Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 17 Jun, 2021

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

Market participants are taking action in supporting climate goals, expanding social considerations, and safeguarding against governance risks. Such activities showcase how the mainstreaming of environmental, social, and governance (ESG) investing has accelerated during the coronavirus crisis and subsequent economic recovery.

More than half of ESG-linked funds outperformed the S&P 500 during the first half of the year, according to S&P Global Sustainable1. Of the 27 ESG exchange-traded funds and mutual funds with more than $250 million in assets under management analyzed, 16 performed better than the benchmark equities index from Dec. 31, 2020 to May 17, 2021—rising between 11% and 29.3%, while the S&P 500 grew 10.8%.

Sustainability-linked bonds are taking off. Passive investors are carbon-optimizing their portfolios. Companies are engaging with voluntary carbon credits. Governments are considering divesting from fossil-fuel stocks. Structured finance sectors are looking to minimize their exposure to ESG risks. Global businesses are confronting negative credit implications due to water scarcity. Trading houses are exploring ways to create environmentally friendly “green” cryptocurrencies. Banks are linking their executives’ pay to diversity targets. Cybersecurity is growing as a top governance concern.

“Shareholders are educating themselves to become more conversant and fluent in ESG risk, and they are inclined to appoint board members who can not only match this skill level but can incentivize management to strike a balance between short-term needs and long-term sustainability,” S&P Global Ratings said in its June sustainable finance report. “The need for this is especially pronounced for investors with long hold periods, such as pensions and life insurers, but with valuations in flux for all fossil fuel companies because of [a] steady parade of discouraging news, there will be few shareholders who don’t want a board that holds management accountable for creating a more sustainable future.”

The oil industry has experienced pressing challenges from the shift to stakeholder capitalism. Activist investors have called for the world’s largest oil producers to expand their environmental disclosures, fast-track their emissions-reduction goals, and more clearly define their strategies for participating in the energy transition to renewable generation.

"We have to meet certain requirements around sustainability ESG standards and we see that pressure coming from banks, coming from investors, coming from regulators," Muriel Schwab, chief financial officer of Gunvor, one of the world's largest independent commodities trading houses by turnover, told the told the FT Commodities Global Summit on June 16, according to S&P Global Platts. "We see banks that clearly have decided that they will no longer support commodity traders or corporates that do not have a clear path and a clear ambition, around the energy transition."

Today is Thursday, June 17, 2021, and here is today’s essential intelligence.

Emerging Markets: The Pandemic’s Fallout and Existing Challenges Restrain Sub-Saharan Africa’s Recovery

