Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 11 Mar, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

OPEC+ Unlikely to Rescue Unstable Oil Market

As global leaders look for solutions to meet their energy security needs and control skyrocketing prices, while economic sanctions and exposure concerns have resulted in businesses pulling out of Russia, they appear unlikely to find a solution from the OPEC alliance.

Energy multinationals including BP and Shell have doubled down on their exits from Russia over its invasion of Ukraine. The Biden Administration imposed a ban on U.S. imports of Russian oil and other energy products and prohibiting new investments in future Russian energy projects on March 8, and appears to be exploring oil trade opportunities with Venezuela to replace Russia’s supply. The U.K. imposed a similar ban, as well as sanctioned the heads of Russian energy giants—including Igor Sechin, the CEO of Russia-controlled oil major Rosneft, on March 10. While the EU has largely shied away from enacting similar sanctions in the immediate term in fear of “unmanageable” risks, European Commission President Ursula von der Leyen announced yesterday that the EU plans to propose phasing out Russian fossil fuels by 2027 to improve the bloc’s energy security.

But in the face of mounting supply concerns and oil prices toppling 14-year highs at $130 per barrel (and Russia warning they could jump to $300 per barrel if conditions continue), the world’s major economies are looking beyond their strategic petroleum reserves and turning to OPEC+—which controls 50% of global oil production—for help stabilizing the market from the fall-out of the Russia-Ukraine crisis. However, OPEC appears uninterested in ramping up its crude production and sees the soaring oil prices as a geopolitical problem of the West's own making, according to S&P Global Commodity Insights. OPEC has largely stood by its alliance with Russia, and the broad coalition hasn’t made any plans to advance their next formal meeting from March 31, during which May output quotas will be decided. Middle Eastern oil superpowers like the U.A.E. have already expressed their commitment to the current quotas.

"We call on oil and gas producing countries to act in a responsible manner and to examine their ability to increase deliveries to international markets, particularly where production is not meeting full capacity, noting that OPEC has a key role to play," G7 energy ministers said in a joint statement on March 10, calling on OPEC to help boost oil supplies to international markets where production is not meeting full capacity, according to S&P Global Commodity Insights. "This will help to ease tensions and note with appreciation announcements already made to this end."

OPEC Secretary General Mohammed Barkindo said March 7 at CERAWeek Conference hosted by S&P Global in Houston that the coalition plans to maintain its oil production schedule and not increase volumes in reaction to the "global gamechanger" of Russia's invasion of Ukraine because “we have no control over current events as geopolitics have overtaken the market” and that “all we can do is stay the course of our decisions."

"The high prices are not an outcome of any OPEC country's actions," an OPEC source told S&P Global Commodity Insights on March 7. "It is a political situation."

OPEC's spare production capacity is likely limited. According to an S&P Global Commodity Insights forecast, by May all OPEC members are expected to be effectively maxed out of additional production—excluding Saudi Arabia, which is likely to hold just under 1 million barrels per day of additional output, and the U.A.E., which could hold approximately 755,000 barrels per day. February saw the 19 members of the OPEC+ group produce their highest monthly crude oil output increase since July 2021, but quotas still fell 764,000 barrels per day short of their collective targets, according to the latest S&P Global Commodity Insights survey.

Today is Friday, March 11, 2022, and here is today’s essential intelligence.

Written by Molly Mintz.

