Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 16 Mar, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

China Resumes Australian Coal Trade

In April 2020, the Australian government joined the growing tide of nations calling for an independent examination of the origins of COVID-19. A week later, China's ambassador in the Australian capital of Canberra hinted at trade retaliation. In the following months, China enacted comprehensive punitive measures on a broad range of Australian industries, including Australia's third-largest export sector: coal.

After two years, China's ban on Australian coal imports appears to have ended. According to S&P Global Commodities at Sea data, about 1.4 million tonnes of coal was loaded from Australia for China in February.

Market participants expect China to procure more coal starting in March to stock up for summer demand and an anticipated rise in industrial activity after the country’s government eased lockdowns. Although China is set to reimpose import tariffs on various coal grades from April 1, after temporarily removing duties for a year until March 31, 2023, Australia is expected to be exempt from those taxes, making Australian coal more attractive to Chinese buyers.

Thermal coal, used mainly for power generation, and coking coal, used in steelmaking, are critical inputs for China's economic engine. Although the country meets most of its demand with domestic production, with plans to ramp up production in 2023, it's still the world's largest coal importer as it relies heavily on coal for electricity generation.

Coal is increasingly important to China's energy security, given that it's a relatively cheap fuel commodity, especially amid soaring prices and supply disruptions. Thermal coal prices soared following Russia's invasion of Ukraine in February 2022 and then stabilized at relatively high levels. Combined with weather disruptions in Australia and Indonesia, 2022 was a year of supply-demand mismatch in the thermal coal segment.

Coking coal, also known as metallurgical, or met, coal, is closely tied to steelmaking, and vice versa. With reduced demand due to COVID-19, global steel output flagged in 2020, but it bounced back along with coking coal demand as the global economy recovered. This, combined with China's ban on Australian coal and other pull factors, created a tight market and surging coking coal prices. The recent resumption of the Australia-China coal trade is expected to further support met coal prices.

Global seaborne met coal spot trades fell 52% year over year to 9.8 million tonnes in 2022, down from 20.6 million tonnes in 2021. S&P Global Commodity Insights observed 193 spot transactions for seaborne met coal in 2022, of which 83% were for premium hard coking coal. Of the premium hard coking coal deals, 90% were cargoes bound for markets excluding China.

Australian sellers looked to other regional markets such as Japan, South Korea and Taiwan to make up for exports once bound for China, and this trend may continue despite the apparent end of China's import ban. According to Carlos Fernández Alvarez, the International Energy Agency's acting head of gas, coal and power markets, discounted Russian coal and readily available Indonesian coal remain decent choices for China, so the world's largest coal importer may not immediately turn back to Australia for thermal coal.

Today is Thursday, March 16, 2023, and here is today’s essential intelligence.

Written by Wyatt Scott.

