Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 15 May, 2024

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

The Early Days of Direct Air Carbon Capture

When videocassette recorders were made commercially available in 1970, prices started at $1,000. Adjusted for inflation, that is equivalent to about $8,050 today. New technologies frequently have high price points. As time progresses, efficiencies in manufacturing and economies of scale reduce costs. Critics of direct air capture (DAC) point out that carbon credits from DAC projects are expensive, costing $300-$2,000 per metric ton of CO2 equivalent depending on the technology and scale, according to data from S&P Global Commodity Insights. The current price in voluntary carbon markets for carbon credits is about $109/mt CO2e. That price gap would be meaningful and disqualifying if the price of DAC never comes down. However, because the technology is in its infancy, it would be ahistorical to argue that the price of DAC credits will never moderate.

The Mammoth DAC and storage plant, located in Iceland, has begun removing CO2 from the atmosphere, according to plant operator Climeworks. Once fully operational, the Mammoth facility will be able to remove 36,000 metric tons of CO2 from the air annually. This CO2 is transported underground, where it reacts naturally with basaltic rock and is stored as stone. The Mammoth plant is 10 times larger than Climeworks’ previous Icelandic facility, Orca. The operator has announced plans to develop similar projects in the US, Norway, Kenya and Canada.

Multiple DAC facilities are being constructed worldwide with an expected capacity of 8.5 million metric tons of CO2e by 2030. However, it should be noted that under the International Energy Agency's Net Zero Emissions by 2050 Scenario, DAC should capture almost 65 MMt of CO2e per year by 2030. The gap between expected capacity and net-zero targets gives credence to critics who believe that carbon capture is progressing “too little, too late, too slow.”

Companies in industries requiring heavy abatement of carbon emissions, such as the power sector, frequently dismiss carbon capture as uneconomical, impractical and untested. Technological efficiencies and process improvements that undermine that argument are not always welcome. On April 24, the Environmental Protection Agency finalized a rule that would effectively require carbon capture technology for many power plants. Power industry groups were unsparing in their criticism of the new rule.

Carbon capture and storage (CCS) "is not yet ready for full-scale, economywide deployment, nor is there sufficient time to permit, finance and build the CCS infrastructure needed for compliance by 2032," said Dan Brouillette, president and CEO of the Edison Electric Institute.

The Biden administration has promoted carbon capture initiatives with tax credits of up to $85 per metric ton of CO2 captured. An uptick in permitting approvals for carbon wells around the US appears to indicate a commitment by the government and private industry to remove carbon and store it permanently and safely.

Today is Wednesday, May 15, 2024, and here is today’s essential intelligence.

Written by Nathan Hunt.

