Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 20 Jun, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Rate Hikes Remain as Tailwind for European, GCC Banks

This year is looking to be a positive one for the net interest income of large banks in Europe and the Gulf Cooperation Council region amid high interest rates.

In Europe, industry experts anticipate that the difference between banks’ interest revenues and interest expenses will increase in 2023 as central banks continue to increase rates and loan portfolios grow. Rate hikes have so far been a tailwind for most of the banking sector as deposit betas, a measure of how quickly central bank interest rate hikes are passed on to deposits, remain low. Consequently, rates on interest-earning assets have been much higher than those on deposits.

On June 15, the European Central Bank raised the key deposit rate to a 22-year high of 3.5% and said future rate decisions will ensure the key interest rates "will be brought to levels sufficiently restrictive to achieve a timely return of inflation to the 2% medium-term target and will be kept at those levels for as long as necessary." The Bank of England, which increased its key interest rate for the 12th consecutive time in May, expressed a similar view.

Another factor prompting the positive outlook is that cost of risk, a measure of loan loss provisions, is not expected to increase significantly in the near term. European banks' cost of risk has mostly returned to average levels, and no significant uptick in this measure is anticipated over the next three quarters, S&P Global Market Intelligence reported, citing Rabobank European bank analyst Paul van der Westhuizen.

Analyst consensus estimates indicate that 23 of Europe's 25 largest banks are poised to record year-over-year increases in net interest income in 2023, an S&P Global Market Intelligence analysis showed. Fifteen banks are expected to see even higher levels in 2024, including Spain-based Banco Santander and Banco Bilbao Vizcaya Argentaria, UK-based HSBC Holdings, Netherlands-based ING Groep and Germany's Deutsche Bank.

In the GCC region, industry observers estimate that net interest margins will remain high as interest rates are likely to stay elevated throughout 2023, according to a recent S&P Global Market Intelligence report.

As the currencies of most GCC countries are pegged to the US dollar, policy rate movements in the region typically mirror those of the US. While the US Federal Reserve decided June 14 against raising interest rates for the first time since March 2022, it indicated that rate hikes may resume as soon as July and that the increase could be higher than previously projected.

High interest rates may limit loan growth, especially in the retail segment, but corporate lending is still expected to rise, driven by government initiatives such as Saudi Arabia's Vision 2030 framework, said Martin Blechta, principal at Boston Consulting Group.

Additionally, banks in GCC countries enjoy the benefit of a near-zero cost of capital on deposits because most of the region’s population only have current accounts. In accordance with Islamic principles, banks do not pay interest on deposits, according to Shoaib Khan, an assistant professor at the University of Hail's department of economics and finance in Saudi Arabia.

As with European banks, GCC banks' cost of risk is expected to remain low. Andrea Gay, a partner at Boston Consulting Group, told S&P Global Market Intelligence that nonperforming loans are not expected to jump significantly due to the positive outlook for GCC economies.

Today is Wednesday, June 21, 2023, and here is today’s essential intelligence.

Written by Jasmine Castroverde.