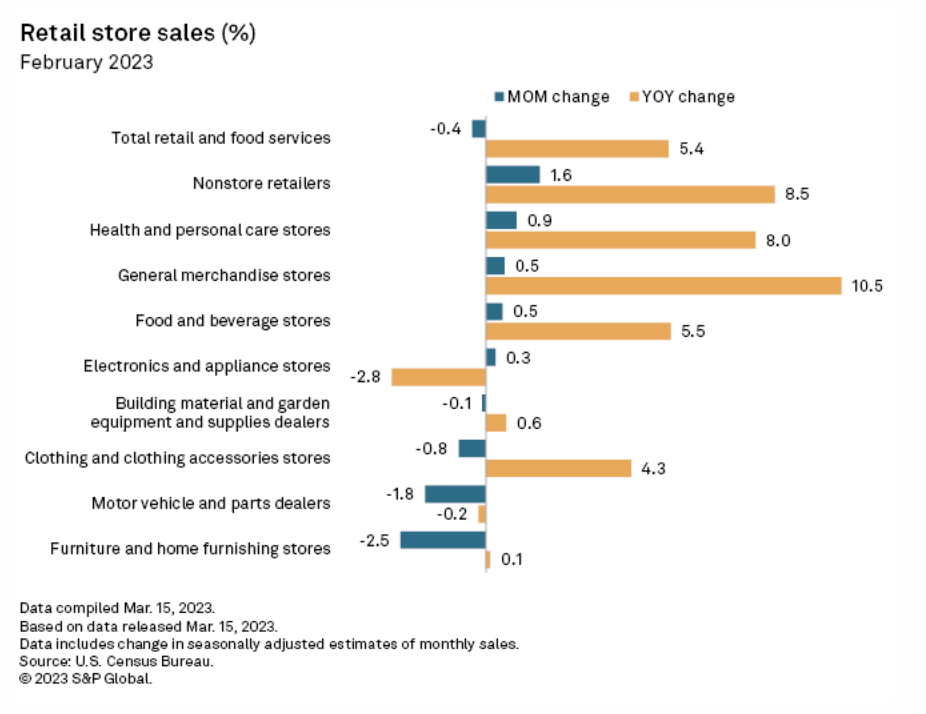

U.S. Retail Sales Fall More Than Expected In February

U.S. shoppers spent slightly less than economists predicted in February. Retail and food services sales dropped 0.4% month over month, according to seasonally adjusted data released March 15 by the U.S. Census Bureau. Economists' estimates compiled by Econoday called for a 0.3% drop. "Retail sales took a step back in February but not enough to signal a major deterioration in consumers' willingness to spend," Oren Klachkin, lead U.S. economist for Oxford Economics, said in a March 15 note. "Momentum may stay upbeat in the very near term, but we expect consumer spending to weaken later this year as income gains soften, excess savings run dry, borrowing costs rise and inflation stays elevated."

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

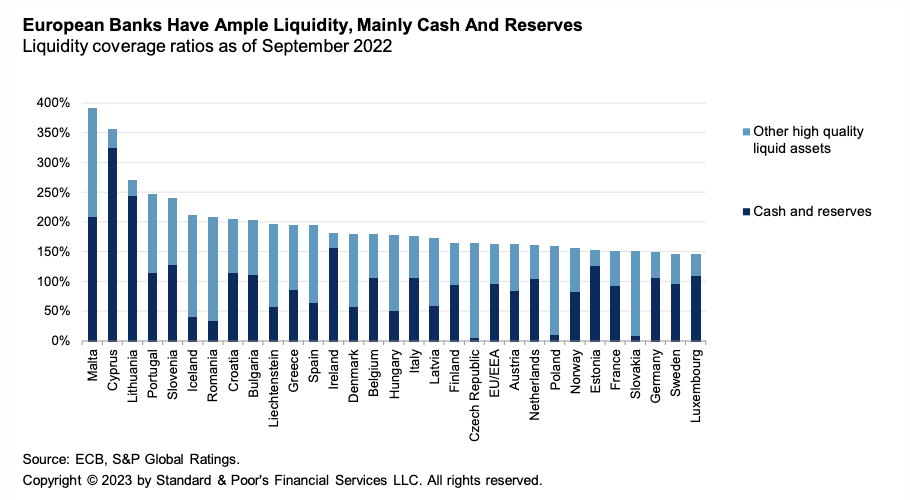

European Banks See Limited Contagion Risk From SVB

The failures of Silicon Valley Bank and Signature Bank are stark reminders that a sudden loss of confidence can lead banks to fail. S&P Global Ratings does not expect European banks will have any meaningful direct exposures to SVB and Signature Bank, which were not major actors in the international markets. As we look for European parallels with SVB, central bank tightening is undoubtedly also happening fast in Europe.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

