Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 7 Mar, 2024 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Companies Navigate Complex Maze to Net-Zero

Many companies plan to reach net-zero greenhouse gas emissions, but the path is fraught with challenges, including controversy around greenwashing, the need to incorporate green energy and the struggle to balance increasing production with reducing emissions. S&P Global Market Intelligence published “Path to net-zero,” a series on how different industries are navigating the way forward.

Sustainable investing — that is, investing in funds that use environmental, social and governance criteria to assess the societal impact of their investments — peaked in 2021, but enthusiasm has since cooled due to political resistance, perceived underperformance and greenwashing allegations. Investors withdrew a net $2.5 billion from sustainable funds in the fourth quarter of 2023, the first recorded worldwide net quarterly outflows from such funds. “While I think climate change and environmental concerns are important to investors, there is also a lot more cynicism about ESG investing. ... We need activism to try and drive change, [but] we also need pragmatism to achieve it, and currently, we have too much of the former and too little of the latter,” Michael Hewson, chief market analyst for CMC Markets, told S&P Global Market Intelligence.

Meanwhile, New York City is an example of how net-zero targets may affect the real estate sector. New York and other cities have passed laws setting greenhouse gas emissions limits for buildings, with New York’s law beginning this year for buildings larger than 25,000 square feet. Property owners will have to invest in green improvements or risk being fined for each metric ton of exceeded emissions. According to S&P Global Market Intelligence, most US real estate investment trusts are “already ahead of the curve with regard to sustainability practices and should be only minimally impacted by the greenhouse gas emission limits starting this year.”

In the banking sector, high-emission portfolios’ decarbonization targets lack meaningful measurements, leading to greenwashing and investor uncertainty. The largest US and European banks are members of the Net-Zero Banking Alliance, which commits to achieving net-zero emissions by 2050 but allows banks to set their own interim targets. “A lack of standardization around climate goals and progress not only makes meaningful comparison difficult, but it can also confuse investors and blur the lines of accountability at banks,” S&P Global analyst Emilio Demetriou wrote.

So far, the insurance sector has not widely adopted a standard to quantify the emissions of underwriting portfolios. “Having a standard to measure the greenhouse gas intensity of underwriting portfolios is important because ... the bulk of [insurers’] greenhouse gas footprint will come from the emissions they effectively enable by insuring and investing in companies,” wrote Ben Dyson, an insurance reporter at S&P Global Market Intelligence. Demands for transparency from insurers and their clients make the adoption of such a standard increasingly likely.

The semiconductor industry is projected to hit more than $1 trillion in revenue by 2030, expanding the sector’s physical footprint but making it harder to reduce its carbon footprint. Semiconductor manufacturing consumes large amounts of electricity and requires specific greenhouse gases with high global warming potential. Companies are working to transition to renewable energy and find less harmful gases, but testing replacement gases is time-consuming and expensive. Like all industries, the path to net-zero for semiconductor producers will not be easy.

Today is Thursday, March 7, 2024, and here is today's essential intelligence. The next edition of the Daily Update will publish Monday, March 11.

Written by Claire Delano.

