Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 24 Jun, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Complications On India’s Growth Path

India is aiming to balance its role as one of the world’s fastest-growing economies with its battle against persistently high global inflation and the trade implications of the Russia-Ukraine war.

As the fifth-largest by nominal GDP worldwide, India’s economy suffered during the first and second waves of the coronavirus—but has enjoyed a strong recovery into this year. However, the country may need to overcome compounding challenges to become a middle-income economy in the medium-term, despite its banks benefitting from the Central Bank of India’s surprise raising of its benchmark repo rate by 40 basis points, to 4.4%, on May 4—its first rate hike in nearly four years. The country is enduring a wheat export ban, steel export tariffs, protracted coal crunch, and elevated oil prices that could risk destabilizing its growth prospects.

“In the medium term, we expect India to continue to achieve strong real GDP growth, well above the median for peers at a similar income level. Following the peak in COVID-19 cases around mid-last year, the Indian economy has embarked upon a solid recovery, well supported by improved consumer and business confidence,” S&P Global Ratings said in its banking industry country risk assessment for the country in May. “The economy has been gradually stabilizing after COVID-19-related shocks in 2020 but it will take a while to fully recover, in our view. Moreover, despite sound growth prospects, India is likely to remain a low-income economy in the medium term.”

Analysts expect Indian banks to raise capital in the bond market to take advantage of still-low interest rates before borrowing conditions tighten, and foresee that Indian banks’ profits are likely to benefit from rising interest rates, declining nonperforming loans, and higher loan growth, according to S&P Global Market Intelligence.

Although India had emerged as a key supplier of wheat to the world in the aftermath of Russia's invasion of Ukraine, India implemented a ban on wheat exports on May 13 to control domestic prices amid a severe heatwave that has exacerbated the global supply crunch of the commodity, according to S&P Global Commodity Insights.

"Following India's decision to restrict exports the government has received requests from several countries. The authorities are assessing domestic wheat requirement and availability of wheat," a senior government official from India’s food ministry told S&P Global Commodity Insights last week, naming Bangladesh, United Arab Emirates, Indonesia, Yemen, and Oman as the countries that have requested imports.

The Indian government also imposed unexpected export tariffs on steel products in May that have sent markets into a tailspin.

The energy-consuming country of 1.4 billion people has also been pushing through a commodity supply predicament exacerbated by higher prices spurred by the war in Ukraine and a heatwave within its own borders. High oil prices have depressed demand and prompted India to establish tax cuts and seek new trading partnerships. And while India plans to reduce the coal-fired power generation from its 81 thermal plants in the next four years to help transition to clean energy sources and reduce emissions, the economy has been buying cheap coal from Russia to correct its domestic shortage of the commodity and meet demand. Whether India will be able to avoid a costly coal crisis at the currently elevated global prices is yet to be seen, and market participants expect that Indian buyers will continue to source competitive supply from Russia if coal prices in Australia, South Africa, the U.S., and Indonesia remain high, according to S&P Global Commodity Insights.

"This year if Indian banks find some payment solution to import coal from Russia, then it is easy to import but otherwise it is difficult," an India-based trader told S&P Global Commodity Insights. "Not every entity is able to find a payment structure to get Russian coal. For crude oil, the number of entities involved in importing were limited."

"Oil prices are a big concern for the government and the economy now because of its cascading effect. Not only pump prices and transportation costs go up, but prices of various other goods and services are affected," Dharmakirti Joshi, chief economist at CRISIL, part of S&P Global, told S&P Global Commodity Insights. "We estimate that every $10 per barrel rise in the price of Brent crude would raise the headline consumer price index by about 40 basis points. The weakening of the Indian rupee will also add to the imported cost of crude and commodities.”

Today is Friday, June 24, 2022, and here is today’s essential intelligence.

Written by Molly Mintz.

