Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 3 Jun, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

U.S. Electric Vehicle Adoption Looks Likely To Accelerate

As electric vehicle adoption continues to expand worldwide, the U.S. market looks likely to start catching up to China and Europe—which have dominated in global electric vehicle sales. But will current inflated battery metals prices and supply chain disruptions slow the U.S.’s decarbonization efforts?

Global electric vehicle production and adoption has advanced against the backdrop of the plans of more than 20 countries to limit new sales of internal combustion engine vehicles over the next 30 years and drive toward a greener future. Last year, global electric vehicle sales doubled year-over-year to 6.6 million—with 16.5 million electric cars on the road worldwide, tripling in growth from 2018, according to figures released by the International Energy Agency on May 23. The IEA’s Global EV Outlook found that plug-in battery and hybrid electric car sales in the U.S. doubled last year, to 630,000, after two years of stalled growth. And that momentum in the world’s largest economy looks likely to continue apace.

By 2030, some 32 million battery electric and plug-in hybrid vehicles are likely to be cruising U.S. roadways—marking a monumental acceleration from the estimated 2.2 million on the road in the U.S. last year, according to S&P Global Mobility. That same year will also likely see nearly 280 electric vehicle models available in the U.S., from just 26 last year.

But the inflationary implications of the Russia-Ukraine war on rare earth and platinum group elements alongside pandemic-prompted supply chain disruptions in China have posed problems for the electric vehicle outlook.

S&P Global Ratings anticipates that global battery prices will remain high in 2023 due to a surge in the cost of raw materials—which could play a role in pushing electric vehicle’s cost parity with internal combustion engine vehicles to the second half of the decade. In response, automakers may spend more on their battery supply chains and evolve their means of doing business.

“The global energy and mobility industry is at a critical inflection point. Meeting ambitious emissions targets while also delivering energy and mobility for a growing world economy will require new thinking, innovation and a transformation of a system that supports the $90 trillion world economy,” S&P Global Mobility said in a recent report. “Further complicating this picture are rising geopolitical tensions and nationalism, growing trade friction, supply chain bottlenecks, economic headwinds, and the ongoing pandemic.”

Today is Friday, June 3, 2022, and here is today’s essential intelligence.

Written by Molly Mintz.

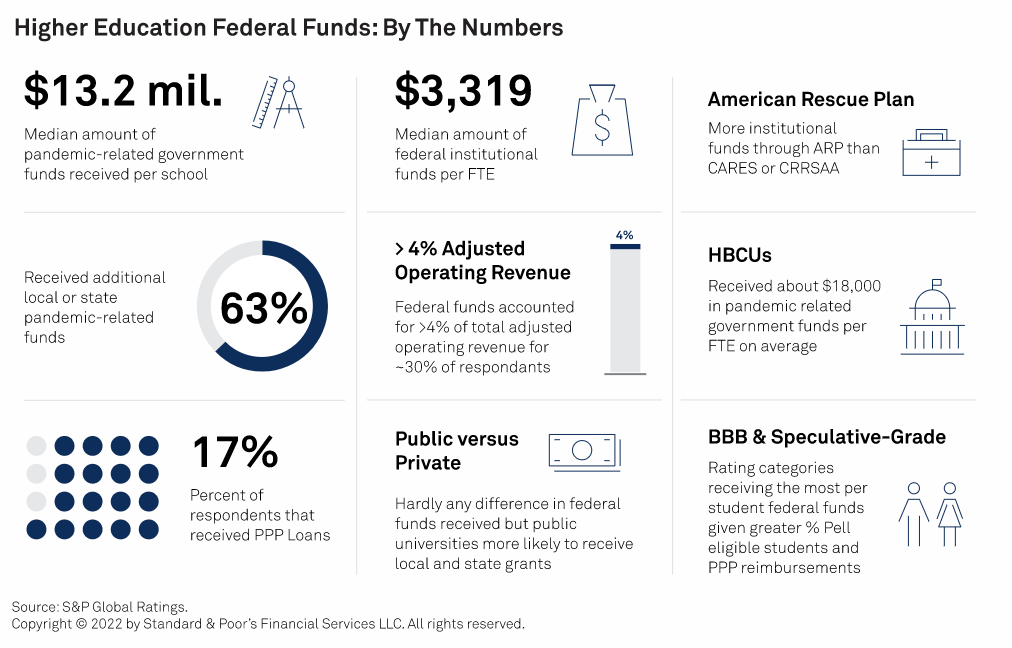

Federal Funds Kept U.S. Colleges And Universities Afloat; Some May Sink When They're Gone