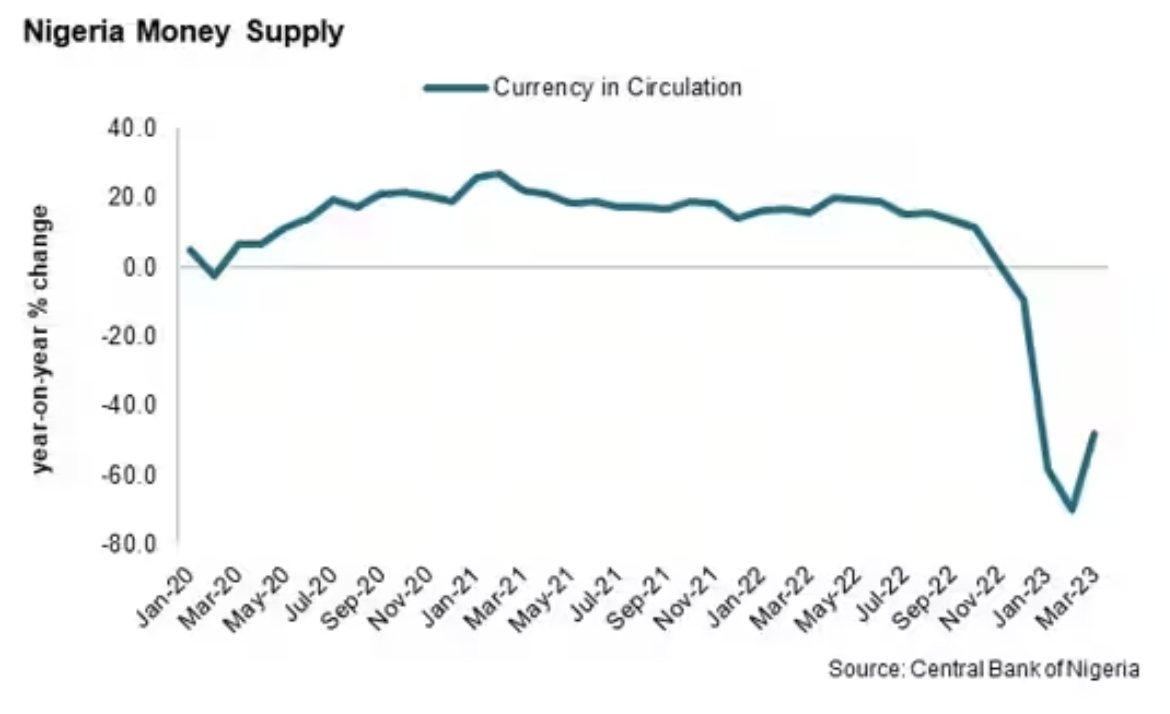

Nigerian Business Activity Recovers As Cash Crisis Eases

The easing of the cash crisis in Nigeria has alleviated pressure on firms in recent months and helped the private sector mount a recovery from the severe disruption seen in the first quarter of the year. Back in March, S&P Global Market Intelligence highlighted the impact that cash shortages were having on businesses in Nigeria as customers were unable to access the money needed to pay for goods and services. The disruption caused severe declines in business activity and new orders for two successive months, but an extension to the deadline for using old bank notes has aided a revival of business activity, according to the Stanbic IBTC Bank Nigeria PMI data, compiled by S&P Global Market Intelligence.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Saudi Arabia’s Debt Market: Ready For Takeoff

In line with its Vision 2030 program, Saudi Arabia has taken significant initiatives to diversify its economy and reduce its oil dependency. The development of its financial sector is one of the key tenets of Vision 2030. It aims to advance the capital market and attract private sector and foreign institutional investors to finance some of the country's key projects. The evolution and development of the debt market — powered by foreign currency issuance in international markets and local currency debt market growth — will be key to meeting these increasing financing needs.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

