Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 2 Mar, 2021

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

More and more, stakeholders are pushing companies to operate on moral principles. While Milton Friedman wouldn’t have been pleased, capitalism in the time of COVID-19 may undergo a transformation to course-correct amid compounding crises.

The coronavirus pandemic continues, having infected 114.4 million people and killed 2.5 million worldwide, as the global vaccine rollout favors advanced economies. The physical effects of climate change last year scorched Australia and California with raging wildfires, while Arctic temperatures recently knocked out much of Texas’ power grid. Geopolitical tensions and nativism have affected economies from the U.S. to the U.K., Brazil to China, and beyond. Economic inequality has afforded the benefits of the past 20 years of productivity gains to the top 10% of the world’s population, with the wealthiest earning trillions during the coronavirus-caused economic downturn while billions of others suffer.

“How do we use our sense of what we need to do to solve these problems to inform the institutions and the conversations and the constraints that will allow us to rediscover capitalism?”, Harvard Business School Professor Rebecca Henderson, who studies how the private sector can play a major role in building a more sustainable economy, told S&P Global’s Essential Podcast. “Capitalism is not inherently good—but it's not inherently bad, either. It's a tool for allocating resources for pulling people together to solve problems. And when it's aimed in the right direction and constrained by the right kinds of guardrails, it's unbelievably good.”

Many in the business community agree. “Stakeholder capitalism” was the hot term at this year’s virtual World Economic Forum annual meeting, during which dozens of the world's largest companies, with trillions of dollars in market capitalization, pledged to report non-financial disclosures in new environmental, social, and governance (ESG) metrics focused on people, the planet, prosperity, and principles of governance. This development marks a step forward in the global effort to streamline and standardize reporting on ESG topics created by the pursuit of stakeholder capitalism, which are difficult to measure and require additional transparency and accountability.

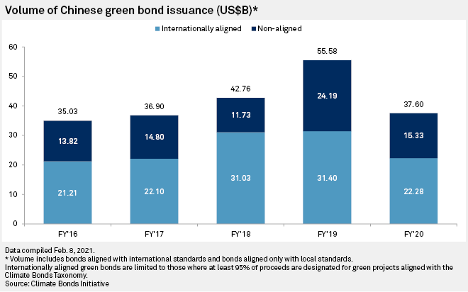

“ESG's rising importance is also reflected in the rise in sustainable debt issuance, which we think could surpass $700 billion in 2021. This is up by one-third from last year and double the 2019 level,” S&P Global Ratings said in a recent report. “Underpinning our expectation is the acceleration in green-labeled bond issuance and the building momentum for social and sustainability instruments. We are also seeing the development of transition bonds, which would enable the more carbon-intensive companies to raise capital that helps reduce their carbon footprint.”

But while engagement with ESG factors has exploded since the onset of the pandemic, the path forward through disclosure and action will be more difficult.

In the U.S., the deep political divide on how mandatory ESG disclosures should be implemented for investors and corporations was on display at a Feb. 25 House of Representatives subcommittee hearing, during which the Republicans’ witness claimed that such mandates and the broad ESG movement threaten democracy by allowing rich stakeholders to dictate the direction of public policy and morality, according to S&P Global Market Intelligence.

“My reading of the economic, political, and philosophical theory that gave us ‘maximize shareholder value’ as a moral duty is that it assumed the competitive market was genuinely free and genuinely fair. And what does that mean? Technically speaking, it means that prices reflect real costs. But to me, it's quite clear that at the moment the market is not free or fair because most obviously we can cause enormous harm to the people around us and to future generations and not pay for it,” Harvard’s Professor Henderson said in the S&P Global podcast interview. “It's the people who are most excited about the free market who should be most aware that they have, if they really believe it, a duty to fix these problems.”

Today is Tuesday, March 2, 2021, and here is today’s essential intelligence.