According to the Department of Education, approximately $75 billion has been disbursed in higher education emergency relief funds through the passage of CARES, CRRSAA, and ARPA. While about half of these funds went directly to students, colleges and universities used the remaining institutional money to help mitigate pandemic-related losses. These one-time funds were distributed swiftly and significantly reduced the schools' credit risks at a very challenging time.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

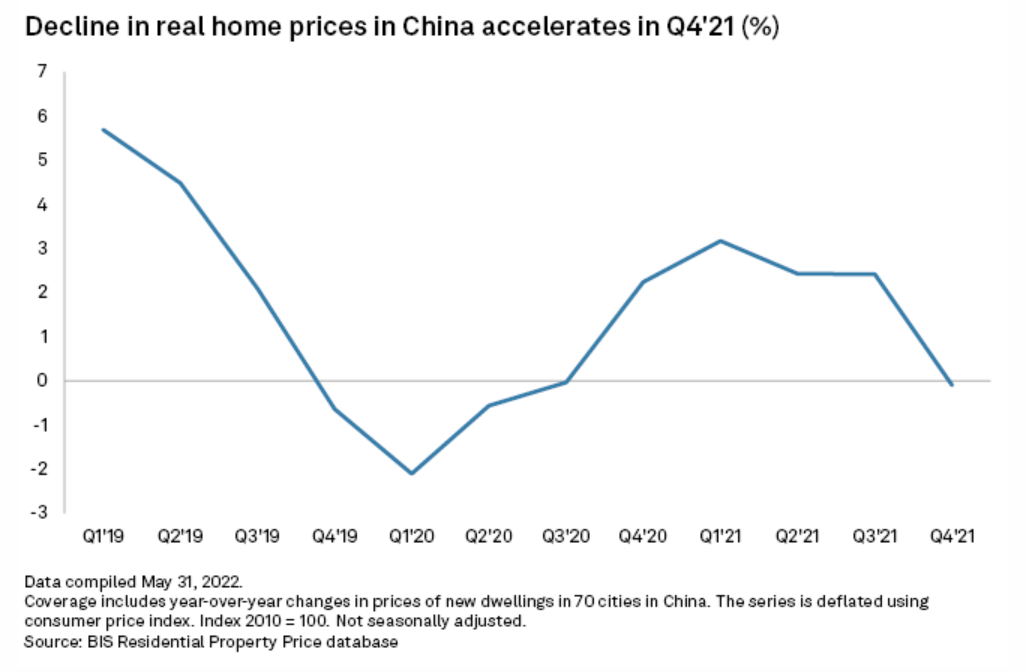

China's Home Loans Poised To Pick Up After Targeted Easing Measures

China’s latest measures to help homebuyers will spur mortgage demand while ringfencing banks from the default risk of builders. Growth in home loans, which account for about one-fifth of total bank loans in China, is set to rebound after a slowdown in recent months. The government has eased mortgage costs through cuts of interest rates, relaxed some rules on ownership of multiple properties, and urged banks to lend more to homebuyers.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