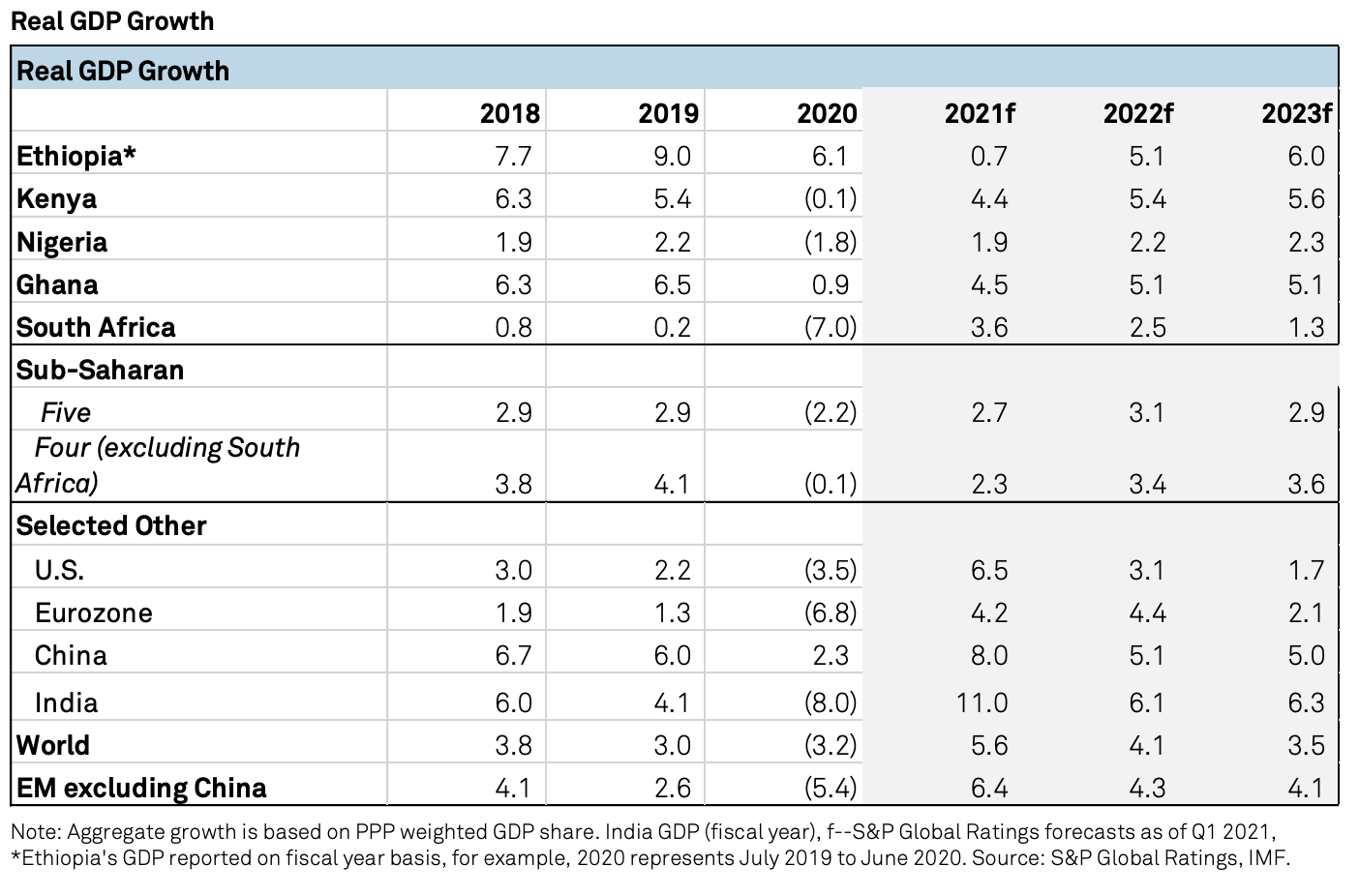

Sub-Saharan Africa (SSA) will likely be the among world’s slowest growing regions in 2021. The size of the economies of five key SSA countries (Ethiopia, Ghana, Kenya, Nigeria, and South Africa) will be 6.6% smaller than the pre-pandemic long-run trend-based estimate by the end of 2024. Pandemic-induced GDP growth shock has hit the SSA sovereigns' fiscal metrics; an expected slow recovery will continue to contribute to existing challenges in the region. SSA corporations are recovering, but remain subject to longstanding red tape and government failures, which have been amplified by the pandemic and are sources of operational friction. SSA banking sectors’ growth prospects remain subdued due to the pandemic's lingering impact, profitability levels may recover to pre-crisis levels after 2022, while credit losses moderate.

—Read the full report from S&P Global Ratings

May U.S. Housing Starts Rise 3.6%, Building Permits Fall 3% on Month: U.S. Census

US housing starts in May rose 3.6% from April, but authorized building permits fell 3% on the month, possibly signaling some moderation of a housing construction boom that has lasted a year, according to US Census Bureau data released June 16. That housing boom has pushed US prices for polyvinyl chloride, a construction staple used to make pipes, window frames, vinyl siding, and other products, to record highs on strong demand and tight supply.

