Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 9 Jun, 2021

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

When it comes to the global economy’s recovery from the coronavirus-caused economic downturn, the outlook for many sectors has modestly improved, but a full return to 2019 activity and credit levels won’t come until 2022 at the earliest and possibly 2023 or beyond, according to S&P Global Ratings. The road to recovery is still contingent on the successful deployment of COVID-19 vaccines around the world, which is advancing in developed economies across North America and Europe but lags in emerging economies like India.

Corporate credit quality appears to be stabilizing. So far this year, 43 corporates have defaulted worldwide, with no new defaults for two consecutive weeks as of June 4, according to S&P Global Ratings. In the U.S., May marked an approximate four-year low in the number of corporate bankruptcy filings—with just 27 new cases bringing the year-to-date total to 210, according to S&P Global Market Intelligence.

As companies determine their post-pandemic strategies and investors return to traditional assets to shield themselves from volatility, economies around the world face distinct challenges.

“Robust economic growth from some of the largest economies, namely the U.S. and China, is supporting the broader global economy. Homebuilders, building materials, chemicals, and metals and mining companies are benefiting from a recovery in demand that is outpacing available supply, resulting in positive revisions in many regions,” S&P Global Ratings said in a report yesterday. “Pent-up consumer demand, fueled by consumer savings and optimism, is beginning to thaw demand for leisure activities and travel, especially for domestic leisure travel in areas where a greater percentage of the population is vaccinated. Recovery expectations remain fluid and will rely on many factors, including companies' ability to adapt to the inevitable post-pandemic changes in consumption patterns.”

In the U.S., demand in the labor market is outpacing the supply of individuals looking for work. The country’s oil market is on the verge of rebalancing by the third quarter of this year. In Europe, banks in Spain and the U.K. have strong capitalization but are wary of ongoing or future credit losses. Across the Asia-Pacific region, climbing coronavirus cases are threatening both Malaysia’s sugar production, supply, and exports and India’s jet fuel market as international travel remains prohibited. China’s COVID-19 containment measures implemented at ports may exacerbate uncertainty for the country’s maritime trade.

A sustainable future may lie at the end of the recovery for economies eager to accelerate their energy transitions from fossil fuels. For high-emitting countries like India, the rebound may influence oil majors to simultaneously expand their portfolio and reduce their carbon footprint, according to S&P Global Platts.

"Perhaps a post-pandemic economic recovery anchored around sustainability and climate action could well be the prudent way," Nitin Prasad, chairman of Shell Companies in India, said in an exclusive interview with S&P Global Platts. "We also believe that there are opportunities to accelerate our activities to help the country recover cleaner and faster, which we are actively encouraging the government to consider … My vision for India is one with a clear focus on decarbonization and climate action, but in a fair and equitable way.”

Today is Wednesday, June 9, 2021, and here is today’s essential intelligence.

The Potential Value of U.S. Equity Allocation to Chinese Investors

The Chinese financial market has continued to evolve and mature over the past decade. More and more domestic Chinese investors are starting to take note of investment opportunities from global markets. What are the potential benefits of allocating globally for Chinese investors?

—Read the full article from S&P Dow Jones Indices

Global Actions on Corporations, Sovereigns, International Public Finance, and Project Finance to Date In 2021

