Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 3 Jun, 2021

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

Demand pressures prompted by the pandemic on energy and commodities are easing. The energy transition away from fossil fuel generation is accelerating. And coal production is ramping up even as the outlook for the industry darkens. These competing factors are creating multiple possibilities for coal’s near- and long-term role in the global energy mix.

Market participants foresee the global mining industry and commodities like metallurgical coal playing a fundamental role in the energy mix over at least the next decade. But after last year’s historic decline in global energy-related carbon dioxide emissions, this year is likely to see an approximate 5% surge in global emissions—driven primarily by coal. Coal production and consumption is expected to rise by 4.5% in 2021 to near the highest levels seen since 2014, according to the International Energy Agency.

In order to achieve net-zero emissions by 2050, "[fossil fuel] use will go down, much stronger in coal, less in oil and much less in natural gas," IEA Executive Director Fatih Birol said May 19 at the Columbia Global Energy Summit, explaining that the global economy would need to eliminate new coal mines and coal mine expansions and the need for unabated coal-fired power plants this year. "The investments in the already existing fields, approved fields will continue. We don't stop them. What we are talking about is developing in new fields, or no new exploration, for example, just to make it simple, no new exploration activity."

The battle between balancing renewable energy and legacy coal plants is most visible in markets like the United States. Overall, U.S. coal-fired power generation capacity has been steadily declining in recent years as utilities and plant owners retire coal-fired units in an effort to reduce greenhouse gas emissions and face economic competition from gas and renewable energy resources. This has constricted the industry from accessing capital as investors eye sustainable investing. Most of the country’s coal-fired power capacity is uneconomic compared to local wind or solar, or is planned to be retired within the next five years, according to clean energy policy firm Energy Innovation: Policy and Technology LLC.

That hasn’t stopped coal production in Northern Appalachia and some other major U.S. regions and companies from roaring back during the first quarter and in recent weeks from last year’s lows. The top 25 coal mines in the Northern Appalachian basin, which spans Maryland, Ohio, Pennsylvania, and northern West Virginia, produced 22.3 million tons of coal in the three months from January-March, marking a substantial increase from production in both the previous quarter and the comparative 2020 quarter, according to an S&P Global Market Intelligence analysis.

Other U.S. regions experienced production declines in the same period. In the Powder River Basin, which is the country’s largest coal-producing region, coal production declined 11.7% year-over-year due to coal-fired power plant retirements and the energy transition, according to an S&P Global Market Intelligence analysis.

Market sources told S&P Global Platts that a significant increase in U.S. coal exports is on the horizon.

Still, jobs within the U.S. coal industry are diminishing rapidly alongside coal plant retirements. Average coal mine employment numbers for the first quarter slumped 16.7% year-over-year to 39,507, according to an S&P Global Market Intelligence analysis of U.S. Mine Safety and Health Administration data. Average quarterly employment in the coal sector has fallen 57.7% since the first quarter of 2012, during which an average of 93,391 workers were employed. Over the same 11-year period, production has declined 47.5%.

"If you look over the last 10 years, without significant climate change policy, we have seen a significant decrease in coal production, largely due to a transition toward natural gas as a power producer … That occurred because of a technology change that occurred because of market principles," Brian Anderson, director of the National Energy Technology Laboratory. "I think that one of the biggest challenges that we have in navigating the energy transition is, in fact doing it to where we're not leaving folks behind.”

Today is Thursday, June 3, 2021, and here is today’s essential intelligence.