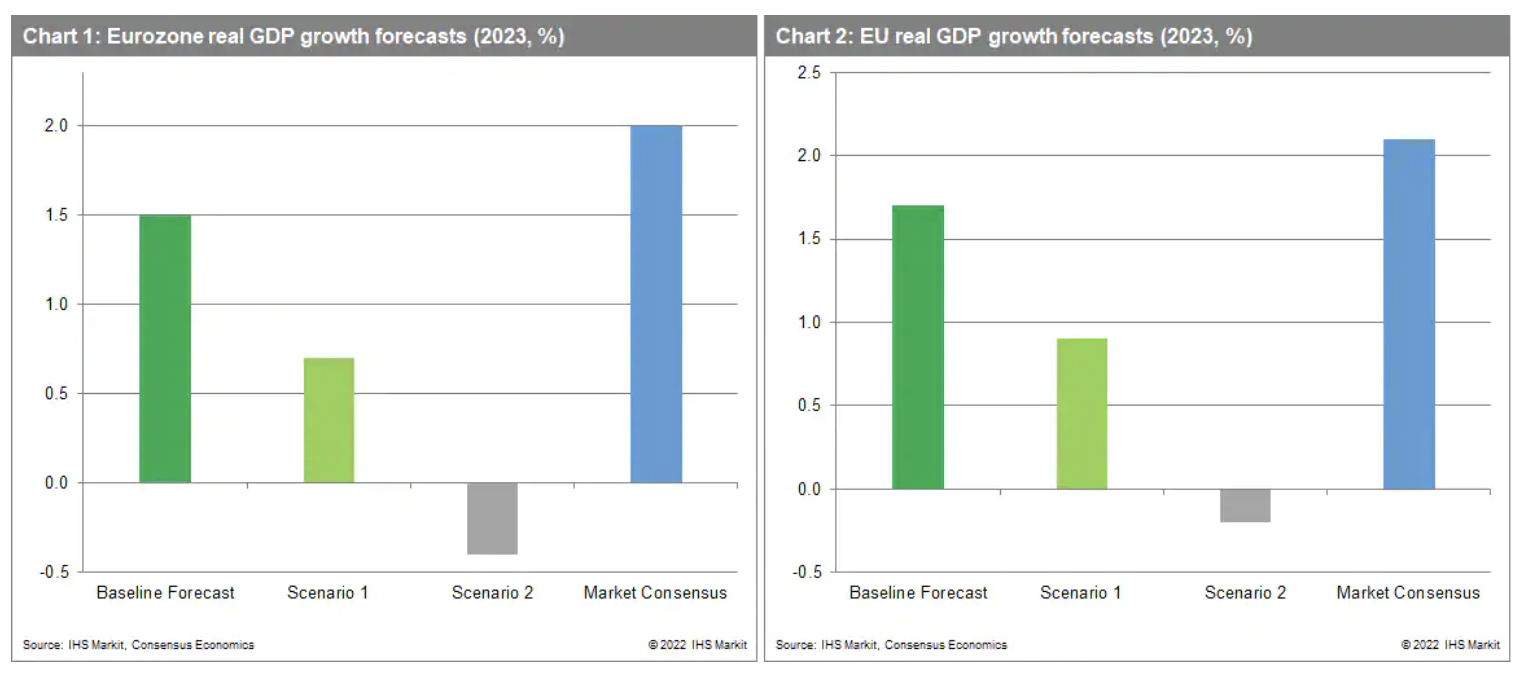

Europe’s Road To Recession

Market consensus expectations for real GDP growth rates in the EU and eurozone through 2023 look increasingly unrealistic. Household real incomes are taking a hammering, while supply chain disruptions are impeding the industrial sector. The broadening of the EU's sanctions against Russia is aggravating concerns related to energy supply and prices.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

The Obstacles To Better Analytics Adoption In Private Equity

Private equity has made many achievements in putting data and technology to effective use in the investment management process. However, the industry has a long way to go, particularly in finding ways to use more sophisticated data analytics to get a competitive edge in deal sourcing. A recent survey of senior executives from U.S. PE firms, conducted by Mergermarket on behalf of S&P Global Market Intelligence, revealed significant growing pains in technological and analytical sophistication at many firms.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