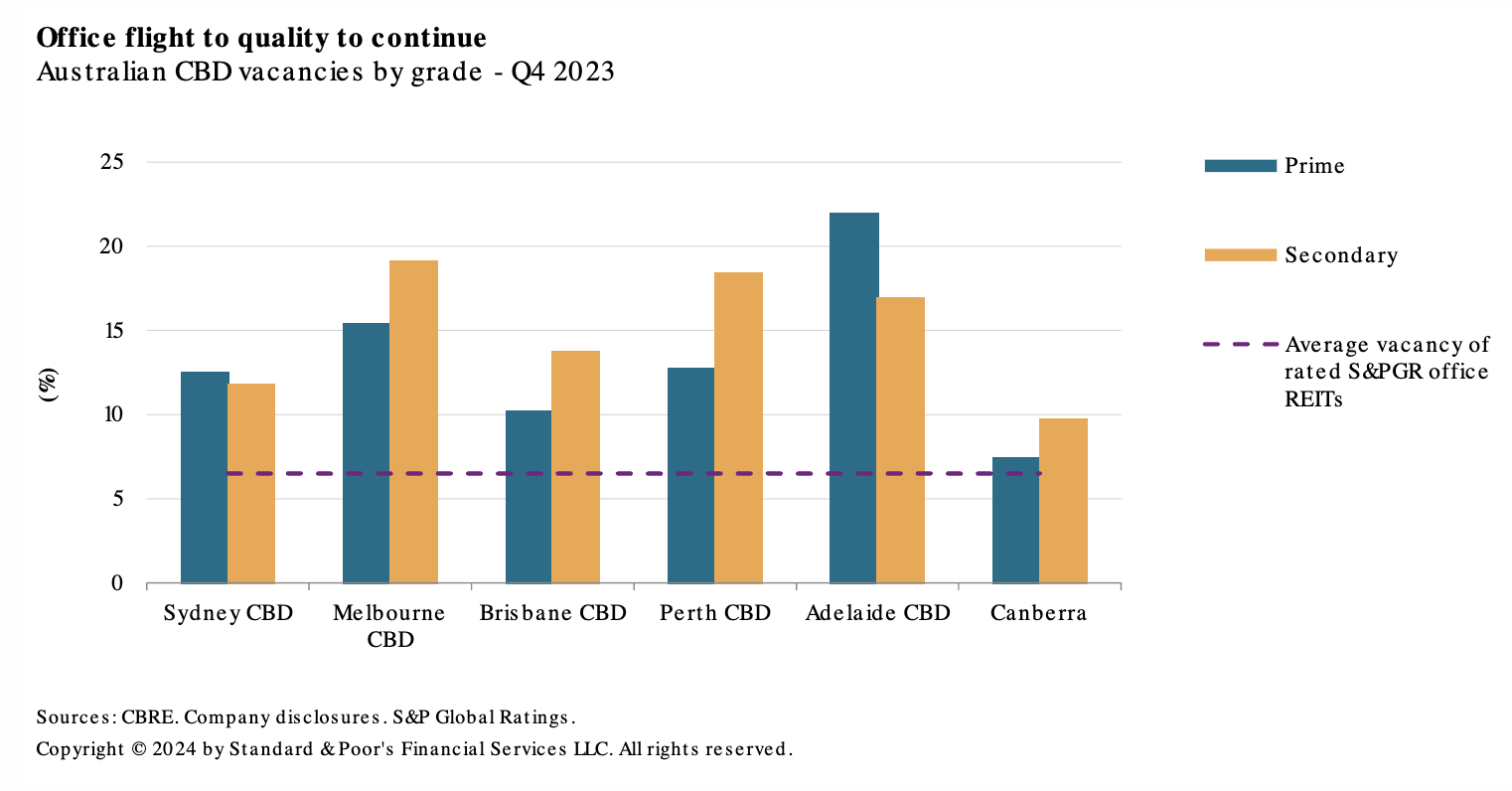

Corporate Australia Eyes A Soft Landing

Corporate Australia's hopes for a soft landing remain on track. Companies have, for the most part, taken higher interest rates and persistent inflation in their stride. But it won't be a smooth ride for all. S&P Global Ratings anticipates a margin squeeze for retailers amid falling demand, as well as sluggish conditions for major ports. Other sectors face material credit hurdles. Most at risk are rate-sensitive office REITs and the structurally declining postal sector.