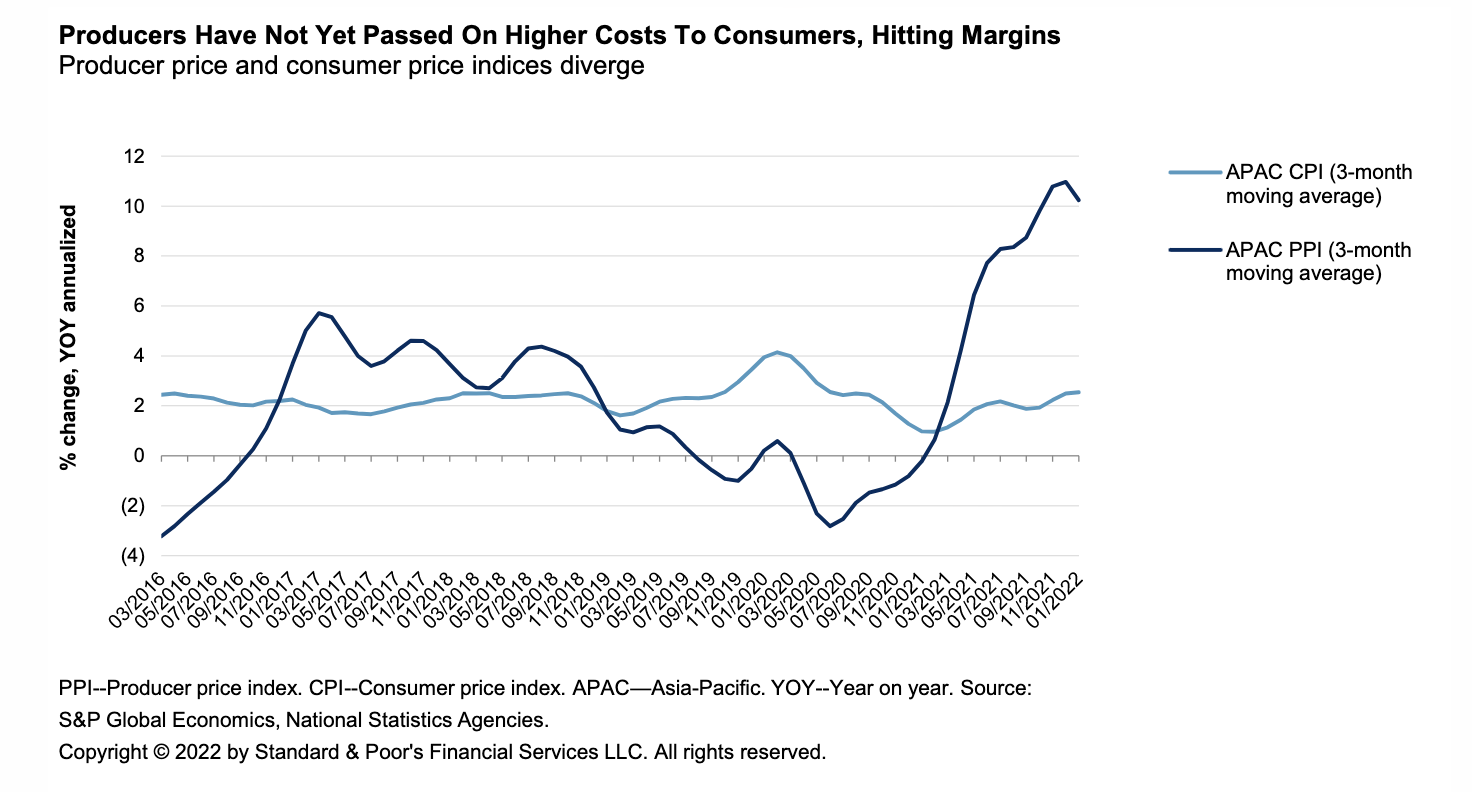

Credit FAQ: Ukraine Conflict And Asian Companies: Commodity Prices, Sentiment Exceed Direct Effects

The Ukraine conflict is raising commodity and energy prices and increasing market volatility in Asia-Pacific. S&P Global Ratings expects these factors will have the most relevant and immediate credit consequences for the corporate sector in the region. A protracted conflict hitting investor sentiment well into 2022 will complicate access to funding for weaker credits dependent on capital markets to refinance. Asia-Pacific entities typically have little or no direct exposure to Russia or Ukraine in terms of revenues, assets, or supply chains. Russian airlines and cargo are an immaterial contributor to traffic at Asian ports and airports, for example.

—Read the full report from S&P Global Ratings

Access more insights on the global economy >

Asset Quality Improves At Most Big European Banks In Q4'21

A majority of European banks with more than €100 billion in assets saw declines in their problem loans ratios on both a yearly and a quarterly basis in the fourth quarter of 2021, while two of the region's five largest lenders posted increases in the levels of bad loans, S&P Global Market Intelligence data shows. The problem loans ratios of Italian lenders BPER Banca SpA and Banco BPM SpA declined 222 basis points to 4.16% and 149 bps to 4.83%, respectively, on a yearly basis, marking the steepest fall among the 26 banks in the sample. Still, BPER Banca and Banco BPM placed first and third in the ranking of banks by problem loans ratio.

—Read the full article from S&P Global Market Intelligence

Access more insights on capital markets >

Listen: Russia-Ukraine Conflict Pushes European Commodities To New Highs

Oil markets—and others—are seeing record prices and intense volatility as Russia's invasion of its neighbor continues. S&P Global Commodity Insights reporters Rosemary Griffin, Elza Turner, and Rowan Staden-Coats discuss with Joel Hanley what the war in Ukraine means for prices, trade flows, and the refineries of Europe.

