Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 23 Jun, 2021

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

Geopolitics, global trade, and the fight against greenhouse gas emissions face a new conundrum: the U.S.-EU dispute over steel and aluminum tariffs.

The effort to combat overcapacity in the global steel industry may be at odds with the industry’s and governments’ ambitions to decarbonize, which would introduce more steel into the marketplace through the production of new low- or zero-carbon steel.

"You have a political priority to resolve overcapacity. When you start decarbonizing the sector, that's going to be increasingly important. You're going to end up with more overcapacity you're going to manage. It's going to go from important to crucial," Thomas Koch Blank, a senior principal official for breakthrough technologies at the Rocky Mountain Institute think tank, told S&P Global Market Intelligence in an interview. He explained that the industry trend toward green technology will reverse U.S. steel producers’ course in trying to prevent production elsewhere in the world. "Managing overcapacity is something that capitalism has done for hundreds of years.”

Global banks are jumping to decarbonize the global steel sector, and some market participants are already exploring green steel markets. Others across the global industry believe that industry standards are needed to define and clarify what green steel actually is, and that steel production may need to relocate near renewable energy generation to achieve decarbonization.

"We are seeing already that there are a lot of customers that are ready to pay a bit more for so-called green steel," Roman Stiftner, managing director of the Austrian Mining and Steel Association, said June 22 in a presentation to the Sustainable Steel Strategies Summit, according to S&P Global Platts. "I think this is a good situation that we have all this transformation available in the society and together with industry we can solve it."

The trans-Atlantic relationship has been strained since 2018, when former U.S. President Donald Trump imposed tariffs of 25% on European steel and 10% on aluminum—which the European Commission countered with levies on some U.S. products after the trade partners couldn’t then come to a deal. At the start of discussions between the trade partners on May 17 and again on June 15 following a U.S.-EU summit, American and European representatives said in joint statements that they were seeking solutions to address the global metals industry’s overcapacity by year-end.

Some observers perceive that timeline to be far-fetched. "There is a desire for the U.S. to find ways to work together with the EU for common issues of concern such as addressing the global overcapacity crisis, and that is definitely worth the effort, but it is not an easy item and can't be done quickly," American Iron and Steel Institute CEO Kevin Dempsey told S&P Global Platts in an interview. "I don't think the current [Biden] administration has made up its mind on reversing the [steel tariff] approach that was put into place by the previous administration … If they wanted to remove that, they could have done that on day one, but they haven't done that."

Many U.S. market participants have urged the Biden Administration to keep the tariffs in place. The EU on June 11 announced plans to extend its safeguard measures on steel-product imports for three years, which will allow for a 3% annual liberalization of the tariff-rate quotas and may intensify steel prices, and bloc member states have expressed their support for the proposal.

"The extension of safeguard measures of the EU is the right and appropriate decision in light of the current challenges as the structural distortions of the global steel industry which are the U.S. steel tariffs and global overcapacity," Hans Jürgen Kerkhoff, head of the German steel industry association WV Stahl, told S&P Global Platts. "These continue despite economic recovery. The [safeguard] measures are especially needed in light of the aim to enter the transformation to green steel industry quickly."

Today is Wednesday, June 23, 2021, and here is today’s essential intelligence.

Listen: The Essential Podcast, Episode 41: Being in the Room — Economics, Policy, and the Diversity Problem

With a profession like economics that is overwhelmingly white and male, how can diverse voices get into the room so that they can bring their experiences to bear and have a voice in policy discussions? Crystal Swann, Senior Policy Fellow for the Progressive Policy Institute and the team lead for the Mosaic Economic Project, joins the Essential Podcast to talk about the lack of diversity in economics and policy circles.

—Listen and subscribe to the Essential Podcast, from S&P Global

Million Dollars no Longer Gets Membership of Top 1% Wealth Club – Credit Suisse

Despite the worst health crisis in at least a century that sent most global economies into recession, global wealth grew 7.4% in 2020 to an estimated $418.3 trillion, according to the Credit Suisse Global Wealth Report 2021 published June 22. The increase was fueled by rising asset prices that surged after the initial shock from the COVID-19 pandemic, and a weaker U.S. dollar. The depreciation of the dollar last year alone added 3.3% to global wealth.