—Read the full article from S&P Global Platts

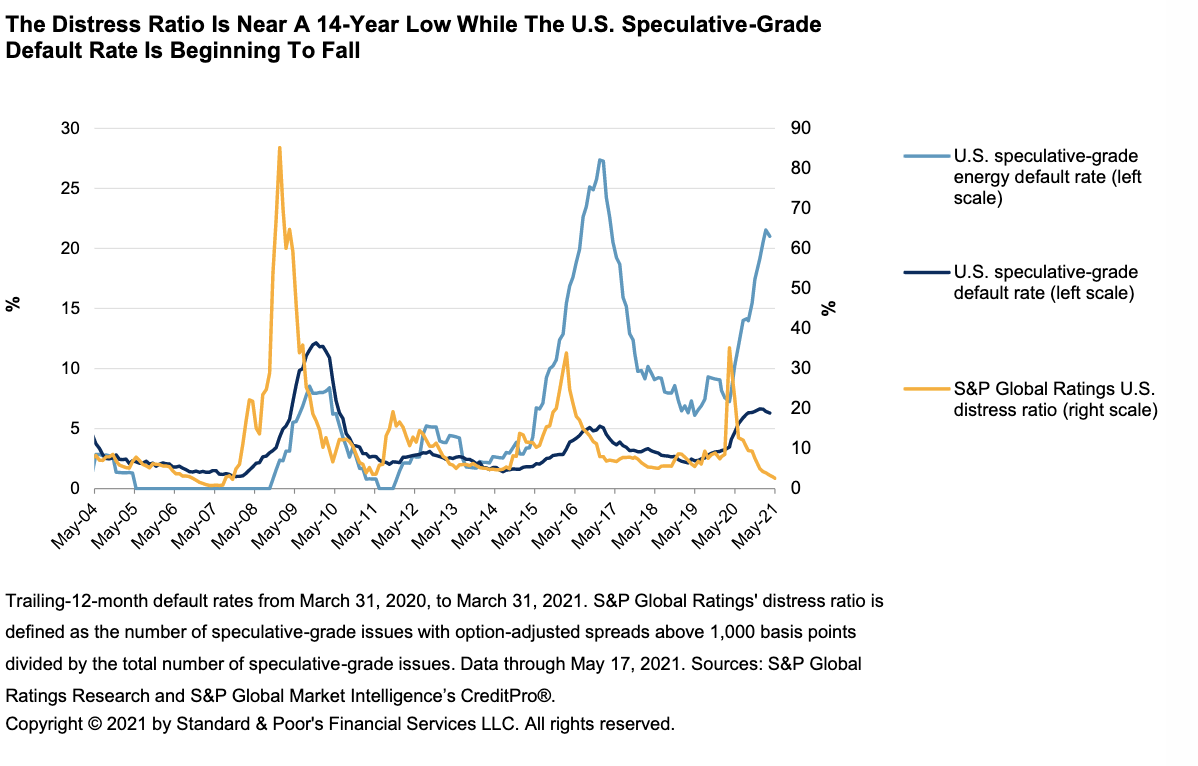

Credit Trends: The U.S. Distress Ratio Drops to Just 2.6%

The U.S. distress ratio continued its downward trend last month, falling to 2.62% as of May 17, its lowest since October 2007. The 32.6 percentage point decline in the distress ratio since March 2020 represents the sharpest recovery since S&P Global Ratings began tracking the distress ratio. Favorable financing conditions since second-quarter 2020 have shifted the ratings distribution of distressed credits, with the percentage of 'B' and 'BB' rated credits falling to approximately 40% from 75%.

—Read the full report from S&P Global Ratings

Sizing Up Style Returns

After more than a decade of underperformance, and in stark contrast to Growth’s dominance for much of 2020, Value has made an impressive comeback so far in 2021, outperforming Growth around the world, including across the size spectrum in the U.S.

—Read the full article from S&P Dow Jones Indices

UAE's New Capital Rule Could Trigger Further Bank M&A In 'Overbanked' Market

A new capital rule for banks incorporated in the United Arab Emirates will likely add pressure on smaller banks and may drive further consolidation in a market seen as overbanked, say analysts. The new rules, which come fully into force by 2023-end, will require local banks to have a minimum of 2.00 billion dirhams of paid-up capital. Banks designated as specialized lenders, which can offer a restricted range of services and have total assets capped at 25 billion dirhams, will only need 300 million dirhams.