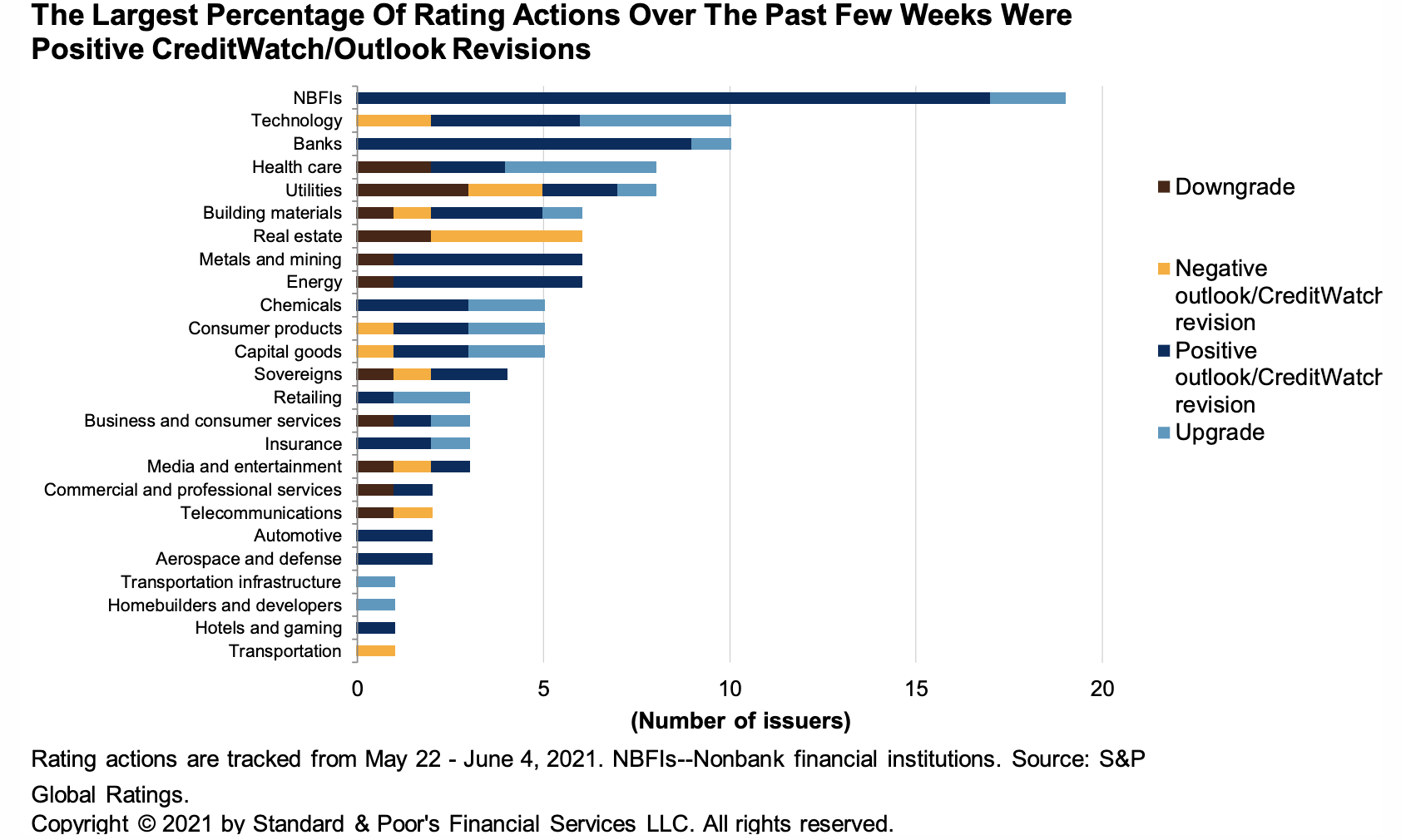

The number of rating actions continues to decline from the April 2021 high but remains positive. So far in 2021, there have been 339 issuers that have had a negative rating action and 951 issuers with a positive rating action. The largest percentage of rating actions has been due to an outlook revision to stable from positive. Most of these were issuers with ratings that have stabilized after having been lowered at least once in 2020.

—Read the full article from S&P Global Market Ratings

Bond Market Sees A Longer Path to Fed Tapering as Job Growth Underwhelms

A relatively disappointing jobs report has likely pushed back the Federal Reserve's timeline for tapering its $120 billion in monthly securities purchases, weighing down government bond yields and the U.S. dollar, analysts said. U.S. employers added 559,000 jobs in May from April, the U.S. Bureau of Labor Statistics reported June 4. The number was within many forecasts but was viewed by analysts as falling well shy of the Fed's broad labor goals.

—Read the full article from S&P Global Market Intelligence

Czech Lenders at Forefront of European Banking's Post-COVID-19 Digital Evolution

When COVID-19 first swept through Europe, Ceská sporitelna a. s. knew it would have to improve its ability to sell products and service customers through online and mobile channels, Josef Boček, a strategy analyst at the Czech Republic's second-largest lender by assets, told S&P Global Market Intelligence.

