Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 30 Mar, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

A Second Seismic Shock For Europe

As the region most affected by the Russia-Ukraine conflict, Europe may experience an economic slowdown and a turning point in the credit cycle.

European economies have seen their energy security destabilize due to their dependence on Russia for approximately one-quarter of the EU’s oil and gas supplies. But diversification efforts to replace the reliance on Russian fossil fuels with supplies from other sources remains aspirational in the near-term. Overall, this external shock has transmitted to the eurozone economies via higher prices—and while Russian energy supplies to Europe remain unaffected thus far, any sanctions or countersanctions that constrict these supplies would spark an even more significant price shock and risk stalling the eurozone economy, according to S&P Global Ratings’ latest macroeconomic and credit conditions outlooks. While the U.K. has little direct exposure to the Russia-Ukraine conflict, its economy will experience pressure from the inflationary effects.

While the European economy overall is likely strong enough to avoid a recession, financing conditions look set to tighten as central banks focus on inflation even as the growth outlook slows. The positive credit trends seen in the past 14 months have stalled, with input-cost pressures weighing on corporate profit margins and default rates likely to move toward 2.5% by year-end.

“The invasion of Ukraine represents a seismic systemic shock to Europe and the world. The humanitarian crisis as well as border and energy security are critical short-term priorities. The political and economic repercussions will take longer to play out. They carry significant downside risks given the highly uncertain and volatile situation, even though the European economy and financial markets have held up well so far,” Paul Watters, S&P Global Ratings European Regional Credit Conditions chair, said in a report yesterday. “Energy security, further supply chain disruption, and amplification of existing inflation pressures are the dominant risks in light of the ongoing Russian invasion of Ukraine. Frontloading a monetary policy response to high inflation could lead to an excessive tightening in financing conditions. Barring a more severe variant, COVID-19 is now increasingly viewed as endemic in Europe.”

S&P Global Economics now expects eurozone growth to be 3.3% this year, compared to 4.4% in a previous forecast, and inflation to reach 5% this year and stay above 2% in 2023. Even if GDP doesn’t increase during the entirety of 2022, growth would still be 1.9% higher than in 2021 on the back of recovery from the pandemic. But growth could face downward pressure, and inflation could be amplified by a higher and longer oil price shock, outright cuts to the gas supply, stronger confidence effects that would lead households to save more, and more acute supply chain challenges. In the U.K., S&P Global Economics projects revised growth of 3.5% for the year, from 4.6% in the previous forecast, due to a stronger surge in inflation that will pack a meaningful punch to households’ spending.

“The Russia-Ukraine conflict is hitting economies worldwide just as activity is recovering from COVID-19. As close neighbors to Russia and Ukraine, European countries are among the most exposed to the latest shock,” S&P Global Ratings Chief EMEA Economist Sylvain Broyer and Senior Economist Marion Amiot said in research published this week. “Yet, the eurozone economy is coming out of the pandemic in a position of strength, with large buffers to protect itself against a full-year recession, unless severe downside assumptions materialize.”

“If a fresh energy price shock had to happen, now is not the worst time,” S&P Global Ratings Senior Economist Boris Glass said of the U.K. economy’s prospects in research published this week. “In fact, were the economy not still benefiting from some recovery momentum and a carry-over from 2021 worth 2.6% of annual growth this year, we might be expecting the U.K. to be on the brink of recession. But, as things stand, growth will continue. This makes all the difference for future growth dynamics because no actual destruction is taking place. This extends to the labor market, which we expect to remain strong, with unemployment to rise only minimally if at all.”

S&P Global Ratings Economics expects the European Central Bank to raise rates by 25 basis points per quarter starting in December, until its policy rate reaches 1.5% by mid-2024. In addition, the Bank of England’s recent interest rate increase in March and expected rate hike in May will prevent inflation expectations from de-anchoring in the U.K. But if central banks can’t look through the amplified inflationary consequences of the conflict, consequence of frontloading a material tightening in monetary policy would materialize as slower growth and weakened public finances.

Today is Wednesday, March 30, 2022, and here is today’s essential intelligence.

Written by Molly Mintz.