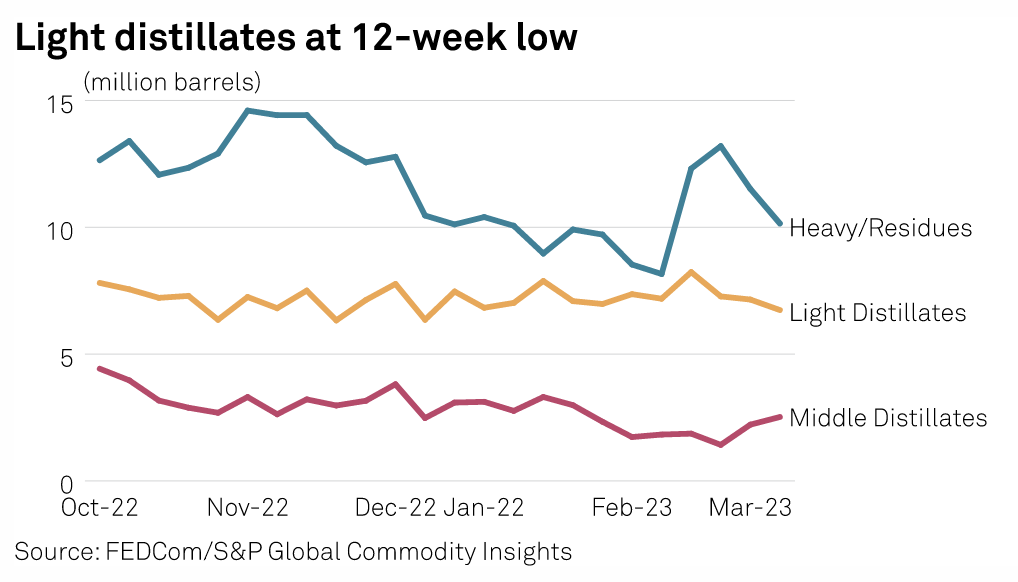

Oil Product Stockpiles Reach Four-Week Low As Heavy, Light Distillates Fall

Stockpiles of oil products at the UAE's Port of Fujairah fell 7.1% in the week ended March 13, led by a 12% decline in heavy distillates used for power generation and marine bunkers, according to Fujairah Oil Industry Zone data published March 15. Total inventories were 19.407 million barrels as of March 13, the lowest since Feb. 14, the FOIZ data provided exclusively to S&P Global Commodity Insights on March 15 showed. It was the third consecutive weekly decline after the 31% increase in the week ended Feb. 20, the biggest weekly gain in one year.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: Women In Leadership: What South African CEO Learned From Taking The Reins During COVID

To mark Women’s History Month and International Women’s Day, S&P Global Sustainable1 is bringing you a special series of the ESG Insider podcast focused on women in leadership, featuring interviews with women CEOs and executives from across industries and around the globe. In this episode, hosts Lindsey Hall and Esther Whieldon are speaking to Jackie van Niekerk, CEO of South African real estate investment trust Attacq, which is listed on the Johannesburg Stock Exchange. Attacq has a majority of women employees from executive leadership right through the business and tries to create an environment for women to succeed, Jackie tells them.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Sustainable1

