Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 8 Mar, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Uncertainty Remains One Year Into Russia-Ukraine War

As Russia’s invasion of Ukraine enters its second year, the outcome of the war remains uncertain, and its end appears to be nowhere near. Regardless of how or when the conflict ends, it will have a deep and drawn-out impact on global markets, macroeconomic outlooks and credit conditions, in addition to a heavy toll on human life and critical infrastructure.

The wide-ranging sanctions imposed on Russia by Western countries in response to the invasion, which began Feb. 24, 2022, have resulted in a dramatic shift in global oil and gas markets. The ban on Russian oil imports by the U.S. and others shortly after the onset of the conflict, followed by the EU embargo on seaborne crude and certain refined fuel products, caused supply shortages and volatile prices globally. Gas and power prices also skyrocketed because of the invasion, which helped trigger an energy crisis in Europe.

To curb oil supply disruptions and price hikes while reducing Russia’s ability to fund the war, the U.S. co-led the $60-per-barrel price cap on Russian seaborne crude in December 2022 with its fellow Group of Seven nations and Australia. The U.S. also released to the market over 600,000 barrels per day from the Strategic Petroleum Reserve in 2022, which was an indirect impact of the war, S&P Global Platts Analytics Chief Geopolitical Advisor Paul Sheldon said, adding that there are now questions as to whether the U.S. will use its Strategic Petroleum Reserve to influence short-term pricing or for geopolitical reasons.

“It adds another layer of volatility because if you have governments getting into the business of trying to influence near-term prices, it goes both directions. There’s uncertainty over how the U.S. is going to be able to repurchase the remaining 40 million to 60 million barrels of [Strategic Petroleum Reserve] crude that were delivered in 2022,” Sheldon said in an episode of the "Platts Commodities Focus" podcast.

Similarly, the war accelerated Russia’s pivot to Asian markets. Amid the EU’s reluctance to import Russian oil, Russia shifted its seaborne crude cargoes eastward, particularly to China and India, as the two Asian countries sought to diversify and secure their energy needs. However, moving oil to the East proved difficult for Russia as its infrastructure capacity was not prepared for the shift.

"Ultimately, you have a situation where you have ships in the Baltic and Black seas doing ship-to-ship transfers and going on a very long, inefficient voyage East,” Sheldon said. “Russia is losing pricing power with its remaining customers, even beyond bearing the higher cost of transportation and insurance.”

The cost of the war is increasingly weighing on Russia's oil revenue-dependent economy, and it is possible the country’s response will threaten upstream investment and energy production in the longer term. "The most unpleasant things might be related to domestic taxation — the government will most likely increase the state's take in order to cover the budget deficit and growing military expenditures," Tatiana Mitrova, research fellow at Columbia University's Center on Global Energy Policy, told S&P Global Commodity Insights.

From a maritime and trade finance perspective, shipping companies, cargo operators, banks and insurers are reexamining their compliance programs to align them with global regulatory policies as a result of the most recent sanctions. In terms of global food production, the invasion has affected prices directly through supply disruptions and indirectly through rising fertilizer prices, according to S&P Global Market Intelligence.

As the war escalates, more sanctions against Russia are expected. In the macroeconomic landscape, tougher sanctions increase the risk of restricted trade and capital flows, which will likely distress overall confidence and business conditions. When it comes to credit, entities affected by international sanctions face greater operating and financial risks, and thus the probability of a default, according to S&P Global Ratings.

"Ultimately I think the biggest risk, the most identifiable risk, is that an escalation in Ukraine causes the West to get a tougher sanctions posture. … Sanctions have really become the West's preferred method for waging conflict," Sheldon said on the podcast.

Although there is potential for the war to further inflict infrastructure destruction, that is more of a “black swan risk,” Sheldon said.

Today is Wednesday, March 8, 2023, and here is today’s essential intelligence.

Written by Pam Rosacia.