—Read the full article from S&P Global Market Intelligence

Global Debt Leverage: Spreads, Costs Shocks May Double Rate of Loss-Making

While companies’ pushing out of debt maturities has cushioned them against interest-cost rises, S&P Global Ratings stress test of more than 10,000 global corporates indicates that a twin shock of 1970s-style cost inflation and spreads at the level of the Global Financial Crisis could almost double potential defaulters, to 12%, by 2023—with the share of "highly indebted" companies reaching almost 40%.

—Read the full report from S&P Global Ratings

An SDR Is Born: The IMF Creates A Reserve Asset for Low-Income Countries

The International Monetary Fund (IMF) is planning a $650 billion increase in Special Drawing Rights (SDR) this year to boost the reserve adequacy of struggling emerging market economies.

—Read the full report from S&P Global Ratings

For Spain's Autonomous Communities, Reducing Reliance on State Funding Will Be Slow and Uneven

The share of state loans in Spanish autonomous communities' funding profiles is decreasing, after rising rapidly since 2012 when central government liquidity facilities were created.

—Read the full report from S&P Global Ratings

Default, Transition, and Recovery: 2020 Annual Asia Corporate Default And Rating Transition Study

Nine companies rated by S&P Global Ratings, including two confidential issuers, defaulted in Asia in 2020, compared with 10 defaults the prior year.

—Read the full report from S&P Global Ratings

Listen: Episode 19: Network Transformation

Networks are a fundamental piece of the infrastructure puzzle, but they’ve lagged behind the needs of modern applications. Mike Fratto, senior research analyst for Applied Infrastructure and DevOps, joins host Eric Hanselman to talk about network automation and what organizations can do to get greater change velocity from this key resource. Bringing developers and networking teams together can ensure that connectivity needs are well integrated. Even when it comes to network connected cows.

—Listen and subscribe to Next in Tech, a podcast from S&P Global Market Intelligence

'Flight to Quality' as Private Insurtechs Draw Big Investments

Insurtech companies on both sides of the Atlantic have turned in numerous large funding rounds thus far in 2021, enticing investors with their return potential and big addressable markets.

—Read the full article from S&P Global Market Intelligence

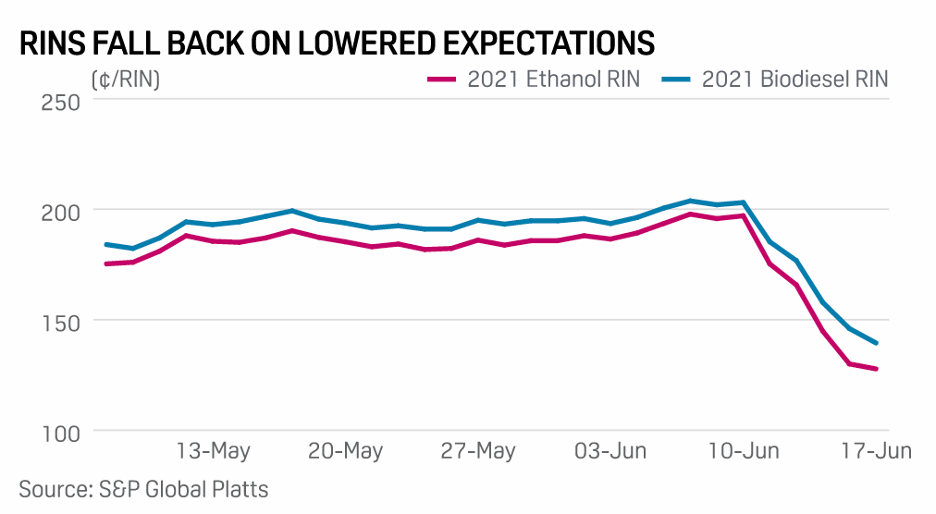

Fuel for Thought: U.S. Refiners, RINs and the RVO

The shale revolution turned the U.S. into an oil exporter, neutralizing issues around energy security, which have given way to concerns about climate change and greenhouse emissions. But the issue of renewables remain a bone of contention as refiners chafe at the loss of market share and high price of compliance.