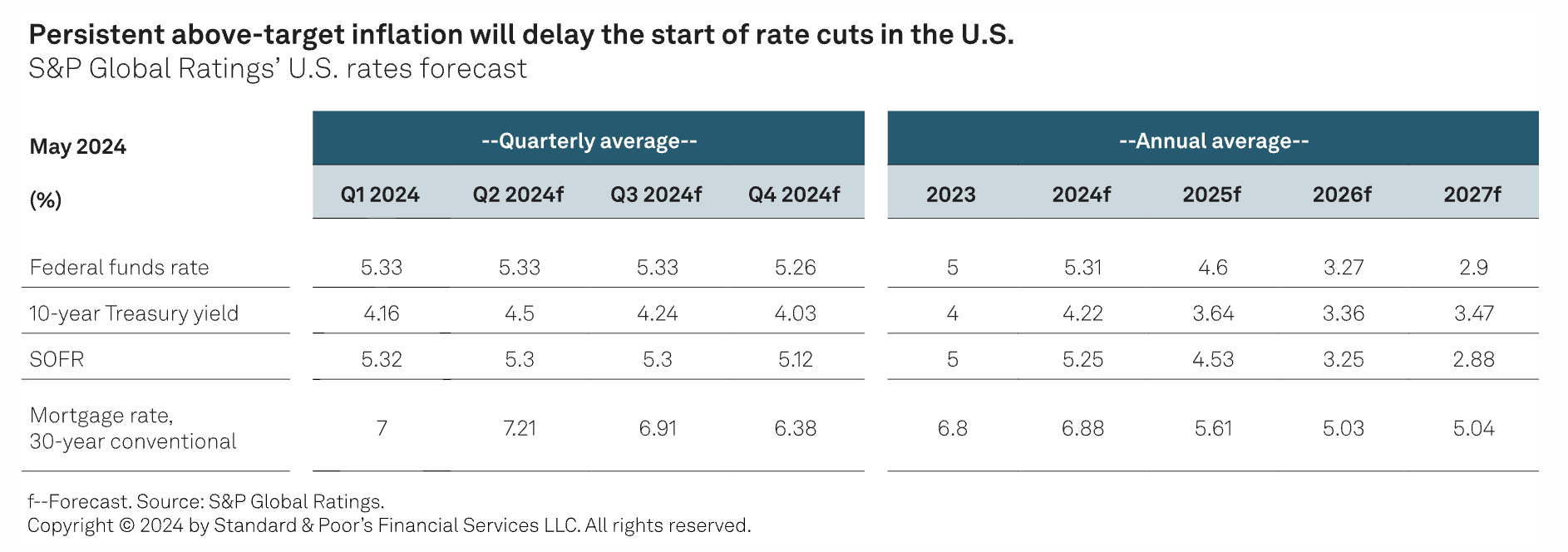

CreditWeek: What Does The Delay In Fed Rate Cuts Mean For The Economy And Credit?

With the Federal Reserve now looking set to delay a rate cut until at least the fourth quarter, borrowers that were waiting for lower rates to refinance debt (especially those at the lower end of the credit spectrum) could get squeezed. After the Fed held its policy rate at 5.25%-5.50% at its May 1 meeting, Chair Jerome Powell said that rate cuts won't occur until policymakers are confident that inflation is on a sustainable path toward the central bank's 2% target (barring an unexpected weakening in the labor market).