Access more insights on sustainability >

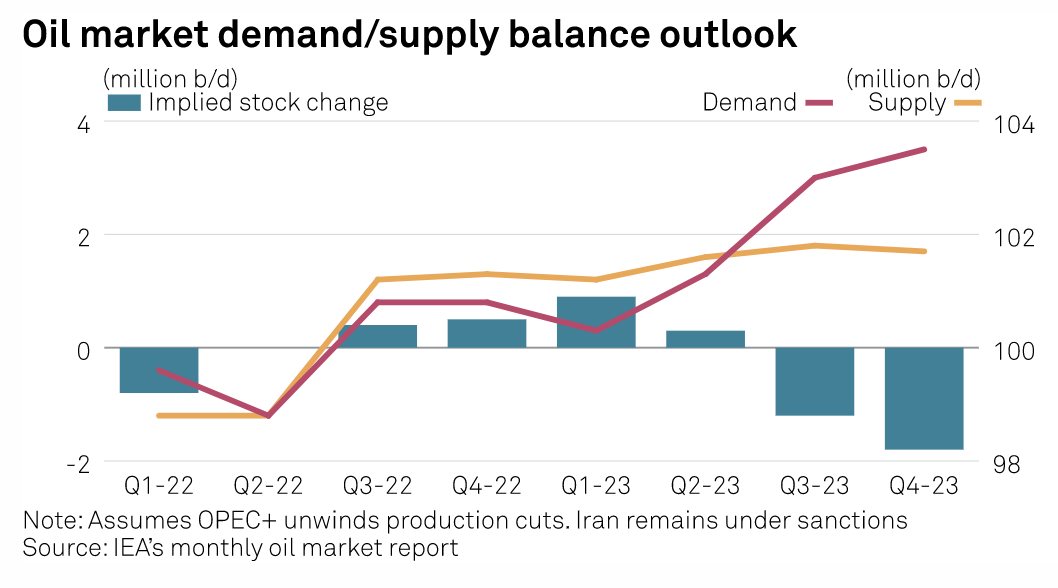

World Oil Demand To Hit Fresh Highs In 2023 As China Rebounds: IEA

The International Energy Agency March 15 raised its estimate for global oil demand in 2023 by another 100,000 b/d as rebounding air traffic and pent-up Chinese demand push consumption to record highs. In its latest monthly oil market report, the Paris-based energy watchdog said it now sees global oil demand averaging 102.02 million b/d in 2023, 2 million b/d higher than in 2022. The gains will accelerate over the year, however, rising to 2.6 million b/d year on year in the fourth quarter, from just 710,000 b/d in the current quarter, the IEA estimates.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

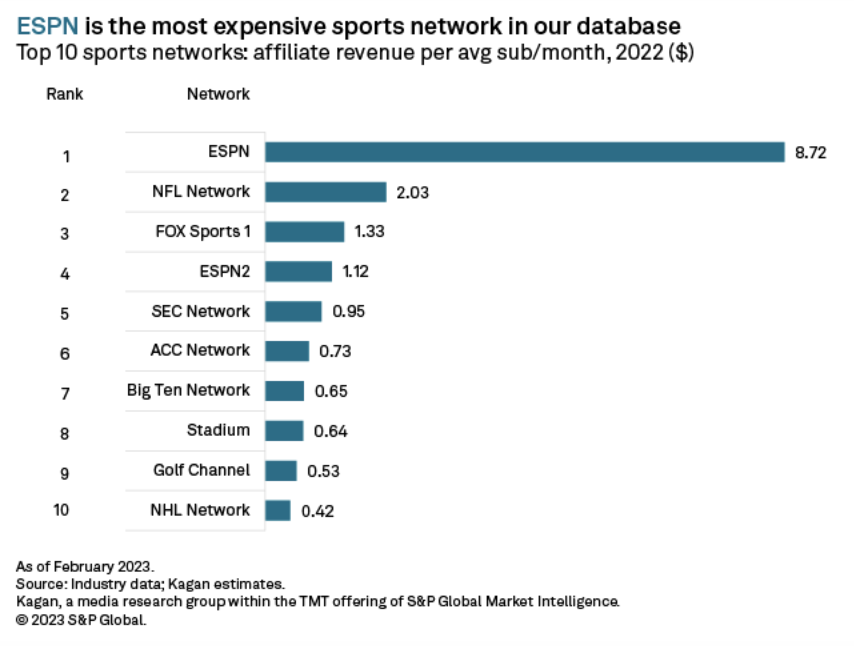

Virtual Multichannel Packaging Update: Sports Networks

Virtual multichannel services continue to add sports networks to their channel lineups to encourage more households to cut the cord and transition from traditional to virtual. Many virtual multichannel video programming distributors offer different kinds of sports networks, from international sports networks to college sports networks and regional sports networks, to cater to different demographics across the U.S. FuboTV lives up to its sports-centric marketing as it offers the widest selection of sports networks to cater to a wide variety of sports fans.

—Read the article from S&P Global Market Intelligence