Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 28 Mar, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

The Need for Transparency & Accountability Across ESG

Against the backdrop of a world order disrupted by geopolitical shocks, climate change, accelerating digitalization, and other factors, accountability, transparency, and credible disclosures for environmental, social, and governance (ESG) decision-making have never been so important.

Engagement with ESG risks and opportunities has become mainstream as companies and investors seek to address short-term needs and meet long-term challenges. Nearly 80% of investors globally consider ESG reporting an important factor for their investment decision-making, and nearly 50% said they were willing to divest from companies for not taking significant ESG action, according to a recent PwC investor survey. But some industry observers believe that institutional investors are not delivering on their initiatives—and that more work needs to be done to close the gap between ambition and action, according to S&P Global Market Intelligence. Global oil majors have confronted pressure to live up to their ESG promises by divesting from their Russian energy assets following its invasion of Ukraine.

Voices calling for greater accountability, transparency, and credible disclosure are growing louder.

"No investor can credibly claim that they don't understand the risks of blowing past 1.5 degrees [Celsius] of warming, and no investor can credibly claim that they can't measure companies against that objective," Eli Kasargod-Staub, executive director and co-founder of the shareholder advocacy group Majority Action—which published a report last month describing many of the high-profile investors within the world's largest climate-focused investor network, Climate Action 100+, as "laggards" in holding corporate boards accountable—told S&P Global Market Intelligence in an interview. "What we see are investors that are failing to uphold their fiduciary responsibility."

Corporate boards and government leaders may need to do more to demonstrate that they are adequately equipped to understand, oversee, and integrate ESG issues and principles in the face of heightened shareholder activism and public pressure over whether to jettison poor ESG performers, according to S&P Global Sustainable1. New ESG regulation may also create increased convergence from companies on ESG data, metrics, and reporting requirements and measures of success. Last week, the U.S. Securities and Exchange Commission unveiled new proposals for climate-risk disclosure regulations that would require publicly traded companies to annually report the Scope 1 and 2 greenhouse gas emissions for which they are directly responsible—as well as report the Scope 3 emissions that companies aren’t directly responsible for if such emissions are considered "material" to their business and if they have a target to reduce carbon emissions.

“More than ever, investors and companies seek evidence-based insights, high quality data, and advanced analytics to support their investment strategies when linking sustainability and business performance. One of the most important tools that companies and investors utilize to assess sustainability performance is an ESG score. An ESG score is typically a headline number that presents the provider’s opinion of a company or entity’s performance against pre-defined ESG criteria,” S&P Global CEO Doug Peterson said in a recent open letter. “At present ESG disclosures by companies can be inconsistent, leading to data gaps that need to be interpreted or modeled in order to present the most comprehensive view available at that point in time. Fortunately, we are seeing an evolution here, as an increasing number of jurisdictions are mandating disclosure of ESG factors, in particular climate, which will hopefully make disclosure more consistent and widespread.”

Today is Monday, March 28, 2022, and here is today’s essential intelligence.

Written by Molly Mintz.

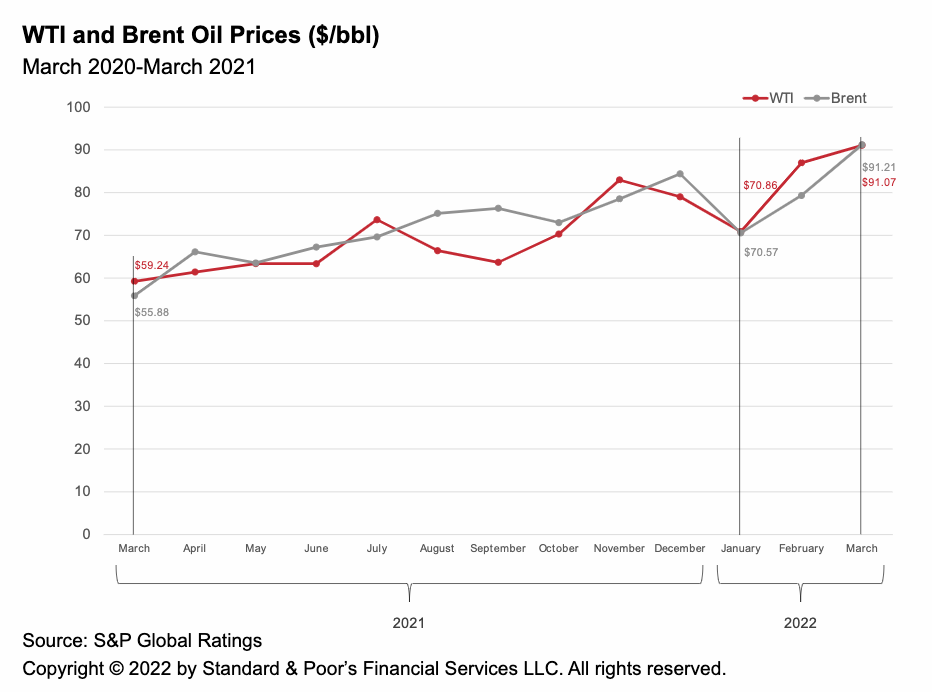

Credit FAQ: Wild Swings In Oil And Gas Prices: What Are The Drivers And Where Do We Go From Here?