—Listen and subscribe to Oil Markets, a podcast from S&P Global Commodity Insights

Access more insights on global trade >

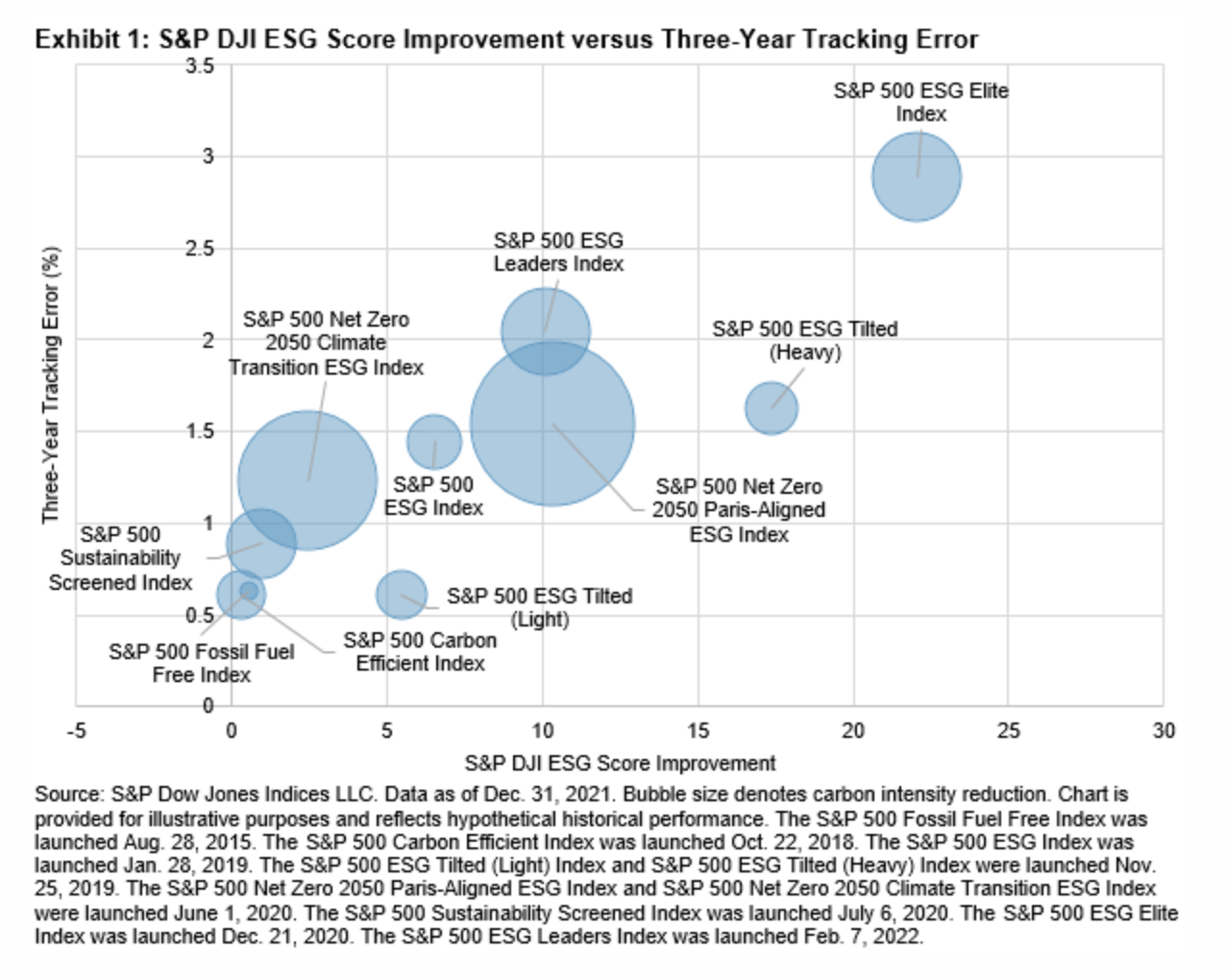

An ESG Solution For Every Objective: S&P 500 ESG-Based Indices

When it comes to ESG indices, different objectives require different solutions. Indices can range from simple to sophisticated, concentrated to benchmark-like, broad environmental, social, and governance to climate-focused, and more. Our growing suite of ESG indices aims to serve a wide range of ESG needs and support the alignment of investments with ESG principles.