—Read the article from S&P Global Ratings

Access more insights on the global economy >

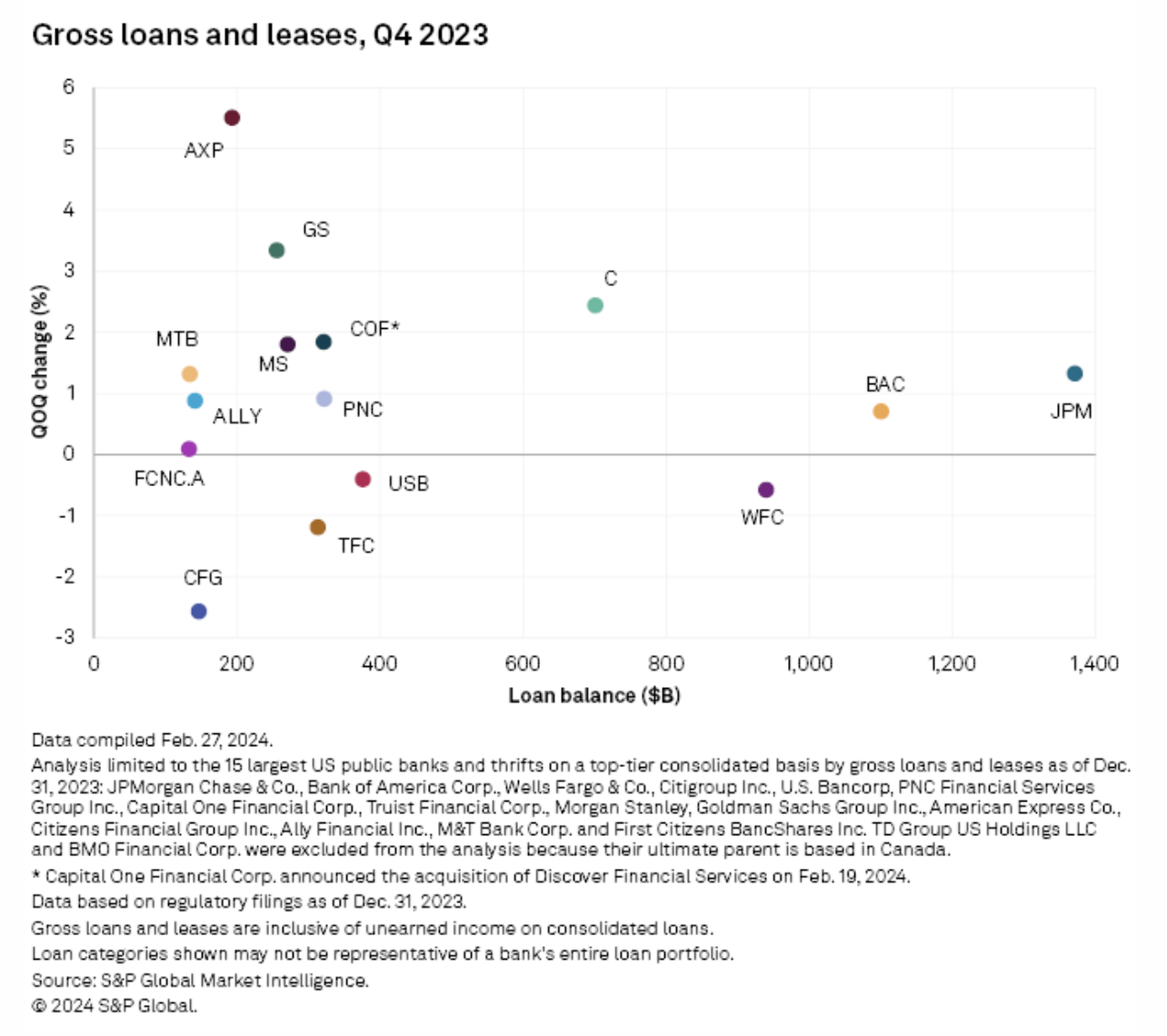

Lending Outlook For Big US Banks Subdued After Soft Q4 2023

The largest US banks are pessimistic about a near-term rebound in loan growth after more weak performance in the fourth quarter of 2023. Median sequential loan growth during the period was 0.9% across the 15 biggest banks, according to data from S&P Global Market Intelligence. Despite a seasonal tailwind during the period, elevated interest rates weighed on borrower demand and banks continued to tighten standards across a variety of loan categories.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

Listen: Maritime And Trade Talk, Episode 26: Logistics Rewired — The World's Largest Ocean Container Shipping Event

At the world's largest ocean container shipping event, TPM, shippers and their transportation providers will have plenty to talk about: navigation restrictions on the Panama Canal, rerouting from the Red Sea to avoid attacks from Houthi militants and the persistent issue of overcapacity. How is the shipping industry responding to these shocks and what impact could we see on trade and the global economy?

