Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 7 Mar, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Indian Banks Well Positioned to Weather a Tough Year

Most analysts are predicting a challenging 2023 for financial institutions in general and for banks in Asia specifically. But Indian banks are looking like a silver lining in a tough category. Despite slowing economic growth, secular challenges for banks, rising interest rates and the Adani Group scandal, it seems most Indian banks have balance sheets and earnings that will help them ride out this cycle.

India achieved growth in 2022-23 that would be the envy of the developed world. According to S&P Global Market Intelligence, the country’s real gross domestic product growth for the period topped 7%. However, the more recent trend is worrying. During the third quarter of India’s fiscal 2022-23, which runs from April to March, India's GDP growth rate moderated to a pace of 4.4% year over year. This slower growth rate can be attributed in part to higher input costs on manufactured goods. The Monetary Policy Committee of the Reserve Bank of India has been pursuing monetary tightening to bring inflation under control. India remains a favorable target for foreign direct investment, with such investments reaching a record level of $85 billion in fiscal 2021-22, the last year for which figures are available.

While the slowdown in GDP growth is only relative, rising interest rates from the Monetary Policy Committee will challenge Indian banks. India’s five largest banks have all enjoyed strong earnings during the current fiscal year. However, banking analysts believe that rising rates will put a brake on credit growth. Credit growth has been a bright spot for the Indian banking sector, reaching a 10-year high of 17.4% in December 2022.

Looking broadly at Asia, analysts at S&P Global Ratings believe that banks will struggle to stay on track this year due to anticipated credit losses. While analysts expect ratings outlooks for Asian banks to remain stable in 2023, there are few prospects for positive ratings momentum.

Concerns that India’s banks are exposed to borrowers that some believe are overleveraged, such as the Adani Group, have been assuaged by a number of banks publishing their exposure to the group. The Adani Group was widely considered an example of a successful and growing Indian company with excellent connections in the public and private sectors. However, activist group Hindenburg Research published accusations in January that the conglomerate engaged in stock manipulation and accounting fraud. The Adani Group has vigorously denied those accusations. Nonetheless, the State Bank of India, IndusInd Bank and Axis Bank all recently shared that their exposure to the conglomerate was below 1%.

Despite Adani, despite rising rates and inflation, and despite a tough environment for banking in Asia, it looks like India’s banks are well positioned for 2023.

Today is Tuesday, March 7, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

Global Economic Growth Accelerates To Eight-Month High In February

Global business activity grew at its strongest rate for eight months in February, reviving further from the low seen last October, according to the S&P Global PMI surveys based on data provided by over 30,000 companies. Growth was led by the service sector but was also buoyed by a return to growth of manufacturing output. Companies cited reduced recession risks, a peaking of price pressures, improved supply chains and a reopening of the Chinese economy to all have helped spur demand, notably among consumers, and to have boosted business confidence and hiring.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