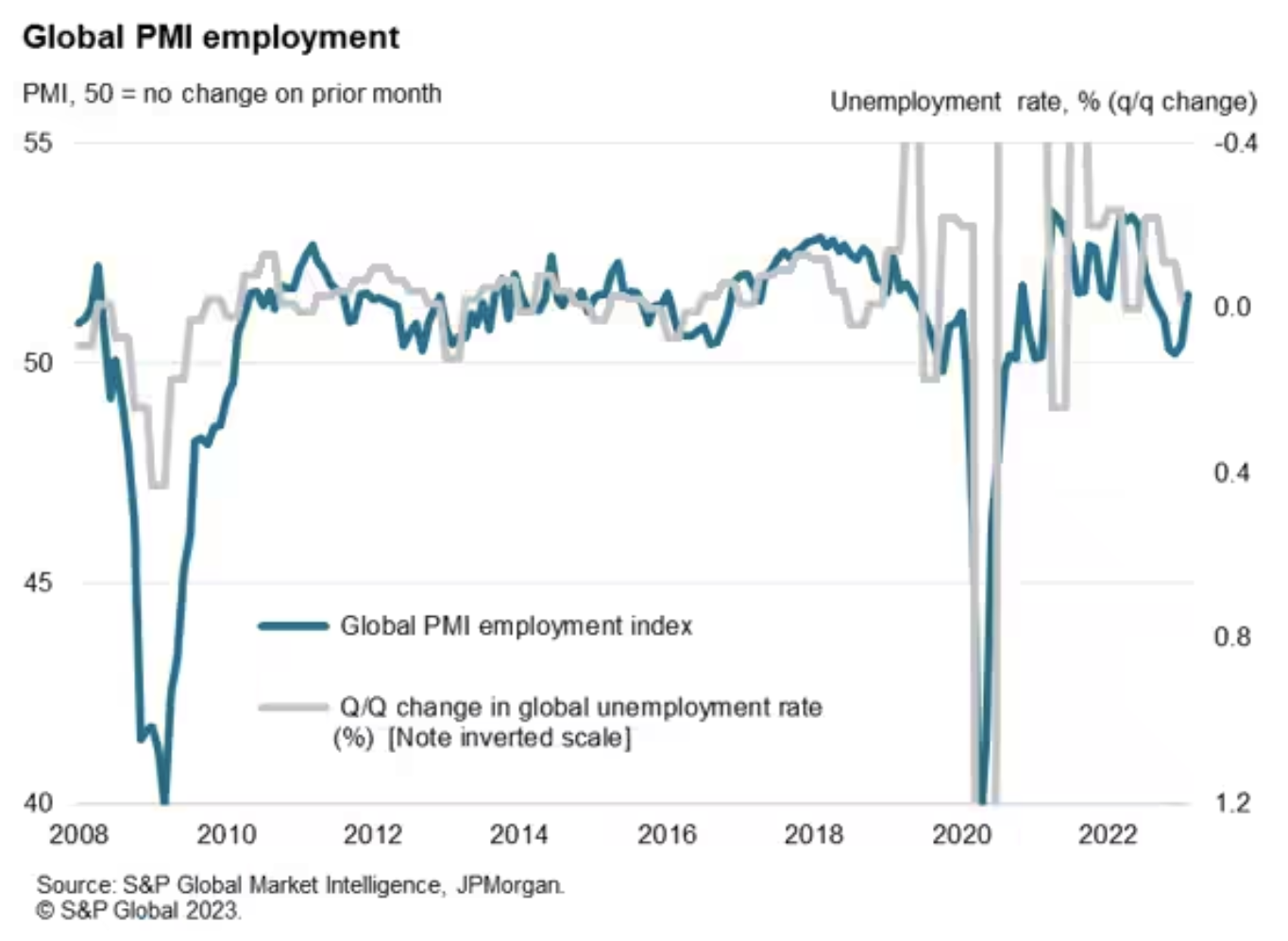

Global Economic Growth Accelerates To Eight-Month High In February

Global jobs growth accelerated to a six-month high in February as improving demand conditions and rising business confidence encouraged greater hiring, with job gains reported in all major economies bar Brazil. The upturn was led by rising employment in consumer-facing services, notably healthcare services and tourism and recreation, buoyed in turn by the re-opening of the mainland Chinese economy. However, the number of companies reporting that operating capacity continued to be constrained by a lock of workers remained well above the long-run average, causing wage pressures to also remain well above their long run trend. Such tightness of the labor markets and the resulting inflationary pressures remain key concerns for the economic outlook.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