The climate for the global oil and natural gas markets can best be described as one of extreme nervousness, uncertainty, and volatility. A plethora of factors are fueling it, including concerns about supply, rising COVID cases in China, and low global inventory levels. Geopolitical events, which are always a factor in oil prices, are probably a well-above-average influence given the crisis in Ukraine. In this report, S&P Global Ratings responds to frequently asked questions on the topic.

—Read the full report from S&P Global Ratings

Access more insights on the global economy >

Asian Banks' Bond Sales Fall To Lowest In A Year In February

Debt issuances by banks in Asia-Pacific fell to the lowest in at least a year in February, as lenders from the region's major economies, notably China, stayed on the sidelines amid uncertainties around interest-rate trends and the country's troubled property market. Banks from the world's second-largest economy were less active selling debt in the first two months of the year, dragging aggregate bond issuances by Asia-Pacific banks, according to data compiled on a best-efforts basis by S&P Global Market Intelligence. In February, just two Japanese banks—Mizuho Financial Group Inc. and Japan Bank for International Cooperation—issued bonds worth $3.10 billion, less than one-third of the $9.88 billion raised in January and $15.14 billion in the year-ago period.

—Read the full article from S&P Global Market Intelligence

Access more insights on capital markets >

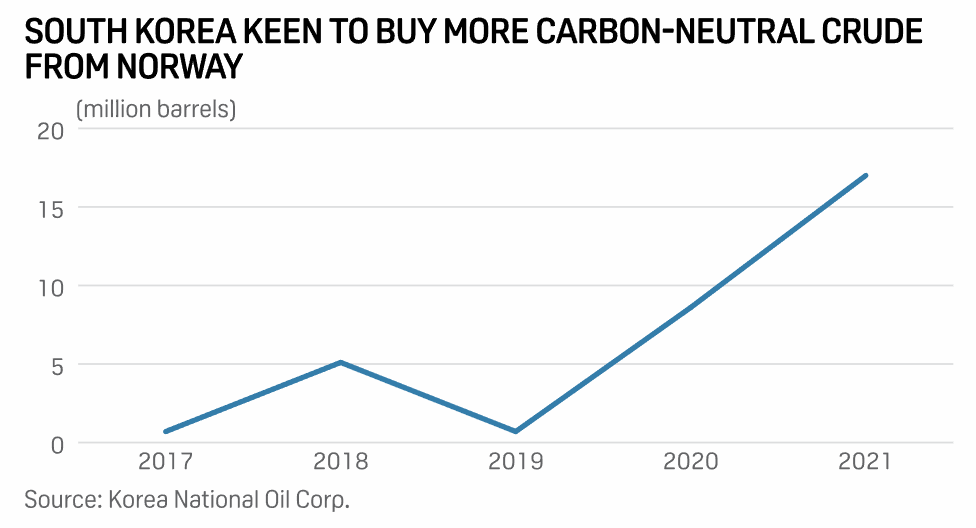

South Korea Aims To Gradually Increase Net-Zero Oil Portion In U.S. Crude Imports

South Korea finds competitive U.S. crude highly attractive in times of surging benchmark oil prices, but Asia's biggest U.S. crude customer also aims to enhance its green energy practices by gradually increasing the share of net-zero crude oil in the overall feedstock imports from the North American producer. Major South Korean refiners said light sweet U.S. crude grades are typically placed on the list of top monthly feedstock choices, especially in times of high global energy prices, as the North American barrels come cheaper than many Middle Eastern grades thanks to U.S.-South Korea free trade agreement. Persian Gulf producers, on the other hand, continue to raise their official selling prices.

—Read the full article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: How Blue Bonds Seek To Boost Marine Conservation

To help fix the financing gap between the terrestrial and marine worlds, some banks are experimenting with a new type of financing instrument known as a blue bond. The first such instrument was issued in October 2018, enabling the island nation of Seychelles to offload a portion of its debt in return for increased marine protection. The deal stabilized Seychelle’s debt position, while boosting investment in the local marine economy. Since then, half a dozen other countries or banks have issued blue bonds, including the World Bank, the Bank of China, and the country of Belize. In the latest episode of ESG Insider, hosts Lindsey Hall and Esther Whieldon speak to Ramzi Issa, a managing director at Swiss bank Credit Suisse who helped arrange the recent Belize blue bond, which raised $364 million. Part of that money was used to restructure Belize’s debt and part of it is allocated for marine conservation.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Sustainable1