Dubai's Property Market In 2021: A Tough Year on The Road to Recovery

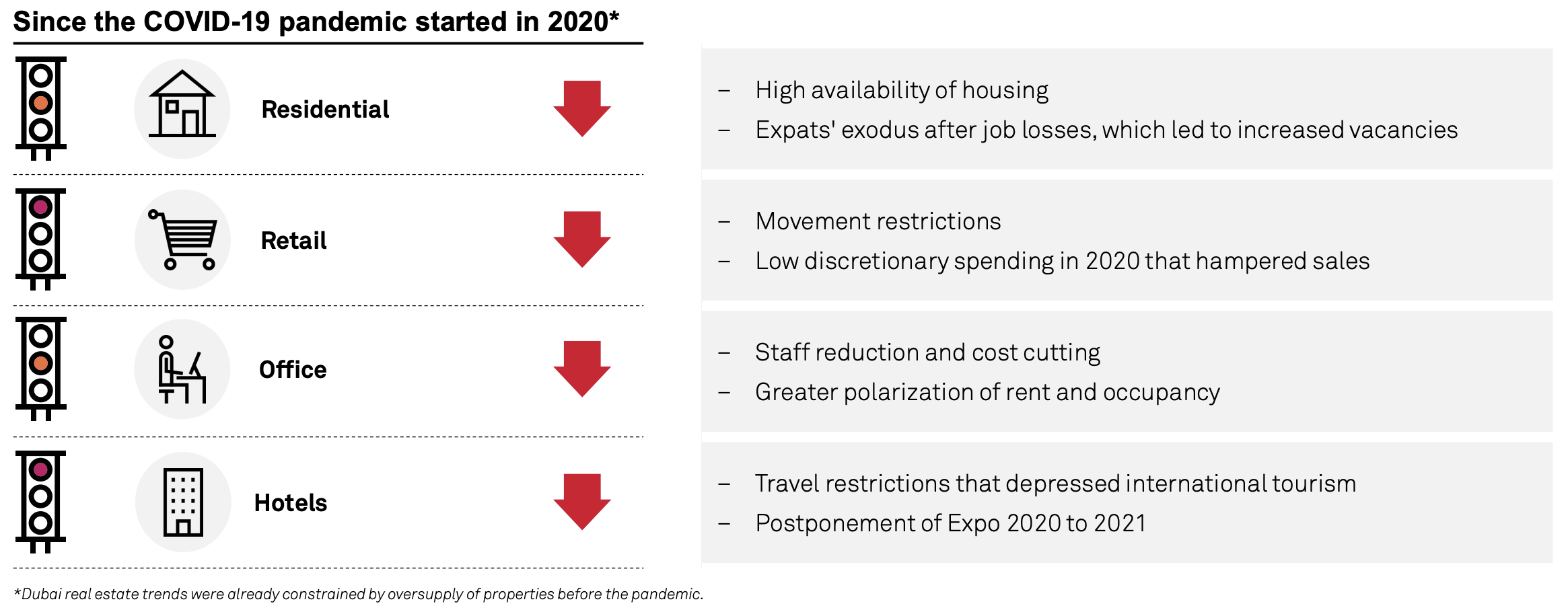

S&P Global Ratings expects Dubai’s GDP growth to recover this year from the sharp recession of 2020 triggered by the pandemic and low oil prices. However, real estate companies' profitability is expected to remain under pressure and leverage to be high. Absent a substantial recovery in revenue, companies are likely to focus on cost optimization, proactively managing their liquidity, and preserving their cash flows.

—Read the full report from S&P Global Ratings

What’s on the Horizon for the Cruise, Hotel & Resorts Sector?

Continued high levels of infections, ongoing travel restrictions, and possible changes in consumer demand make the Cruise, Hotels & Resorts sector particularly vulnerable, and also highly sensitive to the wider availability of effective COVID-19 vaccines. Since recovery to pre-pandemic levels in this sector is not projected until 2023, or possibly beyond, further credit risk deterioration is likely.

—Read the full article from S&P Global Market Intelligence

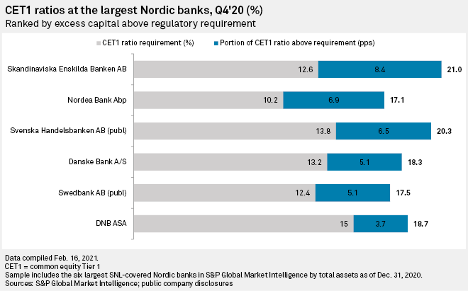

Nordic Banks Likely to Pay Special Dividends to Adjust 'Extreme' Capital Buffers

When dividend restrictions expire at the end of September, shareholders in Nordea Bank Abp, DNB ASA, Swedbank AB (publ), Skandinaviska Enskilda Banken AB and Svenska Handelsbanken AB (publ) can look forward to receiving payouts they have missed out on during the coronavirus pandemic in the form of an extraordinary dividend payment, according to analysts.