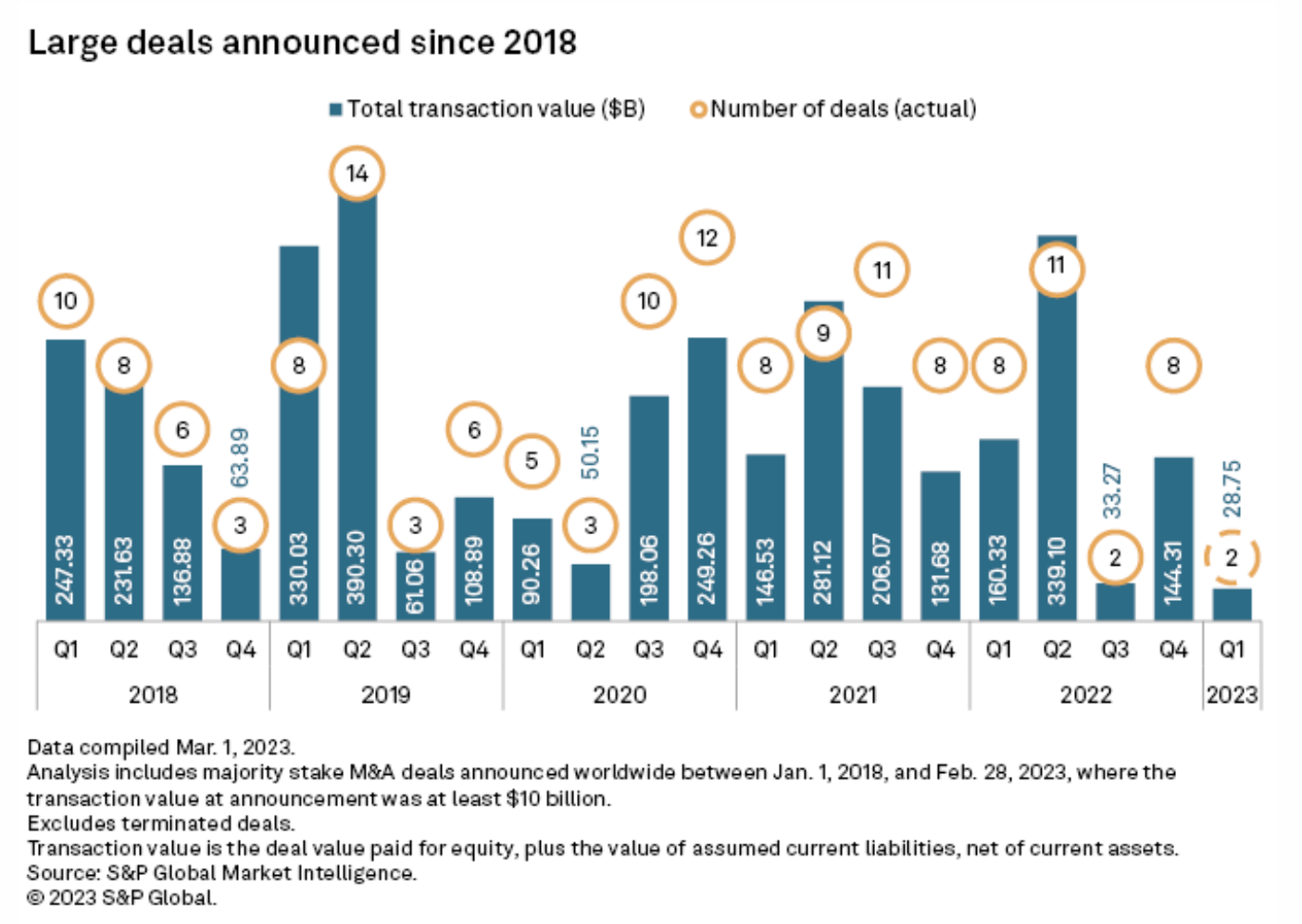

$10B-Plus M&A Dry Spell Stretches Through February

The slow pace of large M&A deals continued in February. Only two global transactions announced in February topped $10 billion: CVS Health Corp.'s $10.42 billion agreement to purchase Oak Street Health Inc. and Newmont Corp.'s bid of more than $18 billion for Australia-based Newcrest Mining Ltd. Both deals were larger than any M&A transactions announced in January.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