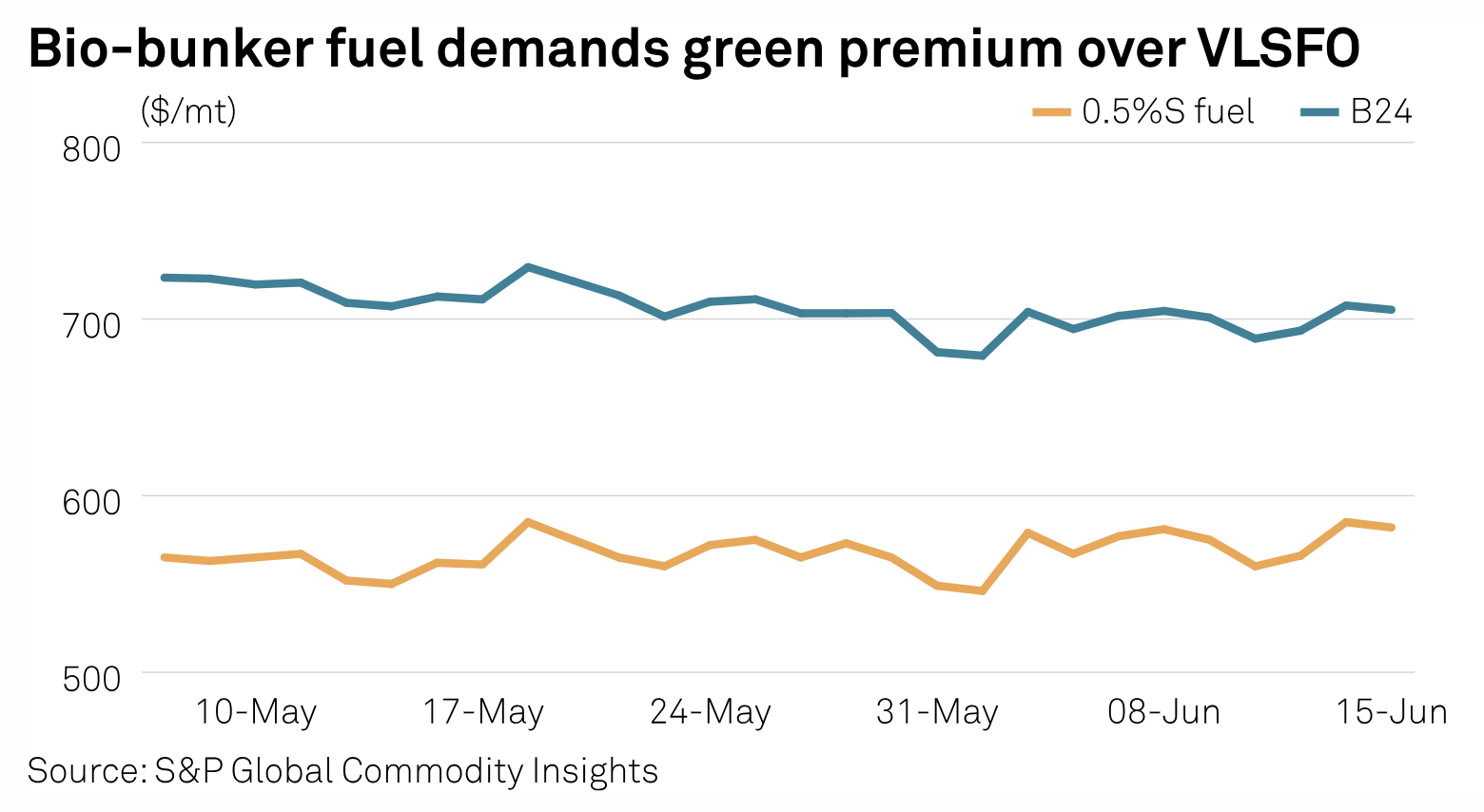

Cargill Kickstarts Maritime Decarbonization With Biofuels, Methanol

US-based agricultural trader Cargill has ramped up a bio-bunkering program for its own shipping fleet and other shipowners as part of initial decarbonization efforts amid the industry switch to a multi-fuel, low-emission future, its top maritime executive said. Some major trading houses, such as Cargill and Trafigura, have been seeking to reduce supply-chain greenhouse gas emissions in recent years via introducing alternative fuels to their bunker usage and sales. In a recent interview with S&P Global Commodity Insights, Cargill Ocean Transportation President Jan Dieleman said the company has taken pragmatic and real steps towards maritime decarbonization with low-, zero carbon fuels.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