—Read the full article from S&P Global Market Intelligence

Spanish Banks Face Higher Provisions In 2021 If Economy, Tourism Fail to Recover

An uncertain economic outlook, a potential delay in the all-important tourism sector recovery and a slower pace of higher credit risk recognition than European peers will require Spanish lenders to recognize higher provisions in 2021 than they anticipate, according to analysts.

—Read the full article from S&P Global Market Intelligence

Added Complexity For PE Firms as UK Funds Fall Outside of EU Regulation

U.K.-domiciled private equity funds fall outside of the EU regulatory framework that allows general partners to market to investors across the bloc following Brexit, creating complexity for firms that previously relied on these rules.

—Read the full article from S&P Global Market Intelligence

From Shoreditch To The World: Review Calls on UK to Help Fintech Sector Scale Up

The independent review into the U.K. financial technology sector provides "sensible" recommendations to help the industry scale up and to underline its position as a global leader, according to industry observers.

—Read the full article from S&P Global Market Intelligence

China's Next Energy Transition Plan Set to Boost Green Bond Issuance In 2021

China's energy transition roadmap for 2021-2025 and beyond, widely expected to be unveiled early March, will likely give a much-needed boost to the nation's green bond issuance that declined for the first time last year due to the pandemic.

—Read the full article from S&P Global Market Intelligence

Green Building Takes Hold: A New Era for the Real Estate Industry

In 2019, the global value of real estate was estimated to be US$217 trillion – roughly 2.7 times the GDP of the entire world. Global real estate consumes approximately 40% of world energy annually and accounts for more than 20% of greenhouse gas (GHG) emissions. This highlights the contribution the real estate industry can make to help achieve the Paris Agreement goal of limiting global warming to well below 2°C from pre-industrial levels.

—Read the full article from S&P Global Market Intelligence

CERAWEEK: Fossil Fuel Demand Seen Growing Through 2030s: Panels

The energy transition took off in a big way just as the coronavirus pandemic was overtaking the globe in 2020, but fossil fuels are still seen growing at least through the 2030s even as renewables usage rises in popularity and affordability, panelists at the annual CERAWeek by IHS Markit conference said March 1.

—Read the full article from S&P Global Platts

Watch: Market Movers Europe, Mar 1-5: OPEC+ to Decide This Week Whether It Eases Production Cuts

In this week's highlights: OPEC+ is set to decide production policy for April and beyond; power auctions begin in the United Kingdom; European gas stocks hit significant lows; and the UK sugar beet industry looks set to avoid pesticides.

—Watch and share this Market Movers video from S&P Global Platts

Container Shipping Lines to Cut Free Time, Increase Surcharges In 2021 Contracts

Companies negotiating annual container shipping contracts with shipping lines before the end of the first quarter can expect increases in peak season surcharges and decreases in allowable free time with the container, as shipowners gain leverage from increased demand, industry participants say.

—Read the full article from S&P Global Platts

Singapore Port Faces Container Congestion Amid Surge In Vessel Calls

Container vessels planning to berth at Singapore port are now facing longer wait times, market sources said, with one source estimating that this has grown to five to seven days from a maximum of two days to turn around an 18,000 TEU vessel.

—Read the full article from S&P Global Platts

Listen: Panama Canal Seeks Solutions to Congestion as Wait Times Increase

As the shortest route from the U.S. Gulf Coast to East Asia, the Panama Canal has emerged as a key fixture in global trade flow dynamics. On the latest episode of Capitol Crude, S&P Global Platts spoke with Ricaurte Vásquez Morales, administrator of the Panama Canal Authority, who has been working to reduce congestion of the canal, which has grown in part because of LNG shipments from the U.S.

—Listen and subscribe to Commodites Focus, a podcast from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language