Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 14 May, 2024

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

A Quiet Protectionism Emerges in US Trade Policy

After spending decades as the global cheerleader for free trade, the US has rediscovered tariffs and embargoes as tools of industrial policy. While there have always been critics of US trade policy who have suggested that the American commitment to neoliberalism was more situational than doctrinaire, the Biden administration has continued and expanded the more restrictive trade policies of the previous administration. While the rhetoric of protectionism has become more muted during Biden’s time in office, it has nonetheless served the interests of US industry.

The US recently announced a new round of tariffs on steel and aluminum from China. The new tariffs include a more than threefold increase in the rate charged on Chinese steel. The Chinese steel industry has been hit by tariffs and restrictions from various countries as plummeting domestic prices have led to Chinese steel manufacturers exporting steel at very low prices. According to S&P Global Market Intelligence, total Chinese exports of iron and steel increased 59.2% year over year in the fourth quarter of 2023 and rose 34.5% year over year in January and February combined. Higher US tariffs on Chinese steel may be interpreted as a preemptive attempt to keep cheaper Chinese steel from affecting US steel manufacturers. They may also be an election-year attempt to appeal to voters in steel-producing regions.

Higher aluminum tariffs on Chinese exports may affect prices in a market where Russian aluminum exports are already restricted. However, 52.6% of the US’ aluminum comes from Canada.

Restrictions on US trade with Russia continue following the invasion of Ukraine in 2022. While the aim of these policies among the US and its NATO allies has been to avoid funding the Russian invasion through trade, the impact has been a boon for US oil, coal and natural gas companies. A US ban on Russian low-enriched uranium imports, which the US Senate approved April 30, drew criticism from Russian state nuclear company Rosatom. Rosatom described the decision as having “a clearly political undertone.” The US provides only 3% of the world’s uranium fuel; over 50% of uranium comes from Australia, Kazakhstan and Canada.

On the flip side of tariffs are tax incentives for domestic industries. Both the US and Europe have provided incentives to domestic manufacturers of electric vehicle batteries and solar panels. The US' Inflation Reduction Act and the EU's Net-Zero Industry Act were intended to break Chinese dominance in these growing industries through targeted funding. According to S&P Global Commodity Insights, US investment in EV-battery making amounted to $40 billion between 2020 and the third quarter of 2023. These incentives have already begun to change market dynamics. China went from making up 85% of global investments in clean technology in 2022 to 75% in 2023. Currently, China accounts for 80% of battery manufacturing capacity. That could fall as low as 60% by 2030 as US and European manufacturers catch up.

Today is Tuesday, May 14, 2024, and here is today’s essential intelligence.

Written by Nathan Hunt.