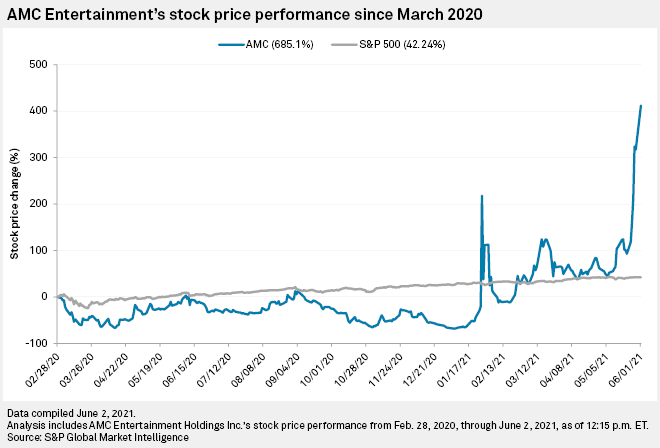

AMC Embraces Retail Investor Surge as Share Price Doubles

Shares in the movie theater giant doubled to a record high on June 2, sitting above $63 during late afternoon trading as "meme stock" chatter continued to swirl around the stock. Year to date, AMC's shares were up over 3,000%, as of 3:15 p.m. ET on June 2.

—Read the full article from S&P Global Market Intelligence

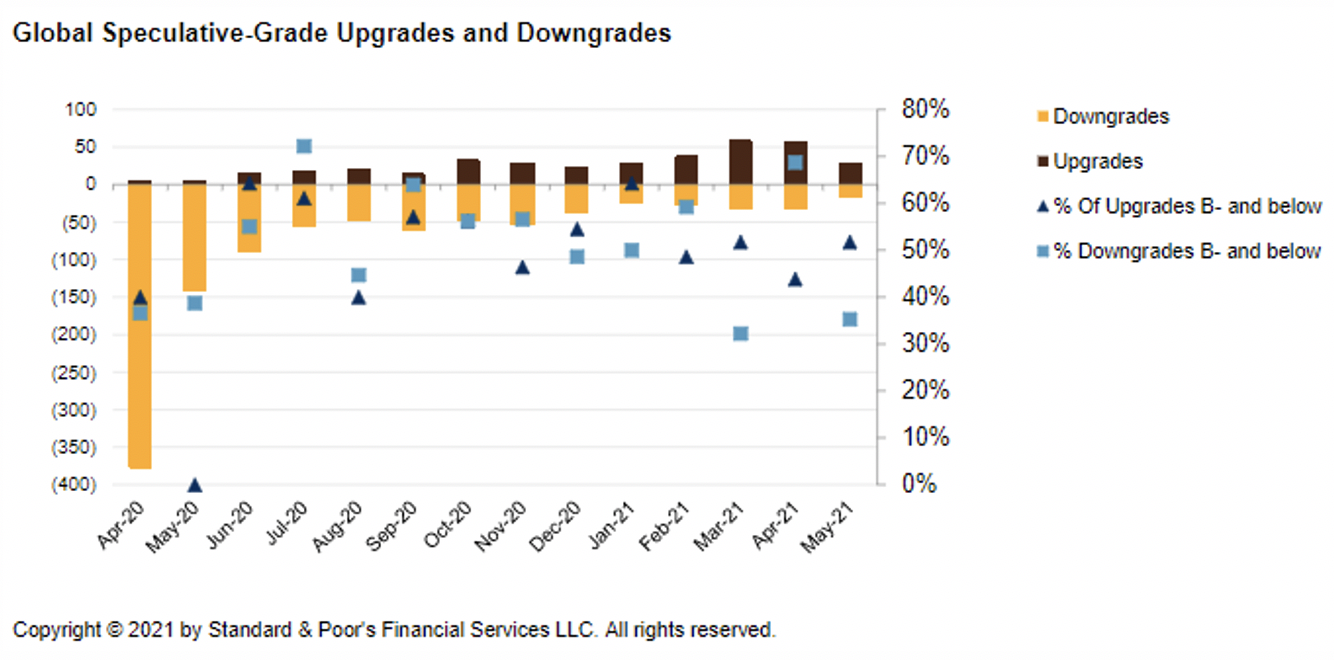

Default, Transition, and Recovery: The Weakest Links Tally Nears Pre-Pandemic Levels

The number of weakest links, issuers rated 'B-' or lower by S&P Global Ratings with negative outlooks or ratings on CreditWatch with negative implications, decreased to 353 as of April 30, 2021, as it nears pre-pandemic levels of 282, as of Dec. 31, 2019. Accommodative financing and an economic recovery contributed to an increase in positive rating actions in April, especially for speculative-grade issuers.