—Listen and subscribe to Maritime and Trade Talk, a podcast from S&P Global Market Intelligence

Access more insights on global trade >

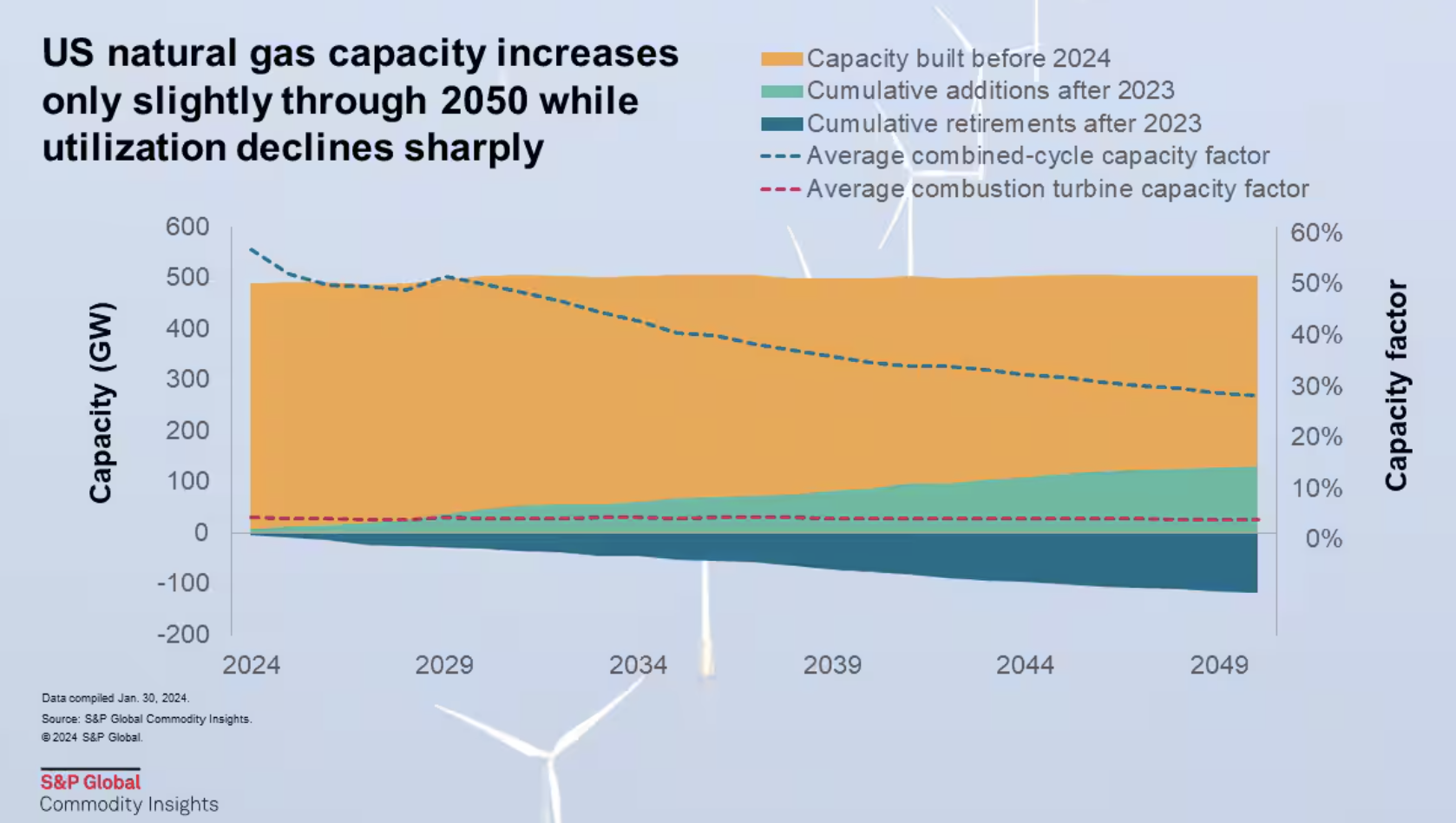

Natural Gas As Part Of Utilities’ Low-Carbon Strategy

While US power generation expansion is largely focused on clean energy technologies like solar, wind and batteries, S&P Global Commodity Insights research has identified a growing trend in the United States to define a reliability-centered role for new natural gas-fired power generation.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