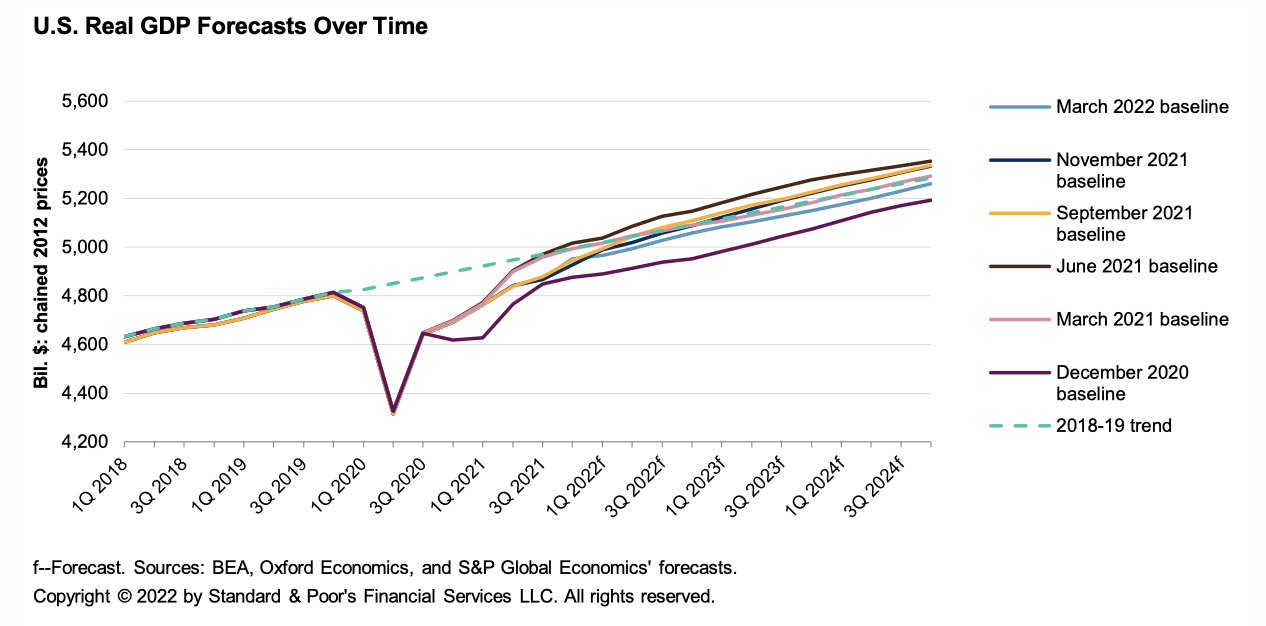

Economic Outlook U.S. Q2 2022: Spring Chills

U.S. economic activity remained largely healthy through early March, based on S&P Global Ratings’ real-time indicators. Omicron infection rates subsided and restrictions were removed, allowing more people to get outside and spend. While COVID-19 appears to be in the rearview mirror (for now), the Russia-Ukraine conflict worsens already troubling pricing pressures tied to continued supply-chain disruptions. The impact on the U.S. economy is relatively moderate when compared to the pain felt in countries closer to the center of the storm, but ramifications are still noticeable. S&P Global Ratings expects the economic damage to lower U.S. GDP growth to 3.2% this year, matching its preliminary forecast in early March but a full 70 bps lower than its November forecast of 3.9%.

—Read the full report from S&P Global Ratings

Access more insights on the global economy >

War, Rate Hikes Mar Growth Prospects For Global Investment Banking Activity

Global investment banking revenues are set for a hard landing as companies shelve M&A and IPO plans on Ukraine war fears and hawkish central bank policies. Tightening financial conditions and widespread uncertainty about the ongoing conflict in Ukraine have created a perfect storm that is slowing down client activity. The trend is on track to impact investment banks' underwriting and deal advisory revenues in the first half of 2022 and possibly beyond. Year to date, M&A, debt, and equity capital market transaction volumes have dropped to their lowest levels in five years, S&P Global Market Intelligence data shows.