—Read the full report from S&P Global Ratings

Latin American Local Governments Face Financial Strains Despite Sovereign Aid

2020 was an unprecedented year for LRG finances. Latin America was among the most severely hit regions by the pandemic, which caused the economic activity to fall 6.8% among the region's six largest markets, while COVID-19 rapidly eroded socioeconomic conditions that were already vulnerable before the pandemic.

—Read the full report from S&P Global Ratings

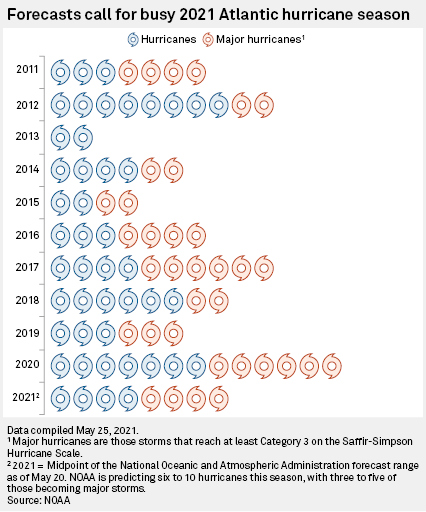

Insurers Facing Prospect of Another 'Above-Average' Atlantic Hurricane Season

Insurers with exposure in coastal states may be facing another year of elevated claims from tropical systems as the National Oceanic and Atmospheric Administration's Climate Prediction Center expects a busy 2021 Atlantic hurricane season.

—Read the full article from S&P Global Market Intelligence

Corporate Governance Reform Can Help Drive Long-Term Value in Asia-Pacific

Corporate governance is becoming a hot-button topic among investors, governments and companies in Asia-Pacific. Regulators and companies in the region are seeking to align the interests of stakeholders, including company management teams and shareholders with the ultimate goal of creating long-term value.

—Read the full article from S&P Global Market Intelligence

Europe's Major Banks Link Exec Pay to Diversity Targets as Trend Gains Momentum

Nearly all of Europe's major banks are now linking executive pay to diversity and inclusion targets, which experts hail as an important move but warn that banks need to go further to diversify their workforces.

—Read the full article from S&P Global Market Intelligence

Listen: ESG Fever and the Challenges of Climate-related Financial Reforms

Investors are proving they have climate change and the energy transition on the their minds. Last week, activist investors got at least two seats on the ExxonMobil board of directors, and Chevron's shareholders approved Scope 3 emission targets, both which could lead to lower oil and gas production ahead.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Platts

