Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 21 Mar, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Russia-Ukraine Ripple Effects Represent Risk to U.S. Economy Over Direct Exposures

The ripple effects of Russia’s invasion of Ukraine are likely to be more concerning for the U.S. economy’s recovery than any direct exposure to the conflict.

Nearly a month after Russia launched its attack on neighboring Ukraine, and the international community imposed a plethora of strict sanctions on Russia, the economic and market implications of the conflict have been felt far beyond the battle zone. Nonetheless, the U.S. is unlikely to experience its knock-on effects to the same extent as Europe due to its limited direct exposure to Russia. In a preliminary forecast, S&P Global Economics anticipates that effects related to the conflict will shave 70 basis points (bps) from U.S. GDP growth in 2022, with the economy now expanding 3.2%—driven primarily by steadily rising interest rates and persistent inflation, rather than by Russia’s current conditions. Europe, in contrast, is likely to see growth trimmed by 1.2% this year from the previous baseline as the region hardest hit by the continuing conflict.

“While the U.S. is comparatively isolated from the effects (certainly relative to the pain many European countries are feeling), the ramifications of the conflict are measurable—both for the world’s biggest economy and the businesses and borrowers that operate in it,” S&P Global Ratings said in a March 18 report. “We see the risks to our baseline forecast as firmly on the downside—mainly related to an escalation of the conflict beyond what is included in our baseline numbers. But we still see the chance of a U.S. recession as moderate, especially after growth surprised on the upside in the fourth quarter as the damage from the coronavirus omicron variant was less pronounced than we expected. If the public health situation in the U.S. keeps improving, the 2022 economic outlook would likely remain largely solid, even as the Russia-Ukraine conflict clouds the outlook.”

Rated U.S. corporates have felt minimal implications from the Russia-Ukraine conflict, according to S&P Global Ratings. The Russian economy accounts for less than 3% of global GDP. Any notable direct sales exposure to Russia was below 15% for the select number of issuers that had any. And suspended business operations due to sanctions and discretionary exits due to security concerns or public pressure have had limited effects on credit quality.

“Although the direct impact for U.S. financial institutions is limited, the situation has created an air of uncertainty with many secondary effects from the conflict looming—notably, our lower U.S. GDP growth forecast,” S&P Global Ratings said in the report, highlighting rising risks for U.S. financial institutions that span cyber risk to market volatility that could hit revenues and profitability for asset managers.

The conflict’s notable inflationary pressures could likely be the biggest risk to the rebound in the world’s largest economy as energy prices rise and the Federal Reserve looks to aggressively tighten monetary policy. But the strength of the country’s oil and gas industry may offset energy price pressures.

The status of the U.S. as a major shale producer has enabled the Biden Administration to sanction Russian energy without the same concerns about economic blowback, as well as ensure that its ban on Russian fossil fuel imports would likely have limited market impact, according to S&P Global Market Intelligence. Nonetheless, analysts told S&P Global Commodity Insights that immediate efforts by producers to increase their oil and gas output may not be meaningful until the medium-term because of a time-lag factor.

“Understandably, consumers of Russia’s oil and gas are accelerating their efforts to diversify,” S&P Global Ratings said in its report. “As net producers of these commodities, American and Canadian companies are positioned to benefit from rising prices, and we are already seeing examples of widening margins.”

Today is Monday, March 21, 2022, and here is today’s essential intelligence.

Written by Molly Mintz.

Listen: The Essential Podcast, Episode 56: The Myth Of Growth — Sustainability, Equality, And The Search For A Post-Growth Economy

Tim Jackson, Director of the Centre for the Understanding of Sustainable Prosperity and author of several books, including "Prosperity Without Growth" and "Post Growth: Life After Capitalism" joins the Essential Podcast to talk about sustainability, equality, the end of growth, the Baumol Effect, and the declining consolations of consumerism. The Essential Podcast from S&P Global is dedicated to sharing essential intelligence with those working in and affected by financial markets. Host Nathan Hunt focuses on those issues of immediate importance to global financial markets—macroeconomic trends, the credit cycle, climate risk, ESG, global trade, and more—in interviews with subject matter experts from around the world.