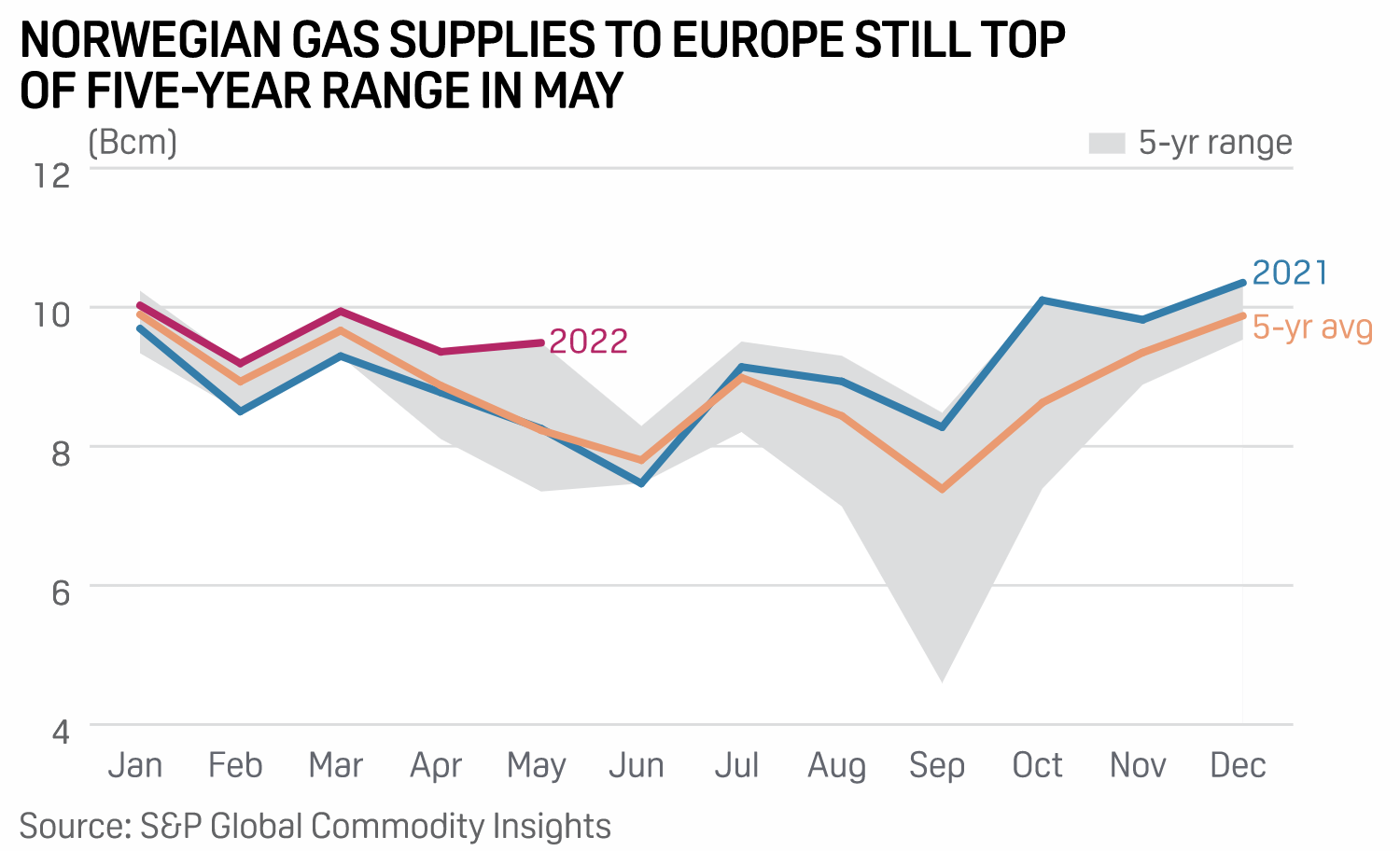

EC Eyes Additional Norwegian Gas Supply Under New Cooperation Agreement

The European Commission and Norway on June 23 agreed to "step up" their cooperation in order to ensure additional gas supplies from Norway to the EU in both the short and long term. In a statement, the EC said Executive Vice President Frans Timmermans, Energy Commissioner Kadri Simson, and Norwegian Energy Minister Terje Aasland recognized the urgency to act following Russia's invasion of Ukraine.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