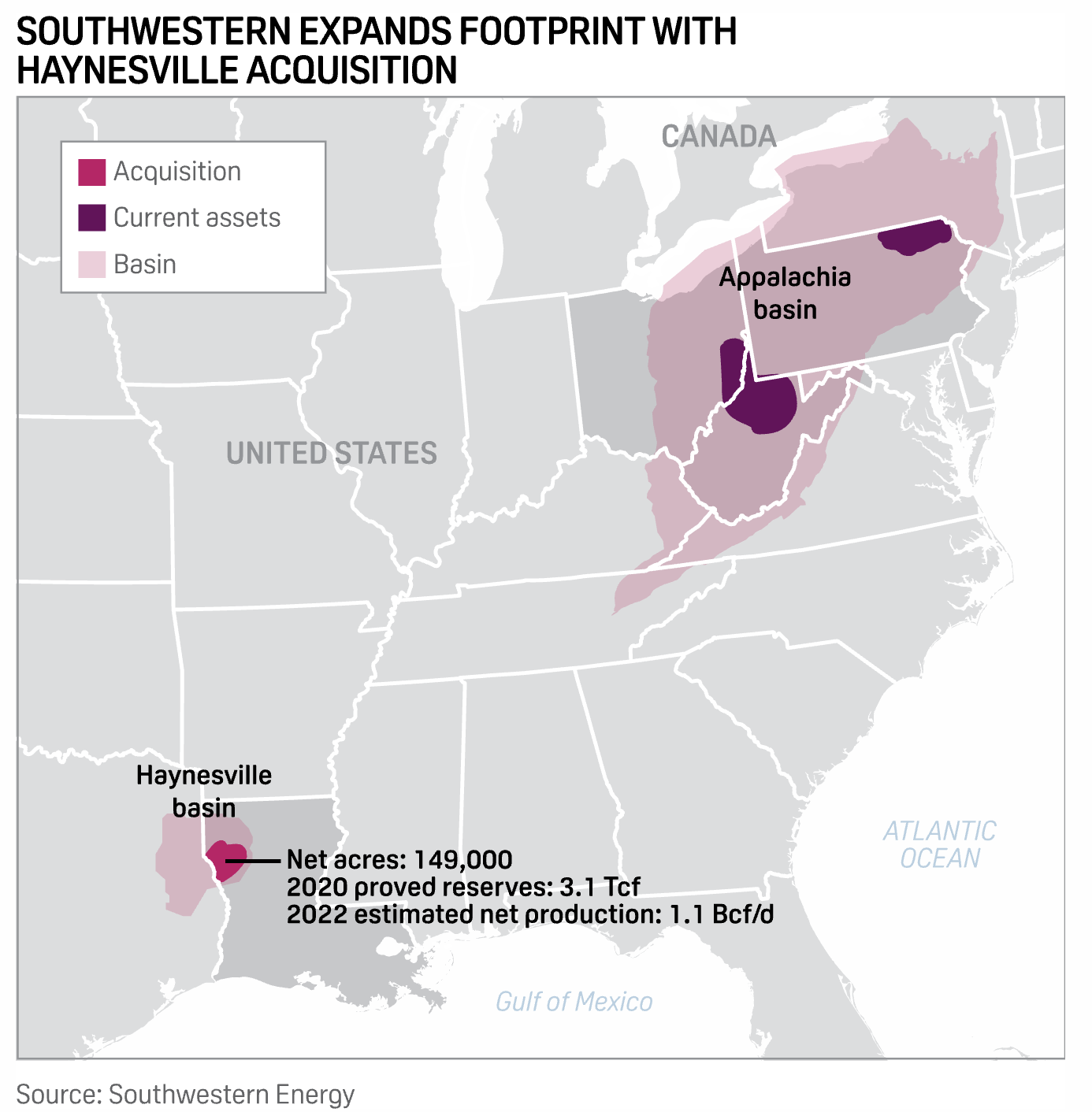

Southwestern Goes All in on Gas Production With $2.7 Billion Haynesville Acquisition

Merger and acquisition activity show no signs of slowing down in 2021 as Northeast producer Southwestern Energy acquires one of the largest Haynesville operators for $2.7 billion, bringing total U.S. shale M&A activity to nearly $30 billion year to date.

—Read the full article from S&P Global Platts

China's Independent Refineries Struggle for Fuel Oil Amid Tight Supply, High Prices

China's independent refineries -- actively looking for fuel oil to feed their distillation units -- are struggling to secure adequate feedstock barrels for the coming months due to tight regional supplies and high prices, market and industry sources told S&P Global Platts.

—Read the full article from S&P Global Platts

H2 2021 Petrochemicals: Polypropylene to Face Logistics, Weather, Covid-19 Challenges

Mixed market conditions across regions is expected to raise the level of uncertainty for polypropylene in the second half of 2021. Factors supportive of prices in the first half of the year, such as healthy downstream demand and tight global supply, are expected to extend into the second half.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language