Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 24 Mar, 2021

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

Asia’s economic recovery is accumulating. Businesses are preparing for a frenzy of mergers and acquisitions, as well as a flurry of foreign investments. Cities have been ranked as the top financial hubs—so much so that HSBC is planning to move the majority of its business there.

All signs point east to the region as the market to prosper in a post-pandemic economy.

Asian countries have demonstrated strength in managing the coronavirus crisis, and have largely experienced resilience in their jobs markets and manufacturing activity. After nations in the region survived a softer hit to economic activity than other countries worldwide, S&P Global Ratings now expects the downturn’s permanent damage to Asian economies’ output to average between 4%-5% of GDP—marking again a less painful decline than elsewhere in the world. In addition, S&P Global Ratings anticipates that emerging Asian economies will likely withstand the normalization of U.S. interest rates.

As central banks in the region approach the balancing act of when to lift their quantitative easing policies, most “appear content to adopt a wait-and-see mode for now and preserve whatever little policy ammunition is left," Selena Ling, chief economist at Oversea-Chinese Banking Corp, told S&P Global Market Intelligence.

Now, investors are eyeing the Asian market as a prime place for investment. The majority of cities in the biannual ranking of the world’s most competitive financial centers by financial-services consultancy Z/Yen Group and the China Development Institute—six out of 10 in the Global Financial Centers Index—are the Asian metropolises of Shanghai, Hong Kong, Singapore, Beijing, Tokyo, and Shenzhen. Economies like Japan are promoting opportunities to develop alternative investments and yield greater returns in order to recruit high-skilled foreign asset managers.

Major international banking players are expanding their operations in the region. London-headquartered HSBC Holdings announced last month its initiative to invest $6 billion over five years in its top business segments across Asia as the driver for a restructuring of its operations. The bank expects to make reductions “coming from the west principally out of global banking and markets in the U.S. and continental Europe which are low-return markets for us relative to the return opportunity in Asia. So we're in the process of running down part of our book in the U.S. and Europe and reinvesting those saved risk-weighted assets into Asia," CEO Noel Quinn said announcing 2020 full-year earnings in February.

M&A growth in Asia exploded last year and market observers expect the activity to continue expanding through year-end. Last year, 255 financial sector M&A deals were announced in Asia-Pacific—more than three times as many as the year before, according to S&P Global Market Intelligence data. Greater China—including Hong Kong, Taiwan, and Macau—remained the top destination for M&A in the region and accounted for more than one-third of the deal count.

"With Asia-Pacific expected to rebound from the effects of the pandemic sooner than the rest of the world, deal momentum is likely to continue well into 2021, given the region's inherent advantages—positive valuations, lower acquisition premiums and a growing mid-market," Yash Chanana, a director of investment banking at the capital market intelligence firm Acuity Knowledge Partners, told S&P Global Market Intelligence.

Fintech firms are drawing investment into Asia, with economies like the Philippines pioneering digital banking and other innovations. During the fourth quarter of last year, S&P Global Market Intelligence data found that 113 deals involving Asia-Pacific fintech firms generated the highest quarterly funding activity for the year, totaling $3.14 billion. This year will likely see a surge of attention to fintech firms in China and Southeast Asia, especially those involved in blockchain, regulatory technology, and wealth management services, due in part to their promising growth prospects, Mr. Chanana said.

However, for investors to reap the benefits of the region’s output, domestic demand will first need to bounce back in China and other Asian countries to stimulate a full economic regional and global recovery.

“The popular narrative is Asia is leading the recovery and digging the world out of a big hole. This is not quite right. Demand from the rest of the world is helping Asia out of the hole. This is mainly due to cautious Asian consumers despite the resilience of labor markets,” S&P Global Ratings Chief APAC Economist Shaun Roache said in recent research. “Until Asia starts pulling its weight in the demand recovery, global growth will fail to live up to its potential … We believe Asia can escape this trap. Our forecasts assume a rotation in Asia's demand will gain momentum in 2021, led by a pickup in consumer spending in China. This rotation may be slower than markets anticipate, however.”

Today is Wednesday, March 24, 2021, and here is today’s essential intelligence.