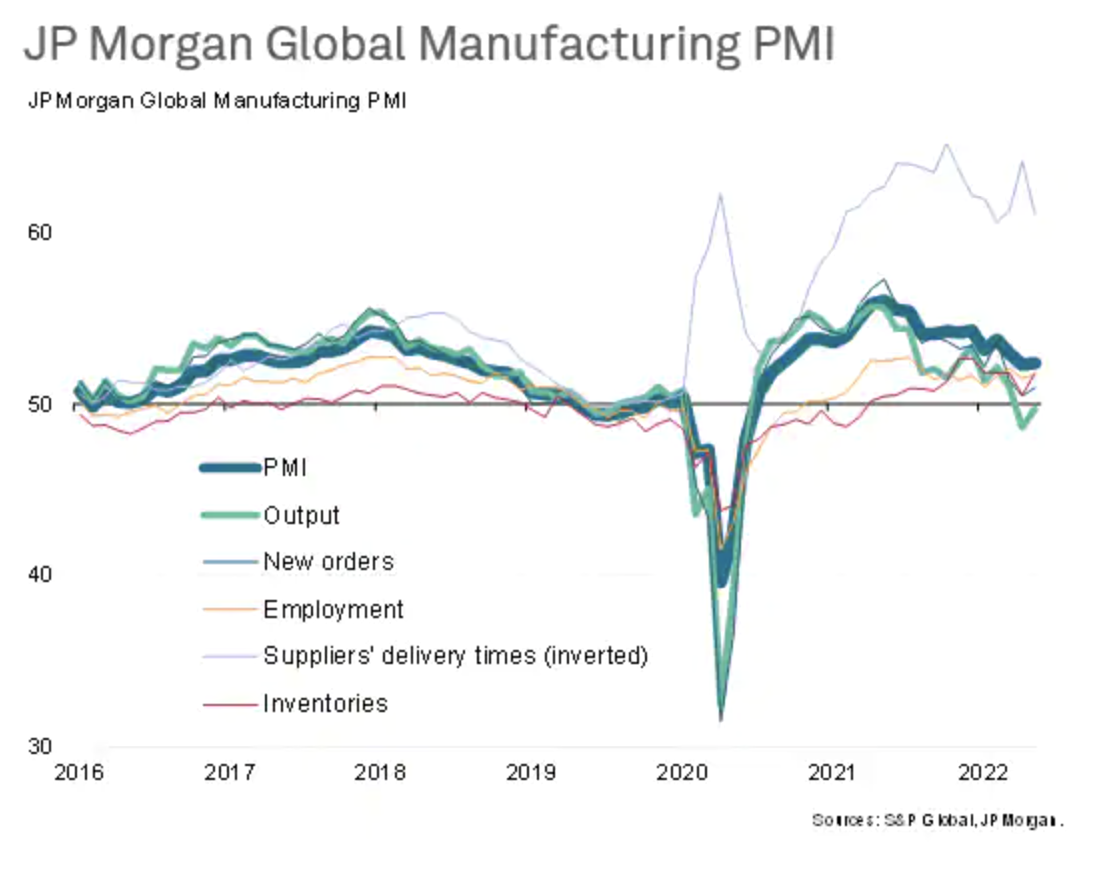

Global Factory Output Falls For Second Month In May Amid China Lockdowns

The JPMorgan Manufacturing Purchasing Managers' Index, compiled by S&P Global, inched up from 52.3 in April to 52.4 in May, though remained at the second-lowest level recorded over the past 20 months. The subdued performance of the goods-producing sector was led by a slight decline in production for a second successive month, thanks principally to a further marked drop in output in mainland China amid ongoing lockdown measures.

