Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 30 Jun, 2020

By S&P Global

With 10.2 million cases of coronavirus confirmed and more than 500,000 reported deaths worldwide, according to Johns Hopkins University, the pandemic has reached a solemn milestone. The contagion is far from contained. As a result, the economic downturn may intensify and the recovery may not make meaningful gains next year, when many current forecasts anticipate a rebound.

“Although many countries have made some progress, globally, the pandemic is actually speeding up,” Dr. Tedros Adhanom Ghebreyesus, the World Health Organization Director-General, said at June 29 virtual news conference. “The worst is yet to come.”

Twenty-seven percent of U.S. chief executive officers don’t expect their companies to recover from the downturn until after 2021, according to the Business Roundtable’s second-quarter economic outlook index. The total 136 CEOs surveyed from June 1-22 believe that the U.S. economy will contract 3.8% this year, down 5.8 percentage points from their first-quarter projection of 2% growth.

“While recent economic data offer some positive signs, we are keeping in mind that more than 20 million Americans have lost their jobs, and that the pain has not been evenly spread,” U.S. Federal Reserve Chairman Jerome Powell said in prepared remarks that he will present today to the House Committee on Financial Services. “We have entered an important new phase and have done so sooner than expected. While this bounce-back in economic activity is welcome, it also presents new challenges—notably, the need to keep the virus in check.”

Despite businesses reopening and the increased hiring and spending seen across the U.S., “output and employment remain far below their pre-pandemic levels,” Mr. Powell said. “The path forward for the economy is extraordinarily uncertain and will depend in large part on our success in containing the virus. A full recovery is unlikely until people are confident that it is safe to re-engage in a broad range of activities.”

In Europe, sentiment “intensified” in June, but remains below pre-pandemic levels, according to the European Commission’s latest monthly survey in which the economic sentiment indicator posted its highest monthly increase, up 8.1 points to 74.8, since the poll’s creation in 1961. The indicator recovered some 30% of March and April’s losses. The survey showed that sentiment increased across all major eurozone economies and in all industries, but a full recovery is unlikely in the immediate term.

“We are slowly emerging from the depths of the economic impact, but I’d hesitate to say that we can see the end of this crisis right now,” European Central Bank Governing Council member Gabriel Makhlouf, who is the head of Ireland’s central bank, said at an online conference on June 29.

International experts agree that the alarming new clusters taking hold across Iran, Austria, in the U.S. states of Texas and Florida, and elsewhere are likely part of the virus’ first wave. The inability of countries to control their outbreaks has played a prominent role in prolonging the pandemic’s acute phase. A possible second wave of the virus may begin after cases reduce or stabilize for a sustained period. The 1918 Spanish Influenza pandemic, which killed 50 million people worldwide and infected approximately one-third of the world’s population, played out across three waves.

“The single most important intervention for breaking chains of transmission is not necessarily high-tech and can be carried out by a broad range of professions. It’s tracing and quarantine contacts,” the WHO’s Dr. Ghebreyesus said. “Six months since the virus started, it could be like a broken record to say exactly the same thing, but the same thing works. Test, test, isolate, quarantine cases.”

Today is Tuesday, June 30, 2020, and here is today’s essential intelligence.

Listen: The Essential Podcast, Episode 14: Rise of the Small City — The Limits of De-Urbanization

As knowledge-workers around the world have converted to work-from-home models, the costs and challenges of large cities are being re-evaluated. What factors are driving de-urbanization, and what are the countervailing forces that may keep people in cities? James Pomeroy, Global Economist at HSBC, shares perspectives on the potential winners and losers in a time of de-urbanization.

—Listen and subscribe to The Essential Podcast, from S&P Global

Economic Research: Canada's Economy Faces A Patchy Recovery

S&P Global Economics forecasts Canada's real GDP will contract 5.9% in 2020 before rising 5.4% in 2021. In the process, the Canadian economy would go through its worst back-to-back quarterly contraction in the modern era, reflecting a real GDP contraction of more than 13% peak to trough. The economy likely troughed in late April/early May. In the coming months, we expect an economic recovery in two stages: a near-term bounce in aggregate demand and employment activity as lockdown restrictions ease, followed by a more gradual, protracted, and uneven improvement in the economy. The risks to our central estimate of the recovery are squarely tilted to the downside.