—Read the article from S&P Global Ratings

Access more insights on the global economy >

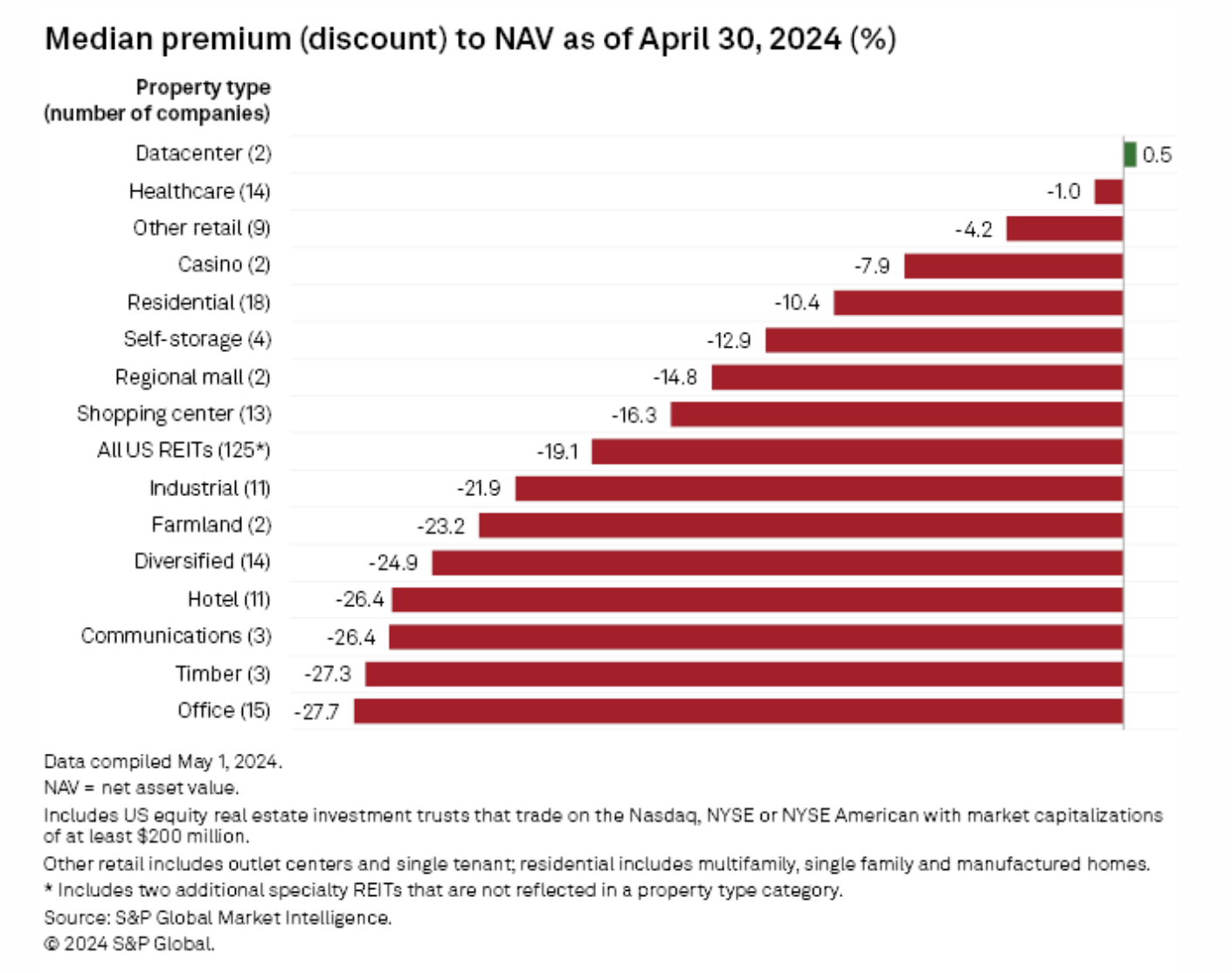

REIT Valuations Down In April; Close At 19% Median Discount

Share prices for US equity real estate investment trusts fell in April, further bringing down price-to-net asset value valuations for the sector. The REIT sector closed April 30 at a 19.1% median discount to their consensus net asset value (NAV) per share estimates, a 4.1 percentage point expansion from the median 15% discount as of March-end, according to S&P Global Market Intelligence data.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

Listen: Diesel Flows Shift As Brazil Fuels Up

Diesel imports into Brazil have risen in recent months, but remains below a recent peak seen in January as the South American country deals with new payment terms for Russian barrels. Not only that, but Russian diesel supplies have tightened following drone attacks on Russian refineries by Ukraine. Will USGC refiners return to the #1 spot in supplying Brazilian diesel imports? What impact has this shift had on US diesel exports? Jeff Mower, director of Americas oil news, discusses these topics and more with senior refinery editor Janet McGurty, Latin American refined products editor Maria Jimenez Moya, and US refined products editor Ben Peyton.

—Listen and subscribe to the podcast from S&P Global Commodity Insights

Access more insights on global trade >

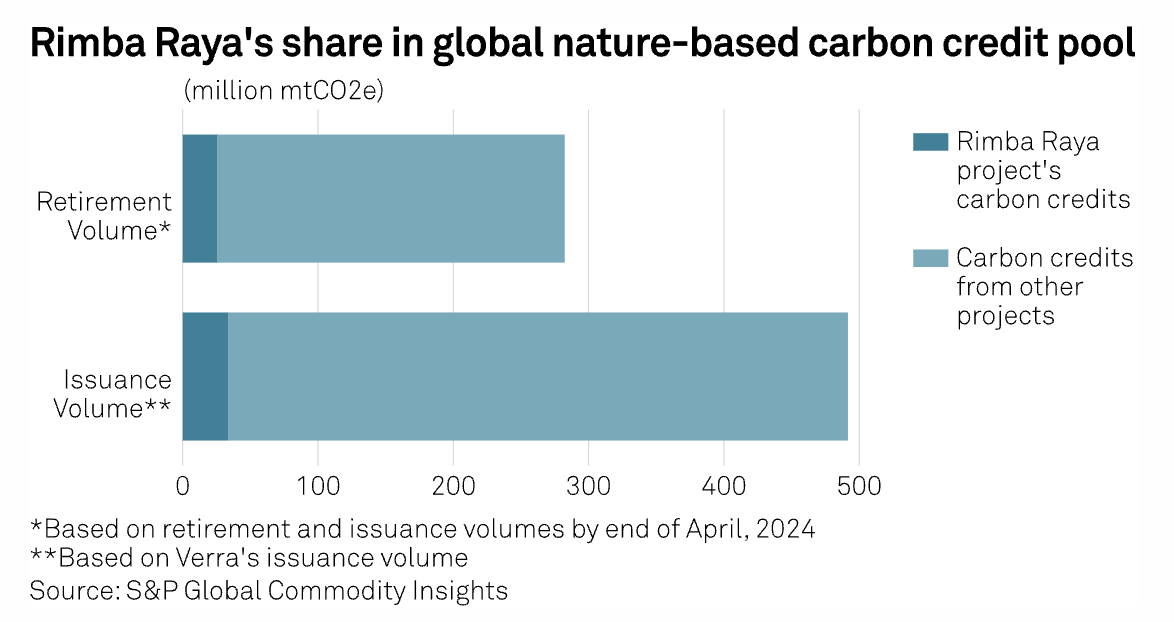

Rimba Raya Reignites Regulatory And Transparency Concerns For Carbon Projects

While the license revocation of Rimba Raya Biodiversity Reserve Project has added to the long list of regulatory risks for carbon projects in Indonesia, the lack of transparency has made it tougher for market participants to manage the disruption. Carbon markets are vulnerable to political risks due to their small size and because efforts to strengthen market mechanisms are still work in progress. Individual policy decisions by a host country have the potential to impact a significant share of global carbon credit supply.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

Dilemmas In LNG Term Deals Amid Higher Henry Hub Forward Curves

As international LNG prices show signs of stabilizing following market fluctuations triggered by tensions between Russia and Ukraine, coupled with several contracts nearing expiration around 2024 and 2025, Asian buyers have initiated negotiations for long-term contracts, or LTCs, since the beginning of 2024. According to market data, approximately ten LTCs have been signed since January 2024, with three or more involving Henry Hub linkage.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

