetary policy in the near-term, when their nations’ economic recoveries are fragile, due to rising commodity prices and inflation expectations.

“Higher energy prices are likely to keep pressuring headline inflation in the coming months,” S&P Global Ratings said. “This year’s increase in oil prices, combined with the uptick in other key commodities such as food, will keep headline inflation numbers on the higher side in the coming months, and weigh on central banks to remain hawkish.”

Today is Monday, May 17, 2021, and here is today’s essential intelligence.

Surprise Driver For Some Q1 Gas Utility Earnings Beats: Winter Storm Windfalls

Natural gas utilities reported another solid quarter of earnings to kick off 2021, with several gas distributors crediting winter storm tailwinds for profits that exceeded expectations and strong year-over-year gains. Eight of nine gas utilities in a group selected by S&P Global Market Intelligence posted EPS that surpassed S&P Capital IQ consensus normalized earnings estimates. All of the companies posted year-over-year EPS gains, and five of those companies have now posted at least four consecutive quarters of earnings improvement.

—Read the full article from S&P Global Market Intelligence

India CEO Series: Cairn Oil & Gas Says Oil Price Recovery Will Support India's Upstream Push

Cairn Oil & Gas, Vedanta Limited is hoping to double its share of India's oil and gas production over the next few years and is confident that a sustained price recovery will offer plentiful opportunities to invest in the upstream sector, the company's deputy CEO, Prachur Sah, who is currently heading Cairn's operations, told S&P Global Platts.

—Read the full article from S&P Global Platts

The Jump In U.S. Inflation Is Transitory And Consistent With S&P Global Ratings’ Recovery Story

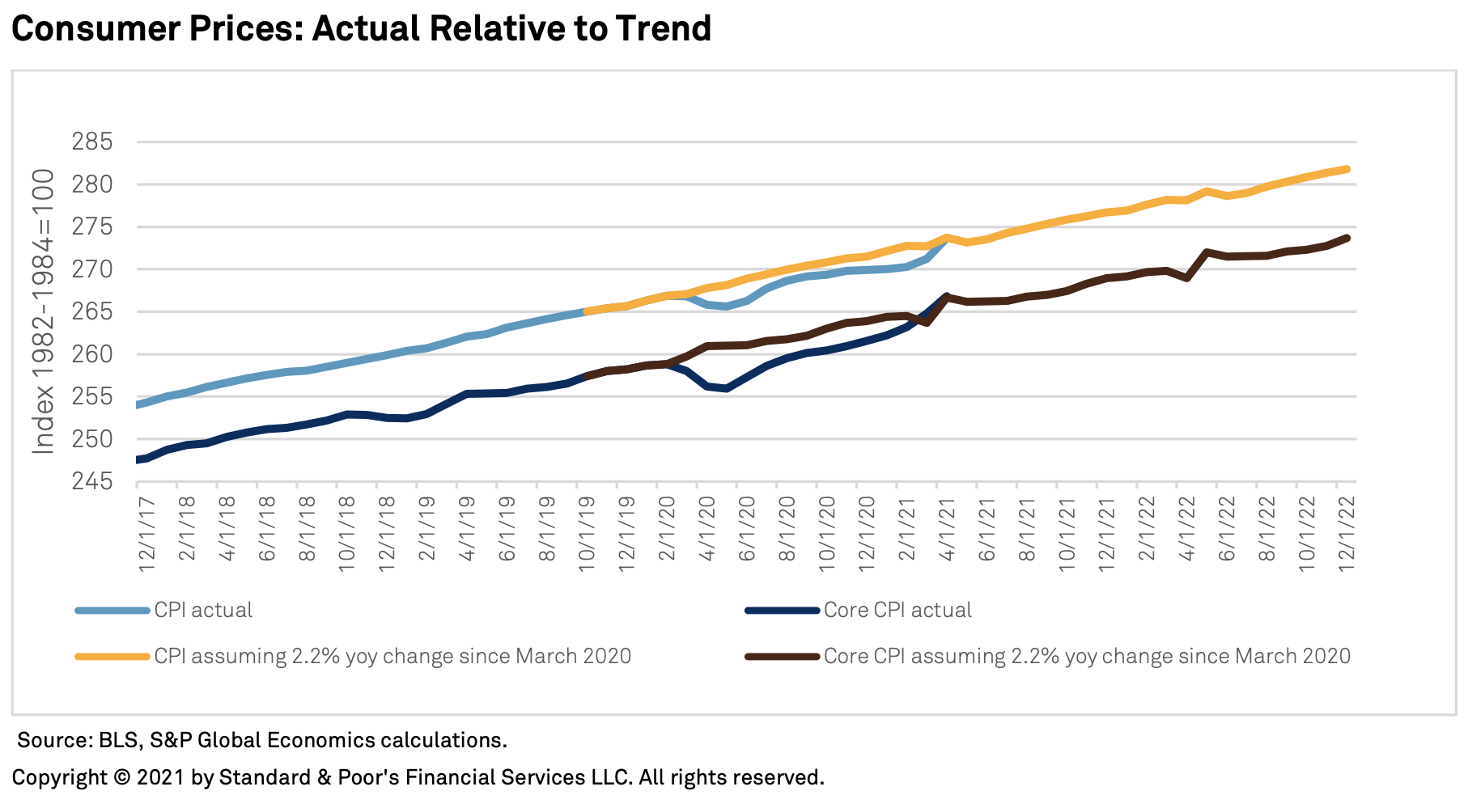

Watching the jump in April consumer prices at first blush was unnerving. Headline CPI topped 4.2% year-over-year (a 13-year high) and core CPI reached 3.0% year-over-year (a twenty-five-year high). In contrast to much of the market commentary, we were not surprised. Indeed, S&P Global Ratings expected to see a spike in inflation as the U.S. economy climbs the acceleration ramp onto the superhighway, as GDP jumped 6.4% in the first quarter and S&P Global Ratings expects a surge of 11.3% in the second quarter fueled by a, faster vaccination rollout and reopening schedule on top of sizable savings and pent-up demand.