—Read the full article from S&P Global Market Intelligence

Access more insights on capital markets >

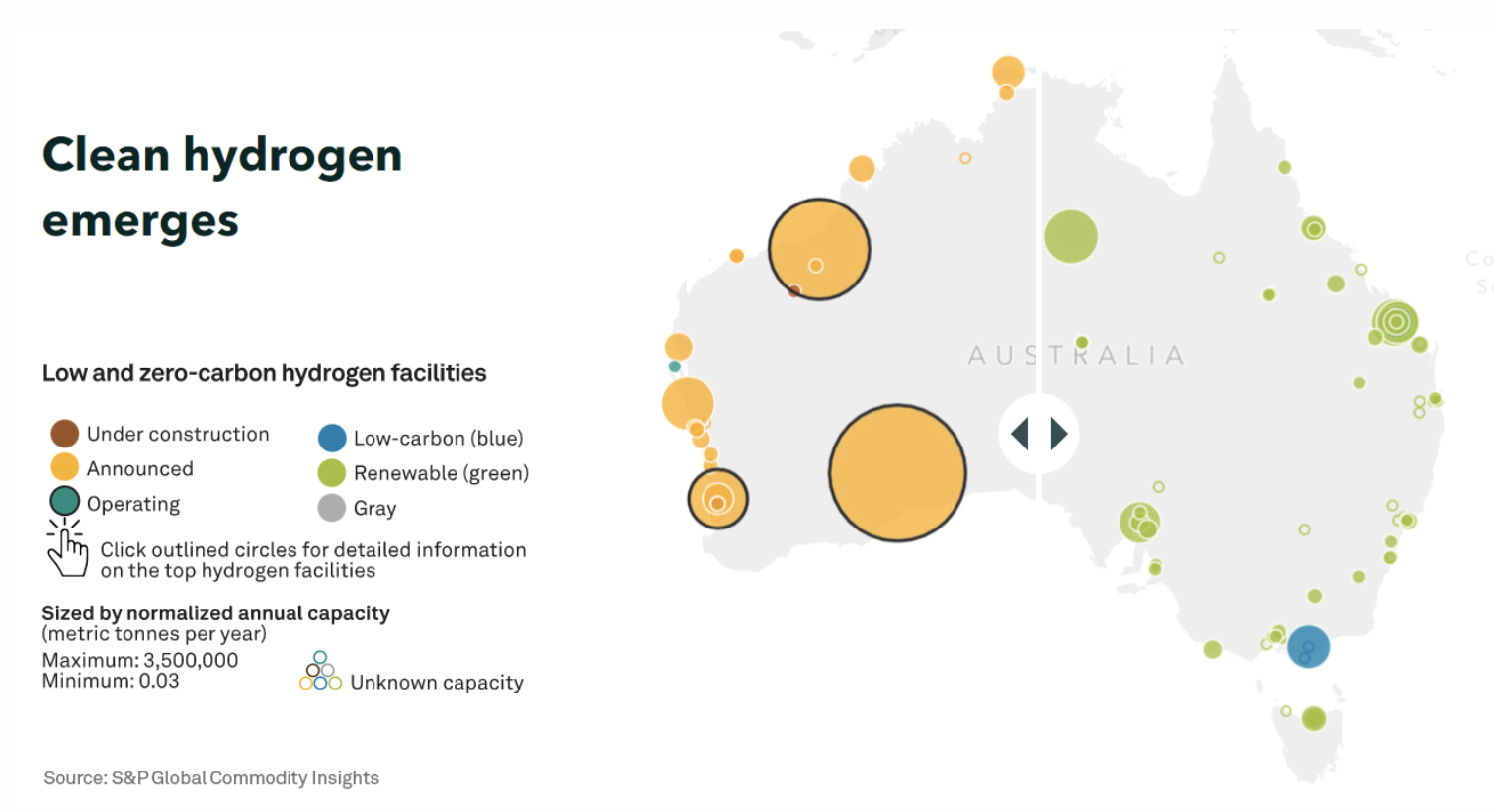

Australia’s Hydrogen Sector Poised For Export Moment Of Truth

Australia is on course to hit a notable century—but not on the cricket field. Around 98 hydrogen projects have been chalked up in recent months, a substantial number aimed at a future export market. And in February, one of them—Victoria's Hydrogen Energy Supply Chain (HESC)—created a minor sensation with the first trial cargo of liquid hydrogen to Japan. Australia is anxious to get a foothold in the nascent hydrogen market to counter its established, climate-compromised position as a major exporter of coal, LNG, and crude oil.