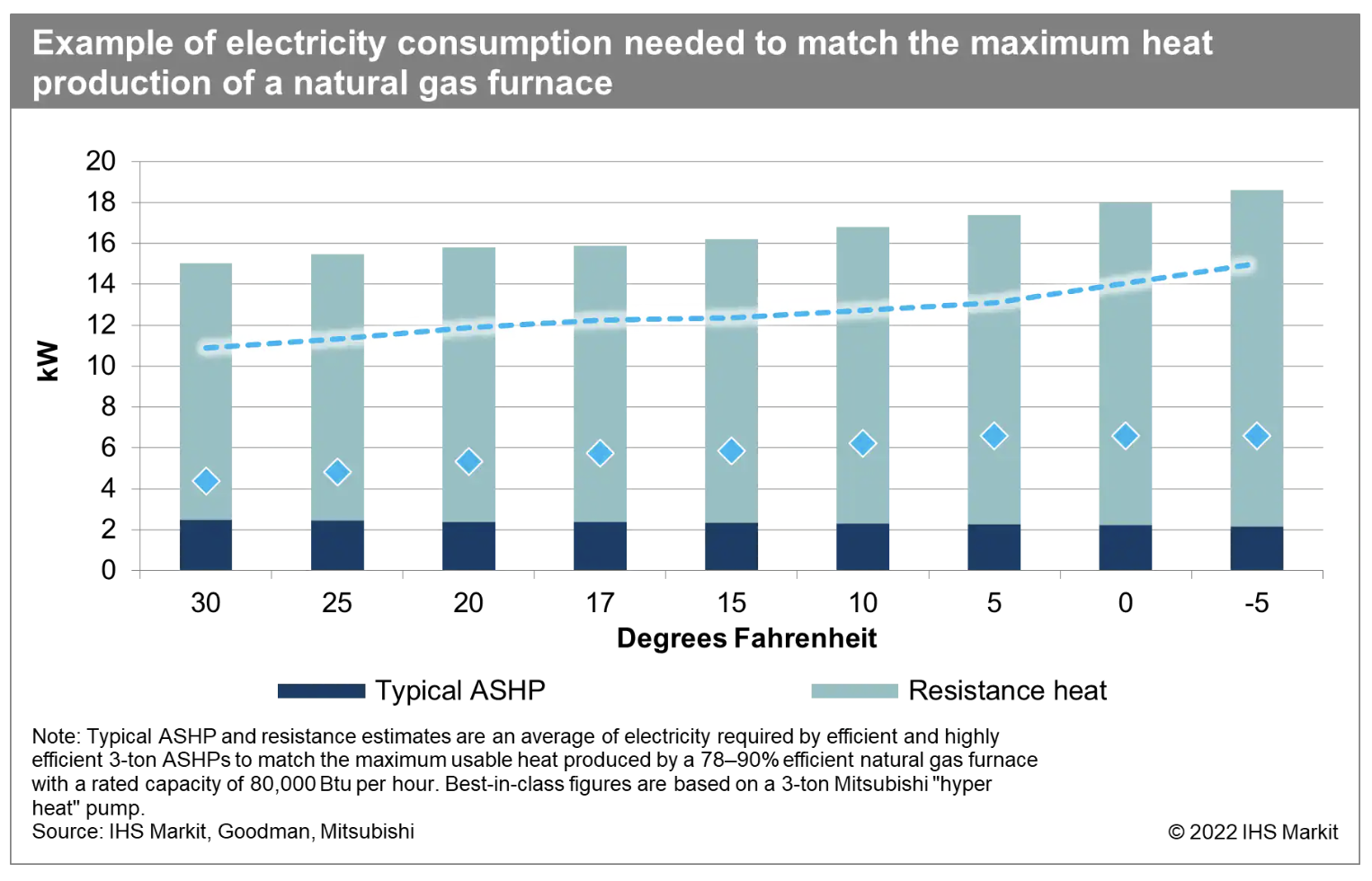

Quebec’s Hybrid Gas-Electric Approach To Decarbonizing Building Space Heat

In May, Québec's energy regulator approved a greenhouse gas emissions reduction program jointly proposed by Hydro-Québec and Énergir—the largest electric and gas utilities in the province, respectively—that aims to reduce building space heat emissions using targeted electrification. Instead of pursuing an all-electric path, Hydro-Québec's and Énergir's "dual energy" program encourages customers to install air-source heat pumps alongside natural gas furnaces.