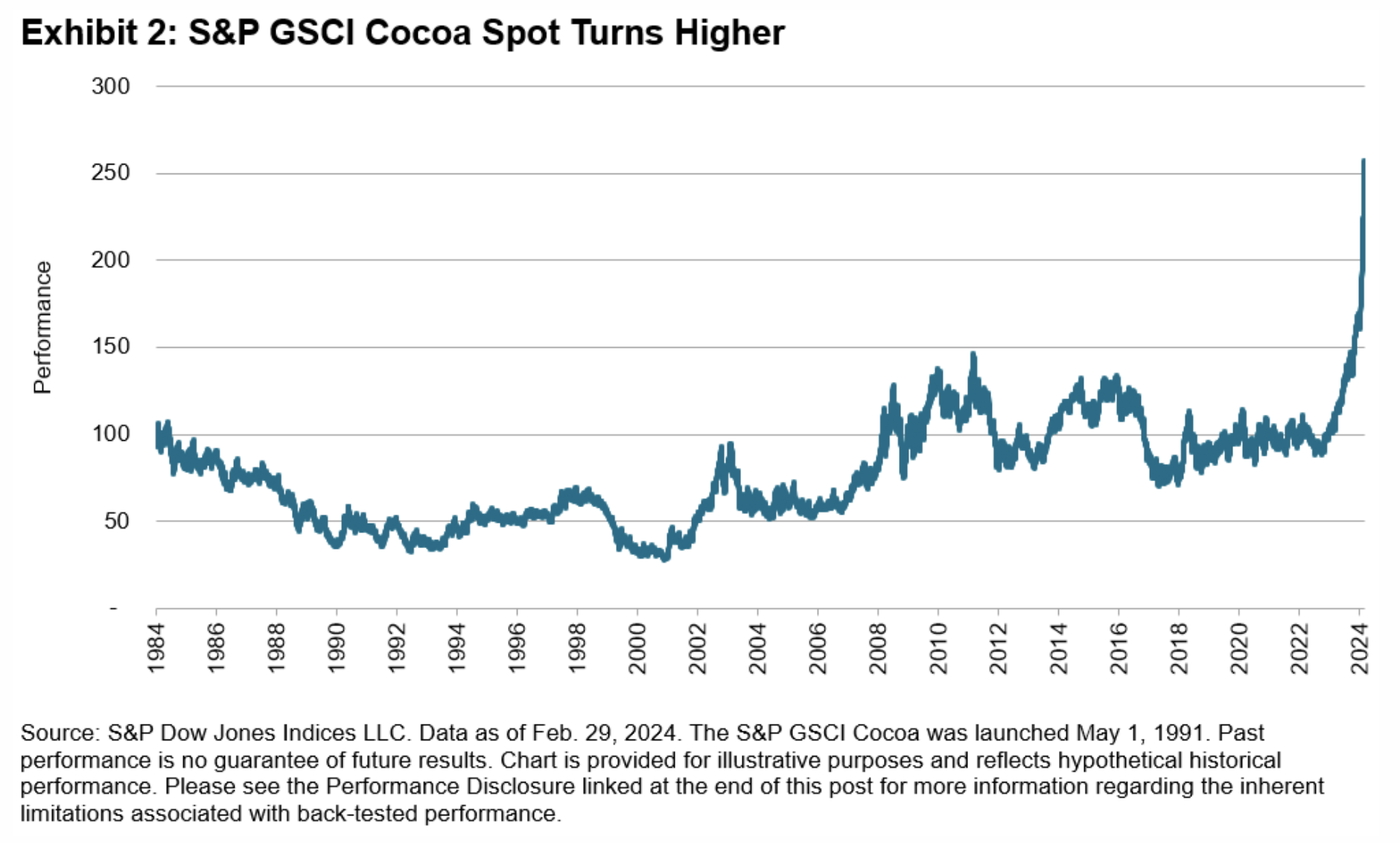

Food Inflation Bites Into Income As Commodities March Higher

Inflation continues to impact consumers and policymakers in negative ways. Hedging through broad commodities has proven to buffer portfolio returns, with the S&P GSCI up 5.38% this year. Going into the year, expectations of Fed rate cuts and continued declines in the Consumer Price Index (CPI) pushed inflation concerns aside. Since then, markets have experienced increased inflation figures and downsized rate cut bets.