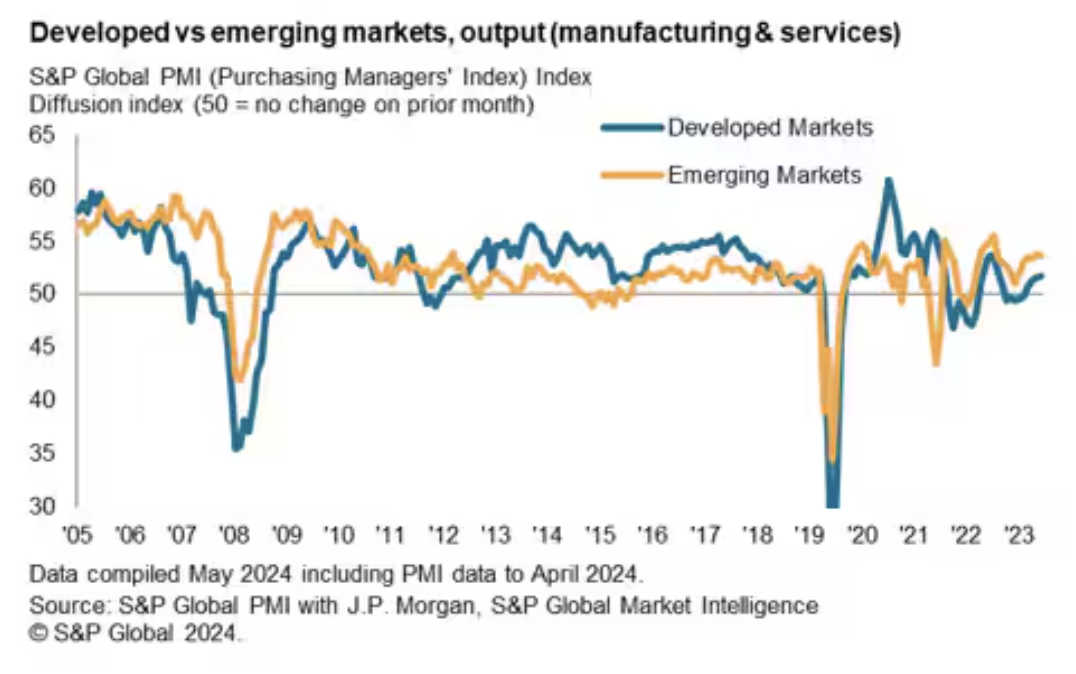

Emerging Markets New Business Expands At Fastest Pace In Nearly A Year

Emerging market economic growth was sustained at a solid rate at the start of the second quarter of 2024, according to PMI survey data with well-balanced improvements recorded across both the manufacturing and service sectors. Forward-looking indicators continued to point to further near-term expansions, with new business inflows notably rising at the fastest pace in close to a year.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