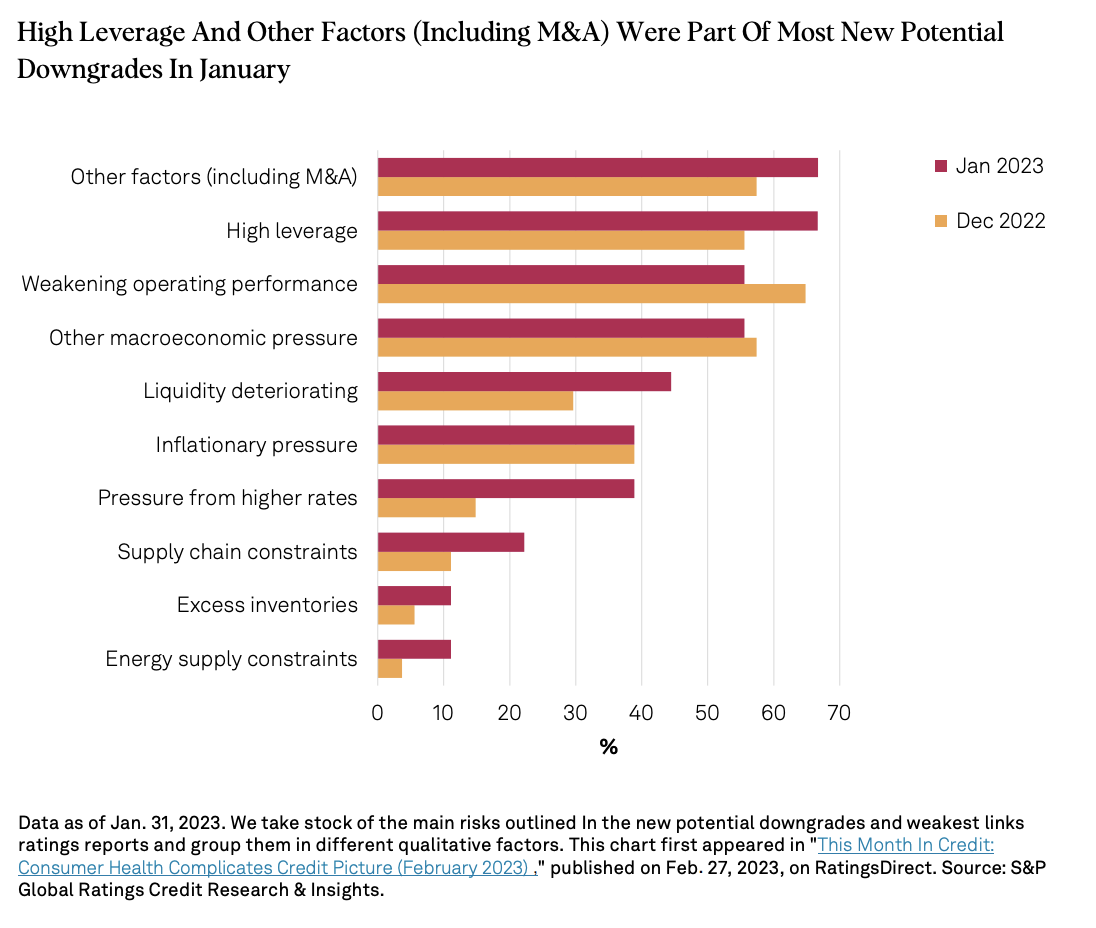

This Week In Credit: Preoccupied With Payrolls

Fourteen corporate defaults in the past three weeks and renewed downward rating pressure provide the backdrop to a busy week ahead for macroeconomic data insights. Central banks will meet to discuss monetary policy, including in Australia (Tuesday), Canada (Wednesday) and Japan (Friday). However, everyone's looking toward Friday's U.S. non-farm payrolls figures, after last month’s report triggered a sharp increase in rate expectations and stifled this year's market rally. Further good news on the jobs front could be bad news for markets.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

China Data: Independent Refiners' Feb Feedstock Imports Down 8.9% On Month

Feedstock imports by China's independent refineries dropped close to 9% in February from the previous month, a trend that might potentially spillover to March due to some scheduled maintenances and a key government meeting during which refiners normally keep their run rates under check. Data from S&P Global Commodity Insights showed on March 3 that feedstock imports by China's independent refineries fell 8.9% month on month to 15.18 million mt, or 3.97 million b/d in February. But, on a barrels per day basis, February imports were still slightly higher by 0.8% from that of January as it has only 28 days.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Beyond ESG With Financial Impacts Of Drought And Water Scarcity

Climate change, population growth and economic development have led to growing competition for water resources. As a result, water is becoming increasingly scarce and costly. Water governance has rarely been prioritized, and corporate action is often disproportionate to the magnitude of the issue. This can present an unexpected source of financial risk for companies and investors, especially in developing markets and biodiverse regions.