—Listen and subscribe to The Essential Podcast from S&P Global

Access more insights on the global economy >

Rising Rate Reflections

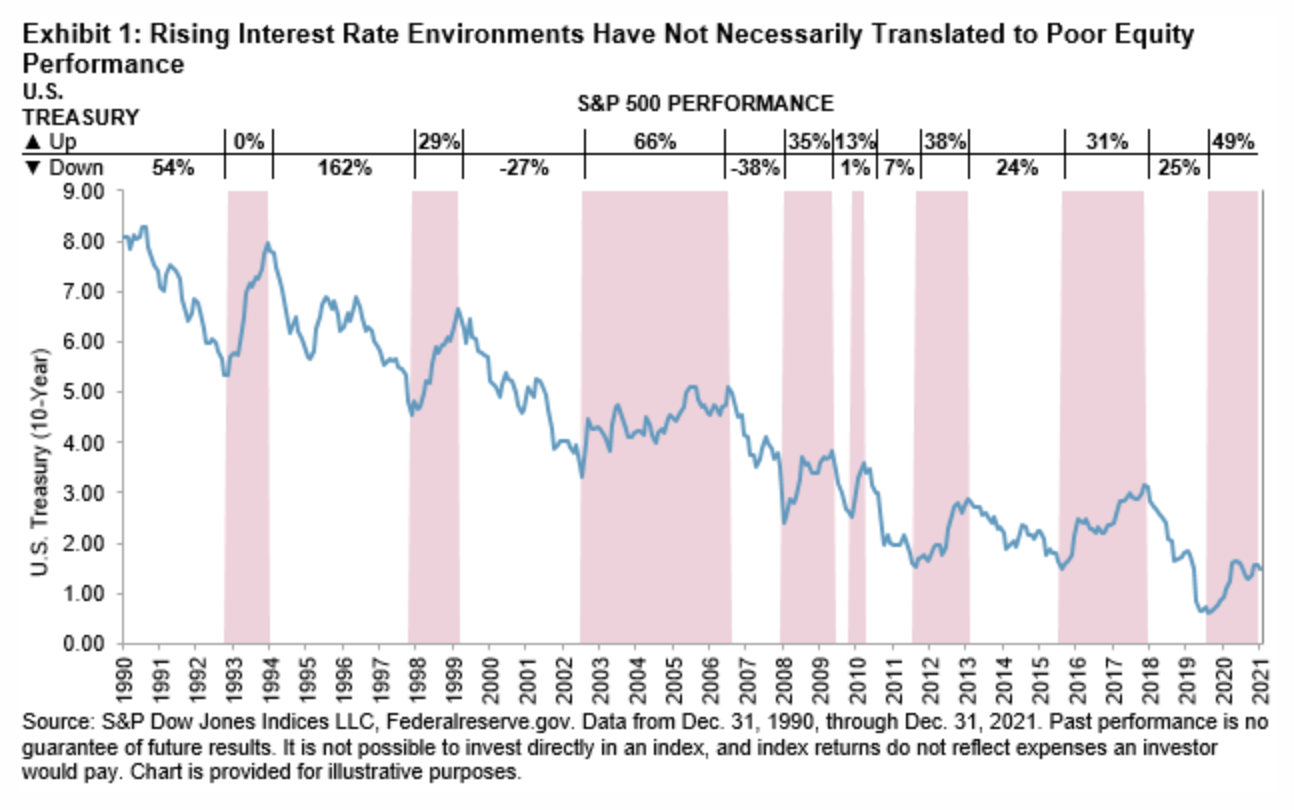

The Federal Open Market Committee voted to raise the Federal Funds rate by 25 bps on March 16, 2022. This move was well telegraphed and not at all surprising—but that doesn’t mean there won’t be concerns about how rising rates will impact equity returns. Finance theory teaches that, other things equal, rising interest rates are not good for the performance of stocks, as rising borrowing costs and higher discount rates tends to translate to lower future performance. For the much of history, empirical evidence has aligned with the theory. But in more recent data, it has been noticed that “other things” may not have always been equal.