—Read the full report from S&P Global Ratings

Default, Transition, and Recovery: Two Distressed Exchanges Push The 2021 Corporate Default Tally To 41

This year's global corporate default tally has risen to 41 after two companies defaulted since S&P Global Ratings’ last report: Switzerland-based catering and provisioning services provider Gategroup, and Holding AG Delaware-based aircraft leasing company Voyager Aviation Holdings LLC. Both additions to this week's tally were related to distressed exchanges--bringing the total number of defaults related to distressed exchanges in 2021 to 24 (nearly 60% of global defaults).

—Read the full report from S&P Global Ratings

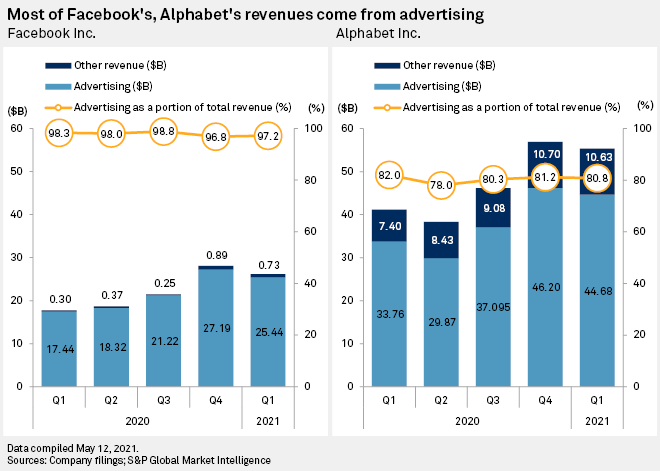

Tech Giants' Growth Overshadowed By Regulatory Risks, Ad Challenges

Big tech's meteoric rise in 2021 could soon come crashing down to Earth amid the specter of new internet regulations and changes to the digital advertising landscape, analysts say.

—Read the full article from S&P Global Market Intelligence

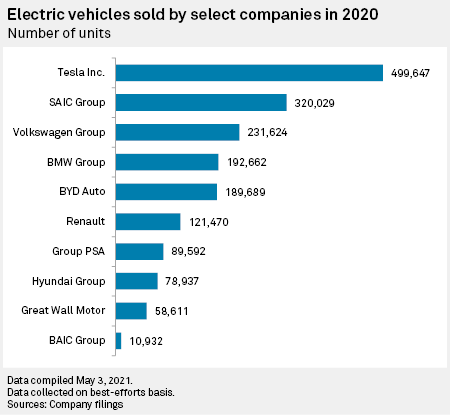

Electric Vehicle Ambitions Buffeted By Political Crosswinds In US Market

As the world transitions to an electrified transportation fleet, the U.S. remains a wild card on electric vehicles and battery manufacturing, largely due to the political polarization gripping Washington, according to industry observers.

—Read the full article from S&P Global Market Intelligence

Former FERC Members Welcome Turn To Environmental Justice, With Some Precaution

As the Biden administration elevates racial equity matters, several former Federal Energy Regulatory Commission members welcomed the agency's recent resolve to turn greater attention to environmental justice implications of its decisions, even as one recent case at FERC highlighted some challenges to balancing competing interests.

—Read the full article from S&P Global Platts

Texas Lawmakers Advance Eight Energy Bills; Send Two For Governor's Signature

Texas lawmakers advanced during the week ending May 14 eight bills related to the mid-February storm that shut off power for about 4 million customers, with two sent to Gov. Greg Abbot to sign. But none of the eight bills addressed key concerns around weatherizing power infrastructure.

—Read the full article from S&P Global Platts

Listen: Iran Talks, US Sanctions, OPEC+ Supply Balancing Dominate Oil Market Geopolitics

Size up some of the top geopolitical factors influencing oil markets with Paul Sheldon, chief geopolitical adviser for S&P Global Platts Analytics. The US and Iran entered a fourth round of indirect talks in Vienna this month. Sheldon explains why he still sees good odds of a framework deal emerging within weeks and what that would mean for the US easing sanctions on Iran's oil, petrochemical, shipping and other sectors. Sheldon also previews OPEC's June 1 meeting, looks further out at the durability of the OPEC+ alliance, and gives his outlook for any easing of Venezuela sanctions.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Platts

US Concerned About Anti-Competition Issues From Proposed Canadian National-Kansas City Southern Acquisition

The US Department of Justice on May 14 sought to derail the proposed $30.5 billion acquisition of Kansas City Southern by Canadian National Railroad, arguing it presents serious anti-competition concerns within the US railroad network. Register Now The DOJ is asking the railroad regulatory body, the US Surface Transportation Board, to reject Canadian National's request for a voting trust after the STB already approved similar terms for a competing deal by CN's smaller rival, Canadian Pacific, to acquire Kansas City Southern for $25 billion.

—Read the full article from S&P Global Platts

Iron Ore Exports In Low Gear Over January-April, Need To Ramp Up: Platts Analytics

Most major iron ore producers fell behind on their export guidance on an annualized basis over January-April which, along with a slow start to May, indicates potentially ongoing weak supply in 2021, according to S&P Global Platts Analytics.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language