Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 23 Mar, 2021

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

Estimates for when the global economy will fully recover range from as early as the second quarter to the end of this year, due to vaccination deployments and levels of activity varying across regions that need to pull out of the pandemic together.

What’s evident amid the uncertainty and after a year of turbulence, however, is that the outlook is brightening.

Favorable external financing conditions and global growth prospects will likely boost economic expansion across emerging markets as the year continues. China’s growth target of above 6% for 2021 signals its ambition to focus on social, technology, financial stability, and environmental goals. In Europe, countries’ jobs markets could shortly enjoy a more rapid rebound than after the 2007-2009 financial crisis. While S&P Global Ratings expects the third lockdown implemented in the U.K. to slow the country’s GDP growth this year to the tune of 4.3%, 2022 may see economic activity jump by 6.8%. In the U.S., the Biden Administration’s American Rescue Plan will support a more robust economic recovery in the country by lifting hard-hit sectors, expanding unemployment benefits and aid to small businesses, increasing COVID-19 testing and vaccination capacity, and broadening individuals’’ healthcare coverage.

Despite the global community’s historic credit burden, S&P Global Ratings thinks a near-term debt crisis is unlikely due to the anticipated trajectory of the recovery.

Even as prospects of greater growth lift U.S. yields, market participants’ concerns that rising inflation could derail credit markets and the overall economic recovery—in the U.S., emerging market economies, and beyond—may be unwarranted.

“As vaccines are rolled out at an increasing pace, activity rebounds, and the light at the end of the COVID-19 crisis tunnel becomes brighter, thoughts have turned to the shape and speed of the recovery. Recently, discussions have focused on the risk of rapidly rising inflation,” S&P Global Ratings’ Chief Economist Paul Gruenwald and Global Head of Research Alexandra Dimitrijevic said in a report this week. “We think inflation fears are overblown and that orderly reflation, around a return to sustainable growth, is a healthy development for both macro and credit outcomes. The recent rise in U.S. Treasury yields, and its spillover into corporate bond yields, indicates greater confidence in a sustained economic recovery, including a normalization of both market functioning and risk pricing.”

Today is Tuesday, March 23, 2021, and here is today’s essential intelligence.

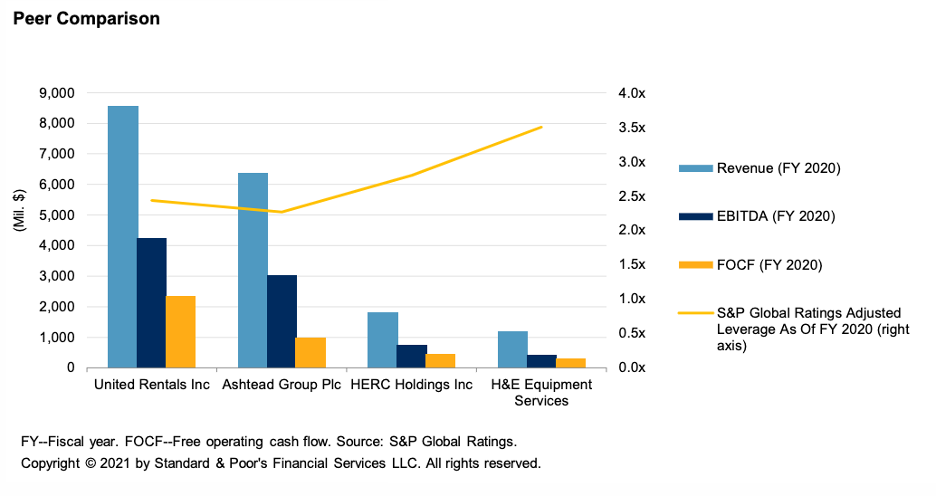

Cost Discipline And Secular Tailwinds Will Help U.S. Equipment Rental Companies Clear A Path Through Difficult Terrain

U.S. equipment rental companies are well positioned to deal with the lingering effects of the pandemic. Commercial construction generally operates with a lag to the general economy, so U.S. equipment rental companies are by no means out of the woods. That said, S&P Global Ratings believes the ability to manage the cost base and rapidly reduce capital expenditures (capex) to protect cash flows, as well as secular demand trends in the industry, position these companies well. S&P Global Ratings believe the impact of the 2020 recession on equipment rental companies will be less than that of the great recession of 2008-2009.

—Read the full report from S&P Global Ratings

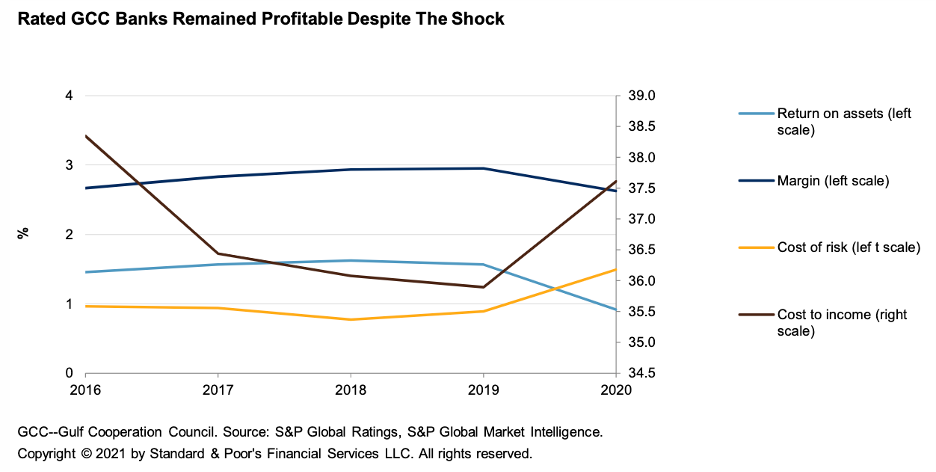

Stress Scenario: How GCC Banks Will Perform Amid Further Potential COVID-19 Shocks