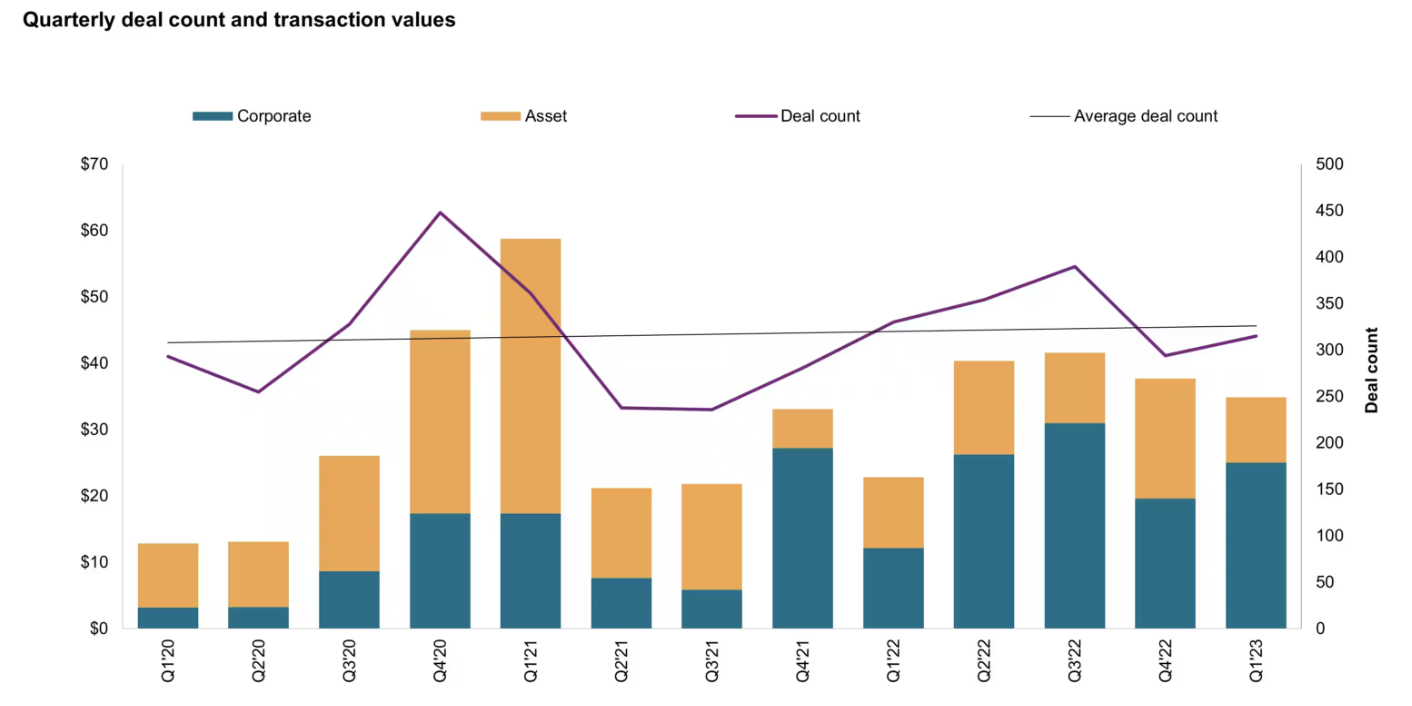

Solar And Wind Leading The Clean Energy Investments And Partnerships In 2023

Low-carbon deal activity gained momentum marginally in the first three months of 2023 following its astonishing growth in 2022 as the countries aiming to achieve their net-zero targets in today's volatile fossil fuel prices environment and geopolitical uncertainties. Corporate acquisitions regained dominance among investors including financial, oil and gas (O&G) and renewable companies.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

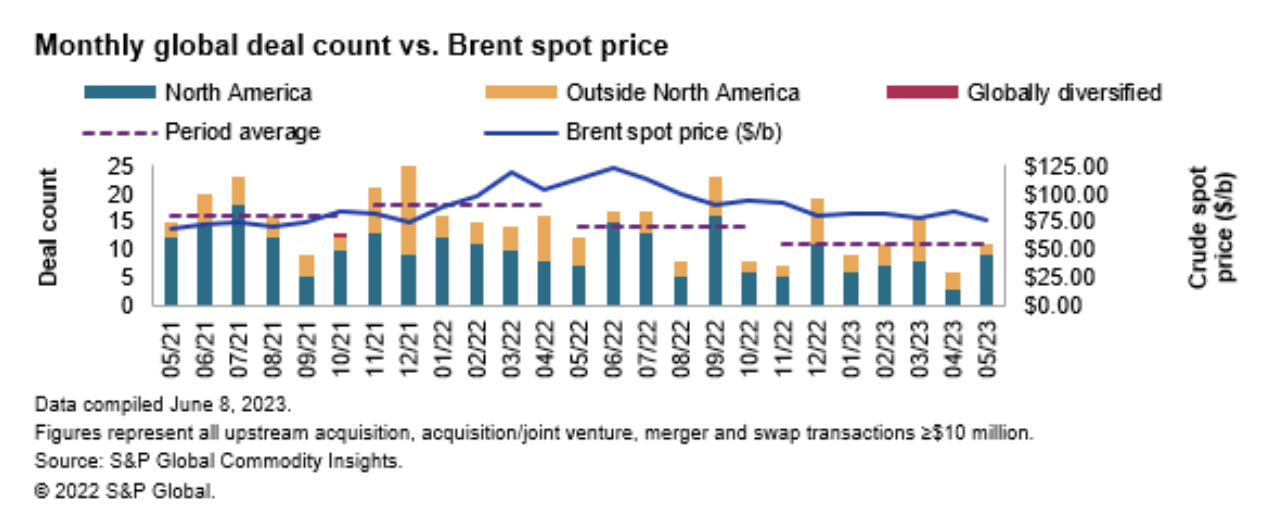

M&A Perspectives — Upstream: May 2023: Key Trends And Insights From The Current Global Upstream M&A Market