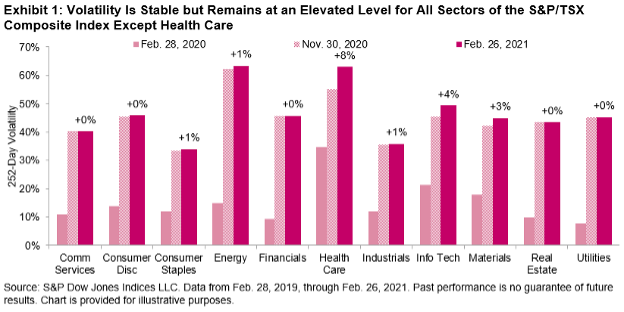

Elevated Volatility Levels in Sectors Remain

The shock that the onset of the pandemic sent through the financial markets a year ago is mostly a distant memory. The S&P/TSX Composite Low Volatility Index was up 34% for the one-year period ending March 19, 2021, lagging its benchmark index. This is not surprising given that the performance of the S&P/TSX Composite Index has been spectacular, up 60% over the past year (from the lows of the pandemic-related panic last March). Volatility at the sector level, though, remains elevated.

—Read the full article from S&P Dow Jones Indices

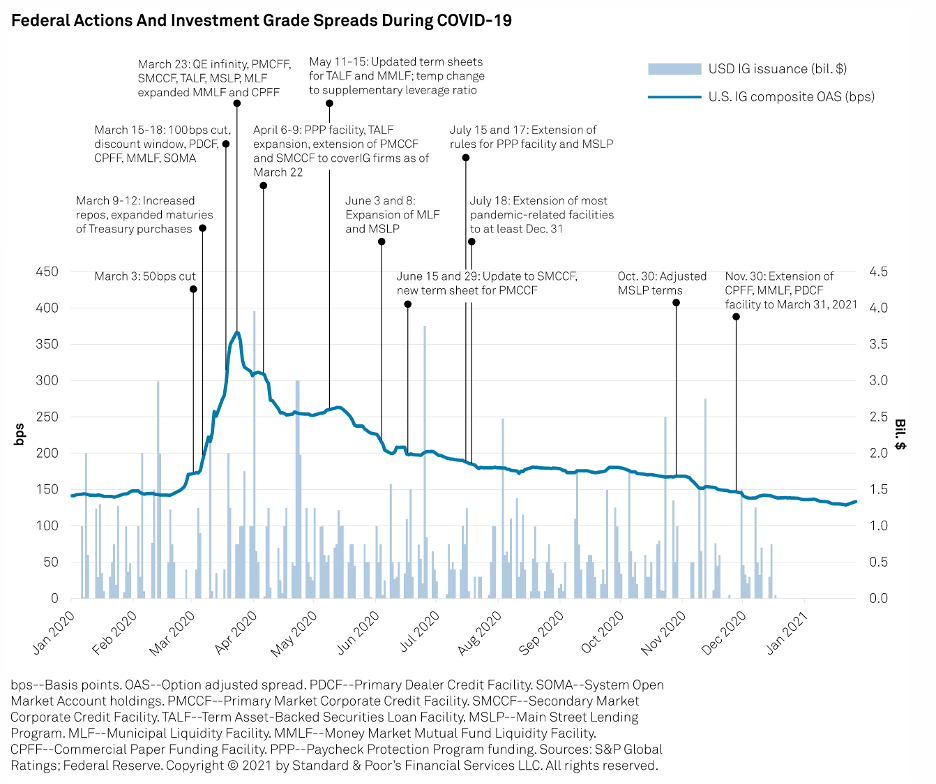

Central Banks, Credit Markets, and The Catch-22 Taper

The scale and success of central bank interventions since the pandemic began have set a new precedent in terms of market expectations, which may be difficult to ignore in times of future stress. Central banks now face a delicate and complicated task: how to continue to support the recovery while also developing an exit strategy that doesn't undermine market stability. Fixed-income investors also face a dilemma, as they have benefitted from the stability central banks have restored, but the continuation of low rates and monetary stimulus is challenging financial returns.

—Read the full report from S&P Global Ratings

Industries Most and Least Impacted by COVID19 from a Probability of Default Perspective

S&P Global Market Intelligence’s sought to explore those industries that have recovered best and worst over the course of the last year (March 2020 – March 2021) and found that Airlines, Leisure Facilities, and Restaurants were some of the most impacted industries while Insurance and REITs were the least impacted. This report takes a look over the last 12 months to assess which industries have been able to adapt and recover best from the major impacts of COVID-19.