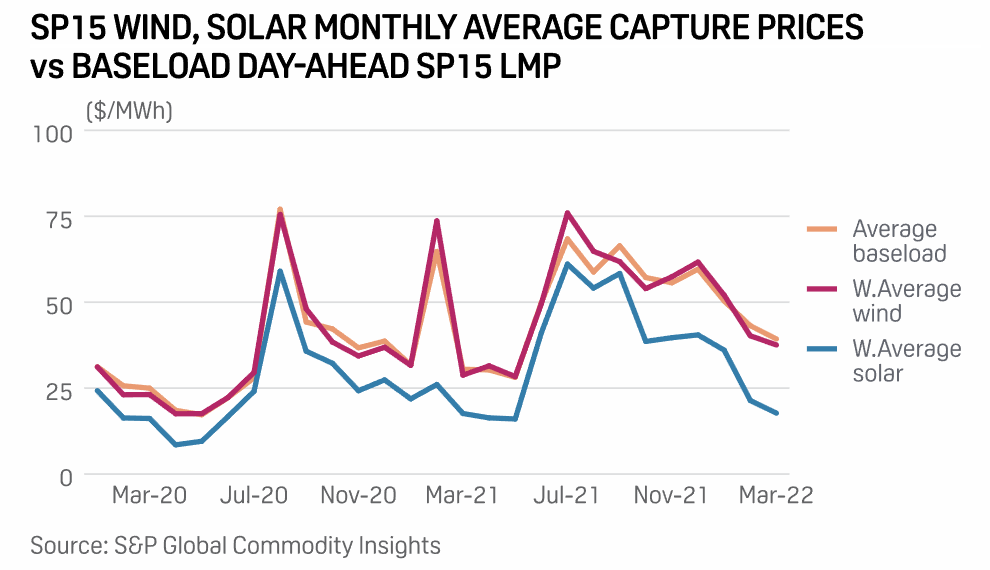

New U.S. Renewable Capture Prices Reveal Revenue Challenges, Opportunities

As the U.S. shifts toward cleaner electricity, the regions of the country with the most wind and solar foreshadow the potential for renewables to erode their own revenue, as well as the opportunity for transmission and storage to help offset this trend, experts following the issue said. Renewable price cannibalization is already showing up in places like California, where solar power floods the market during the central hours of the typical summer day and power prices dip close to or below zero, said Giuliano Bordignon, lead analyst for North American power at S&P Global Commodity Insights.

—Read the full article from S&P Global Commodity Insights

Access more insights on energy and commodities >

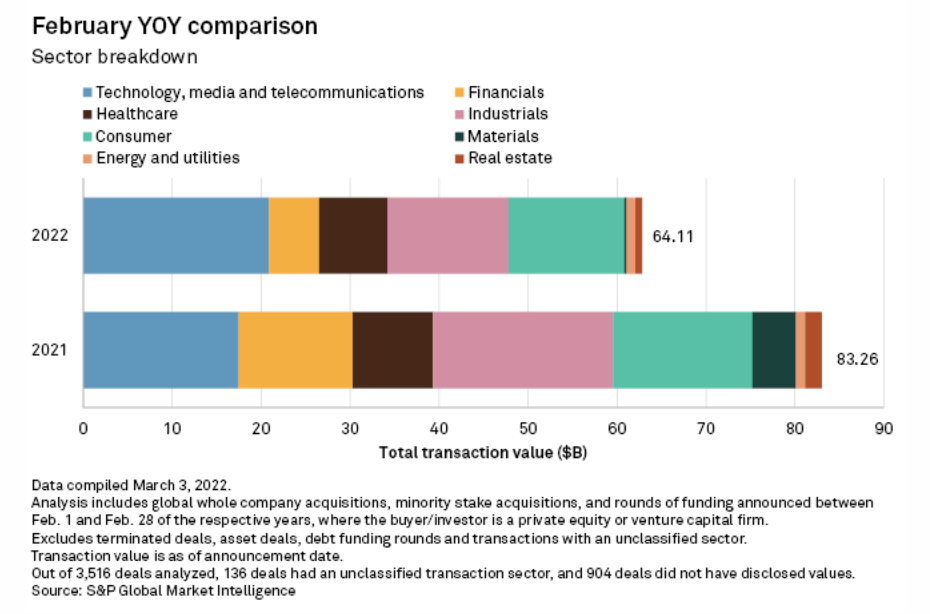

Gridiron Capital Tops Midmarket PE Rankings; Global PE Deal Value Dips

Investments in technology and software companies have been the main factor in making the top-performing large private equity firms list, which is published annually by HEC Paris-DowJones. A new list ranking middle-market private equity firms suggests the top performers have made more diversified investments. Deep sector specialization was much less common among the 20 firms recognized for outpacing their middle-market peers in the HEC Paris-DowJones ranking released March 21. This is a marked difference from the ranking of large firms released two months earlier, in which more than half the top 20 firms demonstrated a clear focus on technology and software companies.

—Read the full article from S&P Global Market Intelligence