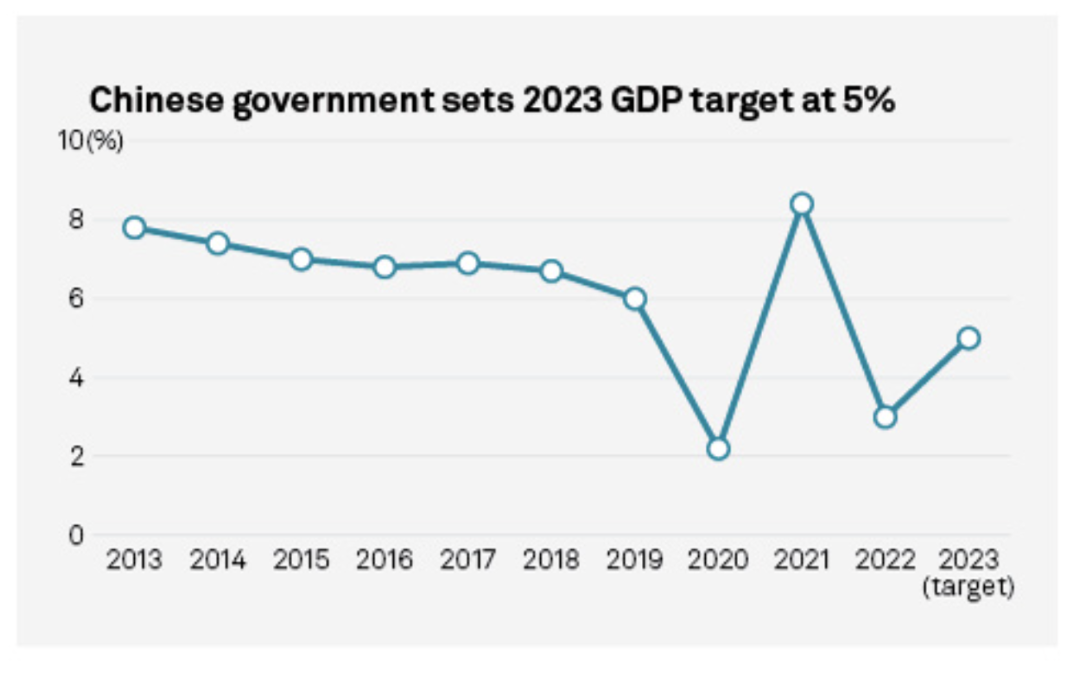

What China's 'Two Sessions' Mean For 2023 Commodity Demand

China's National People's Congress has set the stage for the country's post-pandemic economic recovery and long-term roadmap under new leadership. On March 5, retiring Prime Minister Li Keqiang set a conservative 5% GDP growth target for 2023, which is higher than the 3% achieved in 2022, and will help support commodities demand. But it also signals an uphill task for Beijing in sustaining modest growth amid broader economic restructuring, financial risks from the property sector and global uncertainties.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: Women In Leadership: How Norwegian Industrial CEO Puts Diversity On The Agenda

March is Women’s History Month, and March 8 is International Women’s Day. To mark the occasion, S&P Global Sustainable1 is bringing you a special series of the ESG Insider podcast focused on women in leadership. Hosts Lindsey Hall and Esther Whieldon speak to women CEOs and executives from across industries and around the globe. In the first interview of the series, they speak to Hilde Aasheim, CEO of Norsk Hydro, a large Norwegian aluminum and energy producer with a big focus on renewables and operations in 40 countries. She tells them how she works with women across her company to help them develop their careers. She also explains her career path to the C-suite, and how she approaches diversity, equity and inclusion in her role.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Sustainable1