—Register for the webinar from S&P Global Sustainable1

Access more insights on sustainability >

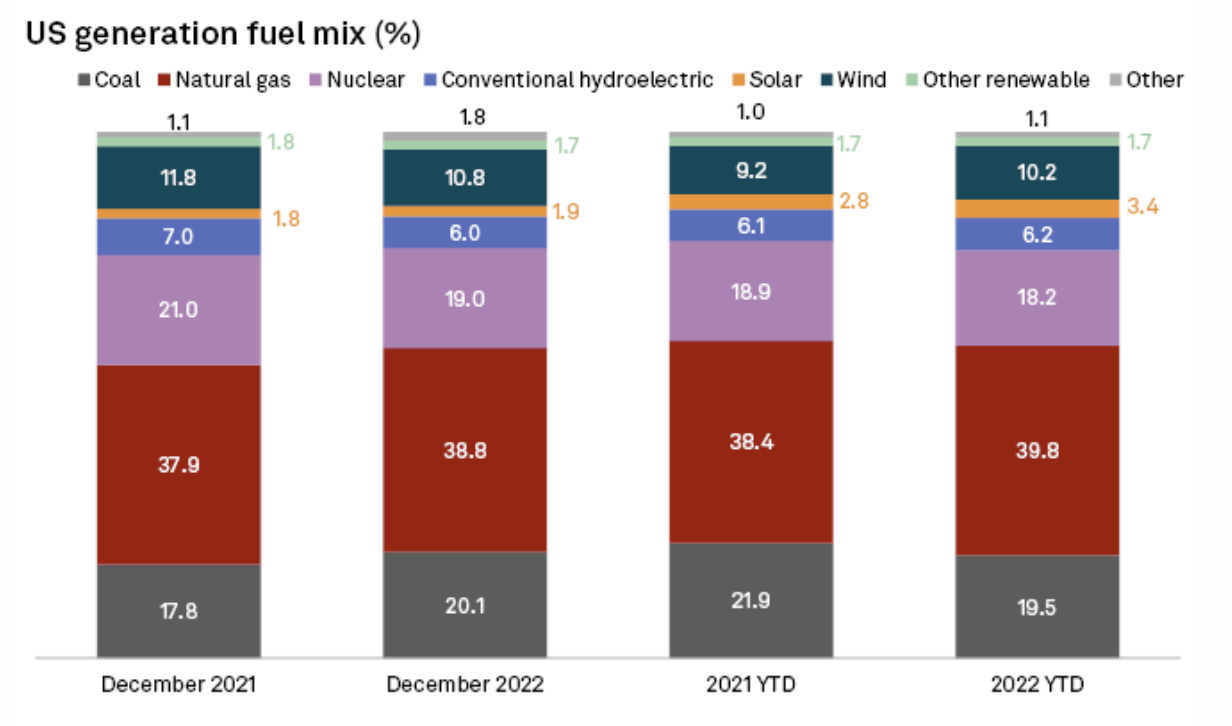

U.S. Net Generation Expanded YOY In December 2022, Driven By Fossil Fuels

Utility-scale generation net of hydroelectric pumped storage increased 7.8% year over year in December 2022 to 363.6 million MWh, up 40.7 million MWh from a revised 323.0 million MWh in November 2022, according to the U.S. Energy Information Administration's latest "Electric Power Monthly" released Feb. 27. For full-year 2022, utility-scale generation net of hydroelectric pumped storage increased 134.8 million MWh to 4.24 billion MWh, compared to 4.11 billion MWh in 2021.

—Read the article from S&P Global Market Intelligence

Access more insights on energy and commodities >

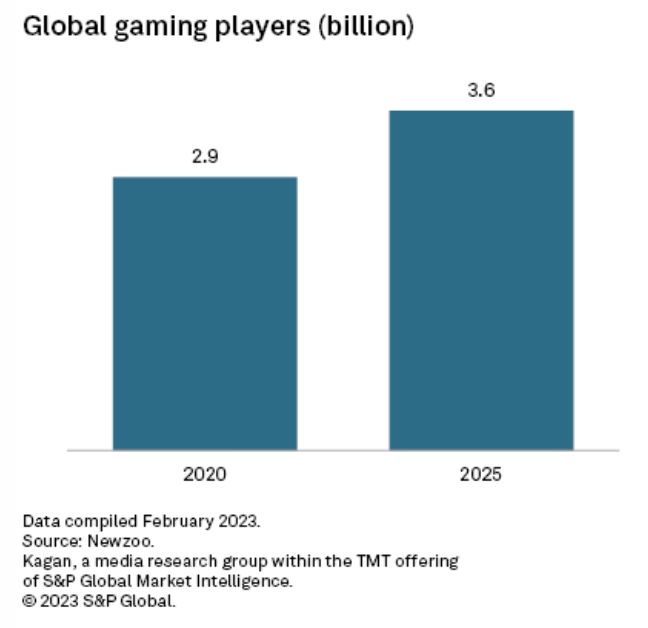

Traditional TV Yet To Define Its Role As Esports Distributor

While esports content distribution spans both digital and traditional TV platforms, the industry is still exploring the best way to monetize growing popularity within the video ecosystem. Specialist platforms, such as Amazon.com Inc.-owned Twitch, offer live streams and social interactivity options for gaming fanatics, while traditional broadcast production values and diverse audiences are valued by esports publishers looking for audience growth and higher income from rights licensing. Traditional TV must differentiate itself from digital platforms, leveraging its strengths as a communication medium to grow a strong and mutual relationship with esports rights owners.

—Read the article from S&P Global Market Intelligence