—Read the full article from S&P Dow Jones Indices

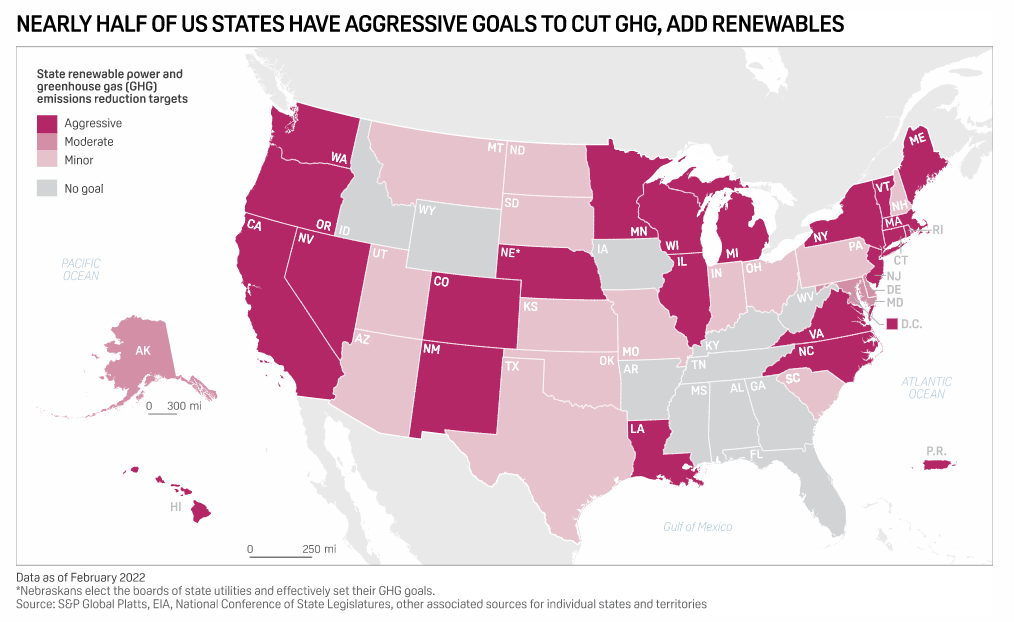

CERAWeek: U.S. Power Grid Needs Modernization To Achieve Decarbonization Goals

The U.S. electric grid needs to be modernized like other aspects of the economy have been in order to shift to the swell of clean energy waiting to come online to help meet net-zero goals, industry experts said March 10. The U.S. grid is stuck in the 1940s and hasn't changed much since it was created, leaving grid operator interconnection queues stacked with renewable projects waiting to come to fruition, panelists said during a session focused on connecting renewables to the power grid at the CERAWeek by S&P Global energy conference in Houston.

—Read the full article from S&P Global Commodity Insights

Access more insights on energy and commodities >

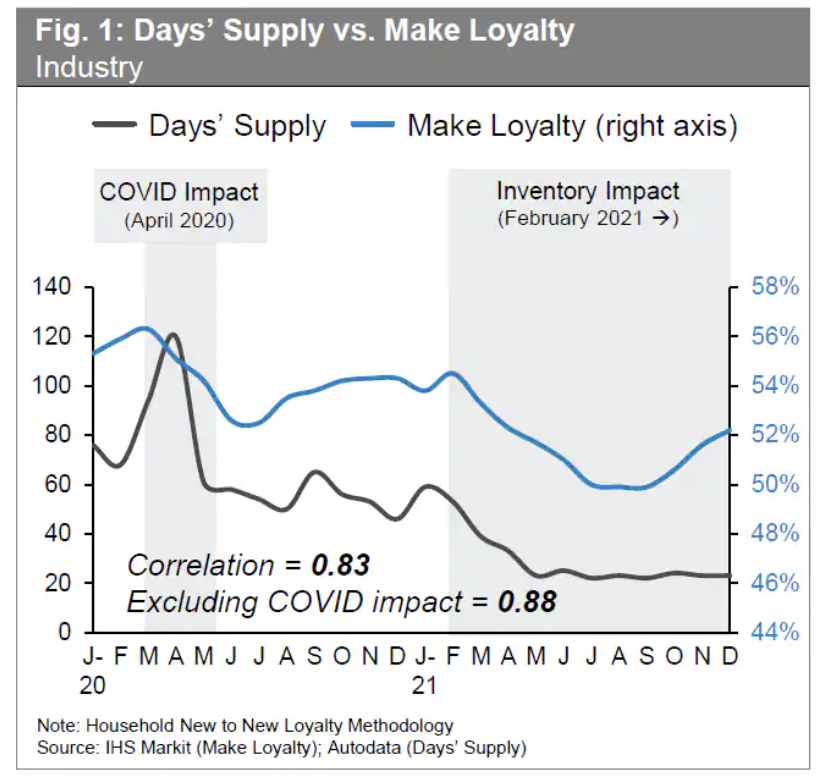

Industry Inventory Impact – March 2022

After the disruption from the COVID-19 pandemic in 2020, the current microchip shortage impact on vehicle production and inventory shortages have hampered sales for almost all brands. As consumers returned to market with limited choices, fewer were loyal to their brand. There is a strong positive correlation between days' supply and make loyalty.

—Read the full report from S&P Global