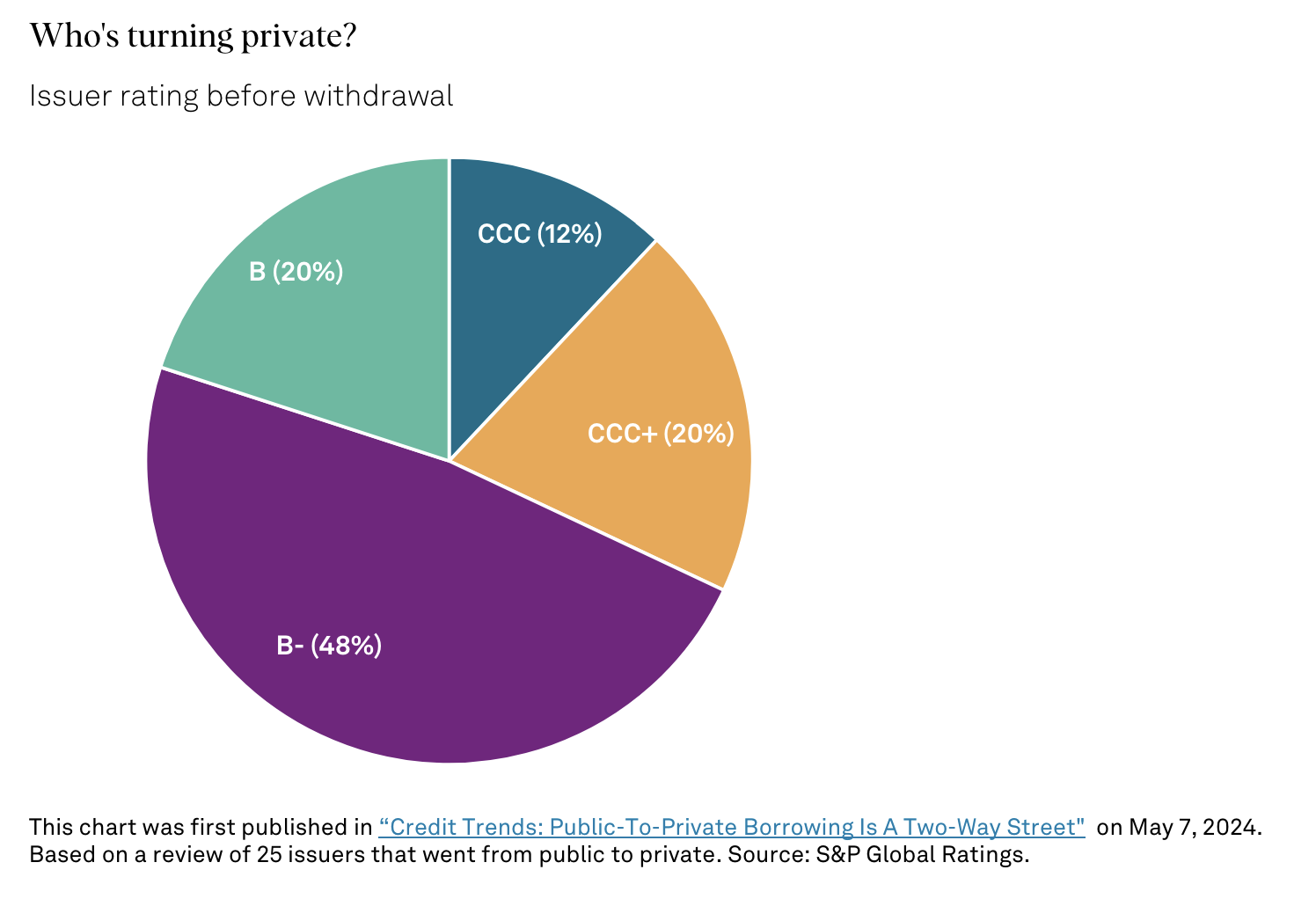

This Week In Credit: Positive Rating Trends Make A Strong Return

A positive week for rating activity as the number of positive rating actions and outlook changes was double that of negative ones. That positive picture was bolstered by the addition of one rising star, Canada-based telecommunications provider Videotron Ltee, which brings this year's total to 11. There was only one default, down from four in the prior week. U.S. radio broadcaster Cumulus Media Inc. completed a debt restructuring, which we view as distressed and tantamount to a default. Credit pricing also had a positive week, with bond and CDS spreads tightening across the board and benchmark yields falling.