—Read the full article from S&P Global Commodity Insights

Access more insights on global trade >

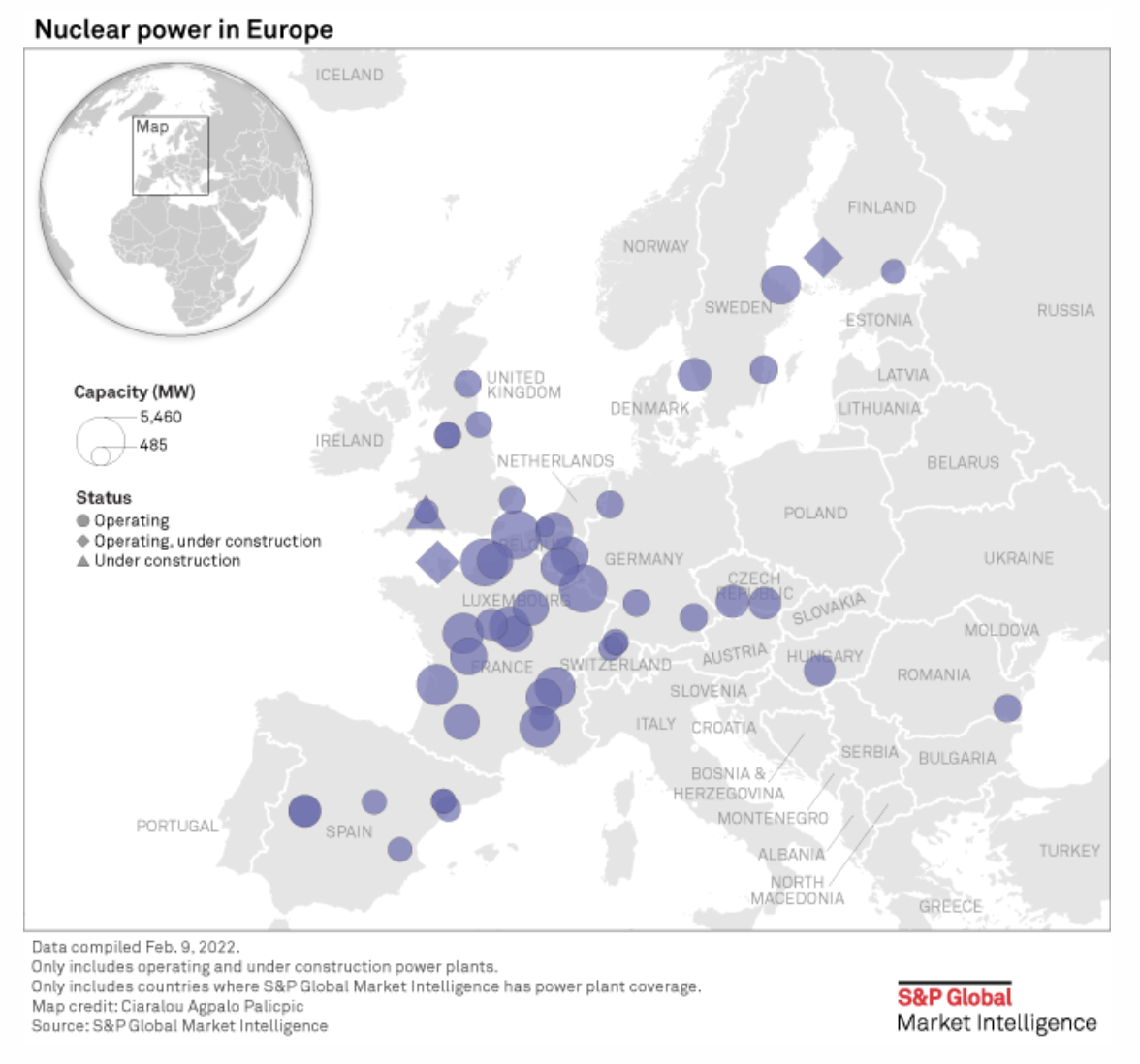

Costs, Permitting Hurdles Dampen Potential For New Nuclear Capacity

Rising oil and gas prices and mounting pressure to decarbonize power grids are unlikely to spur a global buildout of nuclear generation, despite renewed momentum for weaning Europe off Russian natural gas supplies, A.B. Bernstein analysts said. While Russia's invasion of Ukraine has helped revive nuclear power's attraction in Europe, where the technology will join the European Union's green taxonomy in 2023, neither government policy incentives nor technological advancements are likely to trigger a "renaissance" of new projects, according to a March 25 Bernstein report.