—Read the full article from S&P Global Market Intelligence

Players in the Retail Sector Stumble

U.S. consumers further tightened their purse strings in late 2020 amid rising COVID-19 cases and new restrictions on dining and shopping outside of the home. In November, clothing and clothing accessories stores saw a 6.8% decline in sales to $18.48 billion, and by late November to early December two major U.S. retail companies covered by S&P Global Market Intelligence went bankrupt. This pushed the 2020 year-to-date count to 51, a figure that exceeded the number of filings in any year since 2009.

—Read the full article from S&P Global Market Intelligence

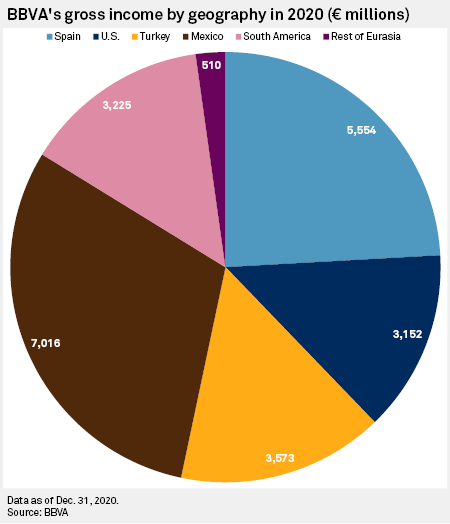

Turkish Bank Shares, Lira Dive Amid Fallout From Central Bank Governor Sacking

Turkey's benchmark bank index traded more than 9% lower on Tuesday as markets reacted to Turkish President Recep Tayyip Erdoğan's surprise dismissal of the central bank governor.

—Read the full article from S&P Global Market Intelligence

Lloyds' Landlord Ambition Offers Test Case for Income-Hungry European Peers

While banks owning income-generating real estate portfolios is nothing new, the recent revelation that Lloyds Banking Group PLC is planning to become a large private, residential landlord may have raised eyebrows in the industry.

—Read the full article from S&P Global Market Intelligence

Listen: The Evolving Energy Sector: Updated Takeaways for Energy Transition Outlooks

In the latest S&P Global Platts Future Energy Podcast, Roman Kramarchuk, Head of Future Energy Outlooks, is joined by Dan Klein, Head of Future Energy Pathways, to talk about the main takeaways of Platts Future Energy Outlooks Annual Guidebook, a comprehensive study that includes Platts oil, gas, and overall energy reference cases, along with long-term outlooks for global crude, regional crude and product markets, and regional natural gas markets.

—Listen and subscribe to Platts Future Energy, a podcast from S&P Global Platts

BP Drops Reserves Replacement Ratio As Strategic Performance Target

BP has dropped its oil and natural gas reserves replacement ratio as one of the company's key performance metrics, it said March 22, underscoring the company's ambitious plans to become an integrated energy player by targeting renewable and low-carbon energy investments.

—Read the full article from S&P Global Platts

Fuel for Thought: Digital Bunkering Gains Traction on Cost, Environmental Grounds

The announcement that marine fuel supplier Minerva Bunkering has launched a digital bunkering platform at major hubs comes amid a wider industry trend that embraces digitization in order to lower emissions and raise transparency.

—Read the full article from S&P Global Platts

Climate Decision at FERC Previews Stricter Stance on Pipeline Emissions

The Federal Energy Regulatory Commission will increase the consideration of climate change impacts in permitting decisions for natural gas transportation and export infrastructure after a shift in policy, likely increasing regulatory burdens on developers but possibly making the process more certain.

—Read the full article from S&P Global Market Intelligence

Market Movers Europe, Mar 22-26: Steel Price Hike, UK Hydrogen Strategy In the Spotlight

In this week's highlights: European steel markets reach all time-highs, green hydrogen advocates lobby UK government for better representation, and dry bulk Panamax rates surge to near pre-financial crisis levels.

—Watch and share this Market Movers video from S&P Global Platts

Wave of Hearings Starts in Oil Pipeline, Federal Leasing Battles

A busy spring season of court and regulatory hearings for crude pipelines and federal oil and gas leasing kicks off March 23 with a long-shot court bid to stop the Line 3 Replacement project in Minnesota.

—Read the full article from S&P Global Platts

Saudi's April Allocation Cuts to Asia Within Expectations; Refiners Seek Alternate Supply

Term allocation cuts by Saudi Aramco to buyers in Asia were mostly within expectations, although some refiners are likely to supplement supply with crude oil from alternative sources.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language