—Read the full article from S&P Dow Jones Indices

Access more insights on capital markets >

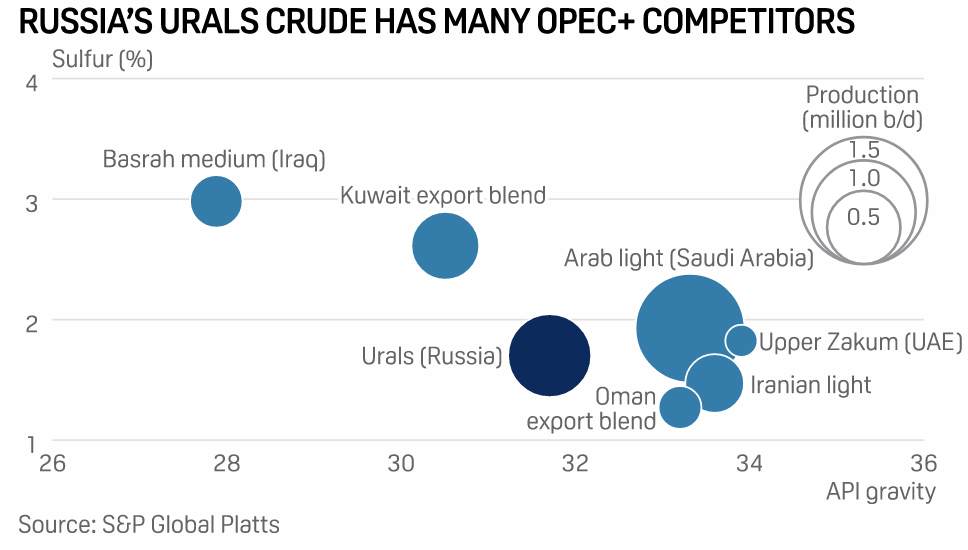

IEA Urges OPEC+ To Boost Supply As Diplomatic Pressure For Increases Builds

The International Energy Agency on March 18 urged OPEC+ countries to boost output, while Japan's prime minister held what his office called "an intense discussion" on oil prices with Saudi Arabia's crown prince, as international pressure grows for a Middle East response to the Russian supply crunch. Saying the market was "really disappointed" by the OPEC+ alliance's lack of urgency to offset the market's tightness at its last meeting March 2, IEA Executive Director Fatih Birol said he hoped the producer group would act more favorably when it reconvenes March 31.

—Read the full article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: Behind The Scenes With Blackrock How The World’s Largest Asset Manager Is Engaging With Companies

The latest episode of ESG Insider brings the world’s largest asset manager about its approach to engaging with companies, including those in carbon-intensive sectors. Hosts Lindsey Hall and Esther Whieldon interview Victoria Gaytan, Vice President at BlackRock Investment Stewardship, the team responsible for engaging with companies and for proxy voting on clients’ behalf. Victoria tells them about BlackRock’s engagement priorities for 2022, and what to expect from the upcoming proxy season. She also describes how the firm’s expectations of corporate boards are evolving on a range of ESG issues, from diversity to climate change to executive compensation.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Commodity Insights