—Read the article from S&P Dow Jones Indices

Access more insights on energy and commodities >

Tech Disruption In Retail Banking: Heavy Digital Investment Helps UK Banks Fend Off Competition

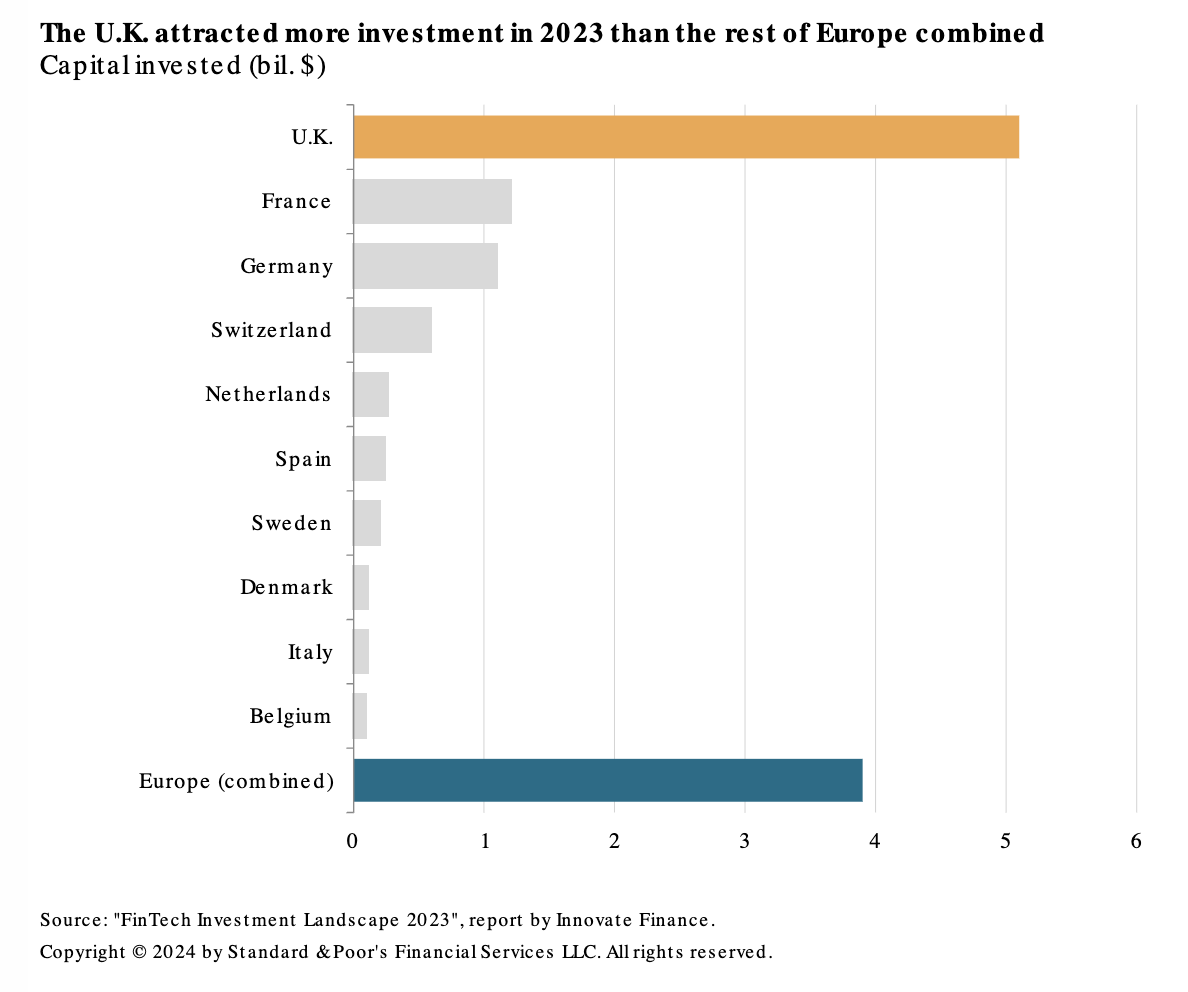

The UK banking sector has undergone significant changes, and incumbent banks have responded with large investments to meet the continuously evolving customer preferences for digital banking over traditional in-branch service. S&P Global Ratings thinks the incumbent banks have done this successfully so far, but they still face work to fend off competition. This is particularly important given the UK's global lead in the fintech space, demonstrated by the £5.1 billion of invested capital in 2023 — more than the rest of Europe combined.

—Read the article from S&P Global Ratings