Access more insights on sustainability >

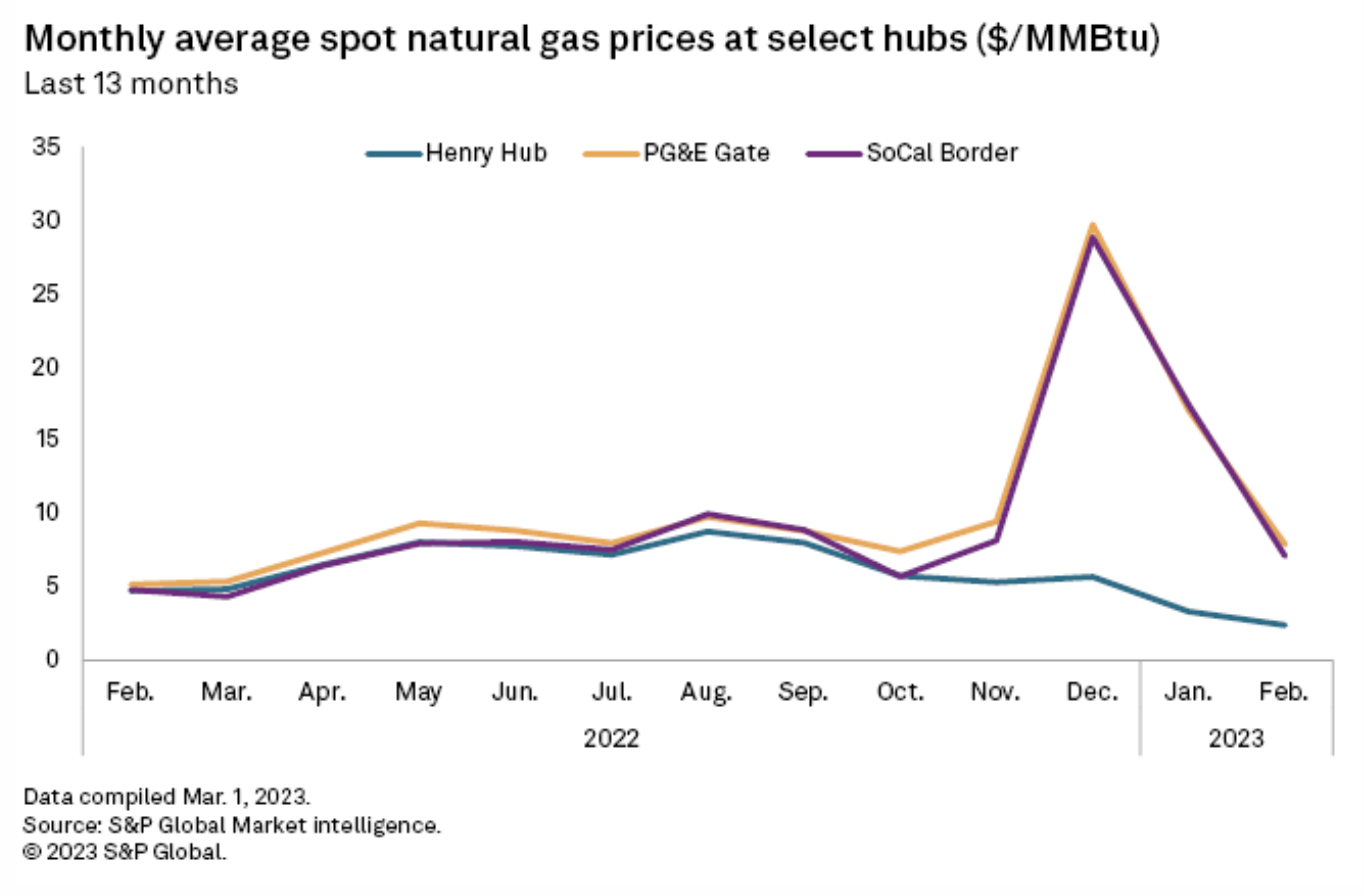

U.S. West Gas Prices Fell By 54% From Prior Month In February But Were Up YOY

The average price of natural gas for day-ahead delivery fell month over month in February in all U.S. regions except the Northeast. The West reported the largest drop in February, with gas prices in the region plunging 53.89% from the prior month. The region was at a 6.5% gain year over year to land at an average of $4.876/MMBtu. The Northeast rose by more than a third month over month, but it was also down by about a third year over year at $4.711/MMBtu. The Midcontinent recorded month-over-month and year-over-year decreases at 24.92% and 48.61% respectively, arriving at an average of $2.333/MMBtu.

—Read the article from S&P Global Market Intelligence

Access more insights on energy and commodities >

Fiber Technology Dominates Asia-Pacific Broadband Growth

Fiber deployment across markets and the demand for fast and reliable internet connection increased Asia-Pacific's customer base to 596.5 million as of year-end 2022, which translates to a 50.7% household penetration rate. S&P Global Market Intelligence’s recent surveys show that fixed broadband service providers earned $82.83 billion in subscription revenues, representing growth of 7.2% year over year. Average blended broadband revenue per user, however, remained nearly flat at an estimated $11.91 per month in 2022 compared with $11.95 per month in 2021.

—Read the article from S&P Global Market Intelligence