—Read the article from S&P Global Ratings

Access more insights on capital markets >

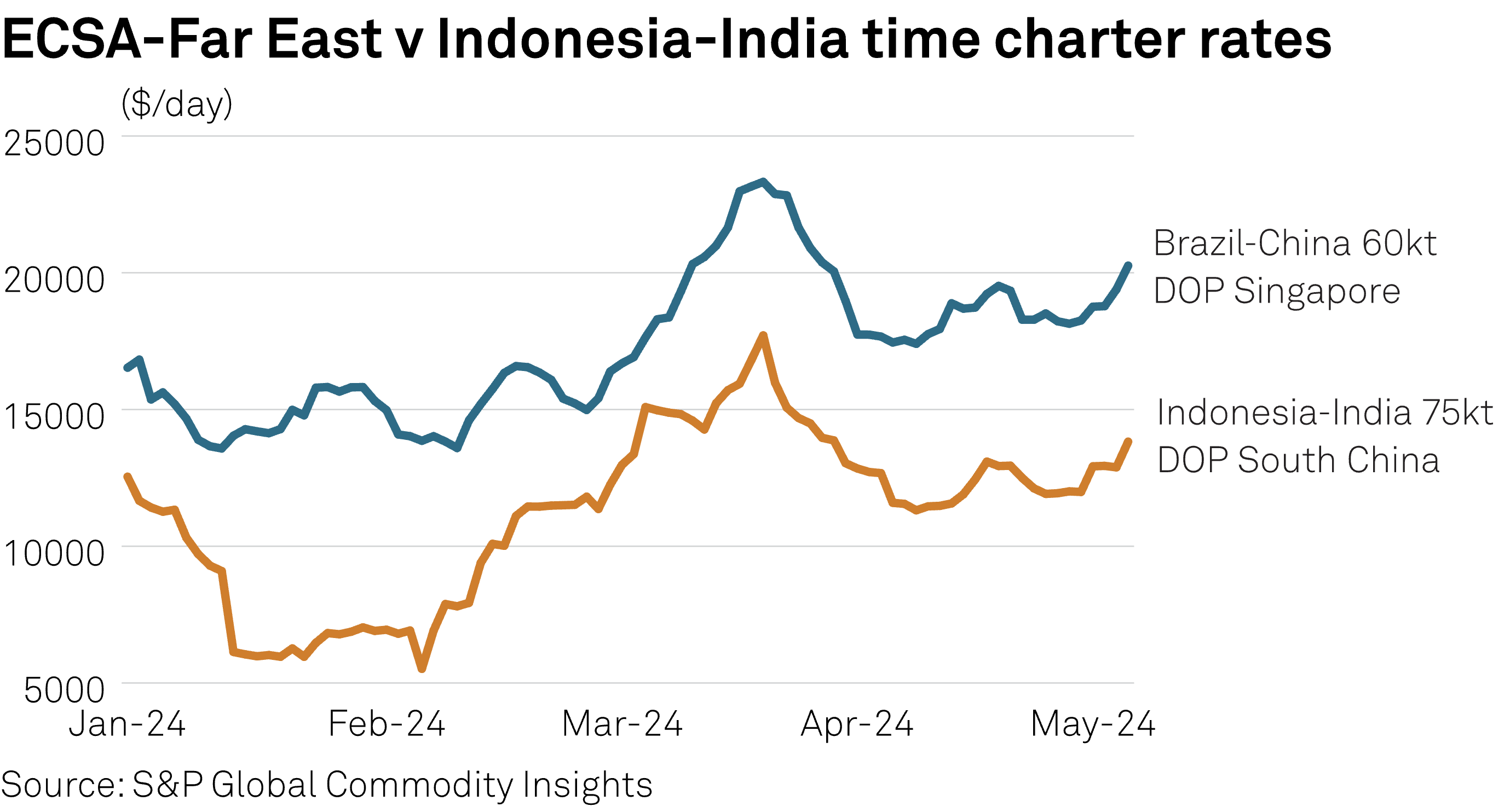

Atlantic Dry Bulk Market Sees Easing Tonnage Concerns Amid Indonesia-India Activity

The concerns of oversupply of tonnage from last week are expected to ease in the coming weeks as market sources now express confidence citing a balanced supply of ships, partly due to concurrent pick up in pacific activity, alongside a healthy cargo book extending through June. A broker in the Pacific business highlighted heightened activity in the Indonesia-India business, stating, "We are seeing a lot of cargoes for both Panamaxes and Supramaxes." Discussing the trade, he confirmed a boost due to stockpiling ahead of the monsoon season in India. Another broker emphasized significant coal flows to Southeast Asia, particularly Vietnam from South Africa. "I've never seen such high volumes of coal to Vietnam in the previous weeks, and this trade seems to be gaining more momentum."

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: ISSB Vice Chair Sue Lloyd Talks Aligning Sustainability Standards Across Jurisdictions

In this episode of the ESG Insider podcast, we’re taking you to London for the third annual S&P Global Sustainable1 Summit, where we sit down with International Sustainability Standards Board Vice Chair Sue Lloyd. Sue was a keynote speaker at the conference, where sustainability leaders from across industries and the investment community gathered on May 8. In the interview, Sue discusses global uptake of the ISSB’s first two standards, launched in June 2023. She also tells us what to expect from the organization for the remainder of 2024 — including a big focus on helping jurisdictions around the world align with ISSB standards.

—Listen and subscribe to the podcast from S&P Global Sustainable1

Access more insights on sustainability >

Listen: Maintaining Reliability In The Face Of An Increasingly Complex US Power Grid

As utilities grapple with how best to expand the US electric grid to improve reliability and support technologies like electric vehicles, they’re turning to a host of technologies like grid storage and AI that can help with planning and managing new demands. On this week’s episode, co-host Taylor Kuykendall and correspondent Camellia Moors speak with guests Anthony Allard, executive vice president and head of North America at Hitachi Energy, Josh Brumberger, CEO of Utilidata, Robert Piconi, chairman and CEO of Energy Vault, and Paul Doherty, principal communications representative at PG&E.