—Read the article from S&P Global Market Intelligence

Access more insights on global trade >

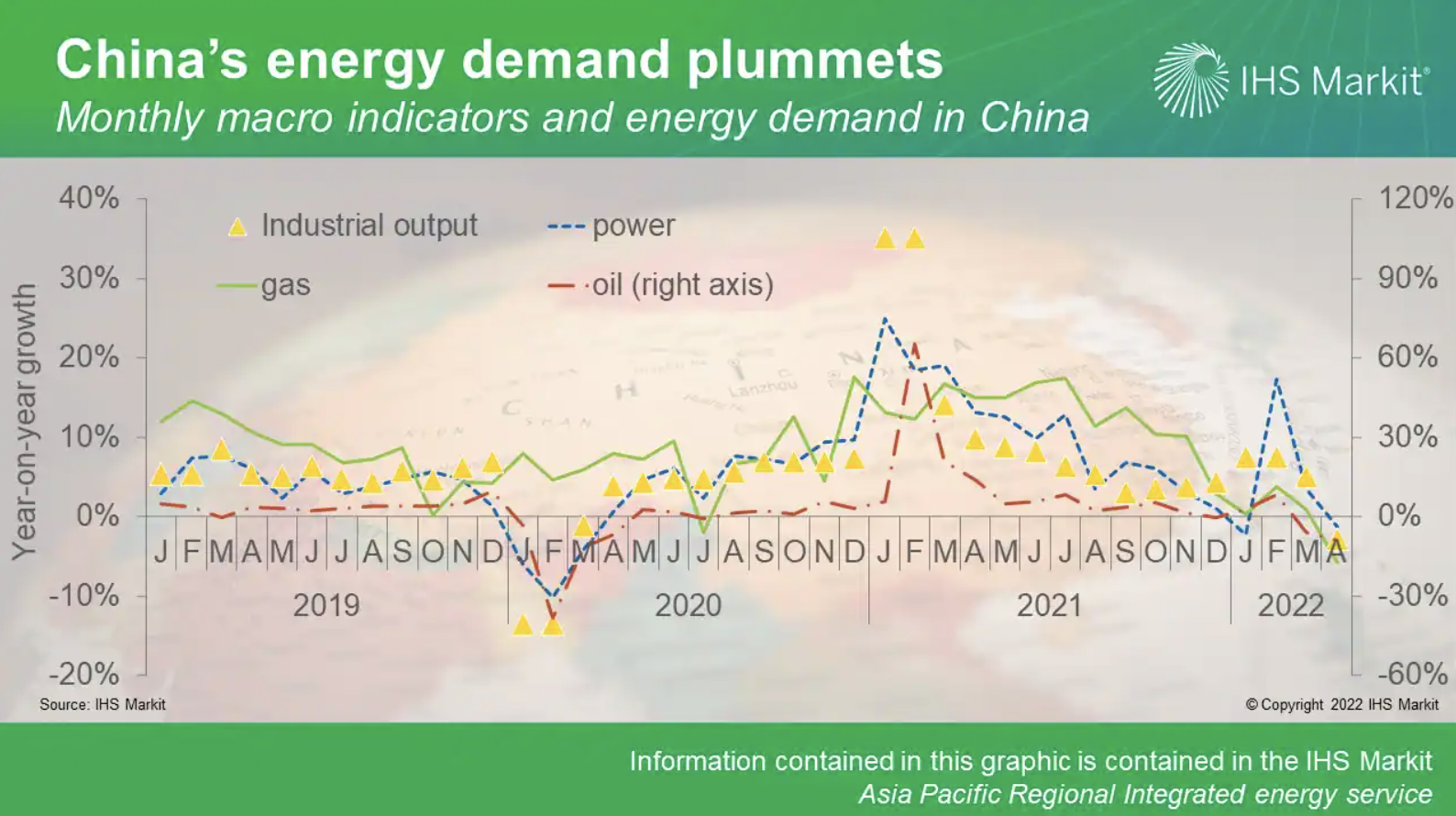

China’s Energy Markets During Latest Covid-19 Lockdown: Coal And Gas Plummeting While Renewables Flourishing

The Omicron outbreak in China since the beginning of 2022 has led to stringent restriction measures that severely disrupted economic activities and energy demand. However, our analysis of the latest data show that the scale of the demand impact did not match that of early 2020 at the onset of COVID-19. The weakness in fossil fuel demand is in contrast with the continued robust growth of renewables.