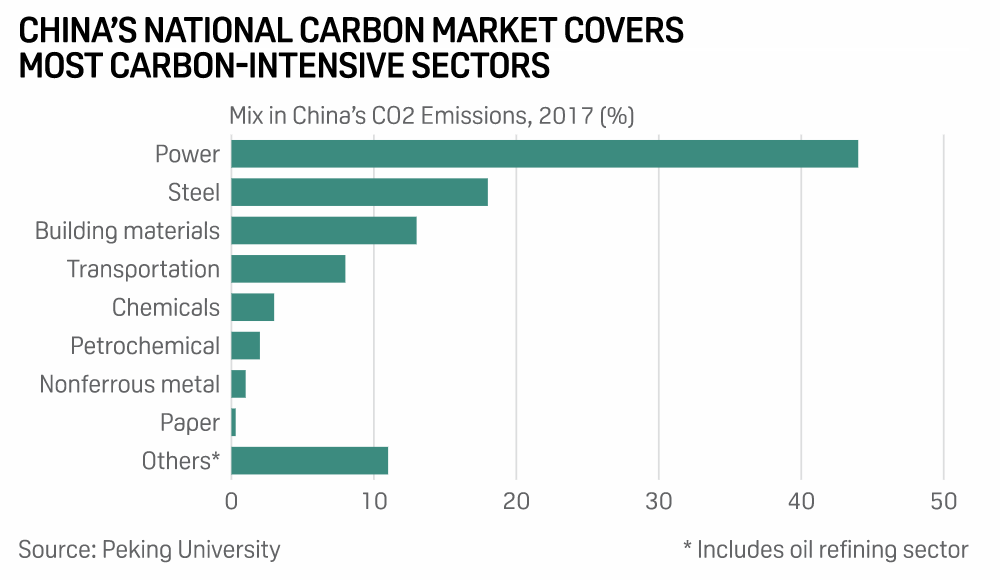

China's Emissions Fraud Cases Signal Challenges In Carbon Market Rollout

China's Ministry of Ecology and Environment has disclosed cases of negligence and fraud by four third-party emissions consultants that were in charge of assessing whether power companies were measuring and reporting accurate emissions data for the national compliance carbon market. The cases range from inefficiency and incompetence to active involvement in falsifying emissions data and coal sampling, and underscore the challenges in rolling out a national carbon market on a scale that has not been previously attempted globally.