Rated GCC banks set aside $10.9 billion of new loan-loss provisions in 2020 because of the expected hit from COVID-19 and low oil prices on their asset-quality indicators. S&P Global Ratings expects more provisions in 2021 as regulatory forbearance measures are lifted by regulators and banks recognize the full impact of the shock.

—Read the full report from S&P Global Ratings

Japanese Banks' Margin, Profit Pressure May Ease as Long-Term Rate Band Widens

The Bank of Japan's widening of the range of the long-term interest rate may ease some pressure on the nation's lending margins and boost profits in the banking sector, analysts say.

—Read the full article from S&P Global Market Intelligence

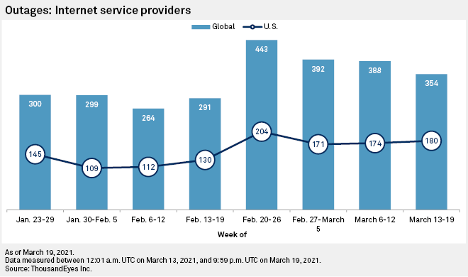

Global Internet Outages Fall 9% in 3rd Week of March

The number of global internet outages decreased by 9% in the third week of March compared to the previous week, marking the third consecutive weekly drop since a peak in late February, according to data from ThousandEyes, a network-monitoring service owned by Cisco Systems Inc.

—Read the full article from S&P Global Market Intelligence

U.S. Fintech Funding Still Going Strong, Following 20% Jump In 2020

As predicted, U.S. fintech funding in 2020 outpaced 2019 in both amount raised and volume of transactions, despite — and in some ways due to — the COVID-19 pandemic. S&P Global Market Intelligence foresees another strong year in 2021, which has already burst out of the gates due to Robinhood Markets Inc.'s $3.4 billion raise amid the GameStop Corp. frenzy.

—Read the full article from S&P Global Market Intelligence

Six Key Corporate Governance Trends for 2021

The pandemic has heightened the need for effective crisis management and has emphasized the importance of stronger board engagement in and oversight of ESG issues.

—Read the full report from S&P Global Ratings

U.S. Clean Power Standard Becomes Centerpiece of Congressional Climate Efforts

Proposals to form a national clean electricity standard have become a central focus of climate change legislation in the new Congress as U.S. President Joe Biden pushes for a carbon-free power sector. The concept has support from Democrats and Republicans, with nearly 40 U.S. states already adopting renewable or clean energy goals or standards, according to S&P Global Market Intelligence data. But lawmakers backing a clean electricity standard, or CES, still need to resolve differences over when the U.S. power sector would need to decarbonize, among other issues.

—Read the full article from S&P Global Market Intelligence

GAO Urges Action To Address 'Far-Reaching Effects' of Climate Change on U.S. Grid

A new government report anticipates "far-reaching" and costly impacts to the U.S. electric grid from climate change and called on federal regulators to step up their resilience efforts. The report came on the heels of widespread power outages in Texas due to extreme cold that some have blamed on climate change and as Congress looks to craft an infrastructure package that could address bulk power system reliability.

—Read the full article from S&P Global Market Intelligence

UAE's Energy Sector to be Integral Part of Circular Economy Plan: Minister

The UAE's energy sector will play a significant role in the country's circular economy plan because the oil and gas industry will be low-carbon and a major contributor to GDP, the climate change and environment minister told S&P Global Platts.

—Read the full article from S&P Global Platts

Meridian Energy CEO Looks to Balance Refining Needs With ESG Concerns

Environmental, social and governance considerations have becoming pressing issues among refiners in today's net-zero carbon world. While other refiners and oil companies are starting to embrace ESG, it has been a key part of Meridian Energy's strategy since 2013, when the company was formed. S&P Global Platts talked with Meridian CEO Bill Prentice about building an ESG refinery in North Dakota.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Platts

Watch: Market Movers Americas, March 22-26: Crude Oil Prices Retreat After Bullish Surge

In this week's Market Movers, presented by Kelsey Hallahan: Crude prices retreat after bullish surge; U.S. crude exports fall amid weak arbitrage opportunities; Aframax tides turn bearish; market economics spur robust U.S. LNG dispatch; potential drilling ban threatens Permian output.

—Watch and share this Market Movers video from S&P Global Platts

China Seen Importing Record Volumes of North Sea Crude in March

China's deliveries of North Sea crude are expected to hit a record this month, helping to offset tepid demand from European markets that remain subdued by COVID-19 lockdowns, according to market sources and an S&P Global Platts analysis of shipping data.

—Read the full report from S&P Global Platts

Spread Of 'Soft Cooking' Rice Varieties Hinders Thai Long Grain Price Competitiveness

The focus of Thai rice production has been shifting in recent harvests, with more and more farmers diversifying away from traditional long grain varieties, according to sources.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Language