—Read the full article from S&P Global Commodity Insights

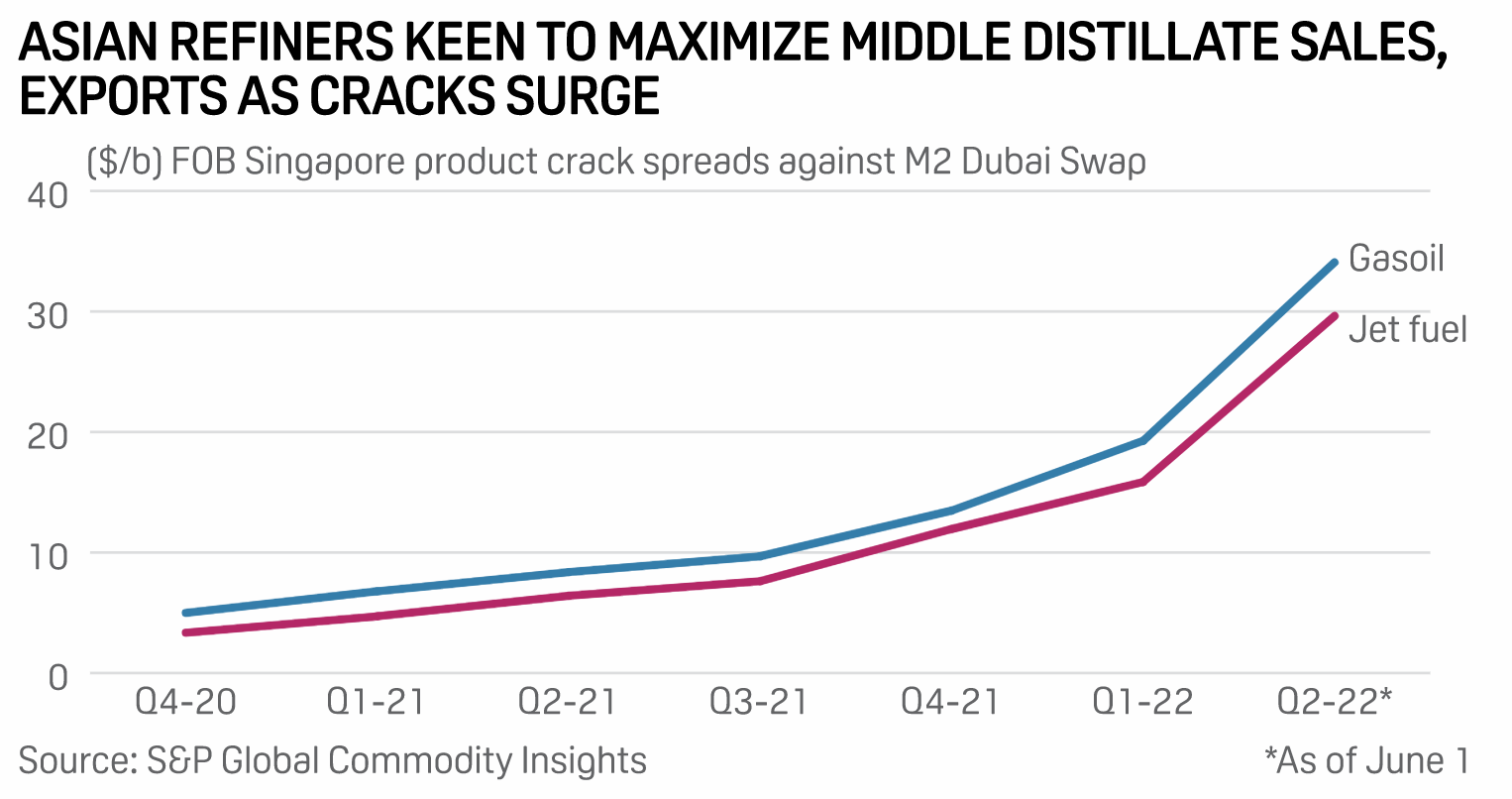

Beijing's Focus On Energy Security To Undermine Chinese Fuel Outflows, Refiners' Export Earnings

China's gasoline and gasoil exports are likely to remain muted in June as Beijing is hesitant to release oil products export quotas in large quantities because of the government's strong focus on domestic energy security in the wake of surging oil prices, market analysts and refinery trading sources told S&P Global Commodity Insights. Beijing is keen to keep the country's oil products exports to a minimum as its top priority is to secure ample supply at home to meet rebounding domestic demand amid easing COVID-19 restrictions, said a feedstock trading strategist at a state-run Chinese petroleum and chemicals company.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