—Read the full report from S&P Global Ratings

As COVID-19 Grips U.S. State Finances, Some Budget Debates Will Continue Well Beyond The Deadline

States' uncertainty about their finances due to COVID-19 and the recession is likely to cause some to delay action on fiscal 2021 spending plans beyond the July 1 fiscal start. 12 states have yet to enact a full-year fiscal 2021 budget. Reasons include compressed budget negotiations in a shortened legislative session, prioritizing closing current-year budget gaps, and waiting for updated economic and revenue estimates. Several have passed or plan to pass short-term or interim budgets until the revenue, expenditure, and federal aid picture comes into sharper focus, which is not uncommon during recessions. While late budget enactment is rarely a good sign, it is not necessarily an immediate threat to credit quality. Many states have procedures to keep operations going and protect debt service.

—Read the full report from S&P Global Ratings

More than $100B of M&A deals terminated amid 'new world order' of COVID-19

More than $100 billion of U.S. M&A deals have been terminated so far in 2020, an S&P Global Market Intelligence analysis finds. While many of the terminations cited the upheaval from the ongoing coronavirus pandemic, the value of scuppered deals in 2020 is largely in line with previous years. Several big-ticket mergers have been called off due to the impacts of the coronavirus, including Ally Financial Inc.'s $2.65 billion acquisition of CardWorks Inc. Ally and nonprime credit card and consumer finance lender CardWorks terminated their deal June 24 citing economic uncertainty related to the COVID-19 pandemic.

—Read the full article from S&P Global Market Intelligence

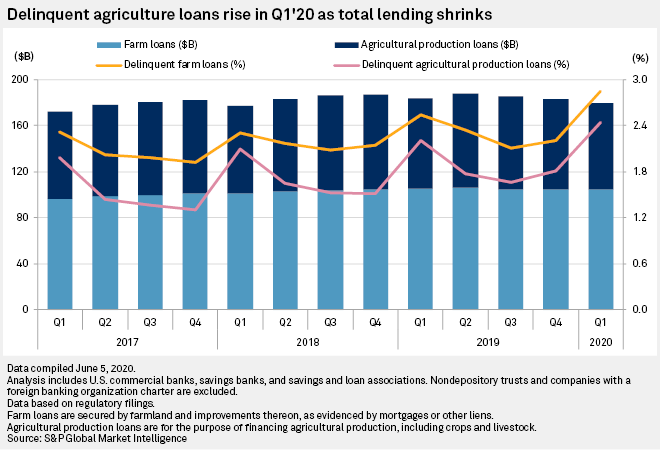

Agriculture loan delinquencies hit 8-year high as farmers grapple with COVID-19

"Where grocery stores may have seen it difficult to stock the shelves with meat and milk and eggs, the farmers that produce those products were swimming in product and all those products became very unprofitable," Kevin Perrinjaquet, an Iowa farmer who owns a mill that provides feed for 600,000 hogs, said in an interview. "They were dumping milk on the ground, they were euthanizing 300-pound hogs that had no place to go… That chain is very, very tight. You disrupt part of it, and it can fall apart really quick." Farmers across the U.S. are grappling with this kind of disruption, which Perrinjaquet said could take years to correct. Animal and ethanol production plants closed as the coronavirus spread. As states nationwide issued stay-at-home orders, restaurants closed, demand for food dropped and commodities prices fell. Unable to sell their products, farmers lost out on income.

—Read the full article from S&P Global Market Intelligence

Oil and gas private equity sector shrinks amid bankruptcies, lack of funds

With bankruptcies mounting in the North American oil and gas industry, the part of the sector backed by alternative asset managers is staring down a phase of consolidation and contraction as energy investors lose their trust in private equity. From asset management giants like Ares Management Corp. and Apollo Global Management Inc. to energy-specific firms such as Riverstone Holdings LLC and First Reserve Corp. private capital has seen some of its portfolio companies file for Chapter 11 bankruptcy protections alongside publicly-owned firms. Industry researchers, consultants and bankruptcy attorneys that spoke to S&P Global Market Intelligence disagreed over the extent of the risk of private companies going under, but most acknowledged that the number of players is already significantly smaller than it was and will continue to dwindle.