—Read the full article from S&P Global Market Intelligence

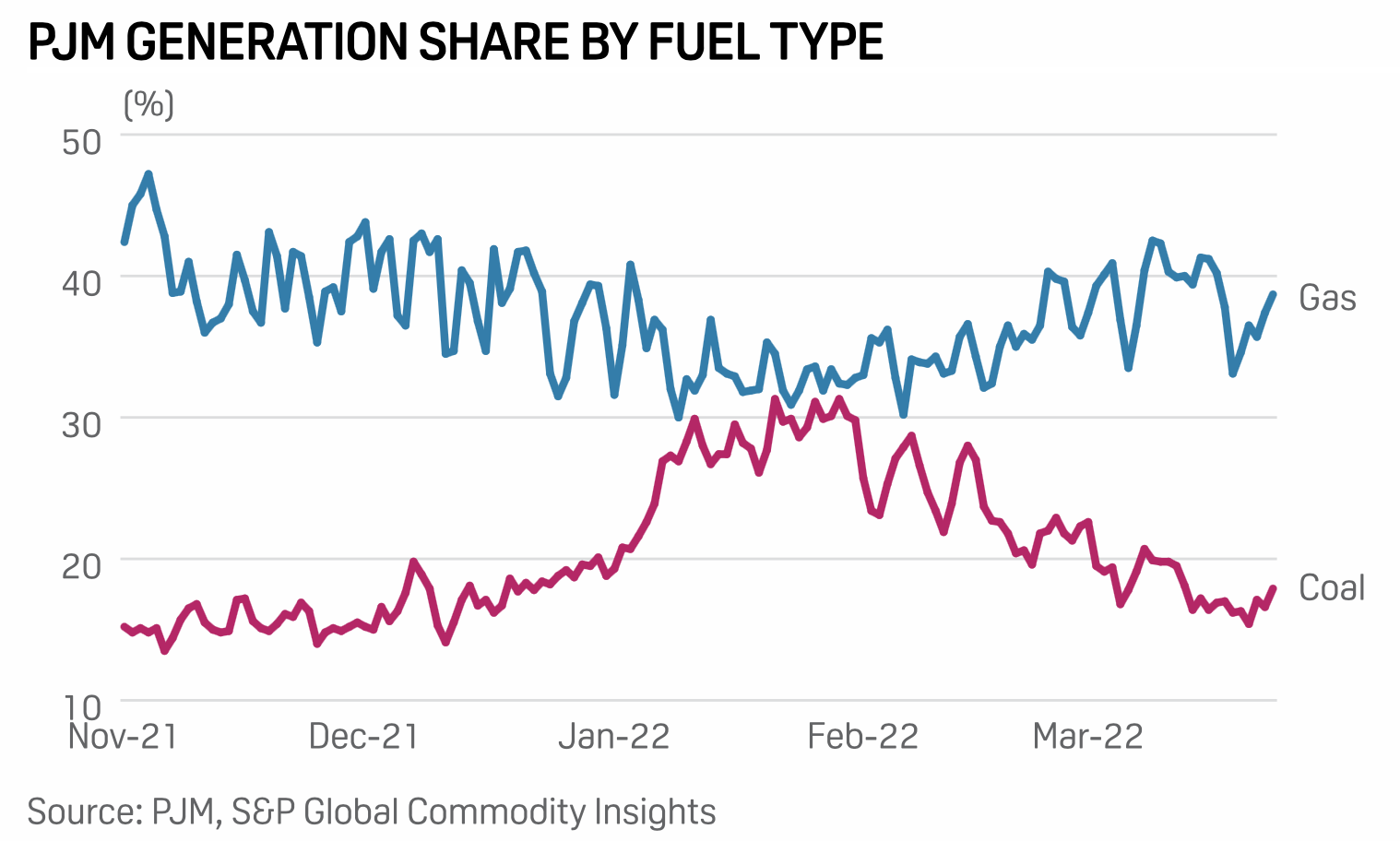

Russia-Ukraine War Lifts CAPP Coal Price, Fueling Upside For Gas Generation

As Russia's ongoing war in Ukraine keeps global coal demand and prices elevated, a move by some U.S. power generators to begin switching to gas could fuel another record season for power burns this summer. Since late February, thermal coal prices have surged globally as traders and end-users seek out potential replacements for Russian fossil fuels. In March, CIF ARA coal—Europe's benchmark price—has traded near record levels averaging nearly $330/mt this month, S&P Global Commodity Insights data shows. In Appalachia, prices have followed the global market higher, trending near $140/st as of late March—also the highest on record dating back to at least 2005 when CAPP coal data collection began.

—Read the full article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: Next In Tech | Episode 58: Technology Hiring Issues

There have been chronic hiring issues in tech, even before the great resignation, and it’s been particularly acute in information security. Research analyst Megan Goodwin joins host Eric Hanselman to talk about alternatives to the traditional internal paths and where targeted learning can be useful. With concerns about burnout being ever more prevalent, training options like boot camps could help to skill up existing staff, but organizations have to invest to make those options pay off.

—Listen and subscribe to Next in Tech, a podcast from S&P Global Market Intelligence