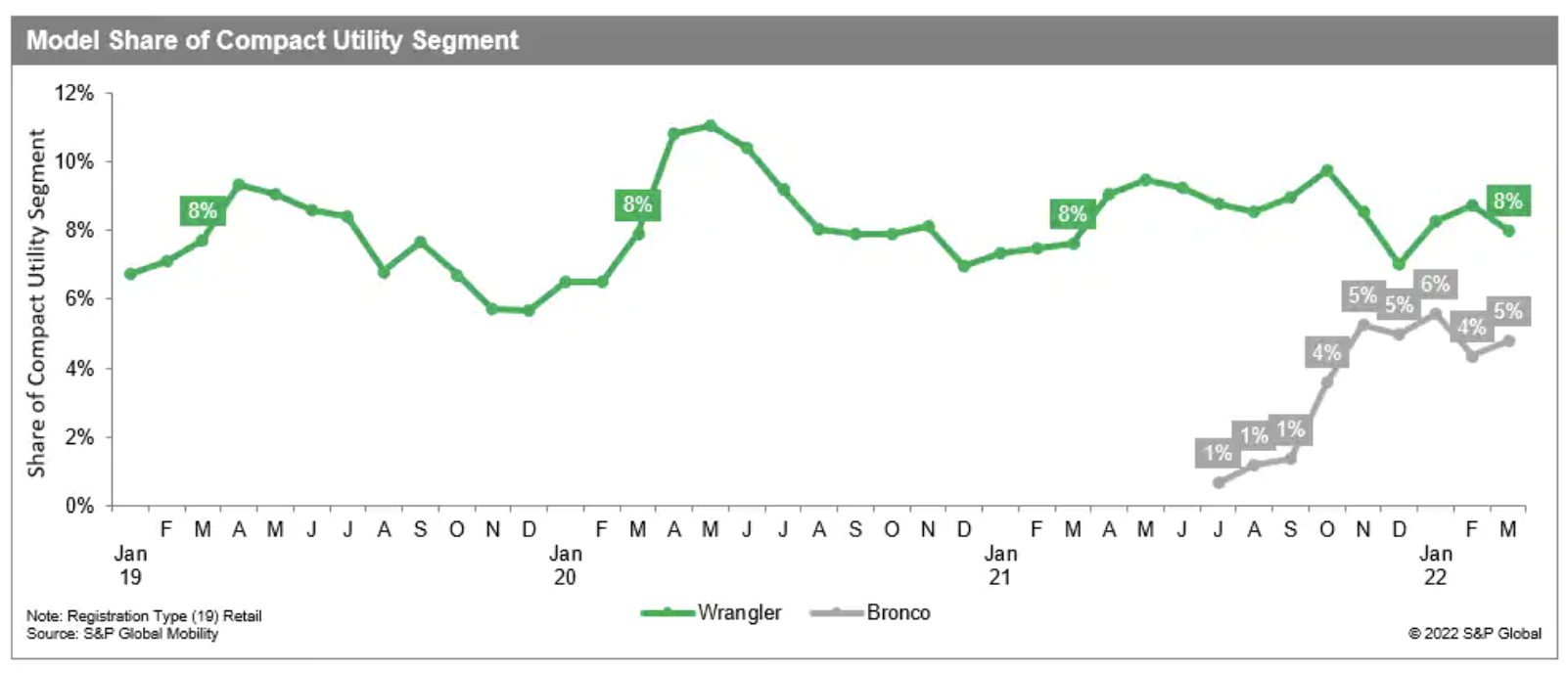

Bronco Vs Wrangler: The Battle Of The True Off-Road Utility Vehicles

The introduction of the Ford Bronco in June 2021 marked the first time in decades that a model has been positioned to compete directly with the iconic Wrangler. S&P Global Mobility new vehicle registration data indicate Bronco has indeed conquested Wrangler owners (more than any other model), but the Bronco lags behind the Jeep on several metrics, including share of segment.

—Read the article from S&P Global Mobility