—Read the full article from S&P Global Platts

Oil, Gas CEOs Concur on Supply Tightness, Energy Transition Goals

The CEOs of of ExxonMobil, Shell and TotalEnergies all see a lack of investment in upstream oil and gas contributing to coming supply tightness following the pandemic, they told the Qatar Economic Forum on June 22, stressing, however, the importance of investment in low-carbon energy projects.

—Read the full article from S&P Global Platts

BP's Looney Touts Oil Price Resilience Under Energy Transition Strategy

BP's core cash generation from its oil and gas business will remain resilient to oil prices below current levels in the coming years even as the company moves away from fossil fuels to renewable energy, CEO Bernard Looney said June 22.

—Read the full article from S&P Global Platts

NRG CEO 'Optimistic and Encouraged' by Texas Market Changes

NRG Energy Inc. President and CEO Mauricio Gutierrez contends that Texas is moving in the right direction to avoid another "systemic failure" similar to the grid and market problems experienced in February.

—Read the full article from S&P Global Market Intelligence

90% of Power Distribution Systems Not Ready for Energy Transition: Siemens

The vast majority of electricity distribution system operators are not ready to accommodate the increase in demand that will come with the energy transition, Siemens Smart Infrastructure CEO Sabine Erlinghagen said June 22.

—Read the full article from S&P Global Platts

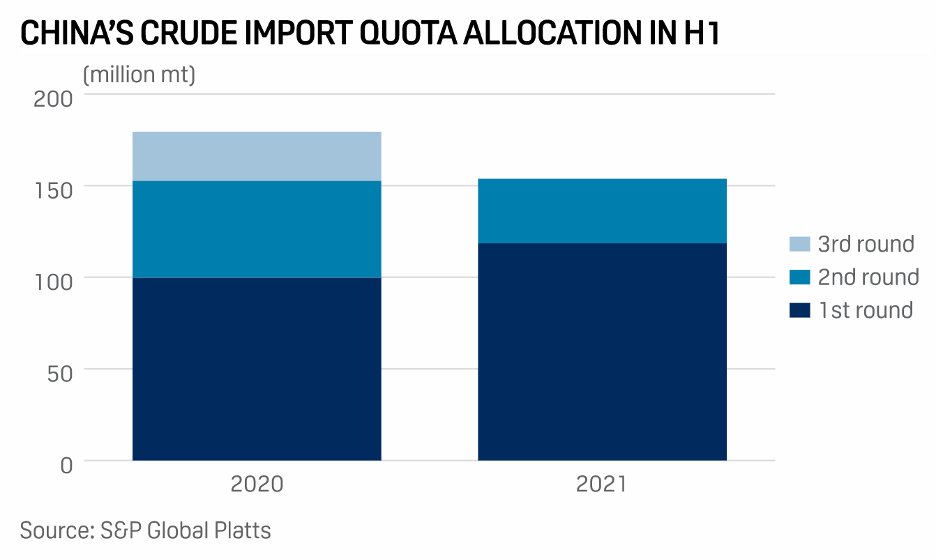

China's Latest Round of Import Quotas Likely to Prompt Caution in H2 Crude Buying

China's second batch of crude import quota allocations has created uncertainty over the total volume that qualified independent refineries will be allowed to import for the full calendar year 2021, which is likely to make them cautious in their procurement activities in the coming months, according to market sources.

—Read the full article from S&P Global Platts

Iraq Expects Southern Oil Exports Around 2.8 Mil B/D in July

Iraq's State Oil Marketing Organization expects its southern oil exports to hover around 2.8 million b/d in July, the marketer's deputy director general told S&P Global Platts, as OPEC's second-largest producer benefits from relaxation of output quotas, lowers crude burn and increases gas output for power generation.

—Read the full article from S&P Global Platts

FEATURE: Pandemic in India Likely to Deter Agriculture Commodity Demand, Spare Production

A resurgence of the coronavirus in India and concerns of a possible third wave of infections in the country are likely to hit agricultural demand in the coming months, while agriculture production is expected to reach new records despite the pandemic, raising concerns over commodity prices and farmers' incomes.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language