—Read the full article from S&P Global Market Intelligence

Supply Chain Finance: How to Remedy Flawed

Supply chain finance (also known as reverse factoring) can be a useful tool that allows suppliers and customers to improve their working capital management. However, for customers using supply chain finance to delay the time taken to pay invoices, current accounting rules and disclosures are not fit for purpose. S&P Global Ratings believes that some customers extend the contractual payment terms with suppliers at the same time as encouraging them to engage in supply chain finance. This allows them to arbitrage the accounting rules and claim that payments are made at the original invoice date and that the liabilities are therefore trade payables rather than debt. S&P Global Ratings typically views payments made by customers to financial intermediaries after 90 days as a form of borrowing and will seek to make adjustments to debt and operating cash flows unless amounts are clearly trivial. S&P Global Ratings strongly disagrees with the IASB's current position on disclosures in supply chain finance and consider that this area requires urgent improvement.

—Read the full article from S&P Global Market Ratings

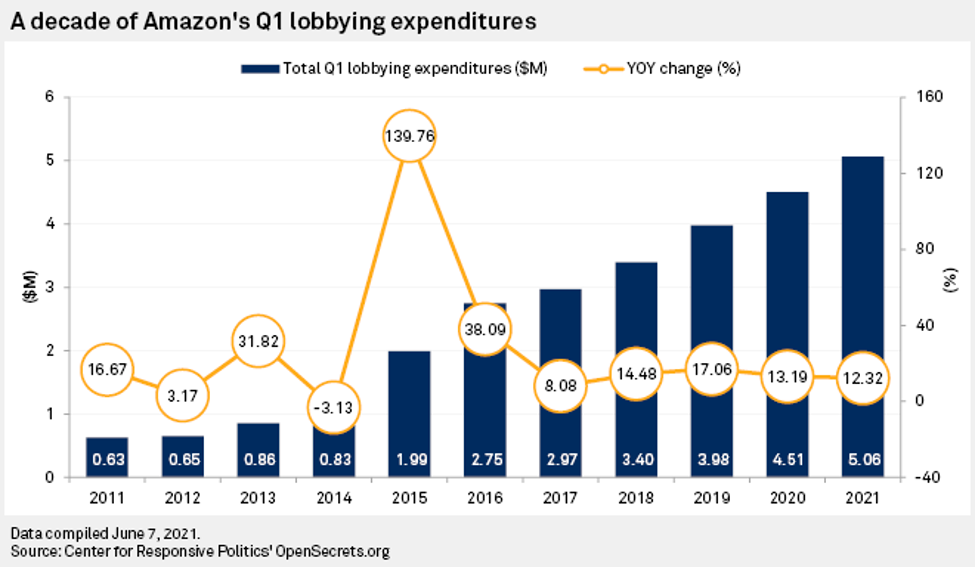

Facing Regulatory Threats, Amazon Ups Its Q1 Lobbying Spending to All-Time High

Seattle-based Amazon spent $5.1 million on lobbying in the first quarter, up 70% from $3.0 million in 2017, the inaugural period of the last presidential administration, according to the Center for Responsive Politics, a Washington D.C.-based nonprofit that tracks money in politics. Amazon broke the $1 million mark on first-quarter lobbying in 2015 and has steadily added to its lobbying expenditures ever since.

—Read the full article from S&P Global Market Intelligence

G-7 Minimum Global Tax Deal Unlikely to Bite Big Tech In Short Term – Analysts

Big tech's global tax obligations could soon get bigger — and messier. Looking to deter multinational companies from stockpiling earnings in low-tax countries to avoid paying taxes, the Group of Seven finance ministers recently agreed to support a landmark minimum tax proposal of at least 15% that would apply to large companies operating across the globe.

—Read the full article from S&P Global Market Intelligence

DOJ Recovers Majority of Bitcoin Ransom From Colonial Pipeline Hack

The US Department of Justice said June 7 it seized the majority of the nearly $4.5 million Bitcoin ransom paid to the DarkSide criminal hacker group for its attack that ultimately took the Colonial Pipeline fuel network down for nearly a week in May.