—Listen and subscribe to the podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

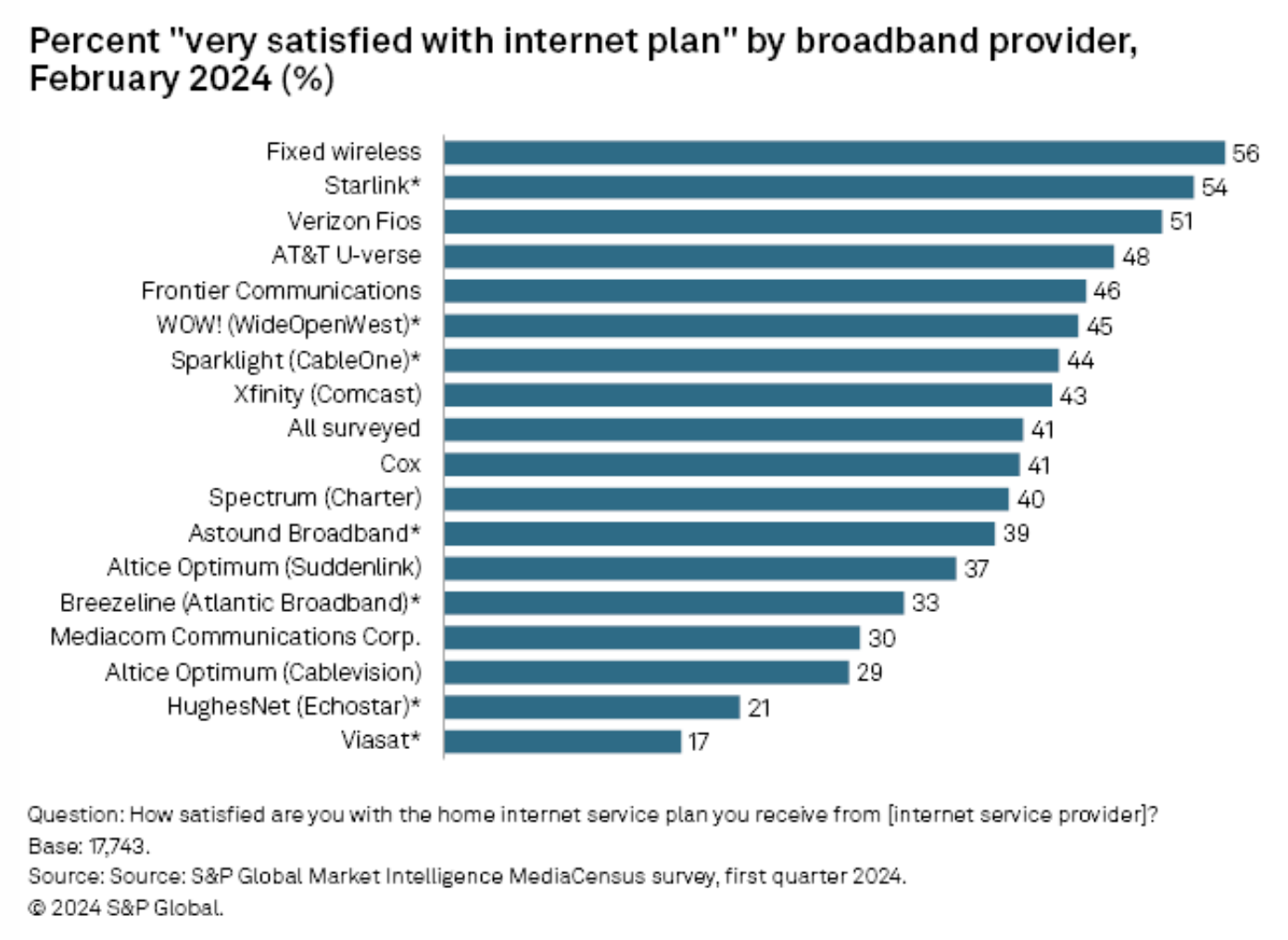

Most Satisfied US Broadband Subscribers? Fixed Wireless

The extent of fixed wireless fandom in the US might surprise some who have recently been dismissing the technology as inferior and its recent subscriber growth as temporary. With 56% of fixed wireless survey takers indicating they were very satisfied with their broadband plans, the group ranked highest on the satisfaction scale, according to our recent survey.

—Read the article from S&P Global Market Intelligence