—Read the full article from S&P Global Market Intelligence

Indian Banks, Nonbanking Financial Companies Chase Gold Rush In Loan Market

Indian financial institutions struck gold, quite literally, as the COVID-19 pandemic triggered a surge in loans against jewelry since early 2020. The pace of growth of such loans may slow as gold prices ease and the stress on household budgets abates. But analysts say that banks and nonbanking financial companies, or NBFCs, may increasingly tap Indian consumers sitting on a $1.5 trillion hoard of the yellow metal as estimated by the World Gold Council, the global market development organization for the industry.

—Read the full article from S&P Global Market Intelligence

After Strong Q1, Global I-Bank Trading Revenue Growth Set to Slacken In Q2

The normalization in global investment banks trading revenues, which the market has been talking about since late 2020, will become more visible in the second quarter as trading volumes in key fixed-income and equities products start to decline and market volatility eases.

—Read the full article from S&P Global Market Intelligence

U.S. Businesses Boost E-Commerce Investments Even as Pandemic Winds Down – 451

Businesses across the U.S. are boosting e-commerce investments even as the COVID-19 pandemic winds down, part of a strategy to lock in revenue from consumers who have converted to online shopping over the last year. Eight in 10 surveyed organizations are prioritizing investments in e-commerce operations equally, or ahead of, in-store experiences, according to the Voice of the Enterprise: Customer Experience & Commerce: Merchant Study conducted by 451 Research, an offering of S&P Global Market Intelligence.

—Read the full article from S&P Global Market Intelligence

Biden Tells Putin To Keep Cyberattacks Off Energy, Critical Facilities

U.S. President Joe Biden urged Russian President Vladimir Putin during their Geneva summit June 16 that energy facilities and other critical infrastructure should be off limits to ransomware attacks, while Putin denied any Russian government involvement in the recent Colonial Pipeline shutdown.