—Read the article from S&P Global Commodity Insights

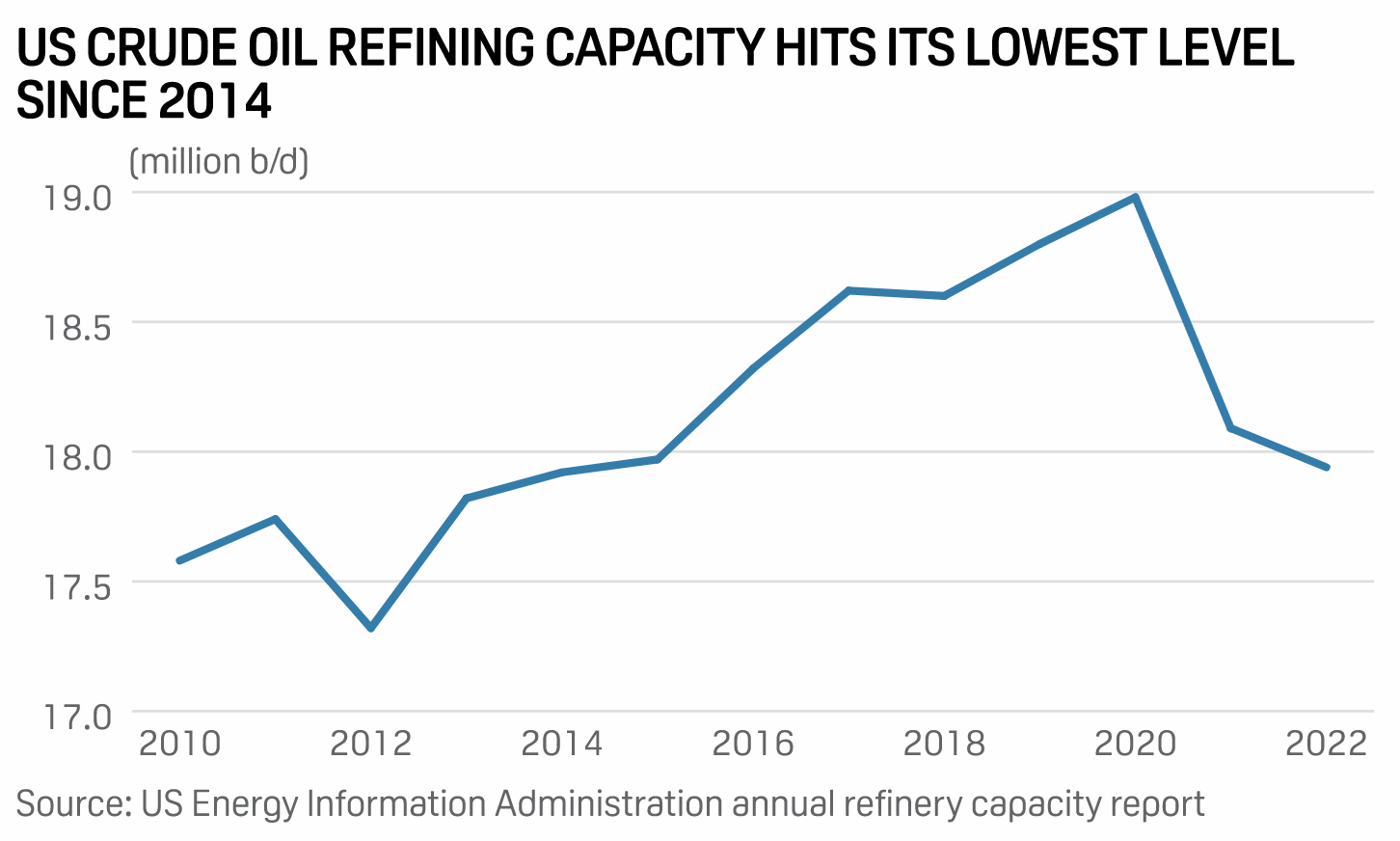

White House Tensions With Oil Industry Remain High After 'Productive' Meeting With Refiners

Heated rhetoric from the White House and oil industry prompted an in-person meeting June 23 between U.S. Energy Secretary Jennifer Granholm and top oil executives, with few details being made public beyond assurances from both sides that the conversation was productive and would be ongoing. The "constructive discussion" focused on "ways to address rising energy costs and create more certainty for global energy markets," the American Petroleum Institute and American Fuel & Petrochemical Manufacturers said in a joint statement.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

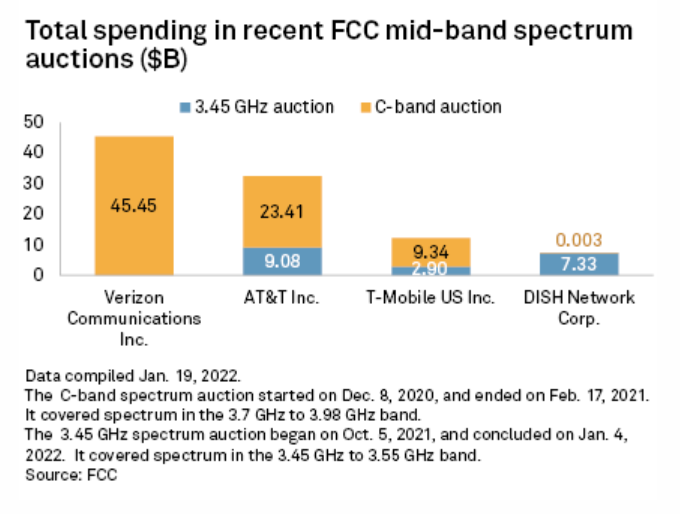

T-Mobile Likely To Lead 5G Spectrum Auction As It Fills Out 2.5 GHz Footprint

With the identities of participants in the upcoming 2.5 GHz spectrum auction now revealed, analysts are predicting which of the top telecom carriers will spend the most aggressively. The bidding round the Federal Communications Commission's upcoming 2.5 GHz auction is set to begin July 29. The FCC earlier this month revealed lists of complete and incomplete bidder applications. Prospective bidders with incomplete applications have until June 23 to complete required documents and payments.

—Read the article from S&P Global Market Intelligence