—Read the full article from S&P Global Platts

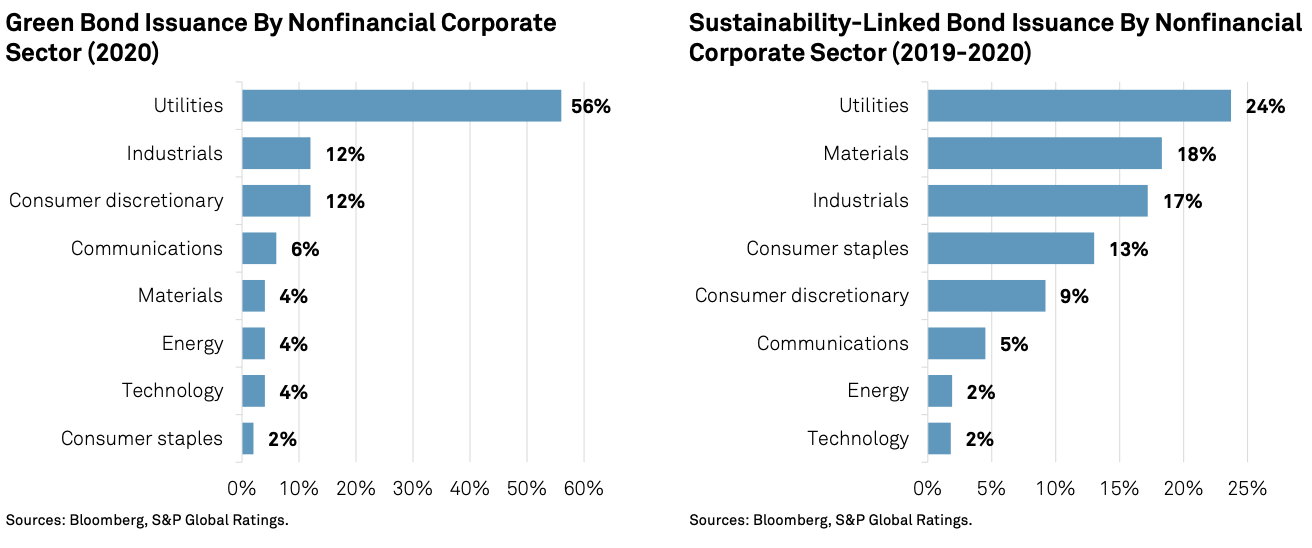

The ESG Pulse: Sustainability-Linked Bonds Are Taking Off

Following on the already established growth of sustainability-linked loans, sustainability-linked bonds are equally taking off with $50 billion of issuance forecast this year. Given the flexibility of such instruments, which are based on sustainability performance targets rather than use-of-proceeds green or social bonds, they allow a greater share of issuers to tap the sustainable debt market.

—Read the full report from S&P Global Ratings

BoE Unveils Climate Change Stress Tests; Results May Affect Supervision

The BoE's Climate Biennial Exploratory Scenario uses three scenarios of early, late and no additional action to explore two key risks from climate change. The first risk is that arising from the structural changes to the economy needed to meet net-zero carbon emissions and this is the transition risk. The second is the physical risk, which is the risk associated with higher global temperatures.

—Read the full article from S&P Global Market Intelligence

Carbon Tax Proposals Ahead of IMO Meeting Make Owners Jittery

Shipping industry fears that any imposition of a carbon tax on ships that use traditional bunker fuels, to encourage greener fuels is likely to make freight exorbitantly expensive, reduce already paltry earnings and discourage investments on new builds, market participants said June 8. The Marine Environment Protection Committee, or MEPC, of the International Maritime Organization is scheduled to meet June 10-17, where according to sources several issues related to reduction of carbon emissions are likely to come up for discussion.

—Read the full article from S&P Global Platts

Watch: Market Movers Americas, June 7-11: WTI, Brent Prices Remain High on Firm Demand Outlook

In this week's Market Movers Americas, presented by Chris van Moessner: Crude prices hold near multiyear highs amid tightened fundamentals; Aframax freight nears 2021 lows; a key election in Mexico could reshape the country's energy sector; Platts records the first East Coast Canada crude deal in the MOC process; strong soybean oil continues to bolster RINs; power forwards climb on weak hydro outlook.

—Watch and share this Market Movers video from S&P Global Platts

OPEC+ Lifts May Output by 430,000 B/D as Saudi Arabia Eases Its Voluntary Cut: Platts Survey

Crude oil production from OPEC and its allies jumped 430,000 b/d in May, the latest S&P Global Platts survey found, led by Saudi Arabia, which accounted for about 84% of the total monthly rise.

—Read the full article from S&P Global Platts

U.S. Unveils Plans for Supply of Batteries, Critical Minerals, Semiconductors

The Biden administration on June 8 released a fact sheet and set of reports outlining plans to address shortfalls in semiconductor and battery manufacturing as well as critical minerals supplies, marking a new chapter in U.S. efforts to compete with China and other nations that dominate those markets.

—Read the full article from S&P Global Market Intelligence

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Language