—Read the full article from S&P Global Platts

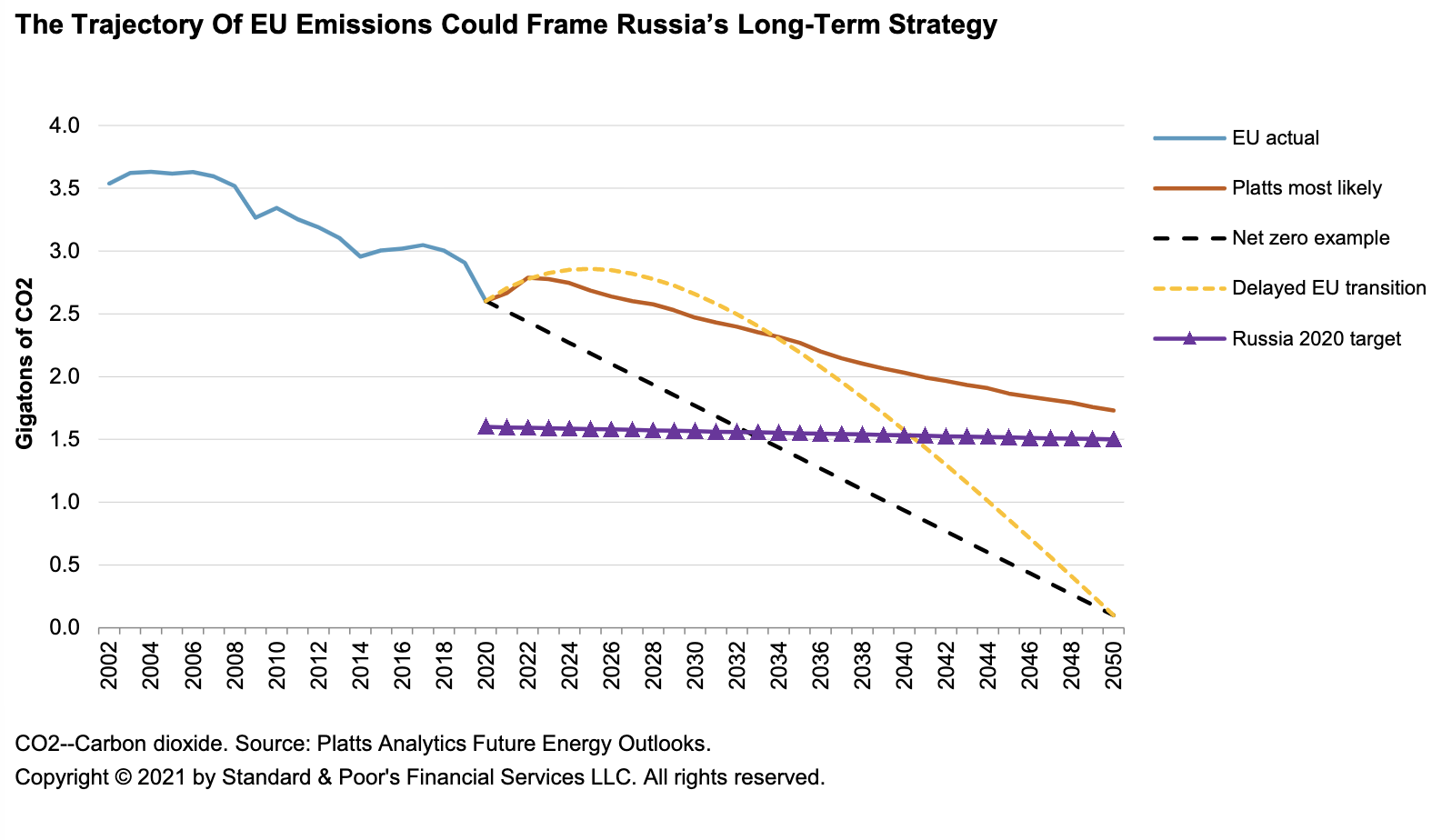

Can Carbon Border Adjustments Push Russia's Electricity Industry Toward Net Zero?

S&P Global believes Russia will lag Europe, the U.S., and China in reducing greenhouse gas (GHG) emissions, particularly from its power industry. Russia has long prioritized the supply of stable and affordable electricity over environmental targets. What's more, its vast hydrocarbon reserves make domestic gas-fired power generation a stable, low-cost business. Pressure from global environmental-protection initiatives is mounting, however.

—Read the full report from S&P Global Ratings and S&P Global Platts

At G-7 Meeting, Some Climate, but Little Change

Hopes for significant new plans to tackle carbon emission reductions and soften the economic impact of climate change went largely unanswered at a meeting of G7 leaders in Cornwall, U.K., June 11-13. The Group of Seven meeting left many key decisions to the 26th U.N. Climate Change Conference, known as COP26, scheduled for November. S&P Global Sustainable1 believes the lack of specific details from the G7 meeting creates doubt as to whether financing to halt global warming will rise to the necessary level.

—Read the full article from S&P Global Market Intelligence

BoE's Climate Stress Tests Not Tough Enough on Banks – Campaigners

Campaign groups have called on the Bank of England to put tougher requirements in place to force banks to align with climate accords. The comments come after the central bank unveiled its climate stress tests and ruled out instituting capital requirements for banks to limit lending to high-carbon projects. The BoE's Biennial Exploratory Scenario climate stress test, unveiled June 8, will not be used to set capital requirements, but it may affect the BoE's supervisory approach.

—Read the full article from S&P Global Market Intelligence

U.S. Interior May Still Limit Oil, Gas Sales After Judge Blocks Leasing Ban: Analysts

While the US Department of Interior said it would comply with a court order to restart oil and gas leasing, the Biden administration may be able to keep leasing activity to a bare minimum while it continues reviewing the larger program, analysts said June 16.

—Read the full article from S&P Global Platts

Biden's 2022 Budget Fails to Fully Fund Energy Demonstration Projects – Manchin

U.S. Senate Energy and Natural Resources Committee Chairman Joe Manchin, D-W.Va., said the budget request does not "appear to include full funding for the Energy Act," though it does offer strong support for "some vitally important" entities. For example, the president's budget did not include all the funding Congress allocated for an advanced nuclear demonstration program, the chairman said during a June 15 committee hearing.

—Read the full article from S&P Global Market Intelligence

U.S., EU Could Resolve Metal Tariff Dispute by Year End

The US and EU have agreed to work together in resolving a metals trade dispute, stemming from the former's Section 232 steel and aluminum tariffs against European countries, by the end of the year, according to a joint statement released following the US-EU Summit June 15.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Language