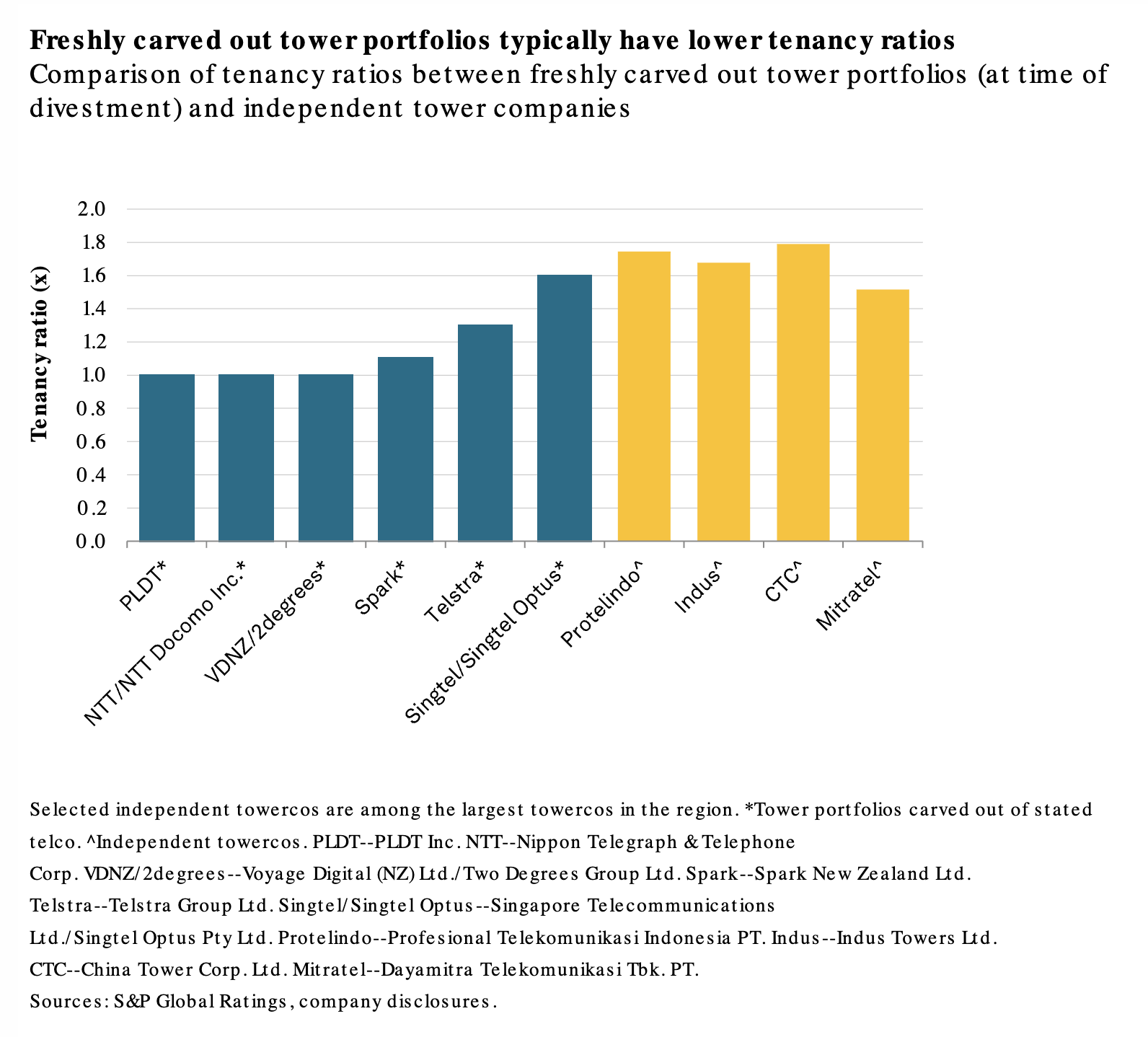

Asia-Pacific Towercos: More Construction, Colocation and Consolidation Ahead

The earning potential for Asia-Pacific telecom tower companies is strong. A boom in tower sales has spawned more towercos and paved the way for more sharing of towers among telcos, or colocation, and possibly consolidation within the tower industry. The surge in data traffic as well as the advance of 5G technology will support rising tower demand. Much of the risk to the credit quality of these towercos will largely depend on their appetite for growth. Investors ask about the key credit differentiators, trends and risks in the towerco sector. They also want to understand how S&P Global Ratings views the unique characteristics of freshly carved out tower portfolios. S&P Global Ratings addresses their most common queries here.

—Read the article from S&P Global Ratings