—Read the full article from S&P Global Commodity Insights

Access more insights on energy and commodities >

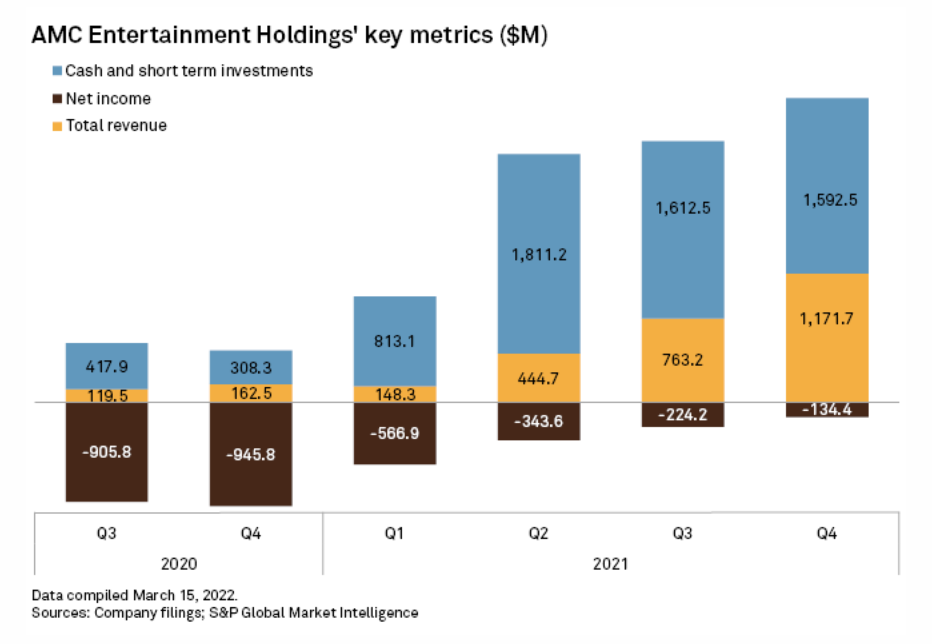

AMC Pressures Balance Sheet With Gold Mining Investment

AMC Entertainment Holdings Inc. continues to surprise investors with new strategies, deviating from its core theatrical business. The company, along with precious metals and mining investor Eric Sprott, each put up $27.9 million to fund the cash-strapped Hycroft Mining Holding Corp., a small gold and silver mining venture with one active operation in Nevada. The deal will provide Hycroft a lifeline after a 2015 bankruptcy and a 2020 reverse-merger with special-purpose acquisition corporation Mudrick Capital Acquisition Corp. For AMC, the investment is relatively small against its cash position, but the theater operator itself is struggling with a massive, high-rate debt load following the COVID-19 pandemic.

—Read the full article from S&P Global Market Intelligence

Access more insights on technology and media >

The ripple effects of Russia’s invasion of Ukraine are likely to be more concerning for the U.S. economy’s recovery than any direct exposure to the conflict.

Nearly a month after Russia launched its attack on neighboring Ukraine, and the international community imposed a plethora of strict sanctions on Russia, the economic and market implications of the conflict have been felt far beyond the battle zone. Nonetheless, the U.S. is unlikely to experience its knock-on effects to the same extent as Europe due to its limited direct exposure to Russia. In a preliminary forecast, S&P Global Economics anticipates that effects related to the conflict will shave 70 basis points (bps) from U.S. GDP growth in 2022, with the economy now expanding 3.2%—driven primarily by steadily rising interest rates and persistent inflation, rather than by Russia’s current conditions. Europe, in contrast, is likely to see growth trimmed by 1.2% this year from the previous baseline as the region hardest hit by the continuing conflict.

“While the U.S. is comparatively isolated from the effects (certainly relative to the pain many European countries are feeling), the ramifications of the conflict are measurable—both for the world’s biggest economy and the businesses and borrowers that operate in it,” S&P Global Ratings said in a March 18 report. “We see the risks to our baseline forecast as firmly on the downside—mainly related to an escalation of the conflict beyond what is included in our baseline numbers. But we still see the chance of a U.S. recession as moderate, especially after growth surprised on the upside in the fourth quarter as the damage from the coronavirus omicron variant was less pronounced than we expected. If the public health situation in the U.S. keeps improving, the 2022 economic outlook would likely remain largely solid, even as the Russia-Ukraine conflict clouds the outlook.”

Rated U.S. corporates have felt minimal implications from the Russia-Ukraine conflict, according to S&P Global Ratings. The Russian economy accounts for less than 3% of global GDP. Any notable direct sales exposure to Russia was below 15% for the select number of issuers that had any. And suspended business operations due to sanctions and discretionary exits due to security concerns or public pressure have had limited effects on credit quality.

“Although the direct impact for U.S. financial institutions is limited, the situation has created an air of uncertainty with many secondary effects from the conflict looming—notably, our lower U.S. GDP growth forecast,” S&P Global Ratings said in the report, highlighting rising risks for U.S. financial institutions that span cyber risk to market volatility that could hit revenues and profitability for asset managers.

The conflict’s notable inflationary pressures could likely be the biggest risk to the rebound in the world’s largest economy as energy prices rise and the Federal Reserve looks to aggressively tighten monetary policy. But the strength of the country’s oil and gas industry may offset energy price pressures.

The status of the U.S. as a major shale producer has enabled the Biden Administration to sanction Russian energy without the same concerns about economic blowback, as well as ensure that its ban on Russian fossil fuel imports would likely have limited market impact, according to S&P Global Market Intelligence. Nonetheless, analysts told S&P Global Commodity Insights that immediate efforts by producers to increase their oil and gas output may not be meaningful until the medium-term because of a time-lag factor.

“Understandably, consumers of Russia’s oil and gas are accelerating their efforts to diversify,” S&P Global Ratings said in its report. “As net producers of these commodities, American and Canadian companies are positioned to benefit from rising prices, and we are already seeing examples of widening margins.”