Global upstream M&A activity rebounded strongly from the 2023 year-to-date lowest monthly deal count in April, nearly doubling in May on higher US activity. North America dominated deal count and value while international activity remained sluggish for the second consecutive month. Total transaction value in May rose for the second consecutive month and nearly doubled month over month boosted by high-value corporate takeovers. Corporate deal value climbed to $12 billion in May, the highest monthly total for corporate acquisitions since December 2021.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

With Mobile Phone Semiconductor Demand Cooling, Automotive Chips Are Red-Hot

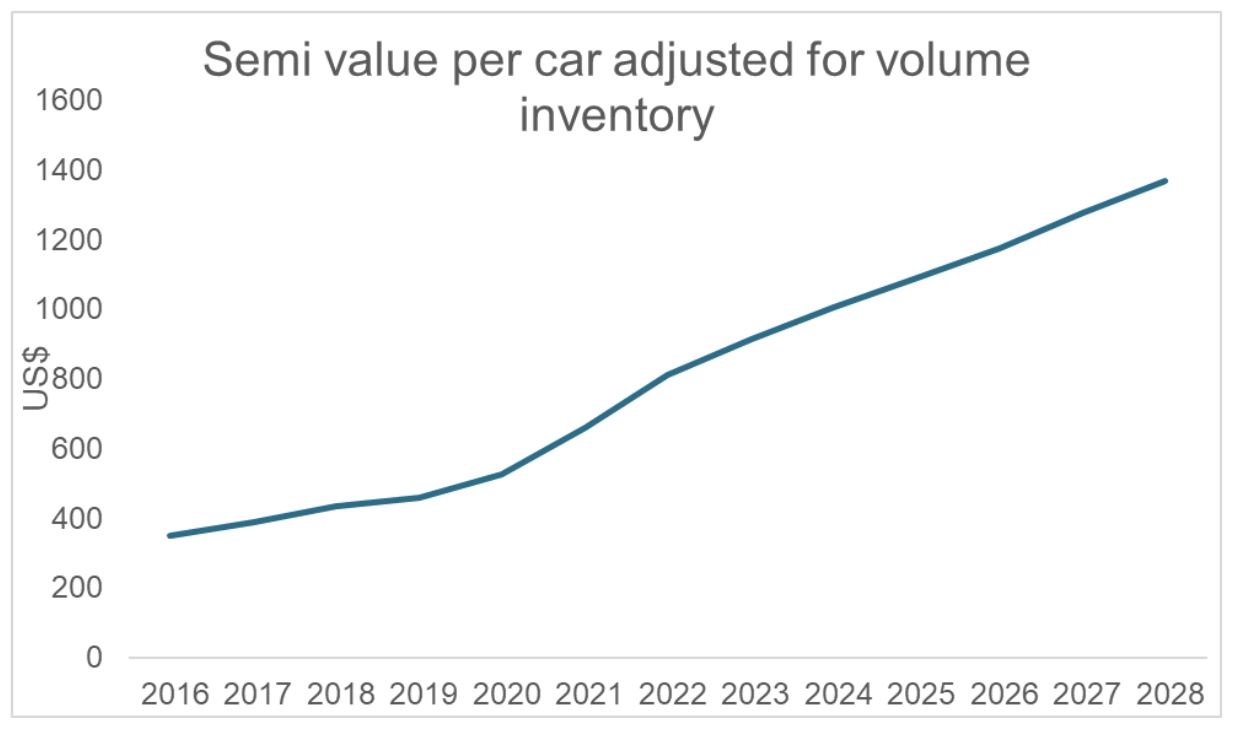

Vehicle electrification and the increasing complexity of infotainment, advanced safety and vehicle autonomy systems will propel the value of automotive semiconductors installed in vehicles from its 2020 level of $500 per car to $1,400 by 2028, according to an analysis by S&P Global Mobility. This will result in a massive growth curve in the automotive semiconductors market - already seen with a 28% year-over-year growth in 2022 to $69 billion. The long-term forecast for growth from 2022-2029 is strongly positive, with continued double-digit market growth predicted.

—Read the article from S&P Global Mobility

Content Type

Theme

Segment

Language