—Read the full article from S&P Global Market Intelligence

Deadline looms for financial services deal on market access between EU and UK

The U.K. wants a deal with the European Union on mutual market access for financial services based on its regulations that provide the same outcomes as EU rules, but no longer on a bespoke "enhanced equivalence" arrangement, according to experts. The deadline to reach agreement on assessing whether each other's financial systems are "equivalent" is June 30. There has been no update from either side on whether that deadline remains in place, but observers said an agreement by then looks unlikely.

—Read the full article from S&P Global Market Intelligence

Post-2008 reforms made big banks safer but resolution barriers remain – FSB

Systemically important banks now hold more capital and less risk than they did in 2008 but their resolution is still a challenge, the Financial Stability Board said in an assessment of too-big-to-fail reforms launched in the aftermath of the global financial crisis. The key goal was to determine whether too-big-to-fail reforms have achieved their objective of making banks more resilient and resolvable without the use of taxpayer money, Claudia Buch, vice president of the German central bank, said June 26. The evaluation also aimed to find whether the reforms have resulted in any material side effects, said Buch, who chaired the group that produced the report.

—Read the full article from S&P Global Market Intelligence

Listen: Street Talk - Ep. 64: Coronavirus jumpstarts digital adoption

The coronavirus pandemic has pushed digital adoption five years into the future, prompted banks to invest more in technology and could set the stage for fintech and bank mergers later this year. In the episode, Todd Baker, senior fellow at Columbia University and managing principal of Broadmoor Consulting; Phil Goldfeder, senior vice president of public affairs at Cross River Bank; and Greg Smith, managing director at fintech-focused investment bank FT Partners, discuss how the coronavirus has changed the way customers access financial services and increased the possibility of mergers between banks and fintechs. The episode also features commentary from executives at Citigroup and Fifth Third about the accelerated pace of digital adoption in recent months.

—Listen and subscribe Street Talk, a podcast from S&P Global Market Intelligence

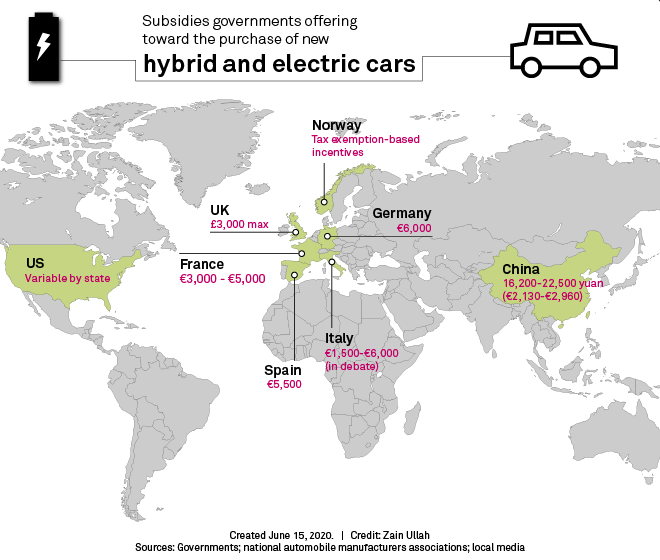

Governments tie auto industry stimulus packages to cleaner mobility

In a rerun of stimulus packages deployed during the post-2008 recession, a number of governments worldwide have unveiled or are considering new cash subsidies toward the cost of cars in the hope such big-ticket purchases will breathe life into floundering economies.

—Read the full article from S&P Global Market Intelligence

BlackRock, BNP Paribas push deforestation as urgent climate change risk

BlackRock Inc. and BNP Paribas SA are among the financial institutions pushing consumer companies to more comprehensively incorporate the substantial financial risks from deforestation in their climate-risk models. In recent years, asset managers have had some success getting food, clothing and luxury goods companies to acknowledge the physical, regulatory and market risks that come with sourcing commodities grown on previously forested land. But the continuing loss of tree cover in large swaths of the world has convinced asset managers to redouble their efforts by linking deforestation more specifically to climate change, a subject that tends to receive more attention in corporate boardrooms.

—Read the full article from S&P Global Market Intelligence

Watch: Market Movers Americas, June 29-July 3: Rig count rises, but pandemic continues to pressure US commodities

In this week's highlights: rising US oil rig counts might signal drilling declines have reached a bottom; President Donald Trump may raise tariffs on Canadian aluminum imports; and rainy weather continues to weigh on US grain prices.

—Share and watch this video from S&P Global Platts

The big spender goes bust: How years of gambles brought down Chesapeake Energy

Years after failing to see its vision of a natural gas-powered future take flight, the driller that introduced "fracking" to the American vocabulary finally fell to earth. Chesapeake Energy Corp. filed for Chapter 11 bankruptcy protection June 28, weighed down by billions in debt after two decades afloat on dreams and financial engineering. Often accused, perhaps unfairly, of being a real estate company with a drilling rig parked in back, Chesapeake led the nation's "land grab" for shale oil and gas assets, investing indiscriminately in fields that would skyrocket and others that would flop. But, Chesapeake and others used fracking to produce far more gas than they could profitably sell; business plans devised around $6/MMBtu gas in the first decade of the century, collapsed at the $2/MMBtu pricing seen for the last few years.

—Read the full article from S&P Global Market Intelligence

BP sells petrochemicals business to Ineos for $5 billion

BP has agreed to sell its remaining petrochemicals business to Ineos Group for $5 billion, as the oil major retools its balance sheet in a push for cleaner energy and Ineos boosts its share of the global polymer market. Under the deal, the UK-based petrochemical giant will acquire all of BP's petrochemicals business in Asia, the US and Europe, which last year produced 9.7 million mt of products and employed over 1,700 staff worldwide.

—Read the full article from S&P Global Platts

OPEC's secretary general, UAE energy minister say tough times ahead for oil markets

Tough times still lie ahead for oil markets despite OPEC+ coalition's implementation of a historic production cut that began in May and has been extended into July, the secretary general of OPEC and the UAE energy minister said June 29. "Although we are not yet out of the woods, but we have proven together with our partners in non-OPEC...that multilateralism is irreplaceable especially in our diverse world of energy that is sometimes punctuated with geopolitics," OPEC secretary general Mohammed Barkindo told a webinar organized by the Canada-UAE Business Council.

—Read the full article from S&P Global Platts

Long-term contracts still eluding coal sector as short-term deals dominate

While longer-term deals still form a smaller share of coal deliveries to U.S. power plants, companies recently delivered a higher share of coal on medium-term contracts with terms of two to four years remaining, according to a recent snapshot of the market analyzed by S&P Global Market Intelligence. About 17.2% of coal delivered to U.S. power plants in December 2019 had two to four years remaining on the contract, up from 13.0% in December 2010. Producers delivered 14.8% of the coal sold in the country under agreements with more than five years left on the contract, down from 19.1% in December 2010. At the same time, coal volumes sold on spot contracts rose from 6.6% in December 2010 to 13.9% in 2019.

—Read the full article from S&P Global Market Intelligence

Listen: Shifting geopolitics of energy during pandemic, trade wars and supply abundance

The fallout from the coronavirus pandemic and a host of other global tensions and trade conflicts brewing in recent months have heightened geopolitical risks to energy trade. Harvard University professor Meghan O'Sullivan shares what she sees as the top geopolitical themes likely to persist beyond the pandemic. O'Sullivan is the director of the Geopolitics of Energy Project at Harvard's Kennedy School of Government. She was a special assistant to former US President George W. Bush and a deputy national security adviser. She sees three main themes dominating: global energy abundance, the interconnectedness of oil markets and efforts to accelerate the energy transition. We also talked about whether a stunted US shale sector will weaken the impact of US sanctions and other foreign policy, the US' role around OPEC+ talks